$25,000 Whole Life Insurance Review [Carriers & Rates Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Are you considering getting $25,000 in whole life insurance coverage on yourself or a loved one like your mom or dad?

Are you looking for the facts and the “fine print” to determine if $25,000 in coverage is right for you?

If you answered YES to any of these questions… you are in the right place!

My goal is to provide a full analysis on EVERYTHING you should consider when looking for $25,000 of whole life insurance.

So… let’s begin!

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation on $25,000 whole life insurance. Enjoy!

Here’s An Overview Of Our Discussion On $25,000 Whole Life Insurance:

- Definition of Whole Life Insurance

- What A $25,000 Whole Life Policy Is Commonly Used For

- Exams – Are They Optional Or Required?

- Qualification Requirements For A $25,000 Whole Life Insurance Policy

- Rates Of $25,000 Life Insurance Policies Revealed

- Other Options If $25,000 Is Too Expensive

- Next Steps In Getting A Policy

What Is A Whole Life Insurance Policy?

Now, let’s answer the most pressing question at hand…

“What is a whole life insurance policy?”

In a nutshell, whole life is the BEST way to get total peace of mind.

Here’s what I mean…

Whole life insurance has a fixed price that NEVER increases.

When you take out a $25,000 whole life plan (or any amount of whole life insurance coverage), you’ll continue to pay the same premium for the length of the policy.

Bottom line, there’s never a price increase!

That’s nice, right?

But not all life insurance is whole life insurance.

An example of what’s NOT whole life insurance

There are many kinds of life insurance out there, especially what’s called term insurance.

Globe Life and Trustage come to mind.

Have you seen their ad that reads like this…?

“Send in a buck and we’ll give you $20,000 of insurance.”

That’s Globe Life, and that’s a term life insurance program.

What’s BAD is that both Globe Life and Trustage offer term life insurance that force price increases on its clients every five years.

Definitely NOT good for people who have tight budgets or are on a fixed income.

With looking at a whole life insurance, premiums will stay the same. They NEVER go up.

Whole life insurance coverage never cancels due to age or health.

Here’s another problem with term life insurance.

Term life insurance is designed to cancel.

If you buy it later in life, you may lose your life insurance coverage when you most need it.

The best way to remember what term insurance does…

…term insurance TERMINATES!

There is an end date to term life insurance.

Luckily, this is not the case if you’re looking for a $25,000 whole life policy.

Whole life lasts your WHOLE life.

That’s one of the biggest benefits to a whole life insurance product.

When you’re looking for $25,000 in life insurance coverage, many people want the certainty and peace of mind.

They want a GUARANTEE that their $25,000 insurance policy WILL be around no matter how old they get!

So they choose $25,000 whole life insurance plan.

Why?

Because it delivers the peace of mind and certainty of coverage that so many people are looking for in their life insurance program.

Our mission at Buy Life Insurance for Burial is to help people like you get the life insurance that they need. It doesn’t matter if you need it to help take care of your loved ones via paying off a mortgage or to cover your final expense, we are here to help.

We do our job by finding the most competitively priced options available to you. Let us start now by providing you with a free quote with no strings attached.

It can be done by phone when you call (888) 626-0439. You can also submit a message on the left-hand side of the screen. Once we hear from you, we will reach out to you within the next 24 business hours.

You may qualify for first-day full coverage with whole life insurance.

Whole life insurance typically provides first-day full coverage from the effective date.

The effective date is defined as when the first payment is made and the policy is put into force.

And of course a lot of this depends on your unique health and the underwriting decision.

In my experience, MOST people can qualify for first-day full coverage.

However, if you’ve got a progressive list of chronic and serious health issues, that may not be the case. A no-questions-asked life insurance program may be more suitable.

This is why it’s vital to talk to a broker like us here at Buy Life Insurance For Burial, where we’ll shop the options for you.

Whole life insurance = peace of mind!

Whole life insurance is ALL about peace of mind.

To recap:

- Your $25,000 whole life insurance policy NEVER goes up in price.

- If you can qualify, your $25,000 whole life insurance policy has first-day full natural and accidental coverage.

- Your $25,000 whole life insurance policy NEVER cancels due to age or health.

You can see why people choose a whole life insurance plan over a term policy, where the risk of price increases and eventual cancellation are real.

Potential Drawbacks Of A 25000 Whole Life Insurance Plan

As with EVERYTHING in life, you have to deal with the good and the bad.

Whole life insurance is no exception.

One of the downsides of whole life insurance is that it’s most commonly sold as a life-pay plan.

Basically, you have to pay your premiums religiously until your final breath.

And there is a chance of paying MORE into the policy than it’s worth.

For example, you purchase $25,000 in whole life insurance at 60 years old for $100 a month.

Good genes are in your family and you live to 100 before passing away.

You’ve paid 40 years for this plan. Each year you’ve paid $100 twelve times for each month.

You’ve paid $1200 annually for 40 years.

You pay in a total of $48,000 in premiums for your $25,000 whole life insurance plan.

Don’t like the idea of paying more premium in than the value of coverage?

Consider a paid-up whole life insurance policy.

Some life insurance carriers offer the option to buy$25,000 in whole life insurance plan on a paid up basis.

Think of it like paying off your car.

Once your car is paid off, you still own it, right?

Well, that’s the same thinking with paid-up whole life insurance policies.

The concept is simple. Pay premiums on your $25,000 whole life insurance plan for a set period of time (usually 10 or 20 years).

After you reach the end of your payment period, you NEVER have to pay another premium!

Better yet, you STILL keep your coverage.

Paid-up whole life insurance plans are a unique type of plan I can offer my clients.

However, the biggest downside is the premiums are higher compared to policies you pay for your entire life.

And my experience is that some people just can’t afford it.

Bottom line, figure out what program fits your budget the best.

Single Pay Whole Life Insurance

Single-pay whole life insurance are one-time premium payment life insurance plans.

You pay one big lump sum. In return, the insurance company covers you for an amount much higher than what you paid.

Let me give you an example of how this works.

I met a lady in East Tennessee who wanted a basic cremation plan.

Nothing fancy. She figured $2,500 in life insurance coverage would do the trick.

I told her about our single-pay plan where that would give her $2,500 in first-day full coverage if she made a one-time payment of $1,500.

Needless to say, she was sold on it! She liked the idea of getting $1000 more in coverage than her premium, and never having to pay another payment.

Do you have money sitting around in CDs, or a bank account, that’s dedicated towards paying final expenses or leaving money to loved ones?

If so, a single pay whole life insurance plan is a great way to get great life insurance protection without ever paying more into the policy, much less ever having to pay another premium ever again.

3 Questions People Ask When Buying $25,000 In Whole Life Insurance

1. What if I need more coverage?

I typically hear this question when a client wants more coverage, but they can’t currently afford it.

Luckily, the answer is relatively easy.

Buy what you can now because you can always add more coverage later.

It is a good idea to have some kind of life insurance on the books, no matter the amount. It provides some level of security, and you can always build it up later when you have the funds to do so.

2. Do I have to do a medical exam?

The short answer is no.

Exams are typically only used in cases where there are significant amounts of insurance being purchased.

This would be approximately in the $400,000 to $500,000 range.

As you’re looking into getting $25,000, you are clearly below that figure.

That means the exam is completely optional. So, if you’re afraid of getting your blood drawn, you don’t have to worry. No exams are required to apply!

3. Do I even qualify for $25,000 of life insurance?

This is mainly determined by your age and health.

As long as you’re younger than 90, there are whole life insurance plans available to you.

The same principle applies to health. The healthier you are, the more likely you are to be approved, as well.

For example, if you are older and suffer from a chronic illness, you might find that it is hard to be approved for specific amounts of life insurance coverage.

A guaranteed issue whole life insurance plan may make better sense.

If you are younger and in great health, your chances to qualify increase.

Note that how much coverage you want matters, too.

If you are looking for just enough to cover your burial and other final expense costs, it might be easier to get you approved for a policy.

If you have any further questions about your qualification, feel free to contact us today.

What Does A $25,000 Whole Life Policy Do?

Let’s talk about what specifically a $25,000 whole life insurance policy can do for you.

Some reasons why people buy a 25000 whole life insurance policy

1. The first reason is they want funeral expense coverage.

Most people recognize that funerals cost around $10,000.

Obviously, your cost depends on where you live in the country.

If you combine the concerns about funeral prices increasing, there may be a need for more than $10,000 of coverage.

For example, the National Funeral Directors Association has shown funeral price inflation increasing 20%+ each of the past 2 decades.

So a $25,000 plan is great, both to cover funeral expenses today AND to cover potential price increases tomorrow.

What about cremation?

With cremation costs being significantly cheaper than burial, $25,000 will easily cover the cost of cremation.

2. Income replacement

Do you have a spouse or partner that relies on your income?

What would happen to your spouse/partner if you kicked the bucket?

Would they suffer financially?

If so, replacing your lost income is a good reason to buy $25,000 in whole life insurance.

The biggest motivator to purchase an income replacement life insurance policy is with married couples or domestic partners.

For example, let’s say a couple both draw Social Security and require every dollar received to maintain their standard of living.

Now, imagine one of them passes away.

A large chunk of monthly income vanishes away with the spouse’s death.

As you can imagine, the surviving spouse will suffer financially. Perhaps making the house payment, utilities, and other living expenses will become difficult.

This is where a $25,000 whole life insurance plan is very useful.

For a period of time, the life insurance replaces the deceased spouse’s income, which is great as the surviving spouse will appreciate any extra money they can get.

3. A gift of love!

What is the reason people purchase life insurance?

Because they love someone!

A $25,000 whole life insurance policy can be wonderful gift of love.

Do you want to leave money to a child or grandchild? Would you like to help fund your kids’ or grandkids’ college expenses?

These are great reasons to buy a $25,000 life insurance policy.

A personal example

My grandfather passed away about 5 years ago. Love him and miss him!

Unbeknownst to my mother, Grandpa left a $7,500 Army life insurance plan he got back in the 1950s.

And, boy, getting the money was perfect timing!

Mom needed a brand new roof, and Grandpa’s life insurance proceeds paid the entire thing off.

Grandpa left a gift of love, and Mom so appreciative.

So you can do really nice things for people with these kinds of plans.

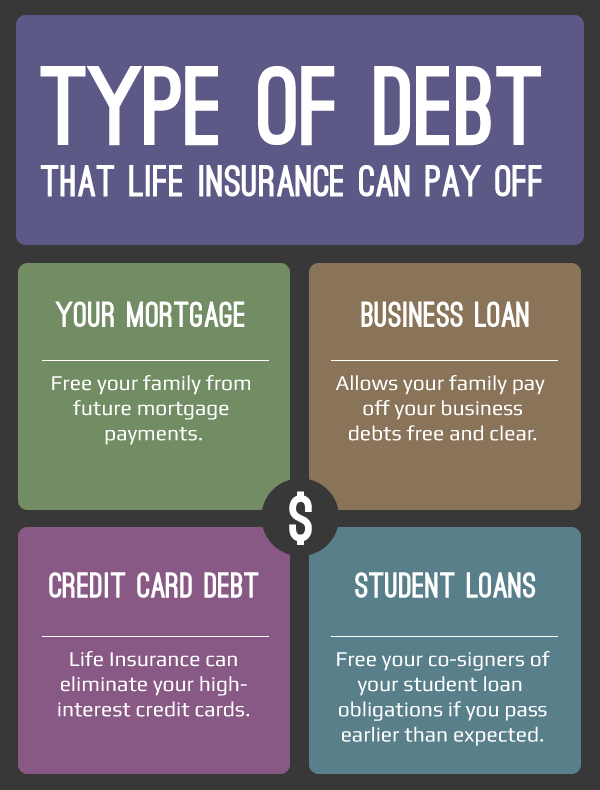

4. Mortgage payment plan

You can also use a $25,000 whole life insurance policy as a mortgage payment protection program.

Here’s what I mean.

Imagine you’ve got a mortgage when you pass away.

That mortgage costs you $500 a month.

If your whole life insurance plan pays out $25,000 to your spouse, she will have enough money to handle the mortgage payments for the next 4 years.

A mortgage protection payment program gives your spouse some room to get back on her feet, and continue making the mortgage payments, all without risk of losing the house and equity built up to foreclosure.

Bottom line, people buy whole life insurance because permanent problems need permanent protection.

Look.

If you’ll have a money problem that won’t go away when you die, like final expenses, income replacement, or mortgage payments, a whole life insurance policy is the perfect solution.

Why?

Because whole life insurance is THE permanent solution to a permanent problem.

As long as you pay your premium, you have coverage that can’t cancel due to age or health, and will be there when you most need it at any age

Exam Or No Exam For A 25000 Whole Life Insurance Policy?

Do you hate physicals and examinations?

Does your skin crawl at the thought of giving blood.

If so, you may worry if taking out a $25,000 life insurance plan will require the insurance carrier to physically examine you.

Here’s the good news.

For a $25,000 whole life insurance plan, examinations are usually optional.

We here at Buy Life Insurance For Burial have access to a variety of life insurance companies. And many don’t require an exam.

All that’s required is an application to sign off on.

Sometimes the application is done completely over the phone, digitally through email, or on old-fashioned paper.

From there, the life insurance companies will review your medical records to determine insurability.

Typically, insurance carriers will ask a series of health questions on a recorded line. They’ll probe your health condition and any prescription drug use respectfully.

Rarely, some insurance companies offering $25,000 of whole life insurance will require an exam.

Examinations may include a urinalysis, blood withdrawal, and a general physical.

Again, I can’t stress enough that this is rare.

So if you don’t like the idea of doing this, it’s probably not something you’re going to have to worry about.

Why consider taking an exam for a 25000 whole life insurance policy?

The biggest reason for a taking an exam is to get a better price.

In most circumstances, you should consider taking an exam if you’re excellent health.

In some cases, you’ll get a better premium.

Why not take an exam?

If you’ve had a multitude health problems, you may still qualify for a $25,000 whole life insurance plan.

BUT… it may NOT make any sense to go the examination route.

You may end up getting a better price WITHOUT taking an exam. Sometimes life insurance carriers will rate people up with health issues up even higher than what you originally would have gotten if you opted not to take an exam.

Look. It’s usually optional. I wouldn’t get too hung up.

If you end up wanting $25,000 in life insurance and you don’t want to do an exam, you can pass on it.

If you want to do an exam, great!

We’ll make it easy for you either way.

Can I Qualify For A $25,000 Whole Life Insurance Policy?

The short answer is YES (in most cases.)

There’s really two types of 25000 whole life insurance programs:

- First-day full coverage product.

- Return-of-premium coverage product.

First-day full coverage.

A first-day full coverage $25,000 plan gives you $25,000 in natural and accidental insurance coverage, right from the start.

Once you make the first premium, you’re fully covered no matter how you die.

Doesn’t matter if you die from natural or accidental death.

If you had $25,000 in whole life first-full day coverage, that’s what pays out.

Return-Of-Premium Whole Life Insurance

If you have a return-of-premium whole life insurance plan, you must wait typically two years before full coverage is in effect on natural death.

Let me explain.

If you end up passing away from natural causes within the first two years of a return-of-premium plan, what you paid in is returned to your beneficiary plus around 10 percent interest.

Doesn’t sound so hot, eh?

Let’s do the math to show you how BAD these plans can be.

If you pay $100 a month and you die in the 10th month, you’ve only paid in $1,000.

Your beneficiary only gets $1,000 plus 10 percent extra. That’s $1,100 instead of $25,000.

Pretty crappy, huh?

Why would you consider getting a return-of-premium whole life insurance plan?

Here’s the truth.

Only EVER consider return-of-premium whole life insurance if you cannot qualify for anything else.

I want to stress to you… It’s unlikely that MOST reading this will have to get a return-of-premium plan.

It’s MUCH more likely you’ll qualify for a first-day full coverage.

So don’t get too strung up on it.

I’m committed to trying for first-day full coverage for ALL of my clients here at Buy Life Insurance For Burial!

What Are The Best Rates/Insurance Companies For A $25,000 Whole Life Insurance Policy?

$25000 Mutual of Omaha Monthly Rate Chart

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 45 | $73.29 | $58.81 | $65.55 | $51.71 |

| 46 | $75.69 | $60.63 | $67.15 | $52.75 |

| 47 | $78.65 | $62.75 | $69.02 | $54.07 |

| 48 | $81.86 | $65.10 | $70.89 | $55.65 |

| 49 | $84.13 | $66.51 | $72.27 | $56.40 |

| 50 | $87.42 | $68.09 | $73.76 | $56.87 |

| 51 | $92.40 | $70.96 | $77.43 | $58.83 |

| 52 | $96.45 | $73.00 | $79.81 | $59.90 |

| 53 | $101.66 | $75.69 | $83.46 | $61.74 |

| 54 | $107.11 | $79.21 | $86.84 | $63.86 |

| 55 | $113.36 | $82.93 | $91.00 | $66.19 |

| 56 | $118.82 | $86.33 | $94.12 | $68.37 |

| 57 | $124.02 | $89.96 | $96.99 | $70.33 |

| 58 | $129.23 | $93.36 | $99.84 | $72.27 |

| 59 | $135.46 | $97.23 | $102.95 | $74.45 |

| 60 | $142.73 | $102.08 | $106.87 | $77.36 |

| 61 | $152.61 | $108.65 | $112.59 | $81.48 |

| 62 | $162.76 | $114.94 | $118.30 | $85.35 |

| 63 | $172.64 | $121.49 | $124.02 | $89.49 |

| 64 | $182.78 | $128.05 | $129.47 | $93.61 |

| 65 | $192.66 | $134.59 | $135.19 | $97.72 |

| 66 | $206.44 | $143.56 | $144.05 | $103.80 |

| 67 | $220.48 | $152.52 | $152.88 | $109.85 |

| 68 | $234.27 | $161.51 | $161.71 | $115.92 |

| 69 | $248.04 | $170.48 | $170.57 | $122.22 |

| 70 | $262.08 | $179.45 | $179.40 | $128.29 |

| 71 | $280.28 | $191.08 | $192.15 | $136.77 |

| 72 | $298.75 | $202.50 | $204.61 | $145.49 |

| 73 | $317.20 | $215.22 | $217.36 | $155.02 |

| 74 | $335.40 | $228.08 | $229.84 | $164.65 |

| 75 | $353.86 | $244.02 | $242.57 | $176.22 |

| 76 | $377.00 | $262.37 | $259.21 | $190.82 |

| 77 | $402.06 | $279.30 | $277.19 | $203.97 |

| 78 | $427.62 | $294.83 | $295.30 | $216.29 |

| 79 | $453.12 | $310.77 | $313.59 | $228.73 |

| 80 | $478.86 | $326.83 | $332.04 | $241.28 |

| 81 | $520.45 | $352.68 | $358.54 | $260.73 |

| 82 | $564.97 | $379.05 | $387.13 | $280.08 |

| 83 | $609.89 | $403.73 | $415.70 | $298.46 |

| 84 | $651.90 | $428.40 | $442.44 | $316.57 |

| 85 | $694.16 | $453.08 | $469.45 | $334.95 |

$25000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 50 | $126.81 | $91.91 |

| 51 | $128.81 | $98.66 |

| 52 | $135.44 | $104.42 |

| 53 | $143.20 | $109.67 |

| 54 | $149.95 | $114.42 |

| 55 | $155.96 | $118.68 |

| 56 | $160.46 | $123.43 |

| 57 | $164.46 | $127.19 |

| 58 | $167.97 | $130.94 |

| 59 | $170.47 | $134.44 |

| 60 | $172.22 | $137.19 |

| 61 | $184.98 | $145.45 |

| 62 | $196.99 | $152.96 |

| 63 | $208.50 | $159.46 |

| 64 | $219.51 | $164.46 |

| 65 | $230.27 | $168.72 |

| 66 | $239.78 | $177.48 |

| 67 | $248.03 | $184.73 |

| 68 | $255.79 | $191.49 |

| 69 | $262.54 | $197.99 |

| 70 | $268.55 | $204.00 |

| 71 | $293.07 | $224.01 |

| 72 | $317.09 | $243.03 |

| 73 | $339.60 | $261.29 |

| 74 | $360.62 | $278.06 |

| 75 | $378.64 | $293.07 |

| 76 | $442.44 | $335.60 |

| 77 | $503.74 | $375.63 |

| 78 | $562.53 | $413.16 |

| 79 | $618.83 | $448.19 |

| 80 | $672.87 | $479.22 |

| 81 | $691.74 | $490.45 |

| 82 | $711.84 | $502.57 |

| 83 | $788.61 | $519.39 |

| 84 | $826.87 | $532.63 |

| 85 | $865.38 | $545.98 |

$25000 Liberty Bankers Life Monthly Rate Chart

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $40.95 | $33.69 | $35.82 | $30.96 |

| 26 | $41.58 | $33.97 | $36.54 | $31.27 |

| 27 | $42.20 | $34.27 | $37.28 | $31.57 |

| 28 | $42.80 | $34.55 | $37.95 | $31.84 |

| 29 | $43.36 | $34.80 | $38.62 | $32.10 |

| 30 | $43.94 | $35.06 | $39.27 | $32.38 |

| 31 | $45.44 | $36.26 | $40.72 | $33.28 |

| 32 | $46.94 | $37.49 | $42.20 | $34.18 |

| 33 | $48.38 | $38.62 | $43.59 | $35.03 |

| 34 | $49.72 | $39.73 | $44.93 | $35.87 |

| 35 | $51.08 | $40.82 | $46.25 | $36.68 |

| 36 | $53.14 | $42.32 | $47.78 | $38.04 |

| 37 | $55.20 | $43.80 | $49.30 | $39.41 |

| 38 | $57.17 | $45.23 | $50.76 | $40.72 |

| 39 | $59.02 | $46.57 | $52.12 | $41.95 |

| 40 | $60.89 | $47.94 | $53.51 | $43.20 |

| 41 | $63.99 | $50.00 | $55.52 | $44.82 |

| 42 | $67.09 | $52.05 | $57.56 | $46.41 |

| 43 | $70.02 | $54.02 | $59.48 | $47.96 |

| 44 | $72.82 | $55.87 | $61.30 | $49.42 |

| 45 | $75.62 | $57.74 | $63.13 | $50.88 |

| 46 | $79.41 | $60.17 | $65.05 | $52.15 |

| 47 | $83.20 | $62.60 | $66.95 | $53.44 |

| 48 | $86.81 | $64.94 | $68.77 | $54.67 |

| 49 | $90.26 | $67.13 | $70.51 | $55.82 |

| 50 | $93.68 | $69.33 | $72.24 | $56.98 |

| 51 | $99.11 | $72.64 | $76.08 | $59.52 |

| 52 | $104.53 | $75.92 | $79.92 | $62.04 |

| 53 | $109.71 | $79.06 | $83.57 | $64.47 |

| 54 | $114.61 | $82.05 | $87.07 | $66.76 |

| 55 | $119.51 | $85.03 | $90.53 | $69.05 |

| 56 | $126.91 | $89.77 | $95.18 | $71.29 |

| 57 | $134.33 | $94.49 | $99.83 | $73.54 |

| 58 | $141.39 | $99.00 | $104.25 | $75.67 |

| 59 | $148.07 | $103.28 | $108.43 | $77.70 |

| 60 | $154.78 | $107.55 | $112.64 | $79.74 |

| 61 | $168.30 | $112.87 | $119.26 | $84.01 |

| 62 | $181.83 | $118.22 | $125.89 | $88.29 |

| 63 | $194.71 | $123.28 | $132.21 | $92.36 |

| 64 | $206.97 | $128.11 | $138.20 | $96.22 |

| 65 | $219.20 | $132.92 | $144.18 | $100.09 |

| 66 | $233.33 | $142.03 | $152.28 | $106.38 |

| 67 | $247.46 | $151.15 | $160.37 | $112.67 |

| 68 | $260.92 | $159.84 | $168.07 | $118.65 |

| 69 | $273.68 | $168.07 | $175.38 | $124.34 |

| 70 | $286.47 | $176.33 | $182.71 | $130.03 |

| 71 | $309.53 | $190.41 | $195.85 | $141.27 |

| 72 | $332.56 | $204.52 | $209.00 | $152.51 |

| 73 | $354.53 | $217.93 | $221.51 | $163.22 |

| 74 | $375.37 | $230.70 | $233.42 | $173.39 |

| 75 | $396.22 | $243.44 | $245.31 | $183.57 |

| 76 | $423.23 | $267.93 | $274.36 | $200.86 |

| 77 | $450.24 | $292.42 | $303.40 | $218.16 |

| 78 | $475.96 | $315.75 | $331.06 | $234.65 |

| 79 | $500.38 | $337.90 | $357.33 | $250.31 |

| 80 | $524.82 | $360.06 | $383.60 | $265.96 |

Final thoughts on $25,000 whole life insurance quotes

I will say if you’re younger than 50, we can still get you $25,000 in whole life insurance programs.

I just start at 50 because most of the people I deal with are over 50.

But hey, if you’re well under 50, you can qualify for $25,000 in whole life insurance coverage in most cases, and it’s very likely that you’ll pay less too.

Other Factors To Consider If $25,000 Premiums Are Too High

Did you fall out of your seat when you saw the $25,000 whole life insurance rates above?

If so, fear not!

In this section, I’m going to detail some alternate strategies to getting significant life insurance in place while also working to reduce the premium to a level you can afford.

Some of you might be fine with those prices, and if you like them, great!

But if you’re thinking, “Well, geez, that’s pretty expensive. Is there any way to get around that?”…

…Then let me share some ideas to lower your premium while keeping the same amount of coverage (or close to it).

How do you eat an elephant? One bite at a time!

I like this saying a lot.

Many of my life insurance clients don’t buy the biggest policies right out the gate.

Maybe they’ve got other financial obligations.

Or maybe they’re on a fixed income.

I look at this way…

SOMETHING is always better than NOTHING, right?

If that means you have to start with $15,000 in whole life insurance, then that’s fine!

So don’t feel bad if you’re in that boat.

There’s plenty of other options that can help you lower the price and still get the same quality of coverage.

Alternatives to a $25,000 whole life insurance policy – No Lapse Universal Life Insurance

The first thing I want to direct your attention to is what’s called a guaranteed universal life program.

It’s very much like a whole life insurance product, but it’s not.

It’s a universal plan, but it acts almost exactly like whole life insurance.

The big benefit with guaranteed universal life is the no-lapse guarantee.

Meaning, as long as you pay the predetermined rate, the universal life insurance program will never increase in premium.

On top of that, the product will never cancel due to age or health. Just like whole life insurance. (But you HAVE to continue paying that same, pre-determined payment until you die)

But the biggest benefit of this plan is the premium you pay can be MUCH less expensive when compared to whole life.

But here’s the thing…

You’ve got to be in pretty good shape to qualify for it.

While not everybody does, it’s still worth comparing no-lapse universal life insurance premiums with whole life insurance premiums. Let’s take a look below to compare.

$25000 Sagicor Guaranteed Universal Life Monthly Rate Chart

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 40 | $35.54 | $21.30 | $30.94 | $19.07 |

| 41 | $36.89 | $21.86 | $32.04 | $19.59 |

| 42 | $38.20 | $22.41 | $33.13 | $20.10 |

| 43 | $39.47 | $22.95 | $34.19 | $20.59 |

| 44 | $40.72 | $23.47 | $35.23 | $21.07 |

| 45 | $41.94 | $23.99 | $36.25 | $21.54 |

| 46 | $44.88 | $25.73 | $38.49 | $22.82 |

| 47 | $47.68 | $27.39 | $40.64 | $24.03 |

| 48 | $50.37 | $28.97 | $42.71 | $25.19 |

| 49 | $52.96 | $30.48 | $44.71 | $26.30 |

| 50 | $55.46 | $31.93 | $46.64 | $27.36 |

| 51 | $57.88 | $32.59 | $48.51 | $27.76 |

| 52 | $60.22 | $33.19 | $50.33 | $28.73 |

| 53 | $62.50 | $34.44 | $52.10 | $29.68 |

| 54 | $64.71 | $35.65 | $53.83 | $30.59 |

| 55 | $66.87 | $36.82 | $55.52 | $31.47 |

| 56 | $72.49 | $39.88 | $59.20 | $34.12 |

| 57 | $77.83 | $42.77 | $62.73 | $36.61 |

| 58 | $82.93 | $45.53 | $66.11 | $38.96 |

| 59 | $87.80 | $48.16 | $69.37 | $41.19 |

| 60 | $92.48 | $50.67 | $72.51 | $43.32 |

| 61 | $96.99 | $52.08 | $75.54 | $43.63 |

| 62 | $101.36 | $54.35 | $78.49 | $45.52 |

| 63 | $105.58 | $56.54 | $81.34 | $45.52 |

| 64 | $109.67 | $58.65 | $84.11 | $49.11 |

| 65 | $113.65 | $60.69 | $86.81 | $50.81 |

| 66 | $123.61 | $66.43 | $94.55 | $55.70 |

| 67 | $133.17 | $71.88 | $101.89 | $60.33 |

| 68 | $142.38 | $77.09 | $108.90 | $64.73 |

| 69 | $151.29 | $82.07 | $115.65 | $68.93 |

| 70 | $159.96 | $86.85 | $122.14 | $72.95 |

| 71 | $168.39 | $96.29 | $128.41 | $79.48 |

| 72 | $176.61 | $100.89 | $134.51 | $83.31 |

| 73 | $184.65 | $105.34 | $140.44 | $87.02 |

| 74 | $192.52 | $109.65 | $146.20 | $90.61 |

| 75 | $200.25 | $113.82 | $151.83 | $94.09 |

| 76 | $237.93 | $127.96 | $170.92 | $104.63 |

| 77 | $274.31 | $141.81 | $189.59 | $114.80 |

| 78 | $309.31 | $155.32 | $207.85 | $124.63 |

| 79 | $390.26 | $168.54 | $225.78 | $134.16 |

| 80 | $574.06 | $181.36 | $243.45 | $143.45 |

| 81 | No Monthly Result | $193.86 | $260.83 | $152.51 |

| 82 | No Monthly Result | $206.05 | $277.96 | $161.35 |

| 83 | No Monthly Result | $217.89 | $294.87 | $170.01 |

| 84 | No Monthly Result | $229.41 | $311.62 | $178.52 |

| 85 | No Monthly Result | $240.62 | $328.17 | $186.88 |

Smaller amounts of whole life insurance coverage

What if you’re not in a position financially to afford $25,000 of whole life OR universal life coverage?

Since $25,000 is the lowest amount of coverage we can get with universal life insurance coverage, let’s take a look at lower whole life insurance coverage amounts instead.

For example, you can look at the following coverage amounts to start:

- $20,000 in whole life insurance

- $15,000 in whole life insurance

- $10,000 in whole life insurance

- $5,000 in whole life insurance

Or you could even look to see what dollar amounts your budget can afford:

Even if you have to reduce your coverage lower than what you originally wanted with $25,000 in whole life insurance at least you’ve got something!

There’s no shame in starting small and working your coverage amount up with time.

I’ve started many of my life insurance clients off with $10,000. Then we add another $10,000 in two or three years later.

Sometimes it takes some time getting used to these payments, and once you’re accustomed to it, then it becomes easier to buy more life insurance.

Bottom line, look, something is better than nothing!

Next Steps

Congratulations on staying this long with me.

If you have, you KNOW in your heart of hearts that getting life insurance coverage on you or a loved is a MUST.

And whether you buy $25,000 in whole life insurance to start, or if you’re interested in another amount, no time is better than the present to take action now towards getting the peace of mind that life insurance provides.

Qualifying for a $25,000 life insurance program is very simple.

The application process for life insurance is easy.

Pick an agent

First, pick an agent that you want to work with.

Naturally, I’ll nominate myself for the job. =)

Find the program best suited for you

Next, after myself or my team listens to your life insurance needs, we’ll give you a quote.

We’ll figure out which program works best, based on your health, budget, and your goals.

Apply for coverage

Then, we’ll move on to completing the application.

In this day and age, I don’t need to show up face to face with you.

We can do everything over the phone or through email.

It’s super easy either way.

Wait for an underwriting decision

Underwriting decision times vary.

Sometimes you’ll get an instant decision. Other times it’ll take a few days. Worst case a few weeks.

Assuming your coverage is approved, you’ll get your policy in the mail a few weeks after.

And that’s it! There’s nothing else that you need to do.

You’re approved for coverage, and you’ve got what you need.

What are the next steps if you’re interested in some kind of $25,000 whole life insurance product?

You can do one of two things.

- Call me at 888-626-0439. That reaches my office. If you don’t get me, leave me a voicemail. I talk with a lot of people all day long and would rather have you leave a message for me to get back to you at a more convenient time.

- Or if you’re not the type to talk necessarily, start by conversing with me via email by sending me a message here.