Guaranteed Issue Life Insurance – Truth Revealed [Price & Coverage]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

If You Or A Loved One Thinks A Guaranteed Issue Plan Is Right (Or Wrong) For You, Then This Article Will Be Extremely Helpful.

Question…

Have you heard of the following burial insurance programs on TV or in the mail:

“Guaranteed acceptance life insurance”… “no-questions-asked life insurance”… or “guaranteed issue life insurance coverage?”

Likely you have!

My clients tell me they can barely get through the day, watching Wheel Of Fortune, Jeopardy, or Bonanza without these commercials playing non-stop!

And most likely you’ve turned up on this page in search for ANSWERS…

Like, “How do these burial insurance plans work?”

Or, if you’re really sharp…

“What’s the CATCH?”

Luckily, you’re at the right website! If you’re looking for a detailed analysis of what the fuss (and the fine print!) of guaranteed issue life insurance is all about, then strap on your seat belt and prepare to get THE TRUTH of how this life insurance product REALLY works, and whether or not it’s a good fit for you or a loved one like your parent.

NOTE: Want to watch my presentation on the TRUTH Behind Guaranteed Acceptance Life Insurance? Watch the video below for the full presentation.

Overview Of Today’s Topic:

- Definition Of No-Questions-Asked Life Insurance

- How A Guaranteed Acceptance Life Insurance Plan Actually Works

- Why One Would Consider Purchasing Guaranteed Issue Life Insurance With No Health Questions Asked

- Is Such A Thing As Guaranteed Term Life Insurance?

- Is There Such A Thing As Guaranteed Acceptance Life Insurance With No Waiting Period?

- Review Of Guaranteed Acceptance Life Insurance Companies

- Guaranteed Acceptance Life Insurance Availability For Different Age Ranges

- My Opinion As An Agent On The Best Guaranteed Acceptance Life Life Insurance Coverage

- Review Common Health Conditions That May Or May Not Qualify Only For Guaranteed Acceptance

- Summary Of Guaranteed Issue Life Insurance

As you can see, this is a very deep dive educational-type of training. I ain’t holding back no punches!

Let’s begin…

What Exactly Is Guaranteed Issue Life Insurance Coverage?

What is guaranteed issue life insurance?

In a nutshell…

Guaranteed issue life insurance guarantees your acceptance for life insurance… WITHOUT taking health into consideration.

With ALL guaranteed acceptance life insurance plans, the company NEVER asks questions about the applicant’s health.

More specifically, where you fill out your:

- Personal information,

- Your mailing address,

- Your beneficiaries,

…All of that jazz, should NOT ask ANYTHING about your health.

As long as you fall within the age of acceptance, guaranteed acceptance life insurance CANNOT decline you coverage because of ANY health issues!

Literally, if you’ve got a pulse and you can sign your name to that application, you’re approved for coverage.

Is It REALLY A Good Deal?

Most people automatically assume the questions life insurance companies ask are a requirement to get any type of life insurance coverage like term, whole, or universal.

It just makes sense, right? If an insurance companies offers your family a large sum of money when you pass away, it’s only sensible that the insurance company does some kind of check up on you to make sure you’re not going to croak anytime soon.

The problem is this: a lot of folks think applying for life insurance is a headache.

Why?

Embarrassing examination… prodding you with needles for blood… peeing into a cup. Stuff we ALL would rather pass on, right?

That’s why guaranteed acceptance life insurance sounds good – just fill the form out and send it in and POOF – like magic you are covered.

Guaranteed Acceptance Life Insurance, No Questions Asked Life Insurance, Guaranteed Issue Life Insurance?

Some people wonder, “Okay, I see these guaranteed acceptance life insurance plans. I see no-questions-asked life insurance plans. Is there any kind of difference whatsoever?”

Bottom line, these are all life insurance policies.

Life insurance is life insurance… except some policies function differently than others, depending on how the program is designed.

What we’re talking about here are just different names for the same thing. Like how some people call it a freezer an icebox.

Likely you have heard of a few life insurance carriers offering guaranteed acceptance life insurance, such as:

- Colonial Penn,

- MetLife,

- Mutual of Omaha,

- Physicians Mutual,

- Canada Protection Plan (for our friends to the north)

- and many others.

(We’ll talk more about these guaranteed issue life insurance carriers in more detail shortly).

How Do Guaranteed Acceptance Life Insurance Plans REALLY Work?

Let’s talk about the specifics of how guaranteed acceptance life insurance plans really work.

Thankfully, no-questions asked life insurance plans are very simple.

You sign the application, and you’re approved without regard to health status. As long as you fit the age brackets, your acceptance for coverage is GUARANTEED.

What if you smoke cigarettes or a pipe or anything else?

Those factors have no bearing on whether or not you’re going to get approved. It’s truly guaranteed to issue!

Buy Life Insurance for Burial wants to help you today. We want to know what your life or burial insurance-related goals are so we can help you to achieve them.

We suggest that you reach out to us today to receive a free, no obligation quote.

To do so, call us at (888) 626-0439 to speak with one of our life insurance experts. Or, you can message us by submitting the form on the left side or bottom of the screen. If you do, expect to hear from us within the next 24 business hours.

Are Guaranteed Issue Life Insurance Products Whole Life?

Guaranteed acceptance life insurance products typically are a whole life insurance type of product.

You’ve probably heard of term life insurance. It’s the most common kind of life insurance.

The second most common are whole life insurance policies.

We’ll dive into this later. For now, the way whole life works is that it’s permanent life insurance.

Guaranteed Issue Life Insurance = Whole Life = Life-long Insurance Protection

The way to think of whole life insurance is it lasts your whole life… as long as you pay the premiums.

With whole life plans, premiums never increase (which is NOT the case with term insurance).

The biggest difference between term and whole life insurance is term insurance is designed to cancel at a later date, OR go up in price as you age.

However, whole life insurance premiums never go up, and you CANNOT be canceled, no matter how old you get.

Here’s the point…

Ninety-nine percent of the guaranteed issue policies you’re going to see are a whole life type of product.

Why Get Guaranteed Acceptance Life Insurance with No Health Questions Asked?

You may be thinking,

“Okay, I like the appeal of this no-questions-asked plan. I just send this application back, and I get approved. What could POSSIBLY be wrong with that?”

Let’s explain when it is appropriate to get a guaranteed acceptance life insurance plan.

Why? Because you’ll see VERY quickly that there are circumstances where getting guaranteed issue life insurance is NOT acceptable.

Otherwise Uninsurable

The main reason to get a no-questions-asked life insurance policy is that you are uninsurable.

Meaning if you apply for any other life insurance policy, you will get declined.

And this is doubly bad because the life insurance companies that decline you usually do NOT offer guaranteed issue life insurance.

If you just don’t fit those health questions then TOO bad – sayonara!

This is where a guaranteed acceptance policy is perfect.

If you are uninsurable, then a guaranteed acceptance life insurance policy may be the way to go.

People buy guaranteed acceptance life insurance because they’ve applied and failed at getting life insurance elsewhere.

Or, they may think, “I’ve had heart problems… Who in their right mind would even cover me? Can I even get life insurance after a heart attack?”

There’s a lot of assumptions that people make, thinking they’re uninsurable, or the premiums will be too expensive on account of their health and age.

But here’s the unfortunate truth about “thinking” you’re uninsurable…

Many people buy guaranteed acceptance life insurance… because they FALSELY think they’re uninsurable!

Some people don’t know there are better options for coverage than guaranteed acceptance life insurance.

Why? Because it’s pretty much the ONLY type of plan CONSTANTLY advertised on television and junk-mailed!

Here’s why people end up getting no-questions asked life insurance… when they don’t have to.

You’ve gotten letters from Colonial Penn and Globe Life for years. They remind you that your “acceptance is approved, that it’s guaranteed!”

You’ve probably ignored it for years on end and then have a health issue and you think, “Okay, maybe this makes sense now.”

On top of that, most people are not well versed in life insurance.

Think about it. We have our own personal challenges to manage. Family, work life, social relationships… that kind of thing.

Life insurance is one of those things most don’t really take time to quite understand. They’re genuinely confused in many circumstances.

These guaranteed issue life insurance companies PLAY on your ignorance! I say “ignorance” in a nice way…. meaning that these companies prefer to take advantage of your lack of understanding of life insurance options.

We all want to take the easiest route with burial insurance.

Truth be told, most people aren’t going to sit through a presentation or read an article. They won’t take the time to investigate their own options.

But obviously you are different! Knowledge and education are important for you.

That is the goal here because guaranteed acceptance life insurance plans in some circumstances aren’t the best option. You should be able to figure out here by the end of this article if it is a good option or not for you and what you can do about it.

What about guaranteed issue term life insurance?

Some folks believe that a term life insurance program is way better than a whole life insurance program.

In my opinion, this is NOT the case.

Part of this problem is that the “gurus” that propagate on radio and television commercials all tell you to buy term insurance, and they do so in a biased way in some circumstances.

Here’s what I mean…

You’d be SURPRISED as to the set up some of these gurus have to get paid for their recommendation, which would make you wonder, “Well, if the ‘guru’ is getting payment for his recommendation, how much can I REALLY trust him to advise me, considering he has NO understanding of my unique situation?”

Look. REAL professionals do not tell you to do something, without FIRST listening to what your goals are!

Doing so would be unethical, wouldn’t it?

I don’t know your personal situation. I don’t know anything about your health. I don’t know anything about your circumstances.

In order to make a recommendation, I must collect the FACTS.

That’s why making blanket statements about a type of life insurance WITHOUT understanding YOU can lead to DEVASTATING consequences for you and your family!

A lot of people ask about term life insurance first because a particular guru pushes it, saying it’s cheaper.

They think cheaper is better.

You know as well as I do…

…Cheaper isn’t always better!

And here’s the thing.

There really isn’t any kind of guaranteed issue term life insurance product on the market.

However, there are a few term insurance plans that ask minimal health questions. It allows you to get a term insurance policy. Yes, it does have a waiting period attached to it, but it is a term insurance policy nonetheless.

Who Would Consider Buying A Near Guaranteed Issue Term Life Insurance Plan With Minimal Health Questions?

A term insurance plan is most appropriate if there is a large obligation that has to be covered.

The perfect example is a mortgage loan.

In that circumstance, a term life insurance product would be sensible. You can get more coverage for every dollar you put in relative to a whole life plan.

However, it’s not always the case. It depends on the severity of the health issues, but the point is to make sure you understand there is this option if you want a term insurance plan.

How Term Insurance Works

Now, in case you don’t know, a term insurance plan terminates.

A lot of these plans that will approve folks in bad health don’t last long. Maybe you’ll get 10 or 20 years before the policy expires.

I actually just got off the phone with an agent of mine in Phoenix, Arizona. He just ran into a guy who had a policy with a 3-year waiting period (yikes!)that was going to cancel in 10 years. So he would actually only be covered for 7 of those years until he lost ALL of his coverage.

It turns out this guy could qualify for preferred coverage with a lot better life insurance!

The downside of term life insurance with a waiting period

True, you may not die within those first few years of your term life insurance policy…

But what if you live PAST the 10 or 20-year period?

That’s the downside of term, especially when we’re looking at final expense coverage.

We don’t know when we’re going to die… but we DO KNOW that it’s going to happen some time!

Considering this.

Many people want assurance and guarantees that their coverage will NEVER cancel as long as it’s paid!

That’s why we like guaranteed issue whole life plans best in these circumstances.

Remember… whole life insurance lasts your whole life.

It’s much more powerful and, in my opinion, much more effective! With that said, term insurance can be useful in some circumstances.

If you are interested in how term insurance works and you want to know your options, you can give us a call today at (888) 626-0439 now to receive a free quote. Our experts will go over your options will you, and they will answer any questions you have about life or burial insurance.

Alternatively, you can send us a message now. All you have to do is submit the form located on the left or bottom side of the screen. Request the information you’d like to know or tell us how we can help you. We will get back to you within the next 24 business hours with your options.

Story from the field

My story today will be about two of my clients. For the story, I’m going to call them the Cooks. It takes place back in 2013, in Alabama.

I was in a rural area, going to meet Mrs. Cook after she reached out to us asking about getting life insurance. I’m headed up their way when I turn on to a gravel road. It was pretty long, and I just made my way towards them. As I’m finally getting to their house, I see a sign.

It read: “Any damage done to your person or your property is not the fault of this property owner. Signed the Cooks.”

Typically, if I saw a threat like this, I would just leave, but for some reason, I felt like I should just give it a shot.

When I pulled up into their driveway, I notice that a man, who I presumed to be Mr. Cook, had been watching me. He saw me read the sign, and he saw me come up to their home. That made me nervous, but I knew I was there to help them.

“Are you Mr. Cook?” I asked.

He coldly replied, “Depends on who’s asking.”

I opted to use humor, “You’re the man I’m looking for,” I laughed.

That was a poor choice on my part. He wasn’t happy.

Then, I told him, “You see, Mr. Cook, you sent this card back and there was no phone number on it for me to call you ahead of time. I know I am dropping in unannounced, but I’m dropping in because you or your wife had requested some information about life insurance.”

He didn’t object, and he took me into his house to speak with Mrs. Cook. She was different from Mr. Cook. She was the perfect prospect, and she understood why burial insurance was so important to get for her family. Previously, she lost her first husband and his coverage was really beneficial to her when she was grieving his loss. It made it easier.

Now, she wanted to take out a policy on Mr. Cook to make sure he would be covered, too, in case she lost him, but there was one issue with him. It was with his health.

He had open heart surgery just three years ago. She had looked at other insurance companies, but the best she could get from them was 2-year waiting products, meaning that his coverage wouldn’t kick in until 2 years after the policy was taken out. Luckily, with my company, I could assure her we would approve her husband for first day full coverage despite his medical history.

She also had a concern. All she could afford on her income was $20 a month. We worked together, and I showed her how it would be possible to cover Mr. Cook’s funeral expenses with a payment $20 a month, and she was so happy.

Now, the final step. We had to get Mr. Cook to sign off on it. We headed to his workshop, and I let her approach him.

She explained, “Honey, I’m going to buy life insurance on you and all I need you to do is sign the application.”

He was hostile with her like he had been with me before, “I’m not signing no damn insurance papers. This man trespassed on my property. What does he think he’s doing here anyway?” said Mr. Cook.

After that, he started to scream in my direction. He even said, “You’re lucky your not buried dead in my backyard the way you showed up.”

I was worried that I had made a huge mistake in choosing to drive past that sign. But, Mrs. Cook was able to calm him down. Eventually, he understood what we were trying to do, and he realized that all I wanted to do was help him. He signed the applications and filled out the health questions.

In my shock at how he quickly went from irate to cooperative, I helped him finish the forms, and then, I got out of there as fast as I could.

Now, while this is a funny story that I can laugh about now, it isn’t the purpose of why I’m telling you this. The real purpose is to show you what Buy Life Insurance for Burial can do for their clients, even those with significant health problems like Mr. Cook’s.

There are actually situations where we are risking our lives, like in this story, just to help our clients get the life or burial insurance that they need. I knew Mrs. Cook really appreciated that we could offer him first day full coverage when she had only been able to find 2-year waiting products on her own.

The insurance plan that we were able to get Mr. Cook will make a huge difference in Mrs. Cook’s life when it comes time to use it. Now, she has peace of mind and can find comfort knowing that she does not have to worry about funeral expenses.

My final thoughts here are don’t shoot your insurance agent. We want to help you, even if it means we show up at your home unannounced!

The BIGGEST Drawback to Guaranteed Issue Life Insurance

By now you’re thinking:

“Well, you’re obviously telling me is there are some drawbacks to a guaranteed acceptance, no-questions-asked life insurance plan.”

That’s correct. So let’s cover the shortcomings of guaranteed issue life insurance, and what to do about them.

Now that you know the pros of no-questions-asked life insurance, let’s talk about the biggest drawback.

The biggest drawback for no-questions-asked life insurance policies is it’s not full coverage from the first day.

If you pick up any one of these guaranteed acceptance plans and die the day after, only the amount you paid in plus a small amount of interest is paid back to your loved ones.

To clarify, this is if you die from natural causes.

If you die by an accident, you would be fully covered with any guaranteed acceptance life insurance plan for the most part.

How long is your coverage restricted with guaranteed acceptance life insurance plans?

Now, here’s the thing.

A lot of guaranteed acceptance life insurance plans have 3 or even 4-year limitations of coverage. This means you do NOT have full coverage that period of time.

With that said, the best no questions asked life insurance carriers limit only for 2 years. Those are the ones I have access to.

The way I look at it when I deal with somebody who ONLY qualifies for guaranteed acceptance life insurance is… why wait 3 or 4 years, right?

Make the waiting period as FAST as possible… because we don’t know when our final day is going to be.

You may be listening to me and thinking, “Ah, these life insurance companies are always out to get you, always some kind of fine print.”

I totally get what you mean.

To be honest, I don’t even like selling guaranteed acceptance policies.

The only reason I do is because they are GOOD options in the long run because SOMETHING is always better than NOTHING!

Circumstances When Guaranteed Issue Life Insurance Plans Make The Most Sense

Let’s talk about why a guaranteed issue life insurance policy may make sense despite the drawbacks of the product.

In fact, it’s very simple…

The only situation where I can recommend a guaranteed issue life plan is when the client cannot qualify for anything else.

If, after asking my client a series of health questions, I determine that NONE of the life insurance companies that do final expense will qualify this person, THEN the ONLY option is a guaranteed acceptance policy.

Under NO other circumstances should an agent say, “Here’s your option that’s going to make you wait 2 or 3 years,” without trying his or her best to get you something better that will fully cover you.

Only in the situation where there’s no first-day full coverage available should you even BEGIN to consider a guaranteed acceptance life insurance plan.

So just to make a note here…

YES, you may be able to qualify for something BETTER than a two-year waiting period plan, and if you stick around, I’ll cover the most common health issues that require no-questions-asked life insurance.

As I mentioned earlier, a lot of people just presume that their health is bad. They feel like, ”I don’t even want to fool with trying to get BETTER burial insurance because the price will be high, and the coverage will be poor. Let me just get this two-year waiting period plan.”

C’mon! Give yourself a shot, for crying out loud! It could mean EVERYTHING to your beneficiary if you die earlier than expected!

That’s what I do for a living. I help people. I have different companies. I try to get them first-day full coverage, and only in the situations where I can’t do I offer some sort of no-questions-asked life insurance.

Trying to get something better than a guaranteed issue life insurance policy is not hard. It only takes a good agent 10 minutes to figure out what you qualify for, and there’s no harm, no foul. You don’t lose anything for trying.

The worst case scenario is you find out you get something better than expected – an unexpected surprise – woohoo!

There’s no downside to trying. There’s only upside.

So give yourself the chance!

Don’t jump into these guaranteed acceptance plans with a waiting period until you talk with an agent, someone like me, who can shop the carriers and underwrite to see who’s going to give you the best chance.

Something is better than nothing

If you can only get a two-year waiting period plan, at least something is better than nothing.

There’s nothing worse finding out someone who COULD have bought a guaranteed issue plan didn’t because they didn’t like the coverage restriction… only to die 2.5 years later… without ANY coverage!

Yes, there’s that two-year period of time that would be not as good as you’d like it to be, but a lot of people make it past the two years.

I’ve had many times in dealing with clients whose beneficiaries profusely thanked me because I insisted on them getting coverage EVEN with the two-year waiting period.

Because I did, their family got a death benefit claim. They had the money to bury them. They had the money to take care of any final expenses.

That’s why it’s so important. Yes, I know. I’m a person too. I buy insurance as well, and there’s good reason to be frustrated with insurance companies.

But the long term is what you have to think about with the guaranteed acceptance policy because something is better than nothing.

I promise you that once you get past those two years, you’ll be TOTALLY happy that you had something.

Once the two years has been reached, you’re fully covered, the rates never go up, you can never be cancelled, even if your health situation worsens. You’re fully covered, and it will pay under any circumstances after that period of time.

Guaranteed Acceptance Life Insurance Company Reviews

I wanted to go through a quick cataloging of the different no-questions-asked life insurance companies that are out there that you’re probably familiar with.

I’m going to give you a quick overview of these companies.

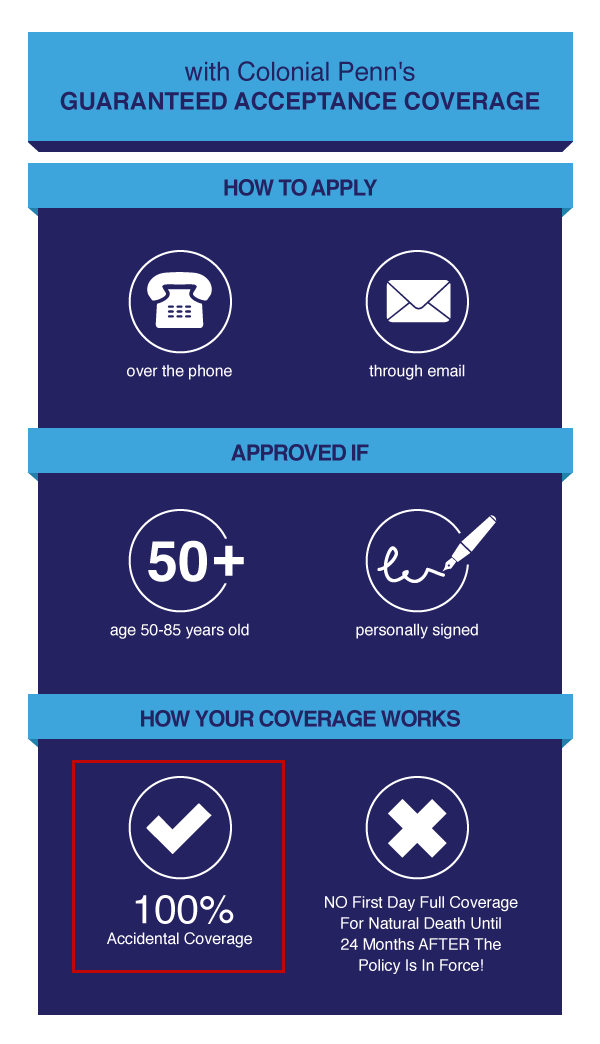

Colonial Penn

You’ve heard of Colonial Penn. Who hasn’t? Everybody gets their junk mail!

You’ve heard of Colonial Penn. Who hasn’t? Everybody gets their junk mail!

They were founded in 1968 and headquartered in Philadelphia. If you watch enough television, you’ll see Alex Trebek from Jeopardy endorsing them and talking about “coverage never goes down, the price never goes up, and your acceptance is guaranteed.”

That’s their most common product. This is the guaranteed acceptance life insurance plan.

Of course, it’s offered in units. You’ve probably seen that before how guaranteed acceptance Colonial Penn plans have $9.99 units.

The product, however, if you take away all the pretty packaging, is a two-year waiting period product. There’s a natural death restriction for two years, and accidental coverage from the first day.

What’s a unit with Colonial Penn?

There’s a reason why they say a unit is $9.99. What they don’t tell you is what a unit is. They you the price of the unit, but what is a unit? It could be anything.

Simply put, the older you get, the less that unit of coverage provides.

If you compare it to other guaranteed issue companies, their pricing usually is about 50% higher.

Now, why is that the case?

Well, Colonial Penn advertises heavily all over the country. You’ve seen them on TV and in the junk mail.

That stuff costs a lot of money. They paid Alex Trebek probably a nice endorsement to do these advertisements.

So the company has a lot more costs that it has to pay for with the premiums that are paid by its clients. Many of these companies that sell without an agent involved pay a lot more to get you as a client. Therefore, the premiums have to be a bit higher to cover this cost of doing business.

MetLife Guaranteed Acceptance Life Insurance

MetLife is headquartered in New York City. It started in 1868.

They offer a lot of insurance products. Guaranteed acceptance life insurance is just one of their products. They do a lot of other products.

Overall, MetLife is an excellent company, but the one that is sold on TV and that you see in the mail is a two-year waiting period. The pricing is high just like Colonial Penn relative to other products.

Physicians Mutual Life Insurance

Physicians Mutual was founded in 1902. They’re headquartered in Omaha, Nebraska.

Again, they’re a very good life insurance company. They do health products. They do Medicare supplements. They do indemnity products. They do all sorts of stuff.

Their no-questions-asked life insurance product is sold through the mail, and I can tell you, based on personal experience, it tends to be a little bit better priced than what you would see from either Colonial Penn or MetLife.

AIG Life Insurance

Let me tell you about what company I represent when it comes guaranteed issue as of the present day.

Let me tell you about what company I represent when it comes guaranteed issue as of the present day.

I represent AIG Life Insurance Company. That’s the company I use for my guaranteed acceptance, guaranteed issue, no-questions-asked life insurance plans.

They were founded in 1919 and headquartered in New York City.

I find that the rates are the most competitive that you can find for a guaranteed acceptance plan, especially between the ages of 50 to 85.

It’s very rare that you’re going to see one of these other companies previously mentioned actually beat AIG in price.

I tend to put most of my guaranteed issue clients with AIG because everything else, in my experience, is extremely high priced.

There’s a lot of companies that offer guaranteed acceptance life insurance through independent agents like me, but you look at the prices and you think, “This stinks! Who would even think about buying something like this?”

AIG is not like that. They’re very competitive, and they’re a company that I like to write because of that fact. A very solid, well-known company, and they do a very good job with premiums as well.

So what I’m showing you here is a quick chart of $10,000 and $20,000 coverage amounts at 50, 55, 60, 65, 70, 75, 80, and 85.

$5000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 51 | $26.96 | $18.92 |

| 52 | $27.36 | $18.93 |

| 53 | $27.82 | $20.00 |

| 54 | $28.22 | $20.97 |

| 55 | $28.68 | $21.84 |

| 56 | $29.45 | $22.62 |

| 57 | $30.27 | $23.49 |

| 58 | $30.98 | $24.17 |

| 59 | $31.65 | $24.86 |

| 60 | $32.10 | $25.50 |

| 61 | $32.58 | $26.01 |

| 62 | $34.77 | $27.52 |

| 63 | $36.97 | $28.90 |

| 64 | $39.08 | $30.09 |

| 65 | $41.10 | $31.00 |

| 66 | $43.08 | $31.78 |

| 67 | $44.81 | $33.40 |

| 68 | $46.33 | $35.96 |

| 69 | $47.75 | $37.16 |

| 70 | $48.99 | $38.26 |

| 71 | $50.09 | $41.93 |

| 72 | $54.59 | $45.42 |

| 73 | $58.99 | $48.76 |

| 74 | $58.99 | $51.83 |

| 75 | $66.97 | $54.59 |

| 76 | $70.28 | $62.38 |

| 77 | $81.97 | $69.73 |

| 78 | $93.20 | $76.60 |

| 79 | $103.98 | $83.02 |

| 80 | $114.31 | $88.71 |

| 81 | $124.22 | $90.69 |

| 82 | $127.59 | $92.83 |

| 83 | $131.19 | $95.83 |

| 84 | $145.08 | $98.17 |

| 85 | $151.97 | $100.53 |

$10000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 50 | $51.92 | $35.83 |

| 51 | $52.73 | $36.68 |

| 52 | $53.63 | $37.99 |

| 53 | $54.44 | $39.93 |

| 54 | $55.36 | $41.67 |

| 55 | $56.90 | $43.23 |

| 56 | $58.55 | $44.98 |

| 57 | $60.01 | $46.34 |

| 58 | $61.31 | $47.72 |

| 59 | $62.21 | $49.00 |

| 60 | $63.17 | $50.02 |

| 61 | $67.54 | $53.04 |

| 62 | $71.94 | $55.80 |

| 63 | $76.16 | $58.19 |

| 64 | $80.21 | $60.01 |

| 65 | $84.15 | $61.57 |

| 66 | $87.63 | $64.79 |

| 67 | $90.66 | $67.45 |

| 68 | $93.49 | $69.91 |

| 69 | $95.98 | $72.32 |

| 70 | $98.18 | $74.52 |

| 71 | $107.17 | $81.85 |

| 72 | $115.98 | $88.83 |

| 73 | $124.24 | $95.52 |

| 74 | $131.95 | $101.66 |

| 75 | $138.55 | $107.17 |

| 76 | $161.93 | $122.76 |

| 77 | $184.41 | $137.45 |

| 78 | $205.96 | $151.20 |

| 79 | $226.62 | $164.05 |

| 80 | $246.44 | $175.42 |

| 81 | $253.19 | $179.39 |

| 82 | $260.38 | $183.66 |

| 83 | $288.16 | $189.65 |

| 84 | $301.93 | $194.33 |

| 85 | $315.82 | $199.06 |

$15000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 50 | $76.89 | $52.74 |

| 51 | $78.09 | $54.02 |

| 52 | $79.45 | $55.98 |

| 53 | $80.66 | $58.90 |

| 54 | $82.04 | $61.51 |

| 55 | $84.35 | $63.85 |

| 56 | $86.82 | $66.47 |

| 57 | $89.01 | $68.50 |

| 58 | $90.96 | $70.58 |

| 59 | $92.31 | $72.50 |

| 60 | $93.75 | $74.03 |

| 61 | $100.31 | $78.56 |

| 62 | $106.91 | $82.70 |

| 63 | $113.24 | $86.28 |

| 64 | $119.31 | $89.01 |

| 65 | $125.23 | $91.35 |

| 66 | $130.44 | $96.19 |

| 67 | $134.98 | $100.18 |

| 68 | $139.24 | $103.87 |

| 69 | $142.96 | $107.47 |

| 70 | $146.27 | $110.78 |

| 71 | $159.75 | $121.77 |

| 72 | $172.96 | $132.24 |

| 73 | $185.36 | $142.28 |

| 74 | $196.92 | $151.50 |

| 75 | $206.83 | $159.75 |

| 76 | $241.89 | $183.13 |

| 77 | $275.61 | $205.18 |

| 78 | $307.95 | $225.81 |

| 79 | $338.93 | $245.07 |

| 80 | $368.66 | $262.13 |

| 81 | $378.78 | $268.08 |

| 82 | $389.57 | $274.49 |

| 83 | $431.23 | $283.48 |

| 84 | $451.90 | $290.49 |

| 85 | $472.73 | $297.59 |

$20000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 50 | $101.85 | $73.93 |

| 51 | $103.45 | $79.33 |

| 52 | $108.75 | $83.93 |

| 53 | $114.96 | $88.14 |

| 54 | $120.36 | $91.94 |

| 55 | $125.17 | $95.34 |

| 56 | $128.77 | $99.15 |

| 57 | $131.97 | $102.15 |

| 58 | $134.77 | $105.15 |

| 59 | $136.78 | $107.95 |

| 60 | $138.18 | $110.15 |

| 61 | $148.39 | $116.76 |

| 62 | $157.99 | $122.76 |

| 63 | $167.20 | $127.97 |

| 64 | $176.01 | $131.97 |

| 65 | $184.61 | $135.37 |

| 66 | $192.22 | $142.38 |

| 67 | $198.83 | $148.19 |

| 68 | $205.03 | $153.59 |

| 69 | $210.43 | $158.79 |

| 70 | $215.24 | $163.60 |

| 71 | $234.85 | $179.61 |

| 72 | $254.07 | $194.82 |

| 73 | $272.08 | $209.43 |

| 74 | $288.90 | $222.84 |

| 75 | $303.31 | $234.85 |

| 76 | $354.35 | $268.88 |

| 77 | $403.39 | $300.91 |

| 78 | $450.43 | $330.93 |

| 79 | $495.46 | $358.95 |

| 80 | $538.70 | $383.77 |

| 81 | $553.79 | $392.76 |

| 82 | $569.87 | $402.46 |

| 83 | $631.29 | $415.92 |

| 84 | $661.90 | $426.51 |

| 85 | $692.70 | $437.18 |

$25000 AIG Monthly Rate Chart

| Age | Male | Female |

|---|---|---|

| 50 | $126.81 | $91.91 |

| 51 | $128.81 | $98.66 |

| 52 | $135.44 | $104.42 |

| 53 | $143.20 | $109.67 |

| 54 | $149.95 | $114.42 |

| 55 | $155.96 | $118.68 |

| 56 | $160.46 | $123.43 |

| 57 | $164.46 | $127.19 |

| 58 | $167.97 | $130.94 |

| 59 | $170.47 | $134.44 |

| 60 | $172.22 | $137.19 |

| 61 | $184.98 | $145.45 |

| 62 | $196.99 | $152.96 |

| 63 | $208.50 | $159.46 |

| 64 | $219.51 | $164.46 |

| 65 | $230.27 | $168.72 |

| 66 | $239.78 | $177.48 |

| 67 | $248.03 | $184.73 |

| 68 | $255.79 | $191.49 |

| 69 | $262.54 | $197.99 |

| 70 | $268.55 | $204.00 |

| 71 | $293.07 | $224.01 |

| 72 | $317.09 | $243.03 |

| 73 | $339.60 | $261.29 |

| 74 | $360.62 | $278.06 |

| 75 | $378.64 | $293.07 |

| 76 | $442.44 | $335.60 |

| 77 | $503.74 | $375.63 |

| 78 | $562.53 | $413.16 |

| 79 | $618.83 | $448.19 |

| 80 | $672.87 | $479.22 |

| 81 | $691.74 | $490.45 |

| 82 | $711.84 | $502.57 |

| 83 | $788.61 | $519.39 |

| 84 | $826.87 | $532.63 |

| 85 | $865.38 | $545.98 |

These rates from AIG are MUCH less expensive than what many of the other options are.

Sometimes the other options are literally DOUBLE, and there’s no reason that you want to spend that much in coverage.

This gives you a good idea of what to expect. If all you wanted was $5,000 and you’re a 65-year-old male, you’d probably pay about $43 or $44 a month. A female would probably pay about $28 or $29 for $5,000 with AIG.

Guaranteed Acceptance Life Insurance At Younger Ages?

The one thing that’s particularly interesting in this market is that, despite there being a variety of people with conditions that are uninsurable at all sorts of ages, a lot of these companies don’t even begin to offer guaranteed acceptance life insurance until the age of 50.

Here’s the thing…

There are tons of people below the age of 50 that would LOVE to have coverage but otherwise can’t get it if they don’t have access to a guaranteed acceptance policy.

Therefore, I’m taking the time here to demonstrate that there are options that will get you a guaranteed acceptance life insurance policy at ages below 50.

I want to make sure we go through the most common age brackets, so we can make sure that we cover each and every nook and cranny when it comes to no-questions-asked life insurance.

Guaranteed Issue Life Insurance For 20- To 30-Year Olds

Let’s start first with 20 to 30-year-olds. This is probably the toughest age bracket to get no-questions-asked life insurance.

For some reason, insurance companies get pretty worried thinking that someone that young has an uninsurable condition, so many of them just don’t offer coverage.

Now, there’s not really any no-questions-asked life insurance, but there are companies that offer minimal underwriting circumstances with two-year waiting period policies for people between 20 and 30.

I’ll give you a perfect example.

I had a client who was in her late 20s, and she actually had congestive heart failure. Sad to have it so young.

That generally is a condition in which only a guaranteed acceptance policy is acceptable. So I wrote her up with a plan that asks a very minimal amount of questions, and we were able to actually get her a waiting period policy at a very competitive rate where in two years she was fully covered. She was very pleased with that.

So there are options within this age range that will allow you to get coverage on the almost guaranteed acceptance basis with minimal underwriting. A lot of people who would end up being guaranteed acceptance actually will qualify for these plans too.

My story is just exemplary of what is potentially possible, but your health is unique. I can’t stress enough to talk to me. I can tell you specifically what you can do in a matter of 10 minutes.

Guaranteed Issue Life Insurance For People Between 30 and 40 Years Old

Now that we’ve talked about guaranteed issue life insurance options between the ages of 20 to 30, let’s talk about availability if you’re between the age of 30 to 40.

Just like before, the level of difficulty is pretty high to get a guaranteed acceptance life insurance plan if you’re between the ages of 30 and 40.

There is one particular carrier that I know of that will do a guaranteed acceptance policy but has a three-year waiting period until natural death full coverage takes effect.

It is something that accepts the vast majority of applicants that apply as long as they are of sound mental health, meaning they don’t have cognitive memory issues like Alzheimer’s or dementia, which is unusual at that age range. So in most circumstances they would be able to get a guaranteed issue plan.

Just like I mentioned before, even though there is a limitation of this kind of coverage available, there are carriers that provide underwriting on a minimal basis for many people with these guaranteed-issue type situations. Thus, they can still get coverage with the two-year waiting period at a competitive price with minimal underwriting.

It can’t be stressed enough that you need to talk to an agent like me, and I can tell you in a matter of five or ten minutes tops what your options are. So again, if I can help, give me a call at the number below.

Guaranteed Issue Life Insurance For People Aged 40 to 50

The good news is as we get into ages 40 to 50 the ability to qualify tends to increase substantially.

There are good guaranteed issue, no-questions-asked life insurance plans that are available as long as you’re between 40 and 50.

These are true guaranteed issue plans where:

- The rates never increase,

- The coverage never cancels due to age or health, and,

- For the first two years you’re fully covered for accidental death. (For natural causes your beneficiary would only receive what you paid in plus, usually 10 percent interest.)

The nice thing about this particular company that I work with is it has pretty competitive premiums. They actually will underwrite from age 40 all the way up to 80.

In the 40s to 50s range, they are perfect because:

- They’re one of the few carriers that will accept that age range, and

- Their premiums are affordable!

So they help a lot of people out. Once you hit the 40-year old range, no matter what conditions you have, if you do a health analysis with an agent and it ends up that you are only qualified for guaranteed issue coverage, you can get something. So hopefully that’s a relief for those of you who are wondering.

This particular company I work with is based out of Salt Lake City, Utah. They’ve been in the funeral and final expense business for a long time. Again, please call me if this is something that would interest you. I can definitely help you. Just call 888-626-0439.

Guaranteed Issue Life Insurance For People Aged 50 to 80

So now we get into the age range most of you are who are reading, which is between 50 and 80 years old.

Getting guaranteed issue life insurance coverage at this age is very easy once you hit the age of 50 all the way up to 80. Again, I have several options with different guaranteed issue life insurance carriers to choose from with the best combination of price and value.

Most of the business that I do if you’re 50 or older with guaranteed issue is American General Life, or AIG. They have the most competitive premium that I have access to for guaranteed acceptance life insurance plans.

Like I said prior, it’s the same setup for guaranteed issue life insurance if you’re over 50 but under 80:

- There’s no health questions asked.

- As long as you can sign your name to the application, you are authorized to get coverage.

- Your rates never increase,

- Your coverage never cancels due to health or age, and,

- As long as you pay the premiums, once you get past the two-year period, you’re fully covered for however much coverage you have.

Many these plans are way more competitive than what you’d find with Colonial Penn or MetLife or Physicians Mutual and many of the other plans that are out there. So I highly recommend that you give these a shot.

What About Guaranteed Issue Life Insurance For People Older Than 80?

Once you get to be between 81 and 85, it’s much more difficult to get guaranteed issue life insurance coverage.

It’s very much like being in your 30s or your 20s and trying to get guaranteed issue life insurance as many of these companies quit offering coverage right at that 80-year-old level.

So what do you do if you’re over 80? The good news is there’s one particular carrier that I work with that offers coverage between 81 and 85 years old. That’s AIG, the same company I showed you rates earlier on.

We can get you guaranteed acceptance whole life coverage as long as you’re between 81 and 85. Just like I mentioned before, health doesn’t matter, and smoking status doesn’t matter.

This is whole life insurance. Your rates never grow up, the coverage never cancels, it can’t be canceled due to age or health. Just give me a call if I can help.

Guaranteed Issue For People Older Than 85?

What about age 85 and older?

There’s a lot of people that are looking for guaranteed acceptance policies that are well over the age of 85. What are the options in that circumstance?

If you’re 86 to 90, there are no guaranteed issue life insurance policies available.

However, there are final expense life insurance companies that will offer coverage up to 90 years old with minimal underwriting.

There’s two in particular in my marketplace that I recommend.

I’ve actually got two examples to demonstrate this point.

Lady in Georgia, Gentleman in Florida

I met a lady down in Cartersville, Georgia, who was 88 years old at the time I took the life insurance policy on her. She was in perfect health, just 88 years old, and she had to get coverage that would cover from the first day.

The one company we got her overage with, which still offers coverage up to 89, approved her for first-day full coverage at a competitive price that fit her budget. The rates will never go up for any circumstance whatsoever, and no matter how long she lives she has a policy.

I met a gentleman in Miami that was referred to me. His father was 88 or 89 years old and could not find coverage anywhere, but they had to have some kind of burial insurance plan.

We were able to write him $10,000 in coverage at that age with the same company, and again, it’s very difficult just to get access to coverage at that age. There were no examinations; just a simple application and then answering some yes/no questions. At the end of 10-15 minutes, he was approved for coverage, and his son had a little peace of mind knowing that he wouldn’t have to pay for that burial.

So it can be done. It just depends on the circumstances, as always, with your health.

How Do I Find The BEST Guaranteed Issue Life Insurance Plan… For ME?

You may be asking, “What is the best guaranteed acceptance life insurance plan for me?

The primary words of concern is “best… for you!”

Let’s talk about how to define what is the best guaranteed acceptance life insurance plan.

The truth is the best plan is the one that has the SHORTEST waiting period with the LOWEST premium.

You don’t want a plan that has a three or four-year waiting period when you could get a two-year waiting period plan for the same price.

Hopefully that makes sense.

Ultimately, you WANT to pay the lowest price for the lowest waiting period policy.

Sometimes people ask whether the insurance companies matter. Does it matter if I go with Company A or Company B?

In the case of guaranteed acceptance life insurance policies, all of these companies are very well known. Everybody knows who Colonial Penn, Physicians Mutual, MetLife, and AIG are. These companies are well known, highly established companies, and they’re very good quality companies.

There’s nothing bad to say about these companies in particular.

They all do a really good job at offering the products they do, and they pay full coverage claims as long as you’re past the waiting period. So there’s not really much concern I have as an agent suggesting these companies to you.

What matters though is what gets YOU the best deal.

If all these companies are more or less decent quality with a decent product and backed by a strong company financially, then what really matters to you is who’s going to give you the best rate with the shortest waiting period.

Again, it comes down to what’s best for you and your family and, of course, for your pocketbook. You want to get the best deal in all categories possible.

If you call one of these companies up that sends you junk mail or TV advertisements, they’re only representing their particular company.

Their job is to sell you their particular product WITHOUT a sober analysis of what else is out there.

Work with an insurance broker

On the other hand, what makes me different from the guy that works at Colonial Penn or Physicians Mutual is I represent a variety of companies. I’m not out to push a particular insurance company on my clients.

What I want for my clients is the best value of coverage and the best premium that we can find for said value. So that puts me in a position to help you out much more than what you would find from an employee that works for one company.

Hopefully that makes sense. It makes a huge difference.

Don’t take a chance with three or four-year waiting periods. They do exist out there; avoid them at all cost. You can easily avoid them by working with me.

Does My Health Make It That A Guaranteed Issue Life Insurance Policy Is My ONLY Choice For Coverage?

Now let’s get to the fun part of this presentation.

We’re actually going to discuss a list of conditions that only qualify for guaranteed issue life insurance.

You may have been wondering this entire time whether your health is going to qualify you for first-day full coverage or only guaranteed issue coverage. Again, most people just don’t know what underwriting concerns companies look at.

The goal at the end of this particular section is to empower you with more knowledge. I want to give you an idea of what is actually possible for your situation.

It might be that I don’t cover your health issue here. In that case, I would highly recommend you contact me, and I’ll tell you exactly what your options are.

Guaranteed Issue Life Insurance & HIV/AIDS

AIDS and HIV are autoimmune diseases that have been around for several decades now. It’s chronic. It usually progressively gets worse, and it is incurable.

Now, there’s been recent medication changes that have allowed people with AIDS or HIV to live a long and truly normal life. It’s amazing how far the medication has progressed to allow people to live normal lives.

However, most companies still look at AIDS and HIV as an uninsurable condition with the exception for a guaranteed issue life insurance policy. So in short, if you have AIDS or HIV, the likelihood is high that your only option is going to be a guaranteed issue life insurance policy.

Now, a recent development is there is a company that will, in certain circumstances, take HIV-positive clients who have no other major health issues and give them first-day full coverage, much like a traditional type of life insurance policy. There is one company in particular that does that.

So if you have HIV and you’re otherwise healthy, you might find that you can get something better than the guaranteed issue case. If you have AIDS or HIV and you have multiple chronic health issues, then it’s likely that a guaranteed issue plan is your only option. Again, it comes down to give me a call and let me help you.

Guaranteed Issue Life Insurance With Alcoholism, Drug Abuse

If you have any current abuse of alcohol, liquor, illegal drugs, prescription drugs, legal drugs, anything at all at the time of the application, then you will only be offered a guaranteed acceptance life insurance policy.

Hopefully that makes sense why. Insurance companies generally don’t want to insure people immediately with full coverage if they’re involved in these kind of activities.

However, this is only if it is a current abuse situation.

If the applicant has had a year or longer since stopping the alcohol or drug abuse, the applicant may qualify for better coverage, potentially on a first day basis.

My client with a drug problem

I had a client who embarrassingly admitted to me that she had a methamphetamine addiction problem and that she had been off of meth for more than two years.

At the end of the day, we were still able to get her first-day full coverage despite that because she was able to honestly say it had been two years since then. So she was able to qualify for coverage. When they pulled her medical records all of this was verified.

Now, I’ll make a special note here.

One particular drug that doesn’t really have much impact anymore in insurability is marijuana. Marijuana has been greatly relaxed in the underwriting outcomes.

Most carriers are completely fine with casual marijuana use. If you’re smoking marijuana once a week or you take marijuana for medicinal purposes, you’re not necessarily going to end up in a guaranteed issue situation. A lot of companies will actually give you quality coverage, and they won’t count the marijuana use against you.

That’s kind of a new thing. It’s very nice. A lot of people are afraid smoking weed is going to be a problem, and it’s not. Again, you work with the right broker, and they can help you.

Guaranteed Issue Life Insurance & Alzheimer’s & Dementia

If you have Alzheimer’s or dementia, the only option for coverage is a two-year waiting period policy.

Every other company that would offer you coverage, even if you can answer all the other health questions no, when you answer yes to the cognitive memory / Alzheimer’s / dementia health question, it will result in your decline 99 percent of the time.

That’s not the case of course with guaranteed issue. You can still get coverage with Alzheimer’s or dementia on a guaranteed issue whole life insurance basis.

Sometimes the carrier may require a power of attorney to sign off on the application for coverage. It may require some additional paperwork.

This is not that big of a deal to overcome. Many people who have dementia or Alzheimer’s that are looking for life insurance have a power of attorney already because they’re just not capable of handling their affairs like they used to.

So if you’re watching this and you’re a power of attorney for somebody else you’re looking for coverage for, as long as you can sign off for them using the power attorney process, then it would be fine to get guaranteed issue life insurance coverage.

I will add that there are many people for whom the doctors have prescribed a medication called Aricept or Namenda or some other kind of cognitive memory medication. This is to slow down any potentiality for Alzheimer’s or dementia, although technically they’ve never been diagnosed with either.

The problem with this situation is that insurance carriers always look at, not just your health history as far as going to the doctor and what events happened, but also what prescriptions you take. It’s a black-and-white world when it comes to qualifying somebody based on their prescriptions.

When someone takes Aricept, even if they’ve never had a dementia or Alzheimer’s diagnosis, it’s always going to be a guaranteed issue option only.

They literally will treat you equivalently as if you had progressed dementia or Alzheimer’s. So if you take a memory pill, expect to have a no-questions-asked life insurance policy as being the best and really the only option that you’ve got.

Guaranteed Acceptance Life Insurance With Amputations

There are two different kinds of amputations to be concerned with.

One that is caused by an accident and then other that’s caused by disease.

Amputations that are caused by accidents such as the outcome of a car wreck generally alone do not deny you coverage with most final expense carriers. Many times you still qualify for preferred rates.

Legless and paralyzed clients in Tennessee

I had a particular client who was on some back road in Tennessee. As she was driving, the car in the opposite lane was texting while taking a corner.

He was well over into her lane, and she pulled herself out of the lane to dodge him. He hit her anyway, and then she ended up in the ditch.

In the process of ending up in the ditch, her leg was crushed literally from the hip bone down, and they eventually removed that leg. Otherwise, she was in great shape.

She could function on her own. She could move on her own. Her health was great. She had no chronic ailments, and she qualified for preferred rates.

I had another guy who had a motorcycle wreck. He hit a patch gravel, lost control of his Harley, had a gnarly wreck, and lost his leg from his knee down. He qualifies for preferred rates.

He’s got a prosthetic. He gets around. The guy still rides! But no problems getting him preferred coverage.

So if you’ve had an amputation because of some accident out of your control, as long as you’re not requiring home health care or any kind of additional help, you should be fine.

Where things get a little bit dicey is when you’ve had amputations due to disease.

The most common case where this happens is if you have progressive diabetes where the circulation is so bad that you have to have fingers removed or toes removed or even limbs removed.

That’s when you’re going to have a lot more occurrence of a guaranteed acceptance life case.

If diabetic complications like those mentioned above happened within the past year, probably the only option you have is a guaranteed issue whole life insurance plan.

Sometimes there are options for full coverage, once you’ve passed the one or two-year mark. A lot of that depends on the state that you live in and what kind of carriers are available in that state.

So just be aware; it is difficult.

I do try to work for my clients to get them preferred coverage as much as possible. Like I said, I don’t want to sell a guaranteed issue plan when I could sell a preferred plan, so I go to bat for you to find out which carriers do it. But be prepared for the level of difficulty if you have an amputation related to disease.

Guaranteed Issue Life Insurance With Heart Attacks, Strokes, Stents, Bypasses, Seizures, Aneurysms, Pacemaker History

Cardiac events cover a broad spectrum.

I’ll try to cover the most common ones: aneurysms, atrial fibrillation, congestive heart failure, pacer defibrillator, strokes, seizures, transient ischemic attacks, heart attacks. We’re going to umbrella these together and cover all of these together.

With few exceptions, most cardiovascular events like what I just mentioned can qualify for preferred rates if enough time has passed.

If one of these events occurred within the last 12 months, the only option that you’re going to have is a no-questions-asked life insurance policy with a two-year waiting period on it.

When you get past the 12-month mark and if you’re under the 24-month mark, you’ll have the potential for full coverage or possibly partial first-day coverage. That’s where you get some coverage but not full coverage. So it gets a little better.

Beyond the 24-month period of time, most companies I work with will give you full first-day coverage with prices equivalent to those who have never had any health problems before. That’s nice!

The exception to this is congestive heart failure.

If you’ve had congestive heart failure, you’re always going to have a two-year waiting period policy 99 percent of the time. It’s just one of those issues that most insurance companies look at, and they immediately blacklist. They either decline you or you have to end up going on a guaranteed issue basis.

Now, there’s a few issues here I didn’t quite go into detail on.

For example, atrial fibrillation can qualify for first-day full coverage even if you had atrial fibrillation within the last 12 months.

Some carriers are much more flexible on that. Same thing with seizures. We’ll talk about seizures more in depth.

Transient ischemic attacks can get better coverage from the first day. So there are positive options in those circumstances where maybe you don’t have to wait the full one or two years to get covered.

Guaranteed Issue Life Insurance If Hospitalized, Bedridden, Hospice Care, Etc.

Let’s talk about some conditions related to being bedridden such as having hospice care, assisted nursing facility care, home health care, and that kind of thing.

With a few exceptions, the issues mentioned only result in a guaranteed acceptance life insurance offer. If you are currently in this situation, 99 percent of the time expect a no-questions-asked life insurance plan offer.

There are a few circumstances where some carriers may offer you better coverage than a guaranteed acceptance life insurance with home health care.

So let me explain that.

The main reason that carriers don’t offer coverage on a preferred basis with home health care is because most of the people who are home health care specialists come in, and they literally help a person with what’s known as their activities of daily living. That means bathing, getting out of bed, going to the toilet, taking medications, moving about, and things like that. They they need the home health care help to survive, and without it, they would be bedridden.

Sometimes, however, some home health care nurses only provide the basic services, like cooking and doing some general housecleaning.

If that’s your circumstance, there are some carriers that will work with you and be flexible on offering coverage if you don’t actually get direct help with activities of daily living. But if they do help with activities of daily living, it’s only going to be a guaranteed acceptance type of policy.

Guaranteed Issue Life Insurance Lung Disease (COPD, Emphysema, Asthma, Etc.)

Within lung disease are a lot of different subcategories. The most common being COPD, asthma, chronic bronchitis, emphysema, sarcoidosis, and sleep apnea.

There are a lot of companies that will allow for first-day full coverage with all of these type of chronic lung problems, which is great. It’s a little bit higher priced than preferred, but there’s no waiting period in most circumstances.

I live in an area where there are a lot of smokers, and many of the people, as you know, that smoked their entire lives will end up with chronic obstructive pulmonary disease or COPD. That’s where it feels like they’re breathing through a straw, and they cannot catch their breath. A lot of people have that, but if they manage it with an inhaler and stop smoking, they find that they can extend their lifespans much more than if they continue down that path.

There are many carriers that will work with the applicant if they have COPD, chronic bronchitis, emphysema to get them first-day full coverage as long as there are no other health factors to knock that out as an option. So if you’ve got COPD, emphysema, that kind of thing, trust me, you have some really good options, and you may be able to get first-day full coverage. We’ll talk about some exceptions to that.

I also want to mention asthma.

Asthma is something that usually isn’t treated as negatively as COPD. Many times, even if you’ve got chronic asthma or just intermittent asthma based off of seasonality, you can qualify for preferred rates. You’re not going to be treated like you were if you were in that COPD category.

Now, here’s the biggest exception to the the COPD first-day full coverage option.

If you use oxygen equipment to assist your breathing, then you’re always going to have a two-year waiting period whole life insurance policy option only.

There are no companies that will insure you if you take oxygen to treat your COPD or your chronic lung disease. Even if you just have asthma, they’ll still just give you a two-year waiting period policy. So if you take oxygen, that’s the best you’re going to get.

Sleep apnea is usually acceptable in most cases with most carriers.

Where that changes, of course, is if you take oxygen. Now, if you wear a mask and that’s forced air, like the little machine that sits on your desktop and it takes air out and into it and pushes it down into your lungs, that is acceptable, but an actual machine and a tank is not acceptable.

Guaranteed Issue Life Insurance With Neurological Disease (Parkinson’s, Cystic Fibrosis, Lupus, Multiple Sclerosis, Etc.)

So let’s talk about neurological diseases: cystic fibrosis, cerebral palsy, lupus, multiple sclerosis, muscular dystrophy, Lou Gehrig’s, and Parkinson’s.

Some are completely easy to qualify for good final expense coverage with first-day full coverage in effect. Then there are others that just won’t even consider you, and there’s some kind of middle ground depending on the severity of the disease.

For cystic fibrosis applicants, guaranteed issue is your only option. If you have cerebral palsy and you’re younger than 25 years old, guaranteed issue with a two-year waiting period is going to be your only option.

Now, if you’re older than 25 years old, there is one particular company that does give first-day full coverage.

There are some strings attached to it. The cerebral palsy applicant has to be able to handle their activities of daily living on their own. They need to be functional and independent. Of course, they have to be cognitively functional as well. Usually most cerebral palsy applicants are cognitively functional. It’s the physical capabilities that are really the question.

I’ve gotten a few people with cerebral palsy first-day full coverage, but they physically were not in the worst of circumstances like some patients are with cerebral palsy.

If you or a loved one has it, it really is going to come down to me asking a few questions. It may be a two-year wait policy only, or it may be full coverage depending on how the questions are answered.

Muscular dystrophy typically is only guaranteed issue.

With Lou Gehrig’s disease, multiple sclerosis, lupus, and Parkinson’s, there is a real potential with many carriers for first-day full-coverage. Again, it depends on the severity of the particular ailment.

If your Lou Gehrig’s has you confined to a wheelchair, you cannot functionally move, and you’re essentially bedridden, you’re not going to get first-day full coverage. Guaranteed issue would be it. But if you’re at the cusp of Lou Gehrig’s disease, there’s one company that will offer you first-day full coverage.

Same thing with Parkinson’s, lupus, and multiple sclerosis.

As long as you can perform your activities of daily living, I can think of several companies off the top of my head that would be happy to offer you preferred or standard first-day full coverage with no two-year waiting period.

Again, these are serious issues that sometimes end up causing the demise of those inflicted with it that we can, in some circumstances, get quality first-day coverage for. People think they can’t, but they really can. This is another example of what is really possible.

Guaranteed Issue Life Insurance With Hepatitis, Liver Disease, And Cirrhosis

Hepatitis B usually is okay. Hepatitis B is something that may have happened a long time ago. Usually most companies don’t care as long as it’s been several years since it occurred, and it’s been resolved.

Hepatitis C is a little different. If somebody currently has hepatitis C, the only option is guaranteed issue. Now, that could change. There’s a lot of new treatments that will almost eliminate or resolve it.

As soon as you put hepatitis C in remission and the doctor says you’re essentially cured, there are some carriers that will immediately offer first-day full coverage without any kind of waiting period. If for some reason there were other issues that were in your way, as long as the one or two-year mark has been passed since remission occurred, there are companies that will offer first-day full coverage if you had hepatitis C.

One of my clients had hepatitis C. He was a heavy drinker, and he had been out of drinking for three or four years when I took the plan out on him. He had gotten sober and went to Alcoholics Anonymous, and he wanted to get a life insurance plan.

The one company I work with in particular is fine for preferred rates if a hep C patient is in remission past the two-year mark. We sent in the application, and they approved him within a day or two.

No examinations, no drilling down on the applicant for questions and frustrating them. It was good to go. So it is possible that, with time, with many of these circumstances, you can get better coverage at first-day full coverage.

Now, cirrhosis is a different story.

Typically cirrhosis is always a two-year waiting period policy. Cirrhosis is very serious whether it’s alcohol induced or prescription drug induced. It can be induced by prescription pills because you take so many.

I had a client who was dying from cancer, and he got cirrhosis in the meantime because of all the medications that he was taking. It was a sad case. So if you have cirrhosis, expect a two-year waiting period policy most of the time.

Guaranteed Issue Life Insurance With Depression, Bi-Polar, Schizophrenia, Etc.

Approximately 20-25 percent of Americans have some kind of mental health disorder, so some of you probably fit that profile, which is fine.

You may wonder who’s going to give you coverage if you have something like depression, whether it’s clinical or mild or major. What if you have bipolar or if you’re bipolar schizophrenic or just schizophrenic alone?

Maybe you have a history of post-traumatic stress disorder from the time you spent in the military or because of an unfortunate circumstance in your life. Maybe you just have plain old anxiety.

Can you get covered with this?

What may surprise you is mental health issues are easier to qualify for first-day full-coverage.

It’s surprising to many of people because they think these things are problematic in getting quality coverage. It’s actually one of the easier ailments to work with relative to some of the other ones I mentioned.

Now, there are a few wrinkles in here, and it just depends on the circumstances.

If you’ve been hospitalized due to a mental breakdown related to one of these conditions or if you spent time in a mental facility to recoup or because you’re under observation, that may limit your options for coverage.

I’m not going to say outright that your only option will be a guaranteed issue life insurance policy.

You just may not have as many options. It might be that we could potentially get you preferred first-day full coverage. Again, it comes down to your particular circumstances, but ultimately the process is a lot easier to potentially qualify for better coverage than other issues.

Guaranteed Issue Life Insurance With Diabetes

There are probably as many people with diabetes as there are with mental health disorders. Diabetes is a very common ailment nowadays.

This is one of those things where people are pretty negative and assume they can only qualify for a two-year wait because they have diabetes.

No!

The great thing is these insurance companies totally understand that a large portion of the population has diabetes, and they designed their plans to work around that.

So you’re going to find you may easily qualify for competitive final expense insurance rates without a two-year waiting period policy even if you have a progressive form of diabetes.

When I say diabetes, what does that mean?

Let me be more specific. If you take insulin, you may qualify for first-day full coverage.

I have many companies that do not care if you take insulin as long as you don’t have anything super serious because of progressive diabetes and you’re managing it well.

They’ll give you preferred or standard first-day full coverage rates. Even for type one, not just type two. Type two being adult onset diabetes and type one being childhood onset diabetes.

If you’ve had diabetes for years since your childhood, a lot of companies don’t even want to deal with you. But I have particular companies that, even if your type one on insulin, they will give you first-day full coverage.

The first thing most people experience with diabetes if they don’t have it well in control is diabetic neuropathy. There are companies that will give you first-day full coverage even with diabetic neuropathy.

Again, a lot of companies decline that and make you go onto your waiting period policy. We have a limited access to carriers, however, that will work with you even, in some circumstances, if you take insulin.

The only limitations I would express here on options for first-day full coverage is if you are a diabetic who has had an amputation due to the onset of progressively worsening diabetes. That is going to most likely be a two-year waiting period, especially if it occurred within the last year or two.

There’s the potential for something better, but I don’t want to put too much stock into it. Ultimately, if you’re in that position, let me talk to you, and I’ll tell you for sure within a matter of minutes.

Guaranteed Issue Life Insurance With Kidney Disease, Dialysis, Kidney Failure, Kidney Insufficiency

Straight up dialysis is always a two-year waiting period life insurance policy. If you’re currently taking dialysis because you have end-stage renal failure, expect a two-year waiting period policy as your only solution.

Some form of kidney failure may qualify for first-day full coverage. It just depends on the severity of the kidney disease and on how well they function as well as on how your doctor defined the disease.

Any kind of acute kidney injury such as from passing a kidney stone is usually fine. That’s not going to cause any problems.

The more serious issue is when you’re functioning is worsening. There are options. A lot of it depends on the diagnosis, when it originated, how well the kidneys are functioning, and what medications are taken.

Non-dialysis kidney disease client in Alabama

I’ll give you an example of a client whom I got first-day full coverage.

I met a gentleman down in Alabama who was in okay shape, but he had had kidney problems although he wasn’t on dialysis.

He was paying way too much for some life insurance he had, and he wanted to get a better price.

So I ran some quotes, and I found out there was only one company out of the 15 or 20 that I could get my hands on that did not care about his kidney insufficiency. The wording on their application states that the only thing they’re concerned about is kidney dialysis.

Long story short, I ended up saving him about $1,000 a year. I got his coverage from $5,000 to $10,000 in coverage, and he was fully covered from the first day.

So there are options in some cases to get better than a two-year waiting period policy even if you’ve got kidney problems.

Guaranteed Issue Life Insurance With Seizures And Epilepsy

There are some companies that don’t care even if you just had a seizure within recent time. They’ll still give you first-day full coverage.

Sometimes they don’t care when they happen; it’s not even a question on the application. Sometimes the question becomes how many have you had in the past two years. But there are more options so you may not have to go the route of a guaranteed acceptance life insurance policy.

So if you have seizures, grand mal seizures, any kind of seizures, epilepsy talk to an agent. Let’s find out what your situation is. Let’s look at underwriting and do a risk assessment, and we’ll be able to tell you in five or ten minutes what your options are.

Guaranteed Issue Life Insurance With Prison, Felonies, Parole

Prison, jail, felony, parole: you have to get out of jail first before you can get guaranteed acceptance life insurance policies. That’s been my experience. There’s not many companies that will allow you to take even a guaranteed issue plan because there may be some stipulations in the fine print saying nobody incarcerated can qualify for this.

Felony convictions and paroles: if you’re out of jail, you may only be eligible for a two-year waiting period policy, but as time passes, it is very much like the heart issues and, as we’re about to find out, the cancer issues. A year or two after a felony conviction or parole, you’re going to find you can get preferred rates again.

Guaranteed Issue Life Insurance With Cancer Of Any Kind

If you currently have cancer, a guaranteed acceptance life insurance policy is your only option. Nobody is going to give you any kind of full coverage from the first day.

Now, if it’s been a year since your cancer has been:

- in remission, and

- a year plus since any treatments have stopped,

You may qualify, in some circumstances, for what’s known as a graded plan. That’s where you get partial first-day coverage, and it grows into full coverage after two years.

Once you’ve cleared the two-year mark, there are many more carriers that will offer you first-day full coverage.

So again, a lot of times you just have to pass the two-year mark as you’ve seen with other conditions, and you’ll find you’re going to qualify for preferred rates.

So even if you had cancer back in 2010, its 2018 now; that’s fine.

I’ve written up tons of preferred first-day full coverage plans for final expense life insurance on applicants who had cancer at various points in their life, and they get preferred coverage because it’s been longer than two years.

Again, surprising; a lot of people think, “I’ve had cancer. Nobody wants to touch me.” Not the case; there are good options for you.

Summary Of Guaranteed Issue Life Insurance

So let’s wrap this up here.

I hope you guys have learned some valuable information.

We covered most of the conditions and under what circumstances that would result in a guaranteed acceptance life insurance situation.

But ultimately, your particular situation is unique, and you’d have to talk to me personally in order to get an accurate assessment on what you can qualify for.

That process is really simple.

If you’re interested in seeing what you qualify for and you want to do it in a no-obligation, no-stress manner, there are two ways that you can do this.

You can call me at 888-626-0439. We can correspond by email, by text message, or via phone.

Whatever is more comfortable for you is comfortable for me. I prefer to talk because there’s always a bunch of questions, and it’s better just to vet it out over the phone.

Again, to call me directly, you can call 888-626-0439. That gets me live, and we can talk about options right away. Literally within 10 minutes I can tell you exactly what you can qualify for down to the penny on the price and coverage.

It costs nothing for this advice. It costs nothing for this perspective. I’m compensated by the company, not by you.