$100,000 Whole Life Insurance For Seniors [Review]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

I’ll Help You Find Affordable Life Insurance Products For Your Self And Loved One

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation for Whole Life Insurance for Seniors.

Here’s An Overview Of Our Discussion On Whole Life Insurance Policy Program:

- What Is A Whole Life Insurance Policy?

- Case Study Examples

- Reasons For Purchasing A $100,000 Life Insurance Policy

- Story From The Field

- Exam Or No Exam?

- Simplified/Non Med $100,000 Whole Life Insurance

- What Are The Best Rates/Insurance Companies For A $100,000 Whole Life Insurance Policy?

- Other Factors To Consider If $100,000 Premiums Too High

- Three FAQs People Have When Purchasing $100,000 In Life Insurance

- Final Steps

Whole Life Insurance policy

You cannot live a whole life insurance plan. And typically if you can qualify for it, and we’ll talk more about this later, it’s full coverage from the first date or the effective date.

Again, it’s gonna depend. If you qualify depending on a can, if underwriting will accept you. Why do people buy whole life insurance? I think the main reason is peace of mind.

They don’t want to get a term insurance plan they may outlive or that were prices may go up and they just want to know they’ve got some kind of coverage in place to protect against a permanent problem, a permanent problems, any permanent solutions, and that’s what whole life insurance does.

Fixed Premiums NEVER increase

Other options you may consider on a whole life insurance plan of any size. You can get paid up plans where you pay a premium for 10 years, 20 years, and then you’re done paying it.

You never have to pay again, but now you own the life insurance. You keep it, you’ll pay, you’ll get 100,000 dollars, your beneficiaries won’t die, but you don’t have to continue to pay premiums to keep it enforced. There’s also single pay plans is cool. It’s where you pay a lump sum premium and you get a multiplier of that coverage.

Coverage NEVER cancels due to age or HEALTH

Maybe have a healthy 55 or 60 year old, put $50,000 to do a single pay whole life insurance. And then if their health is good enough, they may qualify for 100,000 dollars in death benefit coverage. There’s neat things you can do with whole life insurance to get those whole life insurance benefits and there’s a lot of different manipulations we can do and I can discuss with you individually if you’re interested beyond just a premium that you pay until you pass away. What is exactly 100,000 dollar whole life insurance policy to do.

Buy Life Insurance for Burial wants to make sure that you are covered for your final expense needs. We know how important your loved ones are to you, and we know you want to protect them. That is why we dedicate ourselves to helping you find fairly-priced life insurance.

For more information, you can submit a ticket on the left-hand side of the screen; typically, we reply to these messages within 24 hours of getting them. Also, we provide all of our customers with a complimentary, free quote. The process takes around 10 minutes when you call us at (888) 626-0439.

Case study examples

New homeowner needs life insurance

Recently, my clients, Mr. and Mrs. Bennett (ages 64 and 60, respectively) bought a new home that came with a six-figure mortgage that needed to be paid over the next 30 years. They realized that they were responsible for this mortgage regardless if they were living or if they passed away. They wanted to make sure that their family would be able to live in the home in the future, but they didn’t want to put a financial burden on anyone else.

Mr. Bennett suffered from diabetes, but it was not a serious case. He only had to take low doses of insulin to manage his blood sugar. Despite the fact that he had his diabetes under control, and he stuck to a healthy diet, he wanted to know if his condition would affect his life insurance coverage eligibility.

After talking with Mr. Bennett, I went ahead and shopped around. I reviewed multiple coverage plans from different insurance companies, looking for the perfect fit for him. In the end, Buy Life Insurance for Burial was able to offer him the best coverage for his personal needs. Mr. Bennett was impressed that he was able to get such an affordable policy despite having diabetes.

While no one can guarantee that you will be eligible for coverage if you are in the same position as Mr. Bennett, we do everything in our power to find the best possible life insurance coverage for you here at Buy Life Insurance for Burial.

Recently promoted with a risky hobby

My client, Mrs. Young (age 38) reached out to me after she got promoted at her job because she wanted to get life insurance to cover her family in case she passed away. It was a huge promotion that included a significant raise. This made her realize how important her income was towards her families lifestyle, and she wanted to protect them in case something happened to her.

Mrs. Young and her partner frequently went mountain climbing. She confided in me that she had heard stories that people with high-risk hobbies tend to get denied when looking for life insurance coverage. This was her only problem, otherwise, she was a perfect, healthy candidate.

Luckily, we were able to give Mrs. Young good news after we compared the rates of participating insurance companies, and she was thrilled to know she was eligible for quality coverage. Buy Life Insurance for Burial was proud to help Mrs. Young get the insurance she needed, despite her high-risk mountain climbing.

In the end, Mrs. Young took us up on our offer, and we were happy to serve another satisfied client. Here at Buy Life Insurance for Burial, we shop around, looking for the best combination of price and coverage. We make sure that our clients receive the best quality coverage for a rate that fits into their budget.

Please note that your result might not be the same as Mrs. Young’s. Regardless, we will do our best to help you get life insurance that fits your individual needs and insurance goals.

Reasons for purchasing a $100,000 life insurance policy

There’s a lot of reasons why somebody would want to purchase 100,000 dollar whole life insurance policy. One reason this funeral expenses, funeral expenses are going up. People want to have some dedicated to policy to take care of all of it, or a portion of that policy to take care of all that. Whole life insurance plans, look, you can’t outlive them.

You know that hundred thousand or a portion of it is going to go to the funeral expense. Same thing was cremation expenses. Now that thing is income replacement. A lot of people buy a whole life insurance policy because they want a guaranteed lump sum paid to their surviving spouse a because maybe if they die, their pension disappears.

And the lifestyle, the surviving spouse changes instantly. With an income replacement plan through whole life insurance policy, well now you’ve got money, just surviving spouse can live a little bit more comfortably for longer without her spouse being around.

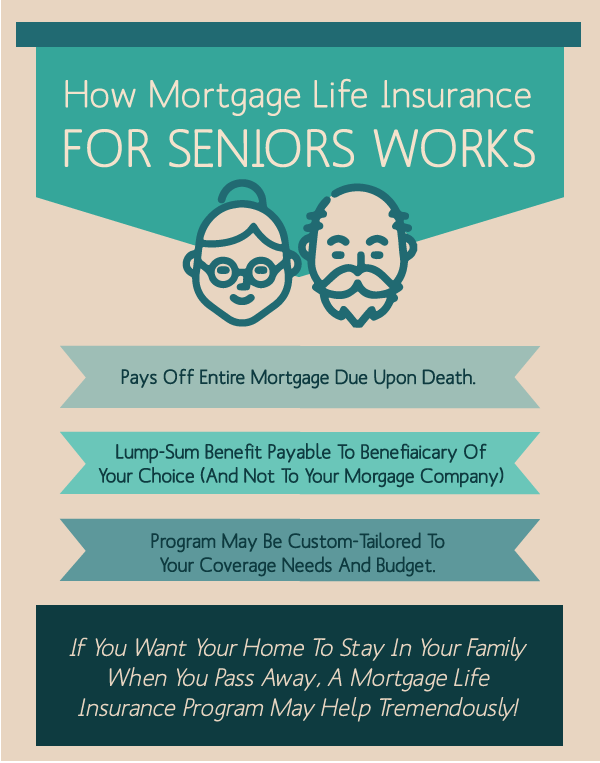

Just the gift of love is a great reason to buy 100,000 dollar whole life insurance policy. Maybe you just want to leave money behind to a kid or a grandkid helped them get started in life. This can be a great idea for that mortgage payment protection program. If you can’t pay off your mortgage with 100,000 dollar plan, at least it pays a lump sum to your surviving spouse so they can deduct the mortgage payments from that plan to pay off the mortgage as time goes on.

Now that you understand how life insurance works, let me remind you that we offer free quotes at Buy Life Insurance for Burial if you are interested. The process takes 10 minutes when you give us a call at (888) 626-0439. All quotes are obligation free. We are just here to help you meet your life insurance needs.

If you are not ready to pick up the phone, but you want more information. You can message us using the submission box on the left-side or bottom of the screen. We will get back to you within 24 hours and thoroughly address your questions or concerns.

Versus coming out of what a retirement income that she receives, a loan pay down, maybe you just have money you owe and you want to make sure something is paid off before, right after you pass away. And also a source of cash funding. If whole life plan and started early enough in life, these plans can potentially pay dividends which increase your cash value and then you can borrow from that cash value.

A lot of people use whole life insurance plans as a source of cast funding, whether for personal or for business reasons. That’s another reason people would buy 100,000 dollar plan. Bottom line, like I said earlier, people buy whole life insurance because permanent problems need permanent protection and whole life insurance is a good solution for those kinds of problems. You may ask yourself as an exam necessary to even get one of these plans. Sometimes they are, but not always, it’s just gonna depend on the company.

Exam or no exam?

Exams usually require either a urinalysis, definitely blood withdrawal or some sort of general physical. Sometimes carriers are just going to require a signature electronic or telephonic there. They may not even require an exam. Again, just depends on what company you qualify with and really what your health is. Some just going to require a phone interview.

Only the reason if you’re asked to take an exam, why should take it is because examinations, if you’re healthy enough generally will allow you to get a better, more competitive price. Whereas if you don’t take an exam and you’re healthy, you might pay more than you have to know.

Sometimes it’s not a good idea to take an exam just because it’s not necessary. Sometimes a smaller amounts of coverage just don’t prompt a company to require an exam as you get up in age. That may change sometimes the requirements titan if you’re older. Generally speaking, I can tell you personally what I would do. I’m in good shape. I’m young.

If I’m buying a large policy and the company says you can get a better deal if you have an exam offered, I’ll take it because I don’t want to pay more than half to.

If it doesn’t make a difference either way, then I’ll pass but I may pass on it. If I’m older and I’m, it’s not required, but I’m not going to lose out on a competitive price, if that makes sense. Can you qualify for 100,000 dollar whole life insurance plan in most cases you can. The question isn’t, yes, it’s just which kind is going to be the best for you. There’s really two types of whole life insurance plans available depending on your age, depending on your health.

Types of Whole Life Insurance Programs

First Day full coverage is the full hundred thousand dollars for natural and accidental death from the effective date. If you can’t qualify for that, the last option you would have the trump card, if you will, as the return of premium or a guaranteed acceptance guaranteed issue plan. It’s where you got to wait usually two full years before your coverage for national death.

The only reason you would want to consider a plan like that is that if you just can’t qualify for anything else, and that usually means you’ve got some pretty serious, chronic ailments. And you know, if you have one of those probably know it’s not just plain old diabetes with pills, usually it’s a combination of here’s series of heart problems, lung problems, a serious stuff. And that would be your only option. That’s the only reason I would recommend it as that literally is the last option that you could say your health is just not good.

Story from the field

Today, I want to share a story that shows why it is important to work with a broker like Buy Life Insurance For Burial. This story will highlight why it is key to get life insurance when you can and how it can affect your family’s life after you are gone.

My father referred me to a client (who we will call Mr. White for the sake of the story), an 85-year-old gentleman who lived in Albany, Georgia. He was a veteran who worked at a college.

When he was working with my father, he told him that he would be interested in adding to his insurance in a year or so. As my father was taking a break from selling life insurance at the time, he sent me to see Mr. White.

Upon meeting with him on a humid day in May, it was clear to me that he was ready to purchase more life insurance. Two years ago, he had gotten remarried, and he was worried about the amount of money he would have to leave for his new wife and his children. He wanted to have peace of mind that his final expenses and his family would be taken care of after he passed away.

As he has a history of strokes and was currently taking blood thinners to treat and prevent any future health complications, he wanted to make sure that he would be able to get an affordable life insurance policy that was also good quality.

Luckily, after I did his health analysis, I was able to find multiple plans that he qualified for. Buy Life Insurance for Burial was happily able to provide him with first day full coverage for natural and accidental causes.

Mr. White was thrilled and extremely happy to qualify for this life insurance policy. He knew that mail and TV advertisements had a tendency to promote their products as if they were the best, but in reality, they don’t always do what they claim to do. For example, for two to three years, some products may not even fully cover you in the case of a natural death.

Everything turned out great and everything was going well until I heard the news that a death claim on Mr. White had been filed. He had passed away in November due to heart failure, and the death claim was reported within the first six months of his new policy. Thanks to his policy, the insurance company paid the entire death claim balance.

I’d like to remind you of something very important. If Mr. White had purchased life insurance from one of those previously mentioned mail-order or TV advertisements, it is very likely that he would not have received the full death benefit payout that he was entitled to from Buy Life Insurance for Burial.

Now, this doesn’t mean that you are guaranteed to qualify for a life insurance policy. It is impossible to know that until you have actually applied for life insurance coverage. But, that isn’t the takeaway here.

I wanted to share this story because it really shows how fragile life is. No one ever knows what day is going to be their last, and it is not something we can control. Fortunately, we can prepare for our final day. We know it is important to take care of our families when we are here and after we are gone. One way to do that is to protect them financially by applying for life insurance.

You can do just that using brokers like us at Buy Life Insurance for Burial. At our business, we try to offer people like you the best option for life insurance coverage, and we take both price and quality into consideration. We never want to see our client settle because we care about them and their families.

We want to do what we did for Mr. White, and we were proud to get him first day full coverage, quality life insurance that was there for him when he needed it most.

Simplified/Non Med $100,000 Whole Life Insurance

My experience is, you know, a great health, OK health, not for sure until I talk to you, but most cases, most people qualify for first a full coverage. Let’s talk about the difference between simplified issue in non med issue whole life insurance. It just means the difference between requesting, um, medical records or not.

If you see simplify this, your non med, generally speaking, you’re not going to be required to take an exam that will pull medical records, prescription records determined insureability. I liked these plans because it’s great for those with health history issues a lot, a lot of times it was more built in flexibility. I’ve literally gotten people who have copd first, a full coverage.

I’ve gotten people who’ve had heart history problems, cancer history problems, a severe insulin usage first, a full coverage at otherwise it’d be decline if they took a fully underwritten policies. The Suv pop processes really fast, usually take days, if not weeks to get approved. The downside is if your house, like I said earlier, you’re going to pay more for that convenience factor is not taking an exam, it’s much more recommended if you’re in really good shape to take that exam, fully underwritten hundred thousand dollar whole life insurance plans means you’ve got to do an entire exam.

Everything I talked about blood, your analysis, physical pros as you get a better price. I did this myself and I’ve looked at price comparisons for what I’m paying for my insurance versus if I didn’t have an exam, would literally be like half the price or half the coverage for the same price. To me, a total rip off, I want the most coverage I can to protect my family. If I die and replace my income, why would I give up on, you know, hundreds of thousands of dollars in difference? That’s for me.

That doesn’t make any sense. And if you’re healthy, it’s worth to the troubles of an exam. God forbid you did die and you needed to leave money behind, I would want you to leave more money behind to your family. It does take weeks to months to get issued because they’re going to pull medical records analysis, pull in-depth medical records, and, and there is the risk that if you do these exams, you’re going to reveal unknown health issues and may affect your insureability.

Ignorance is not bliss in my opinion, especially when it comes to health. I personally want to know if I have health problems, especially if I’m healthy to begin with, I don’t necessarily think that’s a potential negative. And there are the potential for write ups. This mostly happens with agents who are not good at underwriting.

Best rates insurance companies

They’ll go in and low ball the deal and they’ll say, hey, look, here’s, here’s some great rates. Their preferred plus rates and then you get back and you have a table rating, which means the price is probably two, three times as much and it’s just a waste of colossal waste of time. A lot of these rate up potentials happen because of inexperienced agents. You still have the potential to find out something that you didn’t know you had then causes a price increase.

Let’s look at some hundred thousand dollar whole life insurance coverage rates. What we’re going to do is just start by showing you some simplified and non med options. So these are plans where you don’t have a full examination.

I’m not going to get too detailed into examination a policy, so it’s likely if you’re younger or if you’re in really good shape, no matter the age, we may be able to do a better price than you’re seeing, but most of my people who watches videos are seniors, are parents of children with parents that are looking for life insurance. So I gear my presentation towards that.

I’m looking at a 65 year old males on to look at to just show you kinda what the options are. Actually we’ll take a look at 65 year old female as well, non-smokers, and so you can see what it would run for simplified issue non med.

And then I’m going to show you some alternatives if you don’t like what you see and give you some other options as well. OK, so you’re looking at a $50,000, a non-married simplified issue. Whole-Life insurance plan, the ones I’ll direct you to, not so much pig pickins, but also the ones down here, these are all not going to require an exam, but they’re going to be around to the 2:50 to 60 mark.

Now you may be asking why I asked for 100,000, why not 50,000? What will simplify the issue in some non med products, it may be more prudent to do two different policies to get the amount of coverage you had because some of these people that are gonna apply for these products. You may be out there have had health problems and a lot of these plans limit coverage of 50,000 so, but even just no rules and you can’t take out two policies for 50,000.

You get a total of 100,000. You’d be looking at around 500 to five, ten five, let’s say 500, 5:50 a month. And for a female, same thing. Sixty five non-smoker. You’re looking at around the 200 mark. It’s going to be around 400 to four. 20 five for $50,000 for 100,000 dollars in cash, so a lot of people who see this get a little sticker shock because if you’re older than 65 is going to be higher, of course, and even if you’re younger, it’s going to be not too much off unless you’re in your thirties or something.

Some factors to consider

But look, if you’ve got a little sticker shock from this, let me share with you some alternative ideas that you may want to start with. I believe in the old adage of that the way to eat an elephant is one bite at a time. If you don’t want to go full in and it’s just scary or just can’t afford it, let me show you some alternatives.

First of all, I’m going to show you what’s called a guaranteed universal life program. And the idea behind guaranteed universal life is the premiums are fixed. As long as you pay the premium, you never will have the policy canceled. The coverage never cancels as long as you die before age one, 21, which most people will, but if you wanted 100,000 dollars, I’m showing you some options here and this requires pretty good health to be honest with you.

Although we do have some flexibility, but for a hundred thousand and 65 year old nonsmoker, Male, $260, it may be 270. I’m just going to stick with this company. It may go hire. These are standard prices. I usually don’t sell these. Usually stick with static core, but much better than the $525 price point for males. Now if we look at female, same thing, hundred thousand, no lapse guaranteed universal life plan.

Instead of 400 a month, you could be paying a hundred and 67 a month. Perhaps even 219 or some. There are some higher price plans that aren’t showing here, but those would be at the maybe a couple of hundred. I don’t know how much exactly what would be, but it might be lower than what I first showed you. So that’s a creative way to get a better price. But have the same benefits that are just like whole life in the sense of permanent protection. You can also do what’s called a term life product with the permanent conversion options, so this would be where you would buy 100,000 dollars in term life insurance, probably pay a fifth of the price that you would maybe even less than that and then down the line and take that plan and convert at the whole life insurance without evidence of insurability. There was a lot of products that we offer that do that.

If you rather would pay 50 bucks, maybe a hundred bucks a month, maybe not even that and get the same amount of coverage, but understanding it’s only gonna last 10, 15, 20 years, maybe 30 years. If you’re younger a, this is a creative way to get a lot of coverage, but have that plan B option to turn this into 100,000 dollars of insurance down the line. You can also start with the smaller amount of coverage. There’s nothing wrong with starting with smaller, you know, 25, 50, $75,000 in coverage and you’re liking that about half the rates for 50,000 quarter.

The rates for 25,000, you know, do the math. It’s $500 for, for simplified issue, for a hundred grand on a male, 65 non smoker, tobacco, non-smoking, tobacco, non tobacco smoker. You get the idea, it’s going to be about a hundred and $25 a month for a 25,000 to our planet that age and vice versa.

Also a bottom line. Look, something’s better than nothing here. The idea behind here is to sell you on the idea that insurance is important. Clearly, if you’re watching the video up to this point, you’ve realized that, but if you’re not convinced that the premiums are going to work for you, look, there’s a lot of other options. It’s better to do something instead of just walk away and pretend like this problem doesn’t exist.

You don’t have to pay the premium, but the problem still exists. The premiums on problem, the problem’s a problem. Problem is you only have coverage, problem is you’re going to die and it’s going to cost something and he needs something in place. The solution as the premium you pay, of course, the idea here is to get a premium you can affordably and easily pay so there are other options of just wanting to demonstrate them to you.

Let’s wrap this up and tell you how to qualify. Let’s say you’re convinced you want to do 100,000 dollar whole life insurance plan or some kind of variation, whether one of the ones I just mentioned low pick an age and like to work with. That’s the first thing I’ll nominate myself as I always do and the next step would be just for me to interview you, figure out what your goals are, your health and then let me drop a quote.

Assuming you accept it. I will run the application through the process either by email or by telephone. Very, very rare that we require a face to face meeting nowadays with with insurance coverage. Being able to be a completely electronic at this point, a couple of days to a couple of weeks later, if we don’t do an exam, you’ll get approved for coverage.

Three FAQs people have when purchasing $100,000 in life insurance

1. What is the best type of insurance to get?

Is there an on-going problem in your life that you want to be covered for? Do you need a permanent solution? If so, consider whole life and guaranteed universal life insurance. Are you looking to pay for school loans, a mortgage, or another debt? For this goal, the most common type of insurance is term insurance.

When dealing with insurance, always remember that it should be based on your personal goals. Look at your life and what you want, then consider which insurance best fits your personal needs.

2. What do I do when there is no other option available to me?

Do you have a very risky hobby or a chronic health problem? If you have no other option available, guaranteed acceptance life insurance might be a great choice for you.

3. Can I qualify for $100,000 amount of life insurance at this age?

Qualification for life insurance always depends on your current age and health. The younger you are, the more likely you are to qualify. Same concept with health. Healthier individuals are more likely to qualify for higher amounts of insurance.

For example, you might have a problem getting qualified if you suffer from a chronic health problem or if you are currently 100 years old.

Final steps

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

If we have to do an exam, it may take a month to two months, conservatively. After you get approved, assuming you do, we send you your policy and that’s it. And the story, you got your coverage, peace of mind is intact. Final steps,how do you do this? Let’s say you want to contact me very easy. Two options. You can go to my website BuyLifeInsuranceforBurial.com. You’ll see a contact link below.

You’ll see a box to click on a chatbox, either those methods work. Send me a message, let me know what you’re looking for. If you like to use the phone, call me at 888- 626-0439. Let me help you and I’ll talk to five, 10 minutes, give you a quote, what to do with. It’s up to you. As you can tell, I’m pretty laid back and easy to work with. If I can’t help you, no big deal.

Well, hopefully you enjoyed the information in this video today. I do hope that you found that useful and that you’ll let me help you if there is a need for it. My Name is David Duford of BuyLifeInsuranceforBurial.com where I help people across the country get affordable life insurance for themselves or for people they love. Take care.

We truly hope you learned more about $100,000 whole life insurance for people like you. We hope that you take away how important action is in terms of seeking life insurance. Regardless of your life insurance goals, it is always best to be covered as soon as possible.

If you are ready to take the next step, you can contact us via message or phone.

To submit a message to us, please see the submission sections at the left-hand side and the bottom of the screen. If you choose to message us, please let us know what questions or concerns you may have. Also, leave us the best way to contact you so we can reach out to you within the next 24 hours.

Our phone number is (888) 626-0439. To find out what your life insurance options are, what premiums you would pay, and how the programs work for you, please give one of our friendly representatives a call. The process takes 10 minutes or less, and there is no obligation; only information!

Thanks for reading “$100,000 Whole Life Insurance For Seniors [Review]!” We hope you enjoyed it!