$5,000 Burial Insurance Review [Fine Print Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Are you looking for information on $5000 in burial insurance coverage, either for yourself or a loved one?

If so, you have arrived at the right place!

Today’s article will cover ALL the details about…

Purchasing A $5,000 Burial Insurance Policy

Without further adieu, let’s get started!

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Specifically, We’re Going To Talk About The Following:

- How Burial Insurance Works

- 5 Reasons Why People Buy Burial Insurance

- Why Some Select $5000 In Coverage

- Pros And Cons Of A $5,000 Burial Insurance Plan

- Strategies To Help You Get The Best Deal

- Rates For $5,000 Burial Insurance For Ages 40 to 85

The Basics Of Burial Insurance

For most of you reading today, this is your first venture into getting burial insurance.

So let’s take a few minutes to define burial insurance and gain a fuller understanding of how this unique form of life insurance works.

Burial insurance pays money to your beneficiary

First, burial insurance (also called final expense life insurance for whole life insurance) pays the beneficiary of your choosing a lump-sum cash benefit when you pass away.

The purpose of this cash-benefit is to pay off any remaining final expenses you incur upon death. Most common expenses include burial costs, cremation costs, and paying off any remaining debts.

Money to your beneficiary, not the funeral home.

Despite popular belief, final expense life insurance does not automatically go to the funeral home.

As mentioned previously, YOU are in full control of who you want the beneficiary to be.

Sure. It CAN be the funeral home. But it doesn’t HAVE to be.

In fact, most name a loved one like a spouse or child to receive the death benefit payout. Most like to keep the money in the family, first and foremost.

With this freedom comes the beneficiary’s freedom to do as he or she pleases with the money. But most likely your selected beneficiary will follow through and take care of your burial costs.

Plans come in all shapes and sizes

You can purchase a whole life burial insurance plan at whatever size and budget works for ou.

It’s important that you get the right kind of plan that best aligns with your goals.

Don’t get hoodwinked into buying a burial insurance plan that doesn’t accomplish the ultimate goal of why you want to purchase it in the first place.

5 Reasons Why People Get Final Expense Life Insurance

While brainstorming the creation of this article, I wanted to spend time discussing the most common reasons why folks purchase a burial policy.

Since many don’t know enough about these types, I think a little explanation of the most popular reasons why people get final expense plans would help you determine if this type of life insurance is right for you.

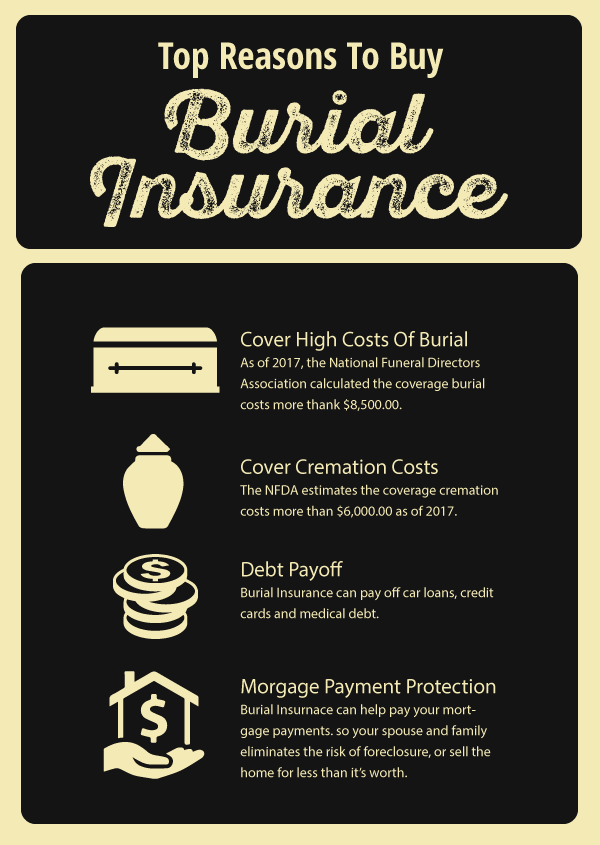

1. Cover a burial

Makes sense, right?

The biggest reason why people buy a $5,000 burial insurance plan is to cover some portion of their funeral expense.

The National Funeral Directors Association states that the average funeral costs as of 2017 exceeds $8,500.

While a $5000 policy isn’t necessarily enough to cover most burials in the country, buying this size policy makes perfect sense for folks who already have a life insurance policy and looking to supplement their coverage.

Maybe you have life insurance through work or through a separate policy. Perhaps you feel like an additional $5,000 to cover your burial will help create a more complete life insurance program.

If you’re looking for a supplementary policy to cover any additional expenses you’d experience at your death, it makes sense to purchase a $5,000 plan.

2. Cremation

Are you with more than half of the population and prefer a cremation over a burial?

It’s no joke that burial prices have gone through the roof. And many people are opting for cremation over burial to combat the seemingly silly expense of a burial service.

Despite the increase in people opting for cremation, the cost for a cremation service is quickly accelerating.

The National Funeral Directors Association states that the median cremation exceeds $6,000 as of 2017.

The truth about cremation expenses.

If you’re like me, you may doubt that cremation expenses could be so expensive.

As someone who’s worked in the burial insurance business since 2011, I commonly see total cremation expenses well under $6,000.

There are discount cremation vendors that offer direct cremations for $2000 and under. And many who opt for full cremation services usually pay between $3,000 to $5,000.

Here’s my point…

If all you’re interested in is enough coverage to pay the cremation, a $5,000 plan should do the trick in most markets.

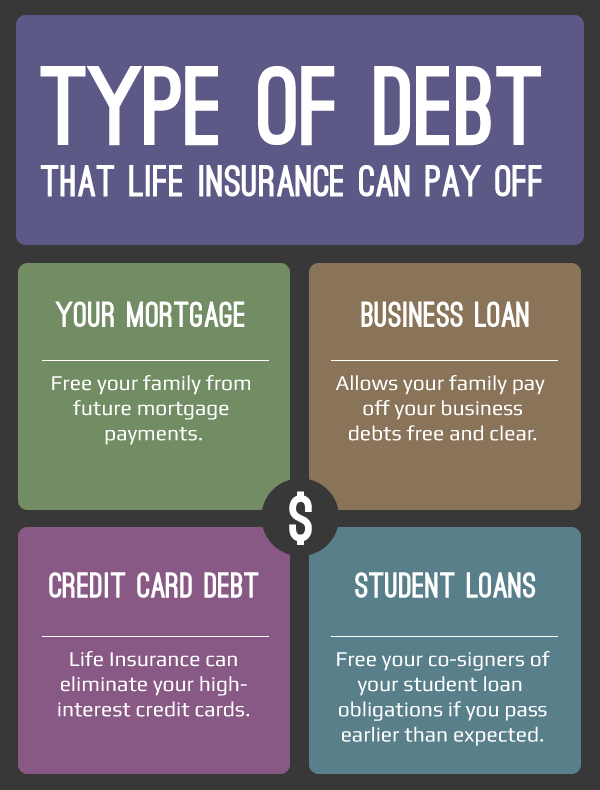

3. Pay off debt

Do you owe money on a vehicle or have credit card debt?

You can use a burial policy to pay off those final expenses, too.

Let’s say you already own $10,000 in burial insurance coverage. You’re considering buying a supplemental $5,000 plan to cover any remaining expenses. You’re worried about the potential for remaining medical bills or other debt.

You can designate the $10,000 burial insurance policy towards your burial and funeral costs, and the $5000 towards any remaining final expenses.

3. Mortgage payment protector

Do you currently pay a mortgage? Have you considered how your spouse or family would handle that mortgage without your retirement money?

A unique reason why people purchase whole life burial insurance is to help your survivors pay your mortgage after you pass away. This is what we call a mortgage payment protector program.

The concept is simple.

Let’s say your mortgage payment payment is $500 a month.

If you purchase a $5,000 burial insurance plan, you spouse now has 10 months worth of mortgage payments covered.

Here’s why you may want to consider this.

A mortgage protector plan buys your surviving spouse time. It prevents your loved one from facing foreclosure, or selling the home at below-market prices.

A $5,000 plan can buy your spouse time to prepare the house to sell and eliminate the stress of struggling to pay the mortgage on her paycheck alone.

4. Gift of love

Perhaps you want to leave $5,000 behind to a kid or a favorite grandchild to pay for college or just to help them out.

A $5,000 life insurance plan is a nice way to say thank you to your loved ones. It lifts their spirits and helps them out tremendously.

5. “Just in case coverage”

While we’ve provided specific reasons why people buy final expense life insurance, some people who don’t necessarily need it buy it just in case something unexpected happens later in life.

Maybe you already have plenty of money set aside.

Perhaps you feel confident you’ll have the resources to pay your final expenses. You have neither debt or a mortgage.

Overall your financial life is great!

But what if something happens tomorrow that you least expect?

Odds are you’ve had life throw curve balls unexpectedly. And folks who understand that are more likely to buy burial insurance, just in case something happens they do not expect.

I have countless stories of people who lived otherwise normal and predictable lives have something all of a sudden happen where there financial certainty was gone in a heartbeat.

Their life insurance plan made perfect sense to cover against those unexpected what ifs. So if you’re just looking to have life insurance cover in case something happens, a $5,000 plan can help out tremendously.

Top 5 FAQ For People Buying $5,000 in Life Insurance

1.Can I qualify for $5,000 amount of life insurance?

The answer to this depends on a number of factors, specifically your health and age. The older you are and more health issues you have, the harder it becomes to find insurance, though that is not to say it is impossible.

However if you are just looking for enough to take care of final expenses, such as a burial insurance plan, you will find that this rule doesn’t necessarily apply and you’ll have more flexibility for smaller amounts of coverage as opposed to larger amounts of coverage.

2.Why is $5,000 dollars in coverage a good amount?

Let me first ask what your personal goals are? Buy Life Insurance for Burial works hard to find coverage that is personalized to meet each client’s goals. Having said that, burial insurance can range from $5,000 all the way up to the double digits. It just depends on what kind of burial or cremation you prefer and the final expense cost in the area of the country you live in.

3. What if I need more coverage?

Usually people ask this question because they want more coverage but aren’t in a financial position to be able to afford more and that’s ok. Personally I think what’s important is that you have some kind of coverage in place, even if it isnt exactly the amount you want. You can always add to the coverage later on when you can afford to do so. Something is always better than nothing.

4.What type of life insurance is best?

Again, this comes down to what your goals might be for insurance. If you have a temporary obligation, term insurance is great. But for more long reaching and permanent obligations, such as burial, whole and guaranteed universal life insurance is the best option.

For example, we all know we are going to die and that is going to be a problem because we have to pay for the burial and other final expenses. Whole life and guaranteed universal life plans do a good job of taking care of that.

5. No other options available

Guaranteed acceptance life insurance is great when there are no other options available because chronic health issues preclude other options.

Do I need to take an exam?

An exam is usually optional unless you have a large amount of coverage, such as $400,000 or more. A lot of companies these days will accept a non-medical application, excluding you from the requirement of an exam.

Why Get $5000 In Burial Insurance And Not More (Or Less)?

By now, you may have reconsidered whether $5,000 in final expense insurance is too much or too little.

Perhaps you want a burial and realize you need more than $5000. Or maybe a direct cremation is enough and you don’t need as much.

Either way, reconsidering is totally normal. Many people start their burial insurance search with a certain number, only to change dramatically after reanalyzing insurance goals.

In this section, I’m going to give you my opinion on when $5000 in whole life burial coverage is a good idea, and when considering a different amount is better.

My goal is to help solidify your belief what amount of coverage will work best for you.

1. $5000 fits your insurance goals.

Consider speaking with us at Buy Life Insurance For Burial to help you determine if $5000 in final expense life insurance sufficiently meets your insurance goals.

This is one of those cases where a conversation with an expert can help iron out any issues or questions as to what amount of coverage is appropriate. So give us a ring!

If you find that $5,000 does not fit the bill, then we can look at other coverage amounts, like less than $5000, $10,000, $15000, $20000, $25000, or more.

2. Fits your budget

Let’s say you’ve agreed with your spouse and your agent that $5,000 is a sensible amount to accomplish your insurance goals.

However, you discover the price is higher than you can afford. What do you do?

Consider purchasing LESS coverage to start with

You see, breaking your budget is NEVER the right idea. It’s far better to purchase a smaller amount of final expense coverage, then add more later when your finances allow.

Nothing is more frustrating than having a person lapse coverage because the premium is too high.

I MUCH prefer starting with an easily affordable life insurance policy, and reassessing a year later to see about adding more coverage.

3. More coverage may cause drama

This is a sad but true reality when it comes to dying.

I’ve run into all sorts of “family drama” issues where the lust of money is the surviving family member’s main motivation.

And many of my clients recognize this in their family, and decide just enough coverage to pay for final expenses is sufficient for their needs.

They do not want angst and drama to burble over and cause unnecessary rifts between family. Therefore, getting just enough to handle the final expenses and leave not a penny leftover is the optimal solution.

If $5,000 in life insurance will do the trick to avoid drama, then by all means, get it!

4. LESS may cause drama

You may find $5,000 in burial coverage simply isn’t enough to cover your final expenses.

This can also create drama. Let me give you a scenario:

Let’s say your burial costs $10,000, and you only have $5,000 in burial insurance coverage. There are no additional funds to pay the burial.

With $5000 left over to pay the funeral service balance, your 3 children now have to split the bill down the middle.

…At least that’s what you THINK would happen. Here’s how it REALLY goes in many circumstances…

One child is not doing well financially. Perhaps he’s between jobs or seems to always have a hole in his pocket. Therefore, he’ll lean on your other kid who has done well in life and insists if he’ll only pay his portion that he’ll eventually pay him back.

The problem is this puts financial stress on your kid who has done well, and flat out isn’t fair. All kids should play a role in taking care of your final expenses.

And what commonly happens is that this money issue starts a rift between your children. Money has a way of ruining relationships, you know.

Of course, this may not happen to your children. But remember… you’re dead and can’t control what they do and how they act anymore.

This is why having sufficient coverage – even if that means buying MORE than $5000 – is well worth your consideration to relieve the burden and stress you’d cause your family without it.

Pros And Cons Of $5000 Burial Insurance

Let’s talk about the advantages of buying $5,000 in final expense life insurance coverage.

Pro #1 – Rates never increase

Most consumers agree that burial insurance is best designed using whole life insurance.

Whole life insurance fantastic! It offers:

Fixed premiums that never increase… EVER

This is great because many people who buy burial insurance are on a fixed income. They want to know EXACTLY what they’re paying and not worry about frustrating future rate increases.

The sad thing is there are well-known brand name companies that offer so-called burial insurance that actually pass along HUGE price increases.

For example, AARP New York Life Insurance and Globe Life Insurance commonly offer what’s known as term life insurance to seniors that stipulate premium increases every 5 years in the fine print.

Imagine turning 76 like my client in Flintstone, Georgia, and seeing her life insurance go up from $50 a month to $140 a month! She had to choose between paying rent, her prescriptions, or her life insurance.

This is all because she had an AARP term life insurance plan that levied an enormous price increase when she turned 76.

Buying a true $5,000 whole life burial insurance plan avoids the risk of premium increases altogether.

Pro #2 – Can’t cancel due to age or health

Do you know when your last day on Earth is going to happen?

Of course not! No knows when we’re going to die.

So why take out a life insurance plan to pay for final expenses that may cancel before we pass away?

Considering our day of death is uncertain, it makes no sense to purchase a final expense plan that doesn’t give us total, lifelong protection.

Here’s the problem with most junk mail life insurance companies on TV and in the mail. Since most offer term life insurance, you can expect your policy to cancel in many cases at 80 years old.

That’s right… you can purchase one of these plans, diligently pay on it for YEARS… and STILL, it will cancel at 80 whether you like it or not!

Imagine paying thousands – even TENS of thousands of dollars – into a plan to pay for your final expenses, only to have NOTHING to show for!

This is why I’m a big fan of whole life burial insurance because it is written in the contract that you CANNOT be cancelled at a certain age or because of health changes.

What’s the catch? You have to continue making premium payments. But that makes sense.

Bottom line, burial insurance provides peace of mind. You know your coverage is good as gold, and your $5000 whole life final expense plan ain’t going anywhere as long as you pay the premium.

Pro #3 – First day full coverage

Burial insurance may provide you first-day full coverage.

First-day full coverage means you’re fully protected for either natural or accidental death after the policy is approved and after making the first payment.

Naturally, eligibility depends on health history and medication usage. We’ll talk more later on how to increase your odds of getting fully covered despite medical history issues.

No questions asked burial insurance

Have you seen ads on TV for Colonial Penn or MetLife?

Both of these companies offer what’s known as guaranteed acceptance burial insurance.

And while you’re not required to answer health questions, you’re forced into a two year waiting period prior to full natural death coverage.

That means if you pass away within two years with Colonial Penn or Metlife’s Guaranteed Acceptance product, your beneficiary does NOT receive the full death benefit amount!

However, these plans DO have a place. But ONLY when someone is in REALLY bad health and cannot qualify for anything else.

In my experience, the vast majority of seniors looking for burial insurance have high odds of qualifying for first-day full coverage.

This is why it’s wise dealing with a burial insurance specialist like us at Buy Life Insurance For Burial, where we shop the burial insurance companies for you to see who will give you the best deal.

Drawbacks of a $5,000 burial insurance plan?

The only real drawback to burial insurance is that you receive LESS coverage per dollar of premium when compared to the same-cost term life insurance plan.

But, really. This isn’t THAT big of a deal.

Think about it this way. Insurance companies are smart. They understand odds. With a term life insurance policy, they feel confident you have a high chance that you’ll outlive the coverage.

In fact, approximately 1 out of 100 term plans pay a death claim. That means 99 out of 100 do NOT pay a death claim!

This is not the case with whole life burial insurance. If you keep the policy, your payout is guaranteed. This means the insurance companies MUST plan on paying the death claim.

And because of this guarantee of payout, insurance companies charge a higher premium relative to term insurance to compensate.

It’s very much like buying a warranty on your car. A warranty guarantees your car is covered in case of problems occurring, instead of paying cash out-of-pocket

A $5000 whole life burial insurance plan is essentially life insurance with a warranty. You’re guaranteed you’re covered, and there’s peace of mind because of it.

Strategies To Buying A $5000 Burial Insurance Plan

In this section, I’ll discuss my preferred strategies to finding the best deal on $5000 in final expense coverage for my clients.

My goal is ALWAYS to provide my clients the best combination of price and value of coverage.

Let’s get started…

1. Avoid TV life insurance companies

Here’s the thing.

Almost all of the burial insurance companies advertising in between reruns of Bonanza and The Price Is Right provide some of the worst options final expense life insurance programs.

When you check out the fine print, you find out how bad they really are.

Many of these plans like those offered through Colonial Penn are what’s called guaranteed acceptance life insurance.

Simply put, they do not cover fully for natural death for the first two years. This means if you die for any natural cause, the policy only returns the money you paid in.

Sometimes guaranteed acceptance life insurance plans DO make sense to consider purchasing. I’ll have the occasional client whose medical history is in bad enough shape to warrant a no-questions asked life insurance policy.

But the truth is most qualify for first day full coverage. And working with these TV and junk mail insurance companies, your odds are higher you’ll have to take out a guaranteed acceptance policy when you don’t have to.

In addition to guaranteed acceptance burial insurance solicitations, you’ll receive mailers and TV ads for term life “burial” insurance.

Instead of limiting your coverage in the beginning, term life insurance limits it on the back end. Many cancel at age 80, leaving you without any burial insurance whatsoever.

2. Avoid an exam

The truth is it’s likely NOT required to sit for an exam if all you want is $5,000 in burial insurance coverage. Most companies won’t fool with an exam at that small of coverage.

In fact, I recommend avoiding an exam if looking for any type of life insurance under $25,000 in coverage. It’s just not necessary anymore.

Why? Final expense life insurance companies follow a non-medical approach to underwriting your policy, only requiring your medical records to determine insurability.

The good news is that this process only requires you to complete an application for burial insurance along with a 15-minute phone interview. You either get an instant decision by the end of the phone call, or within the next day or two.

3. Always opt for first full coverage when you can

With burial insurance, the sooner you’re covered, the better.

Don’t opt for final expense life insurance coverage that forces you into some sort of waiting period. You risk too much unnecessarily, especially when there may be burial insurance companies that will fully protect you.

Moral of the story – always opt for first-day full coverage.

4. Work with a broker

This is REALLY important advice.

If you’re looking for a $5,000 burial insurance plan, work with somebody who has access to a multitude of burial insurance companies.

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

The WORST thing you can do is select a “one trick pony” burial insurance agent.

These are known as “captive agents,” and usually have only one burial insurance option.

Remember. When it comes to life insurance, the less options you have, the less value you receive.

You may pay HUNDREDS of dollars more than you need to with a captive agent. In fact, you may be put into a a two year waiting period policy unnecessarily. I see it happen ALL the time.

We at Buy Life Insurance For Burial have helped thousands of people like you with their burial insurance needs.

I’ve often insured people with first day full coverage that otherwise would have been stuck in a two year waiting period policy.

Bottom line, working with a broker, you’re ability to get a good value for your money is MUCH higher.

$5000 Burial Insurance Rates, Ages 50 to 85

$5000 Mutual of Omaha Monthly Rate Chart

| Age | Male, Smoker | Male, Non-Smoker | Female. Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 45 | $17.22 | $14.32 | $15.67 | $12.91 |

| 46 | $17.70 | $14.69 | $15.99 | $13.11 |

| 47 | $18.29 | $15.11 | $16.37 | $13.38 |

| 48 | $18.93 | $15.58 | $16.74 | $13.69 |

| 49 | $19.39 | $15.86 | $17.02 | $13.84 |

| 50 | $20.05 | $16.18 | $17.31 | $13.94 |

| 51 | $21.04 | $16.75 | $18.05 | $14.33 |

| 52 | $21.85 | $17.16 | $18.53 | $14.54 |

| 53 | $22.90 | $17.70 | $19.26 | $14.91 |

| 54 | $23.99 | $18.41 | $19.93 | $15.33 |

| 55 | $25.24 | $19.15 | $20.76 | $15.80 |

| 56 | $26.33 | $19.83 | $21.39 | $16.24 |

| 57 | $27.37 | $20.55 | $21.96 | $16.63 |

| 58 | $28.41 | $21.24 | $22.53 | $17.02 |

| 59 | $29.65 | $22.01 | $23.15 | $17.45 |

| 60 | $31.11 | $22.98 | $23.94 | $18.04 |

| 61 | $33.09 | $24.29 | $25.08 | $18.86 |

| 62 | $35.11 | $25.55 | $26.22 | $19.63 |

| 63 | $37.09 | $26.86 | $27.37 | $20.46 |

| 64 | $39.12 | $28.17 | $28.46 | $21.28 |

| 65 | $41.10 | $29.48 | $29.60 | $22.11 |

| 66 | $43.85 | $31.27 | $31.37 | $23.32 |

| 67 | $46.66 | $33.07 | $33.14 | $24.53 |

| 68 | $49.42 | $34.87 | $34.91 | $25.75 |

| 69 | $52.17 | $36.66 | $36.68 | $27.01 |

| 70 | $54.98 | $38.45 | $38.44 | $28.22 |

| 71 | $58.62 | $40.78 | $40.99 | $29.92 |

| 72 | $62.31 | $43.06 | $43.49 | $31.66 |

| 73 | $66.00 | $45.61 | $46.04 | $33.57 |

| 74 | $69.64 | $48.18 | $48.53 | $35.49 |

| 75 | $73.34 | $51.37 | $51.08 | $37.81 |

| 76 | $77.96 | $55.04 | $54.41 | $40.73 |

| 77 | $82.97 | $58.42 | $58.00 | $43.36 |

| 78 | $88.09 | $61.53 | $61.62 | $45.82 |

| 79 | $93.19 | $64.72 | $65.28 | $48.31 |

| 80 | $98.34 | $67.93 | $68.97 | $50.82 |

| 81 | $106.65 | $73.10 | $74.27 | $54.71 |

| 82 | $115.56 | $78.37 | $79.99 | $58.58 |

| 83 | $124.54 | $83.31 | $85.70 | $62.26 |

| 84 | $132.94 | $88.24 | $91.05 | $65.88 |

| 85 | $141.39 | $93.18 | $96.45 | $69.55 |

$5000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 51 | $26.96 | $18.92 |

| 52 | $27.36 | $18.93 |

| 53 | $27.82 | $20.00 |

| 54 | $28.22 | $20.97 |

| 55 | $28.68 | $21.84 |

| 56 | $29.45 | $22.62 |

| 57 | $30.27 | $23.49 |

| 58 | $30.98 | $24.17 |

| 59 | $31.65 | $24.86 |

| 60 | $32.10 | $25.50 |

| 61 | $32.58 | $26.01 |

| 62 | $34.77 | $27.52 |

| 63 | $36.97 | $28.90 |

| 64 | $39.08 | $30.09 |

| 65 | $41.10 | $31.00 |

| 66 | $43.08 | $31.78 |

| 67 | $44.81 | $33.40 |

| 68 | $46.33 | $35.96 |

| 69 | $47.75 | $37.16 |

| 70 | $48.99 | $38.26 |

| 71 | $50.09 | $41.93 |

| 72 | $54.59 | $45.42 |

| 73 | $58.99 | $48.76 |

| 74 | $58.99 | $51.83 |

| 75 | $66.97 | $54.59 |

| 76 | $70.28 | $62.38 |

| 77 | $81.97 | $69.73 |

| 78 | $93.20 | $76.60 |

| 79 | $103.98 | $83.02 |

| 80 | $114.31 | $88.71 |

| 81 | $124.22 | $90.69 |

| 82 | $127.59 | $92.83 |

| 83 | $131.19 | $95.83 |

| 84 | $145.08 | $98.17 |

| 85 | $151.97 | $100.53 |

Conclusion

I hope that you found the information in this article useful for your research on burial insurance.

Most importantly, I hope you will make the decision to get final expense life insurance on the books so that you can rest assured that your loved ones will be taken care of.

If you would like to find out more about what your premiums would be, please get in touch at 888 626-0439 to speak to a friendly representative who can tell you more about our offering. It takes less than 10 minutes and you are under no obligation whatsoever to buy anything.

If you prefer to message us, send us your request here. We will be sure to get in touch within 24 hours.

Thanks for your interest and for reading this article.