The Insider’s Guide To Getting $15,000 In Burial Insurance [Rates Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Most likely you’re here today because you think that purchasing a $15,000 burial insurance policy is a good idea.

Perhaps you have concerns about final expenses you may incur upon you or your spouse’s death. And you want to ensure your policy covers those expenses.

If this is what you’re looking for, you’ve arrived at the right article.

Today I will go into detail about…

Reviewing $15,000 Burial Insurance Programs

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Here’s An Overview Of Today’s Topics:

- What Is Burial Insurance?

- Why Buy Burial Insurance?

- Enough, Too Little, Or Too Much?

- Fine Print On $15,000 Burial Insurance

- Drawbacks

- Strategies Buying $15,000 Insurance

What Is Burial Insurance?

Let’s start with the basics and define burial insurance.

Burial insurance is life insurance designed to pay for final expenses like funeral, cremation, and cemetery costs.

In fact, burial insurance is just a fancy way to describe life insurance. HOWEVER, there are some key differences that make burial insurance special (more on that later).

Just like any type of life insurance, burial insurance pays a death claim to your predetermined beneficiary.

However, instead of replacing income or paying off large debts, people use burial insurance to cover final expenses so the surviving spouse or children don’t have to pay out-of-pocket.

Once the life insurance pays the death claim, the beneficiary has full control over how he wants to spend that money. Of course, most end up paying off funeral expenses with the money.

Why Buy $15,000 In Burial Insurance?

There are plenty of reasons to purchase $15,000 of burial insurance.

My clients typically have a handful of the same reasons why they decide to do so. In this section, I’ll identify those reasons, starting now.

Cover a burial

Who woulda thunk it, huh?

Buying $15,000 in burial insurance to insure their burial or someone else’s is the most common reason why folks buy.

And the reason why is that it comes down to love and respect. They do not want their loved ones paying a dime out-of-pocket for their final expenses.

Funerals are expensive

Did you know the National Funeral Directors Association discovered the national median price of a burial is more than $8,700?

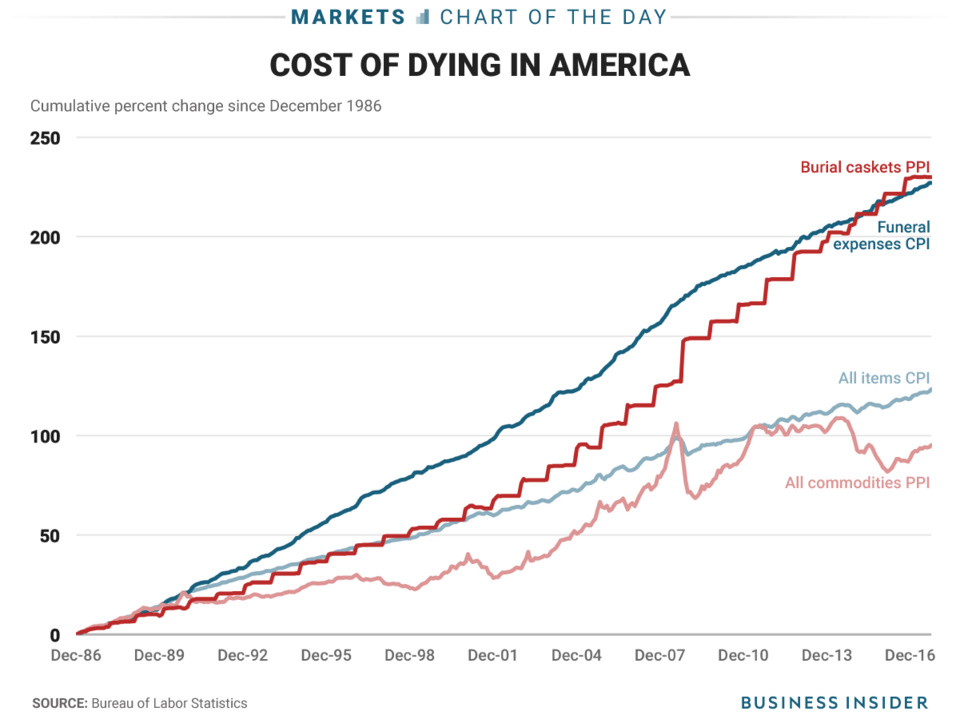

In addition, Business Insider showed in 2017 that the cost of caskets is rising faster than the combined rate of inflation. See the chart below.

Keep in mind where you live plays an important role as to how much you’ll pay. Rural areas of the country pay less for funerals than metro areas due to higher average costs of living.

This is why many of my clients choose $15,000 in coverage. That way they can account for the difference in costs, as well as price increases due to inflation.

Bottom line, a $15,000 burial insurance policy does a fantastic job paying for today’s or tomorrow’s cost of a funeral.

Cremation

Another reason people purchased $15,000 final expense life insurance is to cover cremation expenses.

The National Funeral Directors Association shows the median cost for a cremation was $6,260 in 2017.

However, if that seems high, rest assured you can find lower prices for cremation.

Many people do not want the hustle and bustle of a high-priced funeral service. They simply want the cremation and nothing more. These are called “direct cremations” and have costs as low as $1000.

Point is you have more cost flexibility for a cremation than a traditional burial. When accounting for inflation on cremation services, $15,000 in life insurance should do the trick. But keep in mind less coverage – like a $5,000 burial insurance program – may work equally well, if all you’re interested in is a direct cremation.

Pay off debt

Many folks purchase $15,000 in final expense life insurance to cover just that – final expenses.

In addition to covering funeral expenses, a $15,000 life insurance program can cover medical debt, credit card debt, and any other loans you leave behind.

A life insurance plan for $15,000 provides peace of mind, whether it’s a standalone plan to pay those expenses or a part of your burial or cremation plan leftover to pay those expenses.

Protect your family

Burial insurance is not necessarily just for final expenses or funeral expenses.

Many people want to protect their family once they are gone with supplemental income.

One of the biggest challenges survivors face is adjusting their standard of living after you pass away. A cash-injection from a final expense life insurance policy makes the transition much smoother.

Mortgage payment protection

Are you 60 and older and owe money on your mortgage?

Imagine passing away, leaving the mortgage to your spouse to pay. How long could she make the payments after losing your income?

If you’re worried she could face losing the home, consider buying a $15,000 final expense policy as a mortgage payment protector.

Here’s how it works.

When you die, your spouse receives the $15,000 in life insurance. Your spouse or family applies the $15,000 towards the mortgage payments for a number of months.

This policy benefits your family because it buys them time to prep the house for sale if necessary while retaining the equity you’ve accumulated.

Example

For example, you’re covered with a $15,000 final expense life insurance plan when you die. You and your spouse pay $1,000 a month on your mortgage.

Your spouse now has 15 months using the death benefit to handle the mortgage payments.

This buys well over a year for your spouse to re-acclimate to life without the stress of trying to sell the home, or worse, losing it outright.

Act of love

Life insurance is probably the STRANGEST product you’ll ever purchase.

Think about it.

When you buy a house, a car, or food, you get immediate gratification. You get to experience in real-time the feel of moving into a new home, or the thrill of driving your new car.

But with life insurance, you don’t get any immediate gratification. You simply pay the premium!

Here’s the truth…

Beyond peace of mind, life insurance has no immediate value.

The REAL value of life insurance comes after you die to the ones you love.

And buying a product, paying on it for years, and NEVER actually seeing the benefit of it (because you’re dead when it comes to life)… is only purchased by a special person.

This person truly loves their family, and wants to free the obligation of her final expenses from them.

That’s why life insurance is the ULTIMATE act of love!

You understand life is fragile. We’re all mortal. And your final day is coming.

And while we can’t live forever, we CAN make a difference in the lives of those we leave behind… forever.

This is why a $15,000 burial insurance purchase is a great decision. $15,000 in life insurance goes a long way in helping family out.

“Just in case” coverage

Do you have enough in savings or retirement to pay final expenses, but worry about the unexpected?

If so, a $15,000 life insurance policy is the perfect-sized policy to cover the unexpected “what-ifs” we all face in life.

If you’re like many of my clients at Buy Life Insurance For Burial, you have recognized through life experiences that we cannot predict everything.

As the Yiddish proverb goes: “Man plans, God laughs.”

If you recognize that circumstances may change for the worse, picking up $15,000 in burial insurance may help offset unforeseen financial issues.

While things may be great today… they may NOT be tomorrow. A $15,000 life insurance plan can cover those unexpected issues that sneak up unexpectedly.

Is $15,000 Burial Insurance Too Much, Too Little, Or Just Right?

One very important task you need to follow is to ensure that a $15,000 burial insurance plan is TRULY right for you.

Let’s talk about a few factors that should weigh on your mind before ultimately deciding.

Goals

First, does a $15,000 burial insurance policy REALLY fit your goals?

Earlier, we discussed different reason why people like you buy $15,000 in final expense life insurance.

My hope is that you feel TOTALLY confident that one or more of those reasons matches your goals.

But what if you’re still unsure?

If you doubt a $15,000 burial insurance policy makes sense, consider a different amount.

Burial insurance comes in the following coverage amounts: $5000, $10000, $20000, $25000, and $50000. Check out those pages to learn more.

Bottom line, the best policy to have is the one that matches ALL your goals.

Budget

Are you on a fixed income and worried about your budget?

Working with seniors on a fixed income, matching the best burial insurance policy to your budget is one of my main goals.

When I offer my clients a policy, I want it to be easily affordable.

Trust me. There’s nothing worse than a fixed-income senior buying burial insurance, just to drop it 6 months later because it was too expensive to begin with.

That’s a waste of your hard-earned money. And dropping coverage doesn’t do anyone any good.

Bottom line, only buy what’s easily affordable. Can’t say it enough.

You’ll see prices later and you’ll decide if the premiums fit your budget.

If they don’t… reach out to us at Buy Life Insurance For Burial. Remember, we can quote different companies and coverage amounts.

There’s nothing wrong starting with a LOWER amount of coverage, in order to build up to more over time. Lots of people do it that way to start.

Family Feuds

Are you worried leaving TOO much money behind in your life insurance will cause problems between your children?

Hate to say it, but sometimes money brings out the worst in people. Just check out the article here on What’s Your Grief about family fights after death, and make sure to read the comments. Sheesh.

If you think a $15,000 burial insurance plan will leave behind too MUCH money, consider a $5,000 or $10,000 policy instead.

That way, you can ensure a more exact amount of your final expense policy is used towards your final expenses and nothing more.

Less coverage may cause drama, too

Perhaps you think $15,000 isn’t enough to accomplish your goals.

You may want to opt for a higher amount of coverage if you may leave extra bills behind to your family.

Remember, you can scale up your coverage to whatever amount you desire.

We at Buy Life Insurance For Burial have access to $20,000, $25,000, $50,000, $75,000, even $100,000 in life insurance coverage.

If $15,000 fits your budget, great! Start with that. But if you can afford more and NEED more, look at a higher amount of coverage to give you total peace of mind

Fine Print On The Best $15,000 Burial Insurance Coverage

So far we’ve discussed why $15,000 in burial insurance makes sense.

I want to expand on that and explain how burial insurance is wholly unique from other types of life insurance products.

Here’s the thing…

Not all life insurance programs are the same.

And buying the WRONG type of life insurance to cover burial expenses may have DISASTROUS consequences.

So let’s take a moment to clarify what factors make a quality burial insurance policy, and what types of programs to stay away from.

Premiums NEVER increase

Make sure you purchase burial insurance with fixed premiums that NEVER increase, no matter what age you reach.

This is REALLY important, because many name-brand life insurance companies offering so-called burial insurance have built-in price increases.

Have you heard of AARP, Globe Life, or Trustage offering you life insurance?

If you take a close look at the fine print, all 3 of these companies have price increases approximately every to 5 years.

If you buy an AARP plan at 61, you’ll see price increases every 5 years after that. Not good!

These premiums get REALLY expensive as you approach your 70s, too. Never a good idea for someone on a tight fixed-income.

Hopefully, you see how risky these plans are. Instead, stick with a fixed-price policy like we offer at Buy Life Insurance for Burial.

Can’t cancel due to age or health

Did you know that many “fake” burial insurance programs cancel at age 80?

Did you know that many “fake” burial insurance programs cancel at age 80?

These are called term life insurance programs, and are more appropriate for seniors interested in covering larger, temporary obligations like paying off an entire mortgage, or replacing a substantial amount of income.

But what if you need coverage for final expenses, and you happen to live past 80 with one of these term life plans?

You LOSE your coverage! And you do NOT get your money back!

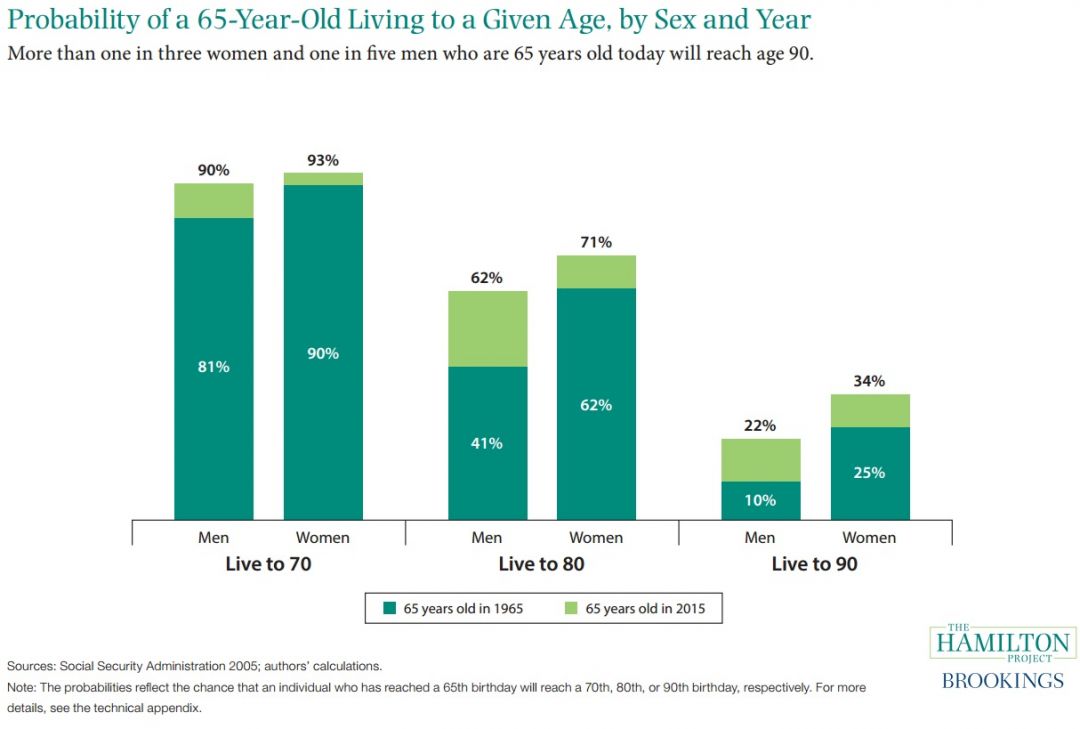

The problem is clear. The Hamilton Project shows that 3 out of 5 65-year olds will make it to age 80.

If the odds are that high you’ll make it, why GAMBLE with your life insurance and bet you’ll die before 80?

We at Buy Life Insurance For Burial don’t like to gamble. If funeral expense coverage is your goal, we recommend our whole life burial insurance programs.

Whole life burial insurance never cancels due to age or health, as long as you pay the premium. It’s as certain as the sunrise!

Bottom line, no one knows when our final date on Earth is. And if our goal is final expense protection, why take a chance with a term life insurance policy that may cancel before we do?

Qualifying for day one coverage

Do you know there are life insurance companies that require you to wait two years before fully covering you if you die by natural causes?

You’ve heard of Colonial Penn before, right? They are the main perpetrators of the two-year waiting period program.

Commonly referred to as no-questions-asked life insurance, these programs offer easy underwriting.

However, hidden in the fine print is the two-year full natural death coverage stipulation.

The truth is if you medically qualify (and many can), you can get first-day full coverage for natural death.

Case study

One of my clients is a good example of why getting first-day full burial insurance coverage is so important.

My client was 84 years old when he passed away, and just six months prior, he took out a $25,000 plan.

He was in good shape, had great health, and had just remarried. He died suddenly on Thanksgiving from a heart attack, and because he qualified for a first-day full coverage burial insurance policy, we paid out the death claim promptly.

The crazy thing is this. Had he gone with Colonial Penn’s no-questions-asked burial insurance, his wife only would have received his premiums back plus 7% interest. She may have received $1500 in death benefit.

See why it’s important to get fully comprehensive life insurance coverage?

Last point I want to make…

I can’t 100% promise you’ll qualify for first-day full coverage burial insurance. Depending on your health, you may only qualify for a guaranteed acceptance life insurance plan.

We’ll let you know your options, and worst-case scenario, can quote you a no-questions asked life insurance policy that’s MUCH less expensive than Colonial Penn’s.

Drawbacks Of A Whole Insurance Burial Insurance Program

When comparing a whole life burial insurance to other types like term life insurance for seniors, expect to pay more per dollar of burial insurance coverage.

Why does burial insurance cost less than term life insurance?

The main reason is that term life insurance is temporary coverage, and burial insurance is permanent coverage.

Term insurance for seniors may only last 10, 15, or 20 years in length before cancelling. The insurance companies know that most approved for coverage will outlive the policy.

That’s the bet all insurance companies try to make with term insurance – try to approve healthy people who have high odds of outliving the risk of paying the death benefit.

Bottom line, term insurance policies are cheaper in premium because most will not pay out a death claim.

On the other hand, burial insurance coverage will ALWAYS pay a death claim. It’s guaranteed since the policy cannot cancel due to age or health.

And the fact that the insurance company MUST pay if the policy is active means they will offer LESS coverage than a term policy.

Hopefully this makes sense.

The moral of the story? You get what you pay for when it comes to buying life insurance. And if you appreciate TOTAL peace of mind, a whole life burial insurance is a much safer selection than term insurance.

Think of it this way – when you buy a car and purchase a warranty to protect against unforeseen problems, yes, it costs you more money, but you get peace of mind knowing that if something bad happened you’re covered and you won’t have to worry about losing the vehicle or spending a ton of money for expensive repairs. That’s how whole life insurance acts.

Strategies To Buy The Best $15,000 Burial Insurance Policy

Now that you know a $15,000 burial insurance plan is the best route to go, let’s discuss my favorite strategies to secure the best deal available.

Avoid mail order and TV company carriers

As a rule of thumb, avoid buying life insurance from TV commercials and mail-out advertisements.

Why? Because the life insurance companies offering coverage are typically some of the worst quality available.

You’ll typically see two types of life insurance plans in the mail or on TV:

- Guaranteed Acceptance Life Insurance – no questions asked life insurance with a two-year waiting period on full natural death coverage. Colonial Penn, AARP, TruStage, and MetLife are the usual suspects offering this type of coverage.

- Term Life Insurance To 80 – covers you until you turn 80, then cancels. Also has price increases every 3 to 5 years. AARP and Globe Life commonly offer term life insurance products like this.

Avoid these companies like the plague!

Working with an independent agent like Buy Life Insurance For Burial, you’ll find better burial insurance options that may provide first-day full coverage at a lower premium.

Avoid Insurance Requiring An Exam

Requiring an exam, blood specimen, and physical unnecessarily extends the length of time to qualify for burial insurance and can lead to unexpected rate-ups in premium.

The most competitive burial insurance carriers only require an application for coverage, a phone interview, and your permission to check your medical records.

Always try for first-day full coverage

The LAST thing I want is my clients to wait two year for full natural death coverage.

I see agents push waiting period coverage far too often. It’s easier to write up since no health questions are asked. But this may not be the best deal for you.

Though you may not qualify for it, it’s best to give first-day full natural death burial insurance coverage a shot.

We always think our life will last long. But that’s not always the case. We can be here one day and gone the next.

Work with a broker

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

This by far is the most valuable advice I can give anybody looking for $15,000 in burial insurance.

Always work with an agent who can shop your coverage goals to see who has the best deal for you.

This is what we do at Buy Life Insurance for Burial.

We work with 10 to 15 of the most competitively priced burial insurance companies to see who provides the best combination of price and value.

What you hopefully get in exchange is the best overall amount of $15,000 final expense life insurance coverage you can afford.

Rates

$15000 Mutual of Omaha Monthly Rate Chart

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 45 | $45.26 | $36.57 | $40.61 | $32.31 |

| 46 | $46.70 | $37.66 | $41.57 | $32.93 |

| 47 | $48.47 | $38.93 | $42.69 | $33.72 |

| 48 | $50.40 | $40.34 | $43.81 | $34.67 |

| 49 | $51.76 | $41.18 | $44.64 | $35.12 |

| 50 | $53.73 | $42.13 | $45.54 | $35.40 |

| 51 | $56.72 | $43.85 | $47.74 | $36.58 |

| 52 | $59.15 | $45.08 | $49.17 | $37.22 |

| 53 | $62.28 | $46.70 | $51.36 | $38.33 |

| 54 | $65.55 | $48.81 | $53.39 | $39.60 |

| 55 | $69.30 | $51.04 | $55.88 | $41.00 |

| 56 | $72.57 | $53.08 | $57.75 | $42.31 |

| 57 | $75.69 | $55.26 | $59.47 | $43.48 |

| 58 | $78.82 | $57.30 | $61.18 | $44.64 |

| 59 | $82.56 | $59.62 | $63.05 | $45.95 |

| 60 | $86.92 | $62.53 | $65.40 | $47.70 |

| 61 | $92.85 | $66.47 | $68.83 | $50.17 |

| 62 | $98.94 | $70.25 | $72.26 | $52.49 |

| 63 | $104.86 | $74.17 | $75.69 | $54.98 |

| 64 | $110.95 | $78.11 | $78.97 | $57.45 |

| 65 | $116.88 | $82.04 | $82.40 | $59.91 |

| 66 | $125.14 | $87.42 | $87.71 | $63.56 |

| 67 | $133.57 | $92.80 | $93.01 | $67.19 |

| 68 | $141.84 | $98.19 | $98.31 | $70.84 |

| 69 | $150.11 | $103.57 | $103.62 | $74.61 |

| 70 | $158.53 | $108.95 | $108.92 | $78.26 |

| 71 | $169.45 | $115.93 | $116.57 | $83.34 |

| 72 | $180.53 | $122.78 | $124.05 | $88.58 |

| 73 | $191.60 | $130.42 | $131.70 | $94.29 |

| 74 | $202.52 | $138.13 | $139.19 | $100.07 |

| 75 | $213.60 | $147.69 | $146.82 | $107.01 |

| 76 | $227.48 | $158.70 | $156.81 | $115.77 |

| 77 | $242.52 | $168.86 | $167.60 | $123.66 |

| 78 | $257.86 | $178.18 | $178.46 | $131.06 |

| 79 | $273.15 | $187.74 | $189.44 | $138.52 |

| 80 | $288.60 | $197.38 | $200.50 | $146.05 |

| 81 | $313.55 | $212.89 | $216.40 | $157.72 |

| 82 | $340.26 | $228.71 | $233.56 | $169.33 |

| 83 | $367.22 | $243.52 | $250.70 | $180.36 |

| 84 | $392.42 | $258.32 | $266.75 | $191.23 |

| 85 | $417.77 | $273.13 | $282.95 | $202.25 |

$15000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 50 | $76.89 | $52.74 |

| 51 | $78.09 | $54.02 |

| 52 | $79.45 | $55.98 |

| 53 | $80.66 | $58.90 |

| 54 | $82.04 | $61.51 |

| 55 | $84.35 | $63.85 |

| 56 | $86.82 | $66.47 |

| 57 | $89.01 | $68.50 |

| 58 | $90.96 | $70.58 |

| 59 | $92.31 | $72.50 |

| 60 | $93.75 | $74.03 |

| 61 | $100.31 | $78.56 |

| 62 | $106.91 | $82.70 |

| 63 | $113.24 | $86.28 |

| 64 | $119.31 | $89.01 |

| 65 | $125.23 | $91.35 |

| 66 | $130.44 | $96.19 |

| 67 | $134.98 | $100.18 |

| 68 | $139.24 | $103.87 |

| 69 | $142.96 | $107.47 |

| 70 | $146.27 | $110.78 |

| 71 | $159.75 | $121.77 |

| 72 | $172.96 | $132.24 |

| 73 | $185.36 | $142.28 |

| 74 | $196.92 | $151.50 |

| 75 | $206.83 | $159.75 |

| 76 | $241.89 | $183.13 |

| 77 | $275.61 | $205.18 |

| 78 | $307.95 | $225.81 |

| 79 | $338.93 | $245.07 |

| 80 | $368.66 | $262.13 |

| 81 | $378.78 | $268.08 |

| 82 | $389.57 | $274.49 |

| 83 | $431.23 | $283.48 |

| 84 | $451.90 | $290.49 |

| 85 | $472.73 | $297.59 |

Thanks for stopping by and reading this article!

If you would like to find out more about what you might qualify for, get in touch. You can call us at (888) 626-0439 or send us a message. We’d be happy to speak with you.