How To Get Life Insurance For $50 A Month Or Less

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

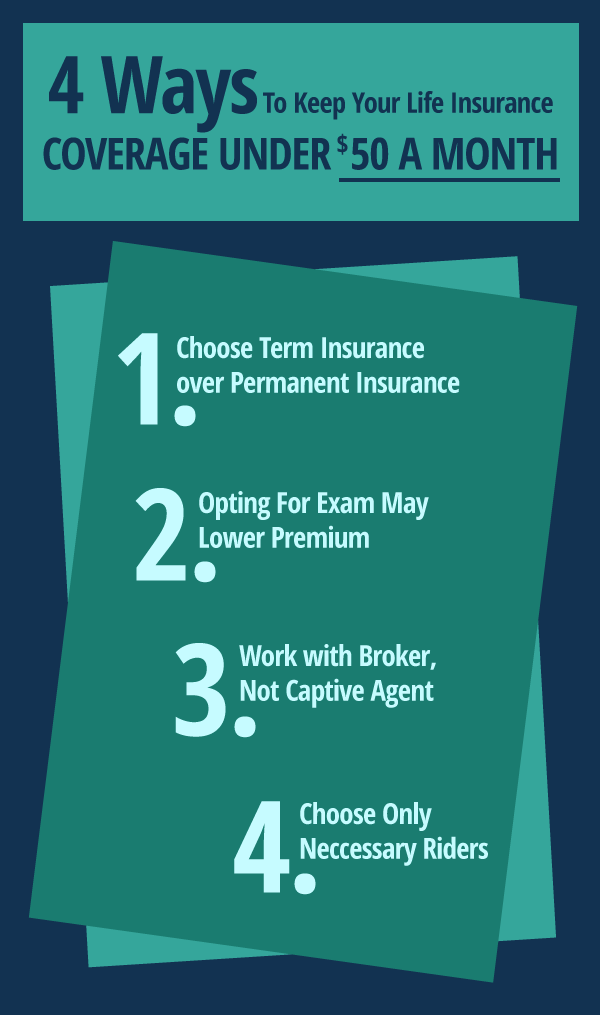

I’m Going To Talk About How To Get A Life Insurance Plan That Will Cost You No More Than $50 A Month

You have an idea in mind about how much money you want to spend per month on your life insurance coverage. You’ve seen quotes for coverage that are well outside of that which you’re comfortable paying.

You want to see what other options are available to you before you decide to spend more than you’d like. This is the perfect opportunity to read about ways to save money on your life insurance.

People are often pressured into buying a life insurance plan that outstretches their capability longer term to keep. I see it a lot. I’ve been a life insurance salesman since 2011. I’ve met all sorts of people in all walks of life that were cajoled and pressured into buying expensive life insurance.

These people wanted life insurance, but not at the price presented. They took it because they felt there was no other option. 6 to 12 months later they just couldn’t make sense of paying such a ridiculous price for life insurance. They had to drop the plan for something less expensive.

To me, this is the most fabulous waste of money in the world. There’s nothing worse than wasting money on life insurance. I’d rather somebody go spend money on something fun and enjoyable than spend money for 6 to 12 months on life insurance and then lose it because they bit off more than they could chew.

Here’s An Overview Of Today’s Topics:

Strategies for overcoming this risk

- Spending too much on your life insurance?

Keep it down below the $50 a month mark. Work with a life insurance agent like us here at BuyLifeInsuranceForBurial.com. We’ll help you to keep your life insurance at an affordable monthly rate.

Should I take an exam?

- What exactly should you expect from an exam?

- What happens in an exam during a life insurance application process?

- What are the pros and the cons of those exams?

- How may they affect your ultimate premium?

- Can they help to get your life insurance at $50 or lower a month?

Life insurance companies are all in the business of measuring risk. What I mean by measuring risk is determining the likelihood of someone living a long time. Life insurance companies generally prefer people that they think are going to live a long time.

- Why is that the case?

The life insurance company will spend a longer time collecting your premium dollars to keep you insured. That means more money for the life insurance company. An exam gives up-to-date and accurate information on your eligibility for life insurance coverage.

An exam involves a physical with a doctor or a nurse practitioner. It is usually held within the comfort of your own home at a time that’s convenient for you.

- The examiner asks you health questions related to the application.

- Usually, they draw blood.

- They may ask you to pee in a cup.

- They’ll also take your height, weight, and blood pressure.

- Some companies may even ask for a saliva sample.

They want more up-to-date information determining your insurability. With it, it’s more likely that if you fit the profile of the health history preferred by the life insurance company, you’ll get a much better rate.

You may have problems initially with the idea of doing an exam. understand it is one of the best ways, if your health is overall in good shape, to secure the best rates.

“Currently, I pay approximately $125 a month for my life insurance plan. Had I got a life insurance plan for the same amount, at the same age, but without an exam, my premiums would be approximately $250 a month.

I’d rather pay half the price for the same amount of coverage than be out of pocket that much. Just because I didn’t want to get stuck with a needle one time? No thanks.”

If you’re looking to get a life insurance plan under the $50 a month mark, consider taking the exam. It’s probably the best way to lower your premiums past those which you’ve seen in the past. In some cases, it isn’t. It would depend on your health.

Term Insurance Versus Permanent Insurance

People often get presented a permanent life insurance option and not a term insurance option. This can cause great upset. I remember speaking to one gentleman at the auto store that I work with.

“I was sold a life insurance policy that was rated at $200 a month. I felt passionate about carrying this coverage. But it got to the point a year later where i couldn’t afford to pay for it.”

“A term insurance plan for the same amount of coverage would actually only cost you about $40 to $50 a month tops.”

He was floored. Shocked and somewhat upset.

If you’re working hard to keep that premium under $50 a month, consider a term life insurance plan. It may not be the best plan that you want to pick up. It’s a temporary plan that may last for 10, 20, or 30 years.

But in my book, something is better than nothing when it comes to life insurance coverage. If the premium is a breaking point for you, you might as well start with something. Investigate opportunities for more coverage at a higher price when it makes sense for your budget.

Consider A Shorter Term Life Insurance Plan

Term insurance plans come in 5, 10, 15, 20, 25, and 30-year lengths. The longer your plan lasts, the higher the likelihood that your premium is going to be that much higher. A quick and easy way to ascertain a lower premium is at the sacrifice of the length of your term insurance plan. You see a plan for 20 years at $50 a month, and a 30-year plan at $75 a month.

Not sure that you can afford the $75 a month plan?

Pick the 20-year term to begin with. Remember, several years after taking your life insurance plan out, you can add more coverage. You can pick up another plan at a 15 or 10-year length. Many times people pick life insurance plans, then their budgets improve with time passing.

This is a way to compromise. To get something on the books. As far as life insurance coverage goes, don’t throw the baby out with the bathwater.

Choose Only Necessary Riders

This is an important distinction that I want to make here. Riders are optional factors to a policy that enhance the benefits.

- Some will return your premiums if you reach the end of your term life insurance plan.

- Some will pay a benefit if you become ill with cancer or a heart attack.

- Some will pay a monthly benefit if you become disabled due to work-related injuries or illnesses.

I enjoy and appreciate explaining how these riders work to my clients. However, all of these riders cost an additional sum per month. If you have to keep your premium under $50 a month, some of those riders may be unnecessary.

The best ones to pick up are the disability waiver riders. These are generally inexpensive. They’re designed to give you a waiver of premium if you become disabled due to work-related injuries or illness and cannot work. Once you reach the clearing period of time there are no more premiums paid for the length of the life of the policy.

“I’ve seen many examples in my career as a life insurance agent where these disability waivers allowed people to keep their life insurance even through disability. They’ve lived their further years in life without ever having to pay another premium again.”

- Looking to keep a good control over what you’re spending monthly for your life insurance plans?

Only consider the most necessary waivers. Dispel the rest.

Work With A Broker

This is another important factor to consider if you’re looking for life insurance coverage.

Talk with a broker and not what’s called a captive agent. A captive agent is somebody who only represents one particular life insurance company.

Captive agents tend to work for companies like New York Life, Metropolitan Life, Northwestern Mutual, and other like companies. Whilst sometimes they will offer companies that aren’t associated with those, many times they are the only option.

Those are fantastic companies. By no means am I expressing any sort of disdain or disappointment with those life insurance carriers. But the truth of the matter is is that those particular companies may not be the best option for you. For what you may qualify for as it relates to your health, lifestyle, hobbies, or profession.

A broker has the capability to shop around. They can see which life insurance companies are going to give you the best combination of coverage, price, and value. So work with a broker like us here at BuyLifeInsuranceForBurial.com.

You’ll be surprised. Your options for life insurance coverage are usually much more competitive. They provide much more value than working with those captive agents that simply offer one singular option.

Something is better than nothing

Remember this phrase. It’s important. I explain it to clients every single day. It’s the concept that you’ve got to get life insurance coverage today.

If you know you need life insurance and you can afford $50 a month, why delay? Can’t find a plan that meets that budget?

What we’re talking about today are ways in which you can ascertain those plans at $50 a month or less. Once you can find a plan and it meets your budget, you should buy it. Even if it’s not the most coverage that you ideally want.

Life has a way of throwing us curve balls. Many times we have to make decisions that don’t represent everything that we want out of life. Life is one big negotiation after all, and we have to take the pros with the cons.

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

When it comes to life insurance, you may not get the most coverage that you want. You have to constantly remind yourself that it’s better than the alternative: nothing. You could look at a plan today. It fits your budget, but because it’s not exactly what you thought you could get, you say no to it.

Then a new health ailment happens tomorrow. You can’t qualify for coverage. Worse yet, you die. You leave nothing to your family. You could have taken care of this!

This is not hysteria or fear factoring. It’s the truth. Life insurance is something you should get. Once you find a life insurance plan that fits your budget, you should take action today.

Sample life insurance plans

Term Insurance Under $50 A Month

What follows are charts for 10, 20 and 30-year term life insurance plans for people between the ages of 25 and 75. Females and males, smokers and nonsmokers, in five-year increments.

- These are level premiums.

- They’re preferred rates, rated with an A+, best carrier.

- You may not qualify for these plans.

- What you may qualify for is dependent upon your unique health profile.

10 Year Term Life Insurance

Please reach out to us at BuyLifeInsuranceForBurial.com

for more accurate information that’s representative of what you may actually qualify for.

Permanent Life Insurance Under $50 A Month

In the following charts, you’re going to find permanent life insurance plans for both whole life and guaranteed universal life.

Whole Life Insurance

Guaranteed Universal Life Insurance

For Guaranteed Universal Life

We are using ages 25 to 80 in five-year increments for a preferred rating. Keep in mind that with guaranteed universal life plans, as long as you pay the described premium, your rates never go up. The coverage never cancels and you’re fully protected from the first day.

Understand that these are not an accurate representation of what you may qualify for and what your eligibility for coverage would be. This depends upon you answering health questions and an underwriter looking at your case independently.