The Ultimate Guide To Getting $20,000 In Burial Insurance

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Are you looking for information on a $20,000 burial insurance policy?

Are you interested in purchasing final expense life insurance coverage on yourself or a loved one, like a spouse, or parent?

If so, you’ve arrived at the right article.

So sit back and enjoy, as we’ll discuss in detail…

How A $20,000 Burial Insurance Policy Works

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Article Overview

- Burial Insurance 101

- Why $20,000?

- When $20,000 Isn’t Right

- FAQ

- Pros

- Cons

- Getting The Best Deal

- Rates

Burial Insurance 101: The Basics

Some people are confused how burial insurance works.

There’s many reasons to own burial insurance, and it’s important to take a few moments to describe the basics.

Burial insurance = life insurance

That’s right.

Burial insurance is simply a form of life insurance.

Just like with life insurance, you work with an insurance agent to purchase burial insurance. Preferably with a specialist like us at Buy Life Insurance For Burial (more on working with specialists later).

As with a life insurance policy, you’re in complete control. You determine the beneficiary, who pays for it, and how much coverage you want.

To clarify, the funeral home has no power over your burial insurance policy.

In most states, you have the choice to name the funeral home as the beneficiary. But most name a close relative or child instead.

In fact, some people buy burial insurance without intending to use it for their burial. Some purchase it to pay for other final expenses, or to leave money behind to a spouse or love done.

However, most buy final expense burial insurance to eliminate the financial burden of the funeral from family.

Unlike many traditional life insurance products, burial insurance doesn’t require an exam. In most cases, all that’s necessary is a short 15-minute phone interview and an online application to determine eligibility.

It’s simple compared to the weeks and months required from traditional life insurance due to exams, medical record requests, etc.

Bottom line, burial insurance is a simplified form of life insurance. You’re in complete control over the details. And it only takes a few minutes to see if you’re approved.

6 Reasons To Get A $20,000 Burial Insurance Policy

Dealing with more than 3,000 people nationally with their burial insurance, I’ve discovered there are 6 reasons primary why buying a $20,000 burial insurance plan is a smart move.

I’ll discuss each with the goal of helping you clarify your own goals.

I can’t express how important it is to crystallize in your mind your life insurance goals. Too many people buy life insurance without serious regard to their goals, only to drop the coverage at a later date.

We don’t want that here at Buy Life Insurance for Burial. Nothing’s worse than wasting money on a burial insurance policy you don’t keep!

So, let’s jump into each of the top 6 reasons…

1. Cover your burial

In most states, $20,000 in final expense life insurance coverage is significant enough to pay for all funeral-related costs.

The National Funeral Directors Association strengthens the argument, since it’s median price for burial expenses in 2017 was $8755.

Taking the median cost into consideration, why buy $20,000 in burial insurance when less may accomplish the same goal?

Here’s why many of my clients purchase more than immediately necessary…

Inflation

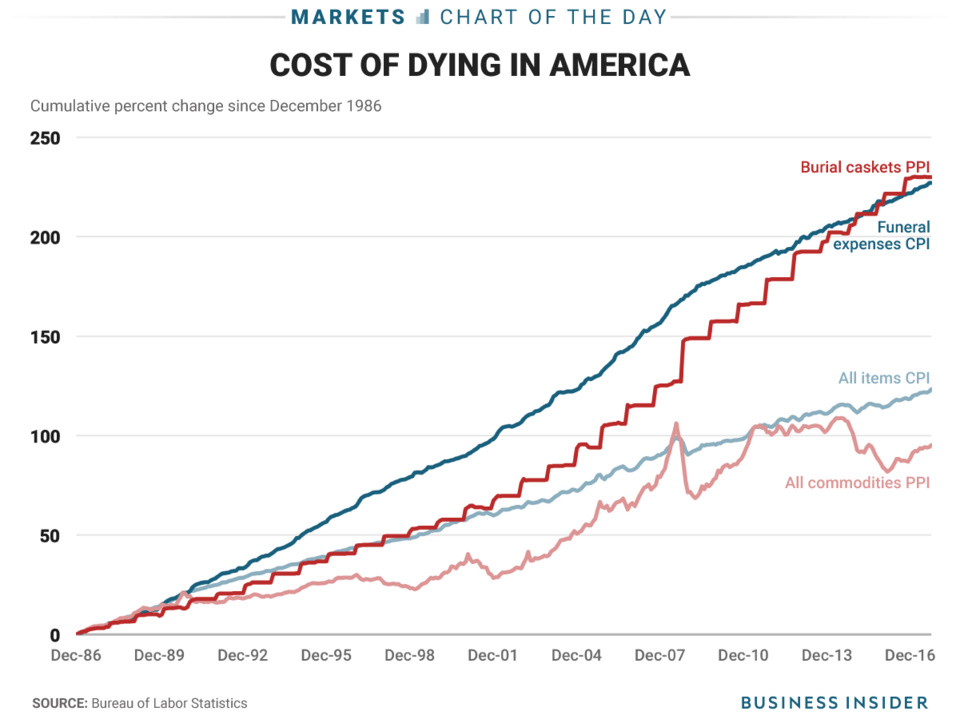

First of all, burial costs have risen dramatically.

First of all, burial costs have risen dramatically.

The chart above from Business Insider shows a nearly 250% price increase on funeral expenses since 1986.

Added, funeral expense inflation is increasing faster than average inflation for all products, which increased 125% since 1986.

And it gets worse projecting future inflation on funeral related expenses. Check out the chart from EEBrokers.com showing just how high funerals may continue to go.

What’s the moral of the story?

People buy $20,000 in burial insurance coverage (sometimes even a $25,000 or $50,000 policy, too) expect higher prices and plan for the future by buying a larger policy.

2. Pay for cremation

Along the same lines, people $20,000 in final expense coverage to pay for cremation expenses.

The good news is cremations are less expensive than burials.

There seems to be some discrepancy among organizations tracking cremation costs.

According to the Cremation Research Council, the average cost of a cremation is $1,100. However, the National Funeral Directors Association states the median cremation cost was $6,260 in 2017.

That’s quite the difference. Who’s right?

I think BOTH are right.

As an insurance agent, I’ve worked with more than a thousand people who want cremation, or know someone who has had cremation.

Rarely have I seen cremation costs exceed $5,000. More commonly, I see cremation costs between $2,000 to $3,000. This accounts for the cremation, the remains container, and a ceremony.

Bottom line… $20,000 in final expense coverage is significantly ample enough to take care of your cremation costs, now and into the future, even when accounting for inflation concerns.

Last point – some of my clients who want cremation end up electing for LESS coverage because of how inexpensive it is. So you may want to look at $5,000, $10,000, or $15,000 burial insurance policies, as well.

3. Pay off debt

Do you have other bills beyond your funeral-related costs that need paying off after you die?

Most people who buy burial insurance have car loans, credit cards, and medical debt.

Since you are in full control of your $20,000 burial insurance program, you do NOT have to spend all of the death benefit on the funeral.

In fact, the beneficiary can allot a portion of the policy towards the funeral home, and keep the rest to pay off your financial obligations.

4. Mortgage protection

Do you owe money on your home?

Would your spouse struggle to make payments if you passed away before she did?

Purchasing $20,000 in final expense life insurance can go a long way in helping to manage the mortgage.

Many senior couples fear the dramatic change in living standards when one passes away before the other, as many depend on both incomes.

Some of you reading pay a mortgage only both of you together can afford, as more seniors now are holding mortgage debt in 2018 than ever before.

This is where a mortgage payment protector program comes in.

Example of a mortgage payment protector program

Let’s say your monthly mortgage is $1,000 a month.

You and your spouse’s combined income is $2,000 each month.

If you die, and our pension plan and Social Security goes with you when you pass, your spouse has significantly less to live on, much less to pay the mortgage.

With less money to live with, isn’t it likely your spouse will struggle to maintain payments on the mortgage?

The solution is to buy a mortgage payment protection plan. While available in different amounts, if you were insured for $20,000, the death benefits pays 20 months’ worth of mortgage payments.

That’s more than a year and a half to where your spouse can ready the house for sale, downsize appropriately, and not risk losing the home to foreclosure.

A $20,000 burial insurance policy covering your mortgage is perfect to help your survivors buy time and to create peace of mind.

5. Cover the unexpected

Perhaps surprising, but many people I do business with who purchase a $20,000 burial insurance policy can pay out of pocket for final expenses, if push comes to shove.

So why do these seniors purchase final expense life insurance?

They do not know what tomorrow will bring. They have lived long-enough lives to know life throws curve balls, and it’s better to be safe than sorry.

Further, my clients often tell me that they experienced this earlier in life. I’ve heard countless stories where people and their families are in good shape and then the unexpected happens.

Imagine your daughter or son getting hooked on meth or heroin. You’d do anything to help them get clean right?

A client of mine paid $90,000 out of his retirement towards his daughter’s rehab. While he doesn’t regret doing this, it destroyed his meager retirement instantly.

Buying a life insurance plan is a good way to account for the unexpected. A $20,000 burial insurance program is a good “Plan B” when circumstances don’t turn out how you expect.

6. Act of love

Ultimately, burial insurance is an act of love.

Whether you want to protect your loved ones from your burial costs, debts, or just want to leave money to loved ones, burial insurance shows your love for those most important in your life.

Is A $20,000 Burial Insurance Policy The Best Plan To Get?

I like playing “Devil’s Advocate” with my clients and in my writing.

The term “devil’s advocate” refers to someone expressing a contentious opinion in order to test your belief.

Basically, I want you to think HARD about what you want from your final expense policy, as I’ve found well thought-out decisions lead to higher satisfaction.

In this section, I discuss why a $20,000 of final expense coverage may NOT be appropriate, as well as what other options you may consider.

$20,000 isn’t enough life insurance coverage

Perhaps you’ve realized that you have multiple goals with your insurance. Maybe you need BOTH funeral cost protection and money to pay off remaining debts.

$20,000 in burial insurance may not cover your total costs.

If that’s the case, consider a higher amount.

At Buy Life Insurance For Burial, we have access to high-dollar burial insurance. We commonly get coverage of $50,000, $75,000, and $100,000 and more for our clients. Large amounts of final expense life insurance like this can more easily accomplish multiple final expense goals you have.

While $20,000 is nice amount of coverage, it may not be enough. We at Buy Life Insurance for Burial can help you decide which amount is the right fit for your goals.

We have access to many burial insurance companies that will give you the best overall package deal.

$20,000 is too expensive

While $20,000 in final expense life insurance may do the job, it also might not fit your budget!

Dealing with fixed income seniors my entire career, I’ve learned the importance of finding life insurance that’s EASILY affordable.

And when the premium is just too much, it’s always a wiser decision to start with LESS coverage to get a better rate.

Here’s why.

Something is ALWAYS better than nothing.

Wouldn’t you agree that taking out NO life insurance is WORSE than taking out less? Avoiding paying the premium does NOT solve your final expense coverage problem!

I have met many people with tight budgets who opted for less burial insurance coverage in order to get started. And some have even passed away.

Had they NOT purchased anything… their survivors would have been in a LOT of financial trouble.

More coverage may cause drama

This is always a fun conversation.

Do you worry that leaving money to your family would cause rifts between each other?

It’s no secret that money can bring out the worst in people. And many times leaving too much money to one child over another can cause permanent problems.

Unfortunately, I’ve talked to a handful of seniors who feel like some family members are only interested in their money. Many times they feel like family members are out to use and abuse them.

Understandably, they worry about leaving TOO much behind and causing more problems than leaving little to nothing at all after they pass.

Do you feel like this? If so, you may NOT want to reassess your insurance goals.

One strategy you can follow is leaving JUST enough in your burial insurance policy to pay for ONLY final expenses and leaving none left.

For example, if all you want is a cremation plan, just buy a plan that will cover everything a leave nothing left. A smaller size plan like a $5,000 burial insurance policy may make perfect sense.

Too little coverage can cause drama

On the flip side, if you purchase too LITTLE burial insurance coverage, you may end up causing bitterness among those responsible for paying your final expenses.

Not having enough insurance or money to pay your final expenses can tear your family apart. Let’s say your burial costs $10,000 and you have a car loan of $10,000, which brings the total to $20,000 in obligations.

In this scenario $20,000 final expense life insurance plan is perfect. However, if you purchase less coverage and you have no additional assets, the burden of paying your expenses will fall on your kid or spouse.

And while you may think they will equally share the burden, that’s rarely the case. And disputes over money are a big factor in families breaking apart.

Consider adding more coverage if you are concerned that not having enough funds could cause a strain on family relationships.

Top 6 FAQ For People Buying $20,000 In Life Insurance

1. Can I qualify for $20,000 of life insurance coverage?

In short the answer totally depends on your health and how old you are when you apply. If you have a chronic illness or are over 60, you may find it more difficult to qualify for larger amounts of coverage.

2. Why is $20,000 dollars in coverage a good amount?

Let me first ask what your goals are? If you want to cover final expenses such as burial or cremation, $20,000 is a good amount to cover those concerns. For income replacement, the amount would most likely need to be more than $20,000. Financial experts recommend 10 times your annual income in coverage to replace income. You will also want to consider debts such as credit cards and a mortgage to determine what amount of coverage is right for you.

3. What if I need more coverage?

The most important thing is to first get something on the books. People often want more coverage but for whatever reason can’t afford it. It’s important to remember though that you can always add to your basic coverage later on. Something is better than nothing.

4. What type of life insurance is best to buy?

It depends on what you want to cover. If you are looking to cover a temporary obligation, term insurance works well. For more long term or permanent obligations, universal or whole life is the best option.

5. No other options available

If you have been declined for term insurance or whole life insurance, guaranteed acceptance life insurance is a great alternative.

6. Do I need to take an exam?

For coverage at $20,000 or less, exams are usually not required.

Advantages Of A $20,000 Burial Insurance Policy

Did you know that not all life insurance operates the same way?

There’s a lot of different types of life insurance or burial insurance products available.

That’s why it’s important to get the right kind of life insurance that matches your final expense coverage goals.

Premiums NEVER increase

When working with my clients interested in final expense coverage, I’m usually quoting a “simplified issue whole life insurance” program.

One of the key benefits to this life insurance product is that the rates NEVER increase.

Whole life insurance is designed to have a level premiums that never go up. That way, you won’t worry about infuriating premium increases so common with “junk mail” and “TV life insurance” burial insurance companies.

Let’s face it. If you’re reading this, you’re probably on a fixed income. Social Security raises aren’t ever that great. Fixed prices on EVERYTHING is good, wouldn’t you agree?

It’s hard to believe, but many life insurance products from AARP, Globe Life, and others are designed to increase your premiums in five year increments.

Skyrocketing premium increases

The problem with these company’s life insurance is that the price increase is dramatic. ESPECIALLY as you age.

Some of you reading this are on a limited income.

Imagine having to shell out 200% to 300% MORE money for your life insurance coverage. JUST because you turned a year older.

How would that affect your budget? Negatively, right?

This is why it’s SO important to find burial coverage like whole life insurance where the premium ALWAYS remains the same.

Fixed premiums that never increase gives you peace of mind, knowing you’ll never have to drop your policy because it has become too expensive.

Make sure coverage NEVER cancels

Guaranteeing your coverage remains intact at ANY age is just as important as ensuring the premium remains the same.

Many products with companies such as AARP or Globe Life Insurance are designed to CANCEL at a future date.

Can you believe it? AARP term insurance cancels at 80, while Globe Life term insurance programs generally cancel at 90.

Think about it. Why buy life insurance for burial if there is a chance you will lose coverage if you outlive the program? That’s crazy!!!

Imagine paying for life insurance for years and have it cancel, just because you turned 80.

How would you feel? Angry? How about ENRAGED!?

All those years of paying premium payments for NOTHING. Literally THOUSANDS of dollars down the drain

This is NOT acceptable to me. Hell, it’s practically highway robbery!

So why do so may people buy these programs?

Bottom line, they don’t read the fine print.

It’s important that you buy whole life burial insurance, where you continue to pay without risk of losing your coverage because you’re a year older.

Try For First-Day FULL Coverage

Wouldn’t you agree that it’s important to get the best coverage available to you?

Believe it or not, there are burial insurance companies that will force you to wait two years before your natural death coverage is in full effect.

For example, both Colonial Penn and AARP have guaranteed acceptance life insurance programs that do NOT cover you for full natural benefits until two years have passed.

And most people die from natural causes of death, not accidental causes. So fully comprehensive coverage is VERY important

How would your family cope with your final expenses if you die within those first two years with these types of plans? You’ve paid on your policy, but your policy will NOT rise to the occasion.

Here’s the truth.

While not all people qualify, many WILL qualify for first-day full natural and accidental death coverage.

Life throws curve balls. We don’t know what to expect from day to day. It is in YOUR best interest to at least TRY for first-day full coverage if possible.

I’ve worked in this business since 2011, long enough to see some of my clients eventually pass away with many dying within the first two years unexpectedly.

However, because some of them were qualified for first day full coverage, they received FULL death benefit payouts, and their family was secured from expensive burial costs.

Don’t skip out on this important detail. You should always strive to get first day full coverage with your $20,000 burial insurance. Accept no substitutes!

Drawbacks Of A $20,000 Burial Insurance Program

Everything in life ain’t only rainbows and sunshine!

In the interest of full transparency, it’s always a GOOD idea to get the FULL scoop on a policy you’re looking into.

So let’s spend time discussing some drawbacks to a $20,000 final expense policy.

You’ll pay more relative to term

The biggest advantage of term life insurance for seniors and those in their 50s who buy term is a lower price per dollar of coverage relative to whole life insurance.

How big is the price difference? Typically, whole life insurance costs 5x to 10x more than term life insurance coverage.

So why doesn’t everyone rush to buy term life insurance to cover final expenses?

Because price isn’t everything.

While some people strictly buy on price alone, most of us want a combination of a FAIR price with GOOD value.

How many times have you bought money on a discount item, just to watch it break within a few hours?

As the old timers say, “You get what you pay for!”

Life insurance is no different. Don’t just think cheap. Compare the benefits of term and whole and decide which works best for your goals.

And therein lies the problem with term insurance. If your goal is lifetime coverage, purchasing term insurance that you’ll probably outlive isn’t a good value, right?

Not enough coverage

What if you need MORE that a $20,000 burial insurance policy offers, but cannot afford more?

If that’s the case, then try not to be too stressed or worried.

I’m a big believer that SOME kind of burial insurance is better than nothing. Avoiding your responsibility doesn’t make it go away.

Bottom line, if all you can afford is $20,000 even though you need more, so bet it. You can always add to your coverage later in life. Life insurance is like eating an elephant. You gotta do it one bite a time!

Locking In The Best Rate For $20,000 In Burial Insurance

In this section, I detail 5 strategies I help my clients with when selecting the best $20,000 burial insurance policy available.

You can use one or as many of these tips as you’d like. My guarantee is that ALL of them will help increase your odds of getting a LOWER premium and better quality of coverage.

Let’s begin…

1. Always work with an insurance broker

We here at Buy Life Insurance for Burial do not just represent one burial insurance product.

We have access to MANY burial insurance options.

The problem with a one trick pony burial insurance agent is that they can only offer you one option for coverage.

Think about it. Who’s to say this one option is the best for you?

Many burial insurance companies also have their own unique standards as far as underwriting goes.

They will have specific questions related to your health, prescription use, hospitalization record, etc. The thing is ALL companies have different standards of what is and is not acceptable.

That’s why one option is probably NOT going to get you either a fair price OR quality coverage.

So why work with one agent at one company, when you could work with a broker. Brokers shop your case to see which company offers the best deal.

This is what we do at Buy Life Insurance for Burial. We’re passionate about getting our clients the best package deal.

Which brings me to point number two…

2. ALWAYS try for first day coverage

Don’t take the risk of going with a plan that doesn’t offer first day coverage.

There’s no guarantee that any of us will live to see the next day, much less the next minute!

ALWAYS ask to apply for first-day coverage if available. If the potential exists, it’s always worth a shot.

As Wayne Gretzky famously said, “You miss 100% of the shots you DON’T take.”

3. Avoid exams

Exams aren’t necessary when applying for $20,000 in burial insurance coverage.

There are enough competitively-priced burial insurance options at the $20,000 level that only require an application and a review of your existing medical records.

No until you apply above $50,000 final expense plan should you concern yourself with an exam.

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

4. Avoid TV life insurance

There are many companies that advertise between programs on television for all sorts of burial insurance.

You’ve probably seen the $9.99 per unit commercials with Alex Trebek.

Do your best to avoid these companies. Why? Because most offer only two-year waiting period policies for natural death.

Instead, consider working with a broker like us at Buy Life Insurance for Burial. We ALWAYS try to get first-day full coverage that NEVER cancels for our clients, first and foremost.

5. Avoid junk mail insurance

Much like burial insurance carriers seen on TV, mail order carriers push term life insurance products designed to cancel at 80 and have rate increases every five years.

If you’re goal is PERMANENT protection “as certain as the sunrise,” then whole life burial insurance is a better selection. Avoid taking a gamble with term insurance.

Rates, Next Steps

What you’ll find below are our rate charts for men and women between the ages of 40 and 85, smokers and nonsmokers, for $20,000 in whole life burial insurance.

Understand that these rates are subject to underwriting and your application. Prices are subject to change and are not a guarantee of coverage, but rather an example of what you may qualify for at a preferred rate.

$20000 Mutual of Omaha Monthly Rate Chart

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 45 | $59.27 | $47.69 | $53.08 | $42.01 |

| 46 | $61.20 | $49.15 | $54.36 | $42.84 |

| 47 | $63.56 | $50.84 | $55.86 | $43.89 |

| 48 | $66.13 | $52.72 | $57.35 | $45.16 |

| 49 | $67.94 | $53.85 | $58.46 | $45.76 |

| 50 | $70.58 | $55.11 | $59.65 | $46.14 |

| 51 | $74.56 | $57.41 | $62.58 | $47.70 |

| 52 | $77.80 | $59.04 | $64.49 | $48.56 |

| 53 | $81.97 | $61.20 | $67.41 | $50.04 |

| 54 | $86.33 | $64.01 | $70.11 | $51.73 |

| 55 | $91.33 | $66.98 | $73.44 | $53.60 |

| 56 | $95.69 | $69.70 | $75.93 | $55.34 |

| 57 | $99.86 | $72.61 | $78.23 | $56.91 |

| 58 | $104.02 | $75.33 | $80.51 | $58.46 |

| 59 | $109.01 | $78.43 | $83.00 | $60.20 |

| 60 | $114.83 | $82.31 | $86.13 | $62.53 |

| 61 | $122.73 | $87.56 | $90.71 | $65.82 |

| 62 | $130.85 | $92.60 | $95.28 | $68.92 |

| 63 | $138.75 | $97.83 | $99.86 | $72.23 |

| 64 | $146.87 | $103.08 | $104.22 | $75.53 |

| 65 | $154.77 | $108.31 | $108.79 | $78.82 |

| 66 | $165.79 | $115.49 | $115.88 | $83.68 |

| 67 | $177.02 | $122.66 | $122.94 | $88.52 |

| 68 | $188.06 | $129.85 | $130.01 | $93.38 |

| 69 | $199.08 | $137.02 | $137.10 | $98.42 |

| 70 | $210.31 | $144.20 | $144.16 | $103.28 |

| 71 | $224.87 | $153.51 | $154.36 | $110.06 |

| 72 | $239.64 | $162.64 | $164.33 | $117.04 |

| 73 | $254.40 | $172.82 | $174.53 | $124.65 |

| 74 | $268.96 | $183.11 | $184.51 | $132.36 |

| 75 | $283.73 | $195.85 | $194.70 | $141.62 |

| 76 | $302.24 | $210.54 | $208.01 | $153.29 |

| 77 | $322.29 | $224.08 | $222.39 | $163.81 |

| 78 | $342.74 | $236.51 | $236.88 | $173.67 |

| 79 | $363.14 | $249.25 | $251.51 | $183.62 |

| 80 | $383.73 | $262.11 | $266.27 | $193.66 |

| 81 | $417.00 | $282.79 | $287.47 | $209.22 |

| 82 | $452.62 | $303.88 | $310.34 | $224.71 |

| 83 | $488.56 | $323.62 | $333.20 | $239.41 |

| 84 | $522.16 | $343.36 | $354.59 | $253.90 |

| 85 | $555.97 | $363.10 | $376.20 | $268.60 |

$15000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 50 | $76.89 | $52.74 |

| 51 | $78.09 | $54.02 |

| 52 | $79.45 | $55.98 |

| 53 | $80.66 | $58.90 |

| 54 | $82.04 | $61.51 |

| 55 | $84.35 | $63.85 |

| 56 | $86.82 | $66.47 |

| 57 | $89.01 | $68.50 |

| 58 | $90.96 | $70.58 |

| 59 | $92.31 | $72.50 |

| 60 | $93.75 | $74.03 |

| 61 | $100.31 | $78.56 |

| 62 | $106.91 | $82.70 |

| 63 | $113.24 | $86.28 |

| 64 | $119.31 | $89.01 |

| 65 | $125.23 | $91.35 |

| 66 | $130.44 | $96.19 |

| 67 | $134.98 | $100.18 |

| 68 | $139.24 | $103.87 |

| 69 | $142.96 | $107.47 |

| 70 | $146.27 | $110.78 |

| 71 | $159.75 | $121.77 |

| 72 | $172.96 | $132.24 |

| 73 | $185.36 | $142.28 |

| 74 | $196.92 | $151.50 |

| 75 | $206.83 | $159.75 |

| 76 | $241.89 | $183.13 |

| 77 | $275.61 | $205.18 |

| 78 | $307.95 | $225.81 |

| 79 | $338.93 | $245.07 |

| 80 | $368.66 | $262.13 |

| 81 | $378.78 | $268.08 |

| 82 | $389.57 | $274.49 |

| 83 | $431.23 | $283.48 |

| 84 | $451.90 | $290.49 |

| 85 | $472.73 | $297.59 |

I hope this article had moved you closer to getting burial insurance in place to protect those you care about most.

If you would like to receive a free quote, here’s what you need to do:

- Call me direct at (888) 626-0439 anytime, or,

- Send a message here to request if you prefer email.

Let us know what you are looking for as well as the best way to contact you. We will follow up within the next 24 business hours with a no obligation quote.

Thanks for reading. We hope to work with you soon!