$50,000 Whole Life Insurance Review [Rates & Companies Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

You’ve arrived at my website because you’re interested in discovering more about your options for $50,000 in whole life insurance.

Perhaps you are looking for life insurance on yourself or a loved one like your parents.

If you want ALL the facts (and a little opinion) on getting $50,000 in whole life insurance, you’re at the right place!

Today, I will review…

Options For A $50,000 Whole Life Insurance Coverage

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation on $50,000 whole life insurance. Enjoy!

Here’s An Overview Of Our Discussion On $50,000 Whole Life Insurance:

- What Is Whole Life?

- Why People Buy Whole Life

- What $50,000 Life Insurance Covers

- Exam Or No Exam?

- 5 Most FAQs For People Buying $50,000 In Life Insurance

- Can I Qualify?

- No Exam $50,000 Whole Life Insurance

- Fully Underwritten $50,000 Whole Life Insurance

- Best Rates For $50,000 Whole Life

- If $50,000 Is Too Expensive

- Next Steps

What is a Whole Life Insurance Policy?

Before we get into the nitty-gritty, let’s take time to cover the basics.

First, let’s discuss how whole life insurance REALLY works…

I find MANY people I deal with are genuinely confused as to how life insurance works. So clarifying the basics on whole life insurance coverage is important

Your Premium Remains The Same… FOREVER

Unlike term life insurance, whole life insurance premiums NEVER increase.

The premiums are contractually designed to stay the same for however long you keep the plan (hopefully forever, right?).

You Can NEVER Be Cancelled Due To Age Or Health

Another important question to ask about your life insurance is how long it’s good for?

The good news with whole life insurance is that it can never cancel due to age or health. This assumes you continue paying the premium, of course.

Unlike term life insurance where coverage is DESIGNED to cancel, whole life insurance guarantees in writing that your coverage is GOOD… no matter how long you live, as long as you continue paying the premium.

Permanent Protection For Permanent Problems

Permanent problems demand permanent solutions.

Here’s what I mean.

One of the biggest reasons why people purchase whole life insurance is to pay for final expenses like funeral costs.

Think about the nature of death. Is it NOT the perfect definition of a permanent problem?

I mean, who alive today will ever cheat death? Anyone?

And that’s why the cost of paying for your final arrangements is a permanent problem.

And buying a term life insurance plan that you may outlive leaves too much at stake.

That’s why a $50,000 whole life insurance plan is a great idea to cover permanent issues like funeral expenses, and leaving money to your spouse or family.

Why Do People Buy Whole Life Insurance?

Why do many people buy $50,000 in whole life insurance?

It’s rather simple, really.

It’s all about peace of mind.

My clients want the feeling of assurance. Assurance that their policy CANNOT cancel due to age or health. And that their policy WILL NOT get more expensive as they age.

Further, my clients want their loved ones TOTALLY protected from the debilitating costs of funeral expenses. And to make their loved ones’ lives as easy financially as possible upon their demise.

Types Of Whole Life Insurance Policies

In addition to the premium- and coverage-guarantees that whole life insurance provides, there are a few whole life policy constructions to be aware of.

Multi-Year Pay Life Plans

A paid-up whole life insurance policy works much like paying off a house or a car.

When you pay off your car or house, you get to keep it, right?

Same goes with paid-up plans.

Foe example, you buy a 10-year paid up whole life insurance policy, you are only required to pay premiums for 10 years.

Once you pay the past premium off in the 10th year, you’re done paying life insurance premiums, forever!

Bottom line, your $50,000 whole life insurance is paid off, and you continue owning it until you die. If you hate the idea of lifetime payments and can afford the higher cost of a paid up plan, consider this option.

Single-Pay Plans

Similar to multi-year pay plans, single pay plans only require a one-time premium and nothing more, ever again!

For example, let’s say you want $50,000 in whole life insurance. There are insurance companies that will take a one-time lump sum payment less than the coverage amount, and give you the $50,000 in life insurance in exchange.

What that amount is depends on your age, health, and other factors.

I have run quotes on people 60 and older for these single-pay plans, and in some cases, a $30,000 one-time premium brought in $50,000 in life insurance coverage!

An instant $20,000 increase! That’s great!

And with single-pay plans, the client gets all the benefits that come with whole life insurance. Coverage never cancels due to age or health… no premium increases (heck, no premium payments with single pay!)

Life-Pay Plans

All said and done, the vast majority of you reading will probably opt for a life-pay $50,000 whole life insurance plan.

It’s fairly simple. With life-pay plans, you pay out the rest of your life.

You only stop paying when you pass away.

Why do most people purchase a life pay plan?

Simply because it’s easier to afford and fit into a real-world budget.

While I love multi-year pay and single-pay whole life insurance policies, the reality is that the premiums can get out of range for the average household.

Either way, I want you to know that there are multi ways to purchase $50,000 in whole life insurance.

As always, the goal is to find the option that best suits you.

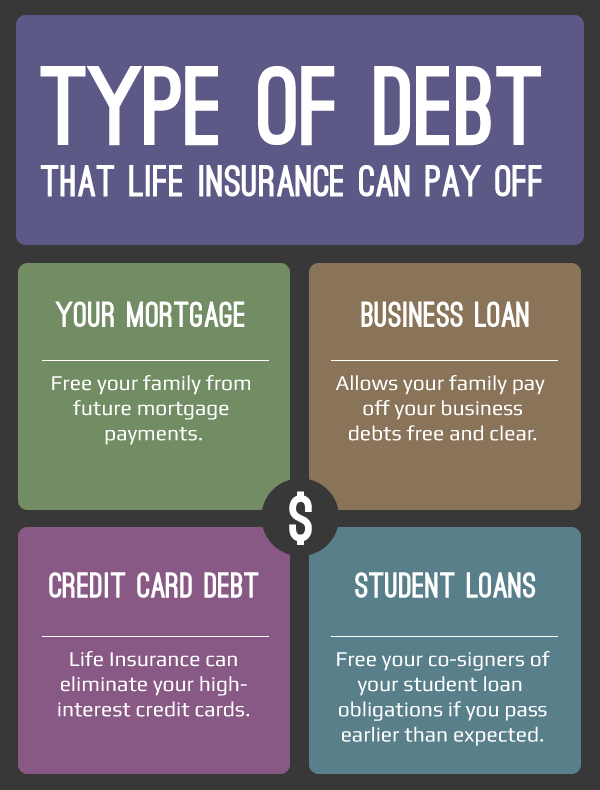

What Does A $50,000 Whole Life Insurance Policy Cover?

There are several reasons why someone would purchase a $50,000 whole life insurance policy.

Let’s jump right in and discuss them.

Funeral Expenses

One reason you may want to purchase $50,000 in coverage is to cover funeral expenses.

I just finished talking to a nice lady in Hawaii. She told me about her beloved grandmother’s cremation ceremony, and how it cost nearly $30,000!

That seemed a little steep to me. But, it is in Hawaii, which is the most expensive state to live in. So I guess I can’t be too surprised!

Many people who buy these types of plans are primarily concerned about funeral costs.

And a $50,000 plan will all that’s necessary, whether you’re cremated or buried.

Income Replacement

Have you ever thought what would to your spouse financially if you passed away?

While many households earn two incomes, the truth is most require BOTH incomes to live comfortably.

And your spouse losing your income may cause serious money problems.

One big reason people purchase a $50,000 whole life insurance plan is for income replacement.

An agent that works with me in Florida called to discuss a case like this the other day.

He has a military retiree drawing a pension along with a spouse who draws a meager Social Security check (she made the home, he worked).

Here’s the problem. The pension goes away upon the husband’s passing. Meaning once he passes away, his wife will NOT receive any portion of the $3,000 a month he collects.

And since their lifestyle requires every last penny of his $3,000 pension check, she’s in for some real hurtin’ if he dies first.

Imagine if you were in her scenario.

She’ll have to change EVERYTHING about her life, won’t she?

She may have to move out of her home because she cannot make the mortgage payment. She may have to stop doing the activities she’s accustomed to.

Her life will REALLY become difficult overnight with him passing away, right?

My recommendation to the couple was to purchase a whole life insurance policy, exactly as we’ve discussed.

If he dies, the policy pays $50,000 to his wife to replace his income.

This gives her instant breathing room, allowing her time to get accustomed to her new way of life. She can gradually make the necessary lifestyle changes instead of being forced to do it suddenly.

If your lifestyle absolutely requires both incomes, then a $50,000 whole life insurance policy is an excellent idea to consider!

Life changes instantly when your beloved spouse passes away. And if you want to slow down that process, a lump sum payout with a $50,000 whole life insurance policy can certainly go a long way.

Gift of Love

You can also just get a $50,000 policy as a gift of love.

Here’s what I mean.

Maybe you have a grandchild or a child that you want to leave $50,000 to help pay for college, or as a down payment on a house.

My grandfather died and had a $7,000 policy gifted to my mother.

It was perfect timing because she really didn’t have the money to put on a new roof her house desperately needed, so she’s really thankful she got it.

Little acts of love like this can go a far way in helping those you love.

You can also leave your life insurance policy to a charitable cause, or to your church.

Mortgage Payment Protection

You can also buy a $50,000 whole life insurance policy as mortgage payment protection.

Let me explain how this works.

Let’s say you owe $150,000 on a mortgage. You’re paying $700 a month.

In total, you’re paying $8,400 a year towards your mortgage balance.

If you pass away, your spouse is responsible to continue paying that $700 mortgage. As discussed in the earlier example, this may be exceedingly difficult without your income.

A $50,000 whole life insurance policy can pay down that mortgage over time.

The benefit is that the policy literally buys your loved one time to refinance the mortgage at a better rate, or to sell the home without worrying about foreclosure.

In this example, you can see that the surviving spouse would get right at 6 years of mortgage payments handled with a $50,000 whole life insurance policy

$50,000 / $8400 = 6 years

$700 into $50,000 is approximately six years, and six years is a long time.

It gives you a lot of opportunity to put your house on the market, get it sold, and not lose it in foreclosure because of the sudden and traumatic death of the uninsured.

Other Loan Obligations

A $50,000 whole life insurance plan can pay off credit cards, car loans, or any type of debt.

This is a great way to provide a guaranteed amount with a whole life insurance policy to pay off those types of expenses.

Bottom line: People who buy a whole life policy do so because they recognize they’ve got permanent problems that need permanent solutions.

Whole life insurance is a permanent solution because it will never cancel or increase in price.

Exam or No Exam?

A lot of people wonder whether or not an exam is necessary to take out $50,000 in whole life insurance coverage.

When dealing with a $50,000 whole life insurance product, examinations usually NOT required.

Much depends upon your age, your health history, and which company you apply with.

If you end up having to undergo an exam, it will require some or all of the following:

- Urinalysis (pee into a cup)

- Blood withdrawal

- A physical where you speak with a nurse or a doctor. They ask you a series of health questions, get your height and weight, etc.

The good news is that if you HATE the idea of doing a physical… it’s a requirement we can avoid if you’d prefer.

Buy Life Insurance For Burial operates as a broker. We work with different life insurance companies that offer $50,000 whole life insurance policies.

I am in the position to find companies that will bypass or simply not require exams if that is your wish (it is with most of my clients).

Bottom line, if you’re dead set against having an examination, then we can find an insurance company that doesn’t require one.

Many companies require only access to your medical records to determine insurability.

Some require a phone interview to ask follow-up questions to clarify your health history.

One good reason to agree to an exam

Now, you may be wondering, what would be the purpose of taking an exam?

The best reason to have an examination is to give yourself the most competitive premium.

If you’re healthy, and don’t take a lot of medications, it’s likely that you’ll get a better combination of price and coverage choosing to take an exam.

You see, an insurance company is all about managing risk.

When you’re insured, the company is on the hook to pay if you die while the policy is in force.

And the more up-to-date medical information company underwriters have through an exam and medical records, the better the price and coverage you’ll potentially receive.

When you don’t take an exam, the underwriters may have out-of-date health information on you. So, they factor that into the premium.

Can I Qualify For A $50,000 Whole Life Insurance Policy?

If you like the idea of a $50,000 whole life insurance plan, you may be wondering how easy it is to qualify for.

In most cases, you’ll qualify without much fuss for $50,000 whole life insurance program.

And now’s a good time to explain the 2 most common whole life insurance policy designs.

Two Options For Whole Life Coverage

First, you’ve got first-day full coverage whole life insurance.

This means you have full, first-day coverage for both natural and accidental death after making the first payment on an approved policy.

Most people with decent health – and even those with some prior health history issues – will qualify for this type of plan.

Next, you have guaranteed issue whole life insurance

With guaranteed issue whole life insurance, you MUST wait two full years BEFORE coverage for natural death is fully effective.

What does this mean?

It means if you die within the first two years, your beneficiary does NOT receive the full death benefit. Only what you paid in plus interest is paid in the death claim.

You may be thinking, “Why would I even consider a plan like that?”

I only recommend considering a guaranteed acceptance whole life insurance plan if no other life insurance company will approve you.

Truth is… your health has to be pretty bad for you to consider.

The following health conditions almost always result in a two-year waiting period policy:

- Congestive heart failure

- Kidney Dialysis

- Oxygen Use

- Alzheimer’s/Dementia

- Recent Cancer, Heart Disease (less than 12 months)

In those circumstances, no company will give you first-day full coverage. The only option is guaranteed issue whole life insurance.

Even if all you can qualify for is guaranteed issue whole life insurance, we can still get you $50,000 in coverage.

I have access to carriers that will allow $50,000 in coverage, even to folks in bad health that require a two-year waiting period policy.

Bottom line, we don’t know what you’ll end up qualifying for. First, you’ve got to talk to my team to see your options.

You can reach us at 888-626-0439. I’ll spend 5 or 10 minutes asking you a series of health questions and tell you what your options are.

More About No-Exam $50,000 Whole Life Insurance Coverage

Let’s take some time furthering our discussion about no-exam $50,000 whole life insurance coverage, since most folks will end up going this route.

As you can probably guess, a no-exam whole life insurance policy does not require an examination for approval. Medical records and prescription records are used instead to determine insurability.

Let’s talk about why no-exam life insurance coverage makes a lot of sense.

Got health issues? No-exam life insurance makes sense

Let me give you a case study.

I talked to a lady last night about her father. It has been two years or longer since his prostate cancer has been in remission.

He has a pacemaker which means he has a history of heart problems. He is a diabetic but it’s under control.

He has high blood pressure, high cholesterol, normal issues for a mid-60 year old gentleman.

He would be a perfect applicant for a simplified issue, no-exam type of whole life insurance program.

Despite his health issues, odds are he’ll get approval for first-day full coverage without a waiting period.

However, if we opted for an exam, my gut tells me he’d end up getting huge premium rate increases to offset his health. He may have even been declined, too.

With no-exam whole life insurance, you’re looking at only days to weeks to get approved. And in some cases, you’ll get same-day approval!

So if you want coverage without all the fuss, no exam whole life products will do it.

The only drawback to no-exam policies? If you’re healthy

If you’re healthy, and haven’t had major health issues, an examination will provide the most relevant, up-to-date information from the blood work, the urinalysis, and the physical.

The more information the insurance company has, the better odds they give you to qualify you for a better price and amount of coverage.

So healthy people. As long as you’re comfortable with the examination process, it’s worth doing a full exam to get a better deal if it’s available.

You may pay 30 percent less for the same amount of $50,000 whole life insurance you’d get with a no-exam application process.

If that’s something you’re concerned about, examinations make definite sense.

Fully Underwritten $50,000 Whole Life Insurance Policy

Unlike no-exam policies, underwritten $50,000 whole life insurance plan requires applicants to submit to an examination.

Depending on your age, you may only require a physical or simple blood work. The benefit is that your premiums are usually much lower than if you applied with a no-exam application for life insurance coverage.

Early 60 Year Old Agrees To An Exam

As a case study, I had a lady in Tennessee who applied for a 20-year term life insurance policy as a senior. She was 63 and in perfect shape.

Height/weight was perfect. She didn’t take any medication. She exercised and was in great shape. And she still worked.

We actually got her super preferred rates.

For the $250,000 term plan for 20 years, she saved literally $30 or $40 a month because her health was so great.

However, if she had gotten $250,000 at 63 on a no exam basis, she probably would’ve paid around $200 a month instead of the $125 we got for her.

So it paid for her to have that examination. She has an extra $900 a year left over.

Hopefully you can see why this is good to do an exam if you’re in good shape.

Slower approval time

The cons of getting an exam are it can take weeks to months before you get a decision.

It depends on how much medical records must be reviewed, and how fast your doctors comply with providing medical records to the life insurance company.

Exams may reveal unknown health issues. You may find out you have diabetes or high blood pressure, and could cause your application for life insurance coverage delay.

I would not let this potential prevent you from trying for the preferred rates with an exam.

If you don’t know if you’re in good shape or bad shape, I can define that for you once I do a health analysis with you to see what your health history is.

I’ll tell you my opinion and recommendation as an agent with years of experience doing this.

Again, the best way to reach me is to call 888-626-0439 or to send me a message.

Rates For A $50,000 Whole Life Insurance Policy

Let’s look at rates for a $50,000 whole life insurance policy.

The goal here is not to give you an exact price. That’s something that you can really only do after you talk to us.

Instead, I want you to get a general idea about what you may qualify for, and roughly what the price is based on your age and gender.

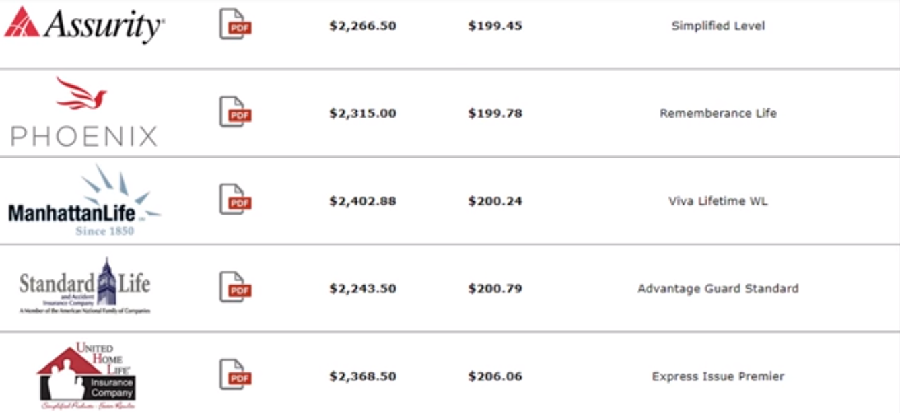

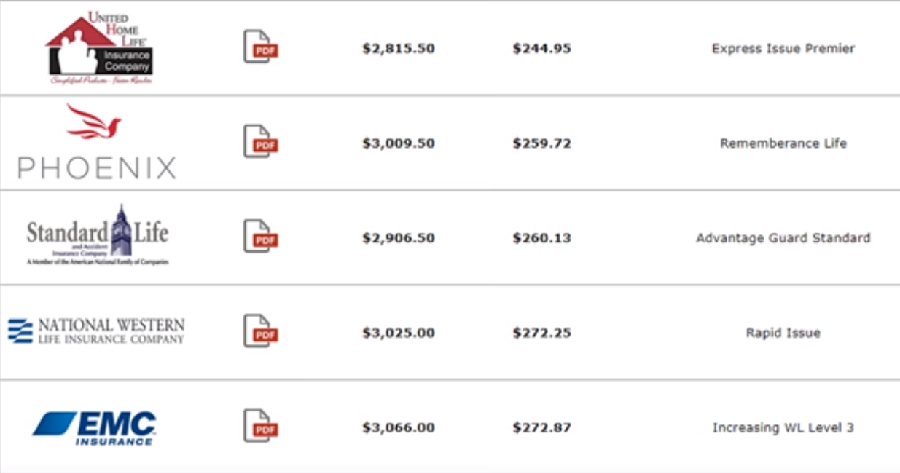

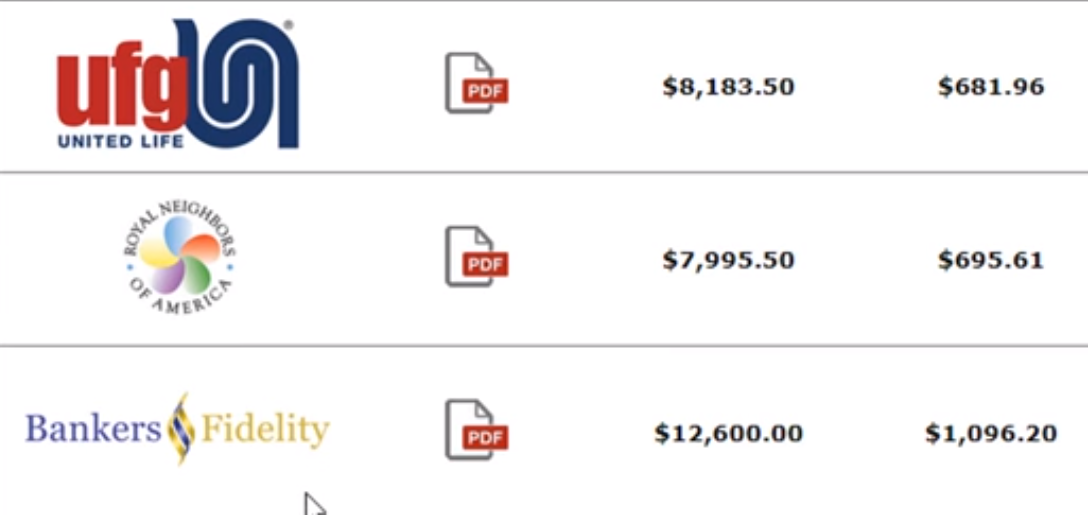

Simplified Issue $50,000 whole life insurance for a 50 year old male nonsmoker

So what you’re looking at here is a collection of companies that do a $50,000 whole life insurance plan on a simplified or non-med basis.

You can see the price range here is between $135 to $170. That’s if you’re a male and 50 years old.

Again, these are products that I would recommend to take if you have had some health history issues.

If you’re in better health, then it’s very likely you’ll get a better premium.

In fact, let’s take a look at that and kind of show you what a more traditional type of plan is it going to run compared to this if you’re 50.

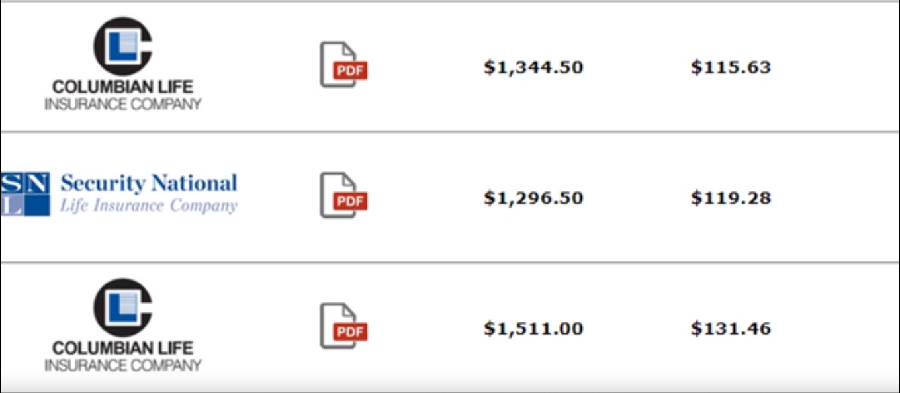

$50,000 Whole Life Insurance Quote, Male, 50, Non-smoker, Traditional Underwriting

Here’s a spreadsheet of what some traditional whole life insurance policies will run for.

I’ll direct your attention to the bottom down here. You’re looking at between $110 to $130, so significant difference for the non-med type of policy.

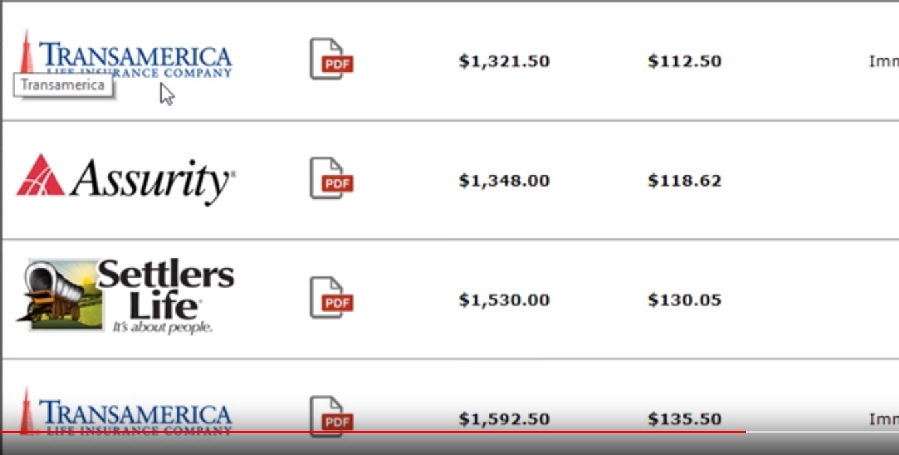

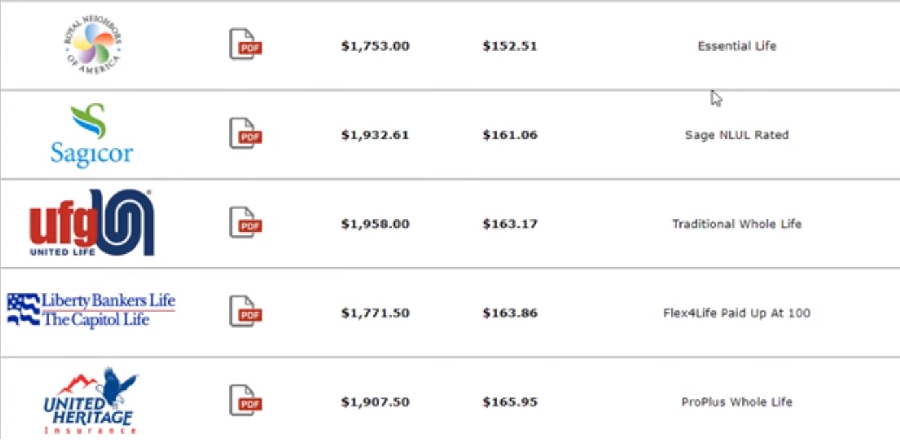

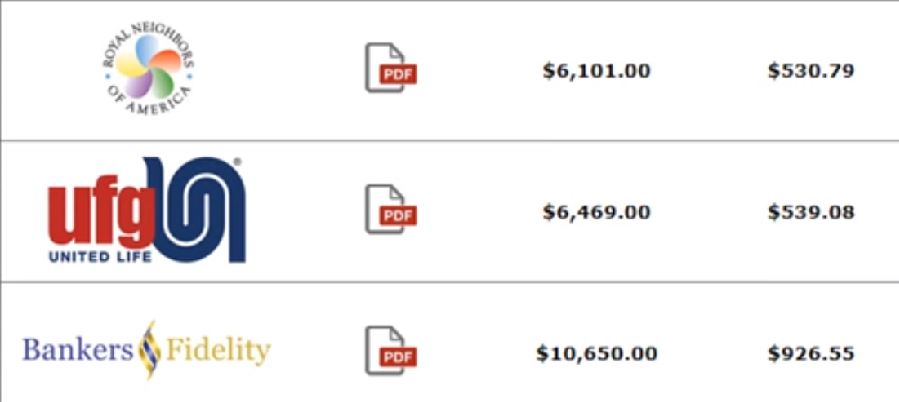

$50,000 Whole Life Insurance Quote, Female, 50, Non-smoker, Simplified Issue

Now we’re looking at females.

Of course, women are always less expensive if the health issues are the same between males and females.

$50,000 Whole Life Insurance Quote, Female, 50, Non-smoker, Traditional Underwriting

The rate for a $50,000 plan on a 50 year old is $112 to $135.

A traditional product that’s fully underwritten is going to be between $93 and $103, so significantly less expensive. If your health is better, these are some better options that will give us a better price.

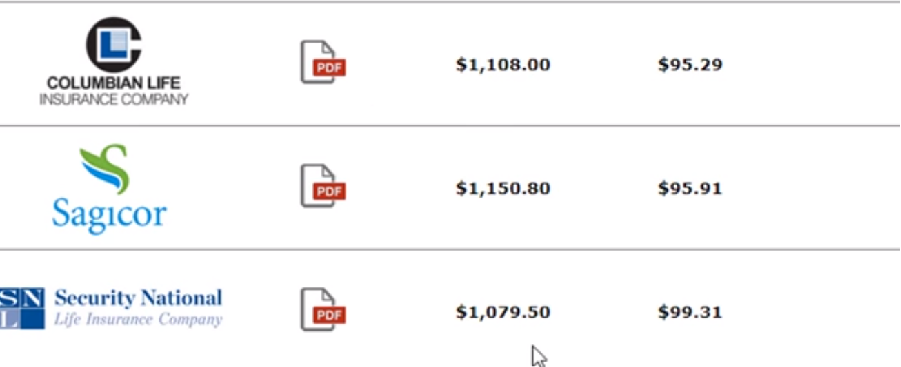

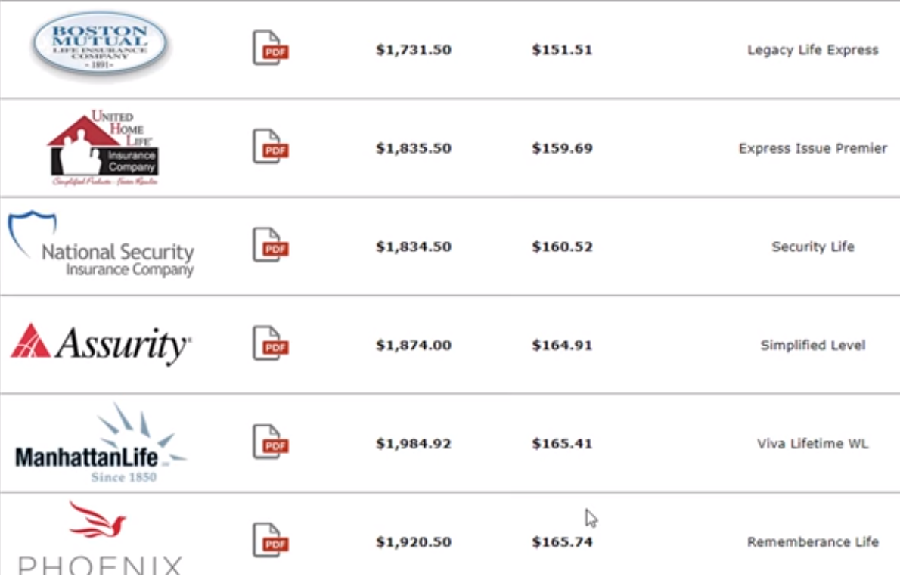

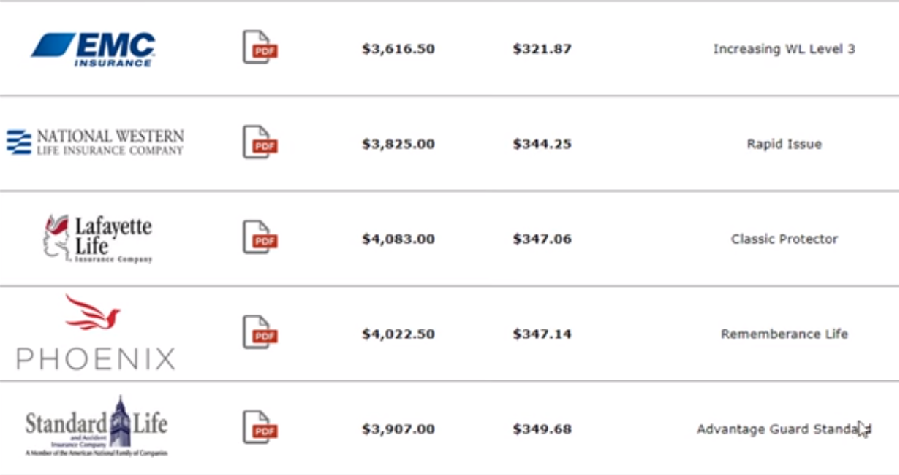

$50,000 Whole Life Insurance Quote, Male, 60, Non-smoker, Simplified Issue

Now we’re back up to a 60-year-old male for $50,000 in coverage.

There’s quite a bit of options here. There’s a low, low price of about a $125 from Pekin.

Most likely that is a fully underwritten product because the rest of these are in the $200 to $210 range for $50,000, and all of these I’m seeing here are all what’s called non-med or simplified issue products.

$50,000 Whole Life Insurance Quote, Male, 60, Non-smoker, Traditional Underwriting

Most likely, if you have health issues, you’d be looking at about $200 to $210.

If you look at a traditional product that’s most likely fully underwritten, you’re looking at around $150 to $165 depending on what product you get and what company you end up selecting.

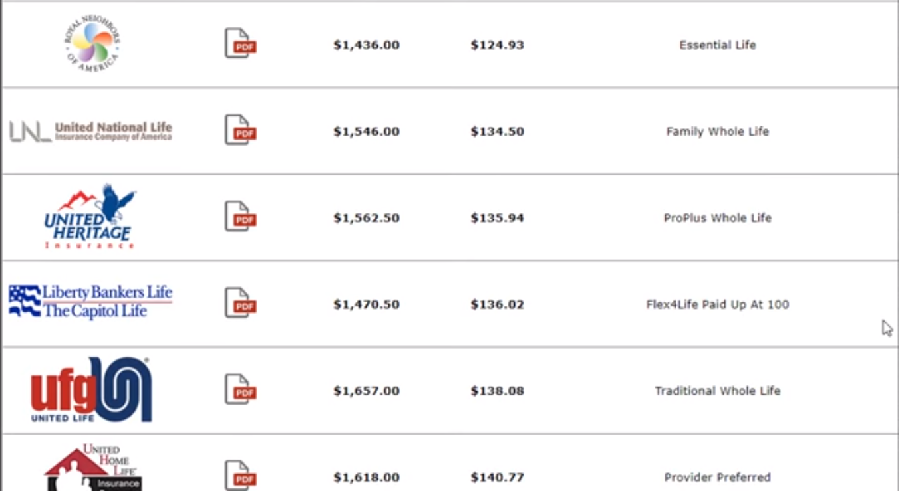

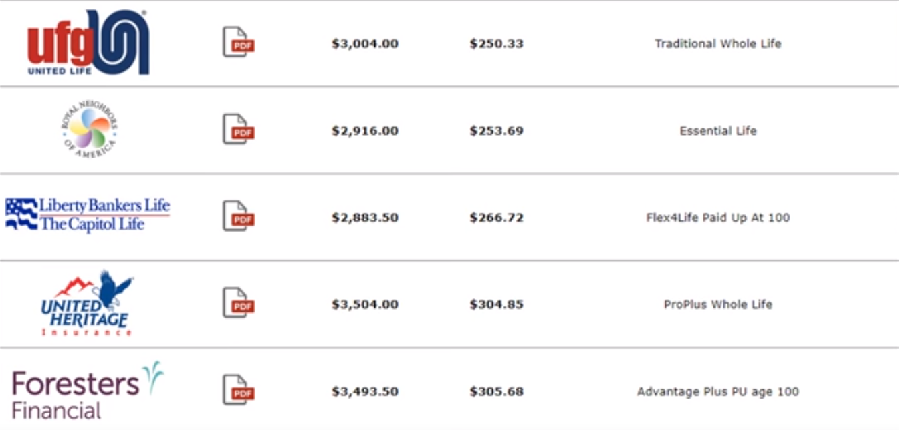

$50,000 Whole Life Insurance, 60 Year Old, Non-Smoking Female, Simplified Issue

It’s the same deal here for females with a non-med or simplified issue product.

It’s between $150 and $180 roughly depending on how your underwriting pans out for non-med or simplified issue products.

$50,000 Whole Life Insurance, 60 Year Old, Non-Smoking Female, Traditional Underwriting

Then for 60-year-old females for traditionally underwritten products that may require an examination, you’re looking at $125 to $150.

$50,000 Whole Life Insurance, 70 Year Old, Non-Smoking Female, Traditional Underwriting

For 70-year-old females with prior health issues looking for $50,000 in coverage of non-med or simplified issue insurance, you’re looking at between about $250 to $300 depending on which company is going to be the best selection.

$50,000 Whole Life Insurance, 70 Year Old, Non-Smoking Male, Simplified Issue

For 70-year-old males looking for $50,000 in coverage, it will be between $300 to upper $300s depending on the company you qualify for.

$50,000 Whole Life Insurance, 70 Year Old, Non-Smoking Male, Traditional Underwriting

For simplified issue, for males with good health at 70 years old, you’re looking at somewhere between $215 on the low side up to the mid $300s on the high side. Again, it’s gonna depend upon your health.

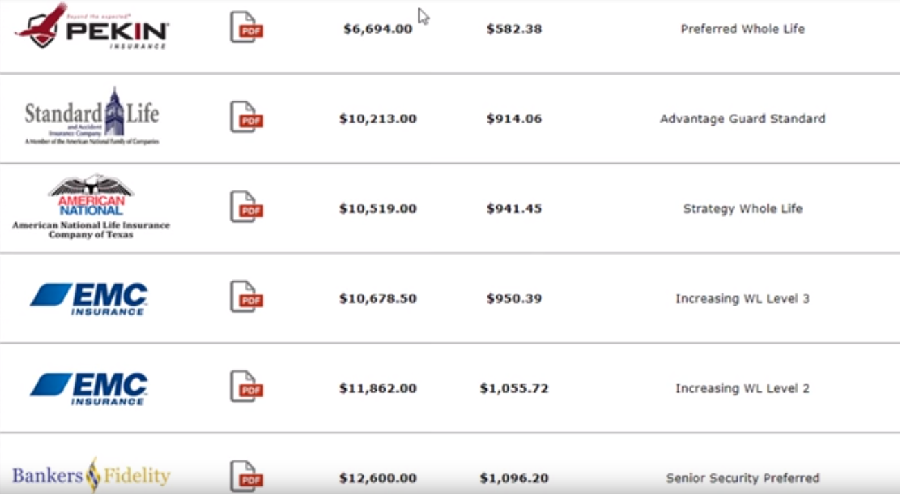

$50,000 Whole Life Insurance, 80 Year Old Man, Non Smoker, Simplified Issue

Now, if you have somebody who’s over 80, we can get them coverage up to 85. In fact, there are some companies that go up to 90.

They don’t go up to $50,000 in coverage, but you can get $50,000 in whole life insurance at 85. This would be non-med issue.

You’re looking at between $900 to $1,100 just depending on health and age and which company they qualify for.

There are ways to achieve $50,000 if these companies don’t offer the best options for underwriting because coverage is because very limited at 85. We can stack different companies in order to achieve that.

$50,000 Whole Life Insurance For 85-Year Old Male, Non-Smoker, No Exam

Here are fully underwritten products for 85-year-old males which are much less expensive.

$50,000 Whole Life Insurance For 85-Year Old Female, Non-Smoker, No Exam

And last but not least, a couple of selections for $50,000 for a fully underwritten product for females at 85 years old.

$50,000 Whole Life Insurance For 85-Year Old Female, Non-Smoker, Traditional Underwriting

And here are prices for females with health issues for non-med and simplified issue.

What If A $50,000 Whole Life Insurance Policy Is Too Expensive?

What do you do if $50,000 in whole life insurance has shell-shocked you?

Pretty simple…

Eat the elephant one bite at a time!

A lot of people want a lot of life insurance. But maybe the price is just too far out of reach.

Remember… something is ALWAYS better than nothing.

And the good news is that there are several alternative life insurance options that may help you achieve the same coverage goals at a better price.

Let’s discuss!

Guaranteed Universal Life

The first thing I’m going to show you is what’s called a guaranteed universal life program.

Guaranteed universal life guarantees coverage will not lapse as long as you pay the premium. It will last until you’re age 121 (let me know if you make it that long =).

As long as you pay the premiums in a timely manner, the premiums never go up, and the coverage can’t cancel because of age or health.

Guaranteed universal life insurance acts almost exactly like a whole life insurance plan.

But the greatest advantage of a guaranteed universal life insurance program is that you can get more bang for your buck.

You may qualify for $50,000 in coverage at a far lower rate when compared to whole life insurance.

Let me show you some examples here of what I mean.

$50000 Sagicor Guaranteed Universal Life Monthly Rate Chart

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 40 | $71.08 | $42.59 | $61.87 | $38.14 |

| 41 | $73.77 | $43.72 | $64.08 | $39.18 |

| 42 | $76.39 | $44.82 | $66.25 | $40.19 |

| 43 | $78.94 | $45.90 | $68.37 | $41.17 |

| 44 | $81.43 | $46.94 | $70.46 | $42.14 |

| 45 | $83.88 | $47.97 | $72.50 | $43.08 |

| 46 | $89.75 | $51.45 | $76.98 | $45.63 |

| 47 | $95.36 | $54.77 | $81.28 | $48.05 |

| 48 | $100.74 | $57.93 | $85.42 | $50.37 |

| 49 | $105.92 | $60.96 | $89.41 | $52.59 |

| 50 | $110.92 | $63.86 | $93.28 | $54.72 |

| 51 | $115.75 | $65.17 | $97.02 | $55.52 |

| 52 | $120.44 | $66.38 | $100.66 | $57.46 |

| 53 | $124.99 | $68.88 | $104.20 | $59.35 |

| 54 | $129.42 | $71.29 | $107.66 | $61.17 |

| 55 | $133.74 | $73.63 | $111.03 | $62.93 |

| 56 | $144.98 | $79.75 | $118.39 | $68.23 |

| 57 | $155.65 | $85.54 | $125.45 | $73.21 |

| 58 | $165.85 | $91.06 | $132.21 | $77.91 |

| 59 | $175.60 | $96.31 | $138.74 | $82.37 |

| 60 | $184.96 | $101.33 | $145.02 | $86.63 |

| 61 | $193.98 | $104.15 | $151.08 | $87.25 |

| 62 | $202.71 | $108.69 | $156.97 | $91.04 |

| 63 | $211.16 | $113.07 | $162.68 | $94.68 |

| 64 | $219.34 | $117.29 | $168.22 | $98.21 |

| 65 | $227.30 | $121.37 | $173.61 | $101.61 |

| 66 | $247.22 | $132.85 | $189.09 | $111.40 |

| 67 | $266.34 | $143.76 | $203.78 | $120.65 |

| 68 | $284.75 | $154.17 | $217.80 | $129.45 |

| 69 | $302.58 | $164.13 | $231.29 | $137.85 |

| 70 | $319.92 | $173.69 | $244.28 | $145.90 |

| 71 | $336.78 | $192.57 | $256.82 | $158.96 |

| 72 | $336.78 | $201.77 | $269.01 | $166.62 |

| 73 | $369.29 | $210.68 | $280.87 | $174.03 |

| 74 | $385.04 | $219.30 | $292.40 | $181.21 |

| 75 | $400.49 | $227.64 | $303.65 | $188.18 |

| 76 | $475.85 | $255.91 | $341.84 | $209.25 |

| 77 | $548.61 | $283.62 | $379.18 | $229.59 |

| 78 | $618.61 | $310.63 | $415.69 | $249.25 |

| 79 | $780.01 | $337.07 | $451.56 | $268.32 |

| 80 | $1,147.46 | $362.72 | $486.90 | $286.90 |

| 81 | No monthly Result | $387.72 | $521.66 | $305.01 |

| 82 | No Monthly Result | $412.09 | $555.91 | $322.70 |

| 83 | No Monthly Result | $435.78 | $589.74 | $340.02 |

| 84 | No Monthly Result | $458.81 | $623.24 | $357.04 |

| 85 | No Monthly Result | $481.23 | $656.34 | $373.75 |

You’re literally looking at a huge difference in price, $101 compared to $200. So you could literally cut your premiums in half and still have the same type of advantage with guaranteed premiums that cannot cancel as long as the premium is paid.

I like using Sagicor if you want $50,000 in life insurance coverage, are reasonably healthy, and can’t afford whole life insurance.

Again, you may want to check this out, and if you’d like more help with it, call me at 888-626-0439. I’d be happy to help you.

Term Life

Another life insurance coverage option to consider is purchasing a term life product with a permanent conversion option.

Here’s how that works.

Some term insurance plans have what’s called a term insurance conversion rider. The rider allows you to convert the term plan to a whole life plan… WITHOUT any health questions asked.

Because term life insurance is typically less expensive than whole life or universal life insurance, this allows you to keep the whole life policy “in your back pocket.”

You have the option to convert your policy to whole life at a future date.

But make sure you review the term insurance rider. Some of them cut you off before your term insurance cancels.

Remember, we at Buy Life Insurance For Burial are happy to help you find a term life insurance plan with a conversion option to your liking.

Here are sample rates you may qualify for with Banner Life’s term insurance program:

$100000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-smoker |

|---|---|---|---|---|

| 25 | $17.37 | $8.49 | $15.05 | $6.88 |

| 26 | $17.37 | $8.49 | $15.14 | $6.88 |

| 27 | $17.37 | $8.49 | $15.31 | $6.88 |

| 28 | $17.46 | $8.49 | $15.39 | $6.88 |

| 29 | $17.46 | $8.49 | $15.57 | $6.88 |

| 30 | $17.46 | $8.49 | $15.65 | $6.88 |

| 31 | $18.06 | $8.54 | $16.08 | $6.88 |

| 32 | $18.58 | $8.59 | $16.60 | $6.89 |

| 33 | $19.18 | $8.60 | $17.03 | $7.05 |

| 34 | $19.52 | $8.60 | $17.54 | $7.05 |

| 35 | $19.61 | $8.60 | $17.97 | $7.05 |

| 36 | $20.47 | $8.77 | $18.74 | $7.78 |

| 37 | $21.41 | $9.03 | $19.47 | $8.00 |

| 38 | $22.45 | $9.29 | $20.29 | $8.00 |

| 39 | $23.56 | $9.47 | $21.18 | $8.00 |

| 40 | $24.77 | $9.63 | $22.09 | $8.00 |

| 41 | $26.06 | $10.04 | $23.16 | $9.05 |

| 42 | $27.52 | $10.43 | $24.27 | $9.05 |

| 43 | $29.07 | $10.86 | $25.64 | $9.05 |

| 44 | $30.79 | $11.20 | $27.09 | $9.49 |

| 45 | $32.68 | $11.20 | $28.59 | $9.96 |

| 46 | $34.92 | $12.35 | $30.26 | $10.41 |

| 47 | $37.32 | $12.95 | $32.05 | $10.89 |

| 48 | $40.08 | $13.59 | $34.11 | $11.42 |

| 49 | $43.09 | $14.28 | $36.23 | $12.00 |

| 50 | $45.80 | $15.03 | $38.49 | $12.63 |

| 51 | $49.83 | $15.99 | $41.17 | $13.39 |

| 52 | $54.27 | $17.03 | $44.07 | $14.21 |

| 53 | $58.91 | $18.18 | $47.19 | $15.10 |

| 54 | $64.16 | $19.44 | $50.57 | $16.06 |

| 55 | $70.00 | $20.81 | $54.22 | $17.11 |

| 56 | $75.25 | $22.51 | $58.31 | $18.17 |

| 57 | $81.10 | $24.40 | $62.74 | $19.31 |

| 58 | $90.35 | $26.48 | $67.53 | $21.86 |

| 59 | $98.29 | $28.79 | $72.73 | $23.55 |

| 60 | $106.97 | $31.35 | $78.36 | $25.63 |

| 61 | $116.09 | $34.73 | $85.09 | $27.57 |

| 62 | $126.02 | $38.55 | $92.45 | $29.70 |

| 63 | $131.84 | $41.84 | $125.52 | $41.84 |

| 64 | $143.96 | $47.02 | $135.70 | $46.96 |

| 65 | $157.47 | $52.58 | $142.38 | $46.96 |

| 66 | $173.03 | $58.54 | $165.70 | $58.54 |

| 67 | $190.58 | $64.77 | $182.54 | $64.77 |

| 68 | $210.27 | $71.47 | $185.11 | $68.17 |

| 69 | $232.63 | $79.03 | $206.70 | $75.92 |

| 70 | $257.91 | $87.54 | $230.87 | $75.92 |

| 71 | $286.55 | $97.78 | $257.96 | $94.43 |

| 72 | $319.15 | $109.31 | $288.23 | $103.20 |

| 73 | $356.38 | $121.19 | $353.24 | $121.78 |

| 74 | $398.78 | $138.03 | $398.78 | $132.35 |

| 75 | $447.46 | $155.59 | $402.82 | $145.94 |

$250000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $28.38 | $12.81 | $21.93 | $8.60 |

| 26 | $28.59 | $12.81 | $22.36 | $8.62 |

| 27 | $28.59 | $12.81 | $22.57 | $8.66 |

| 28 | $28.81 | $12.81 | $23.00 | $8.70 |

| 29 | $28.81 | $12.81 | $23.22 | $8.74 |

| 30 | $29.02 | $12.81 | $23.65 | $8.78 |

| 31 | $29.67 | $12.81 | $24.29 | $8.82 |

| 32 | $30.31 | $12.81 | $24.72 | $8.86 |

| 33 | $30.74 | $12.81 | $25.37 | $8.86 |

| 34 | $31.39 | $12.81 | $25.80 | $8.86 |

| 35 | $32.03 | $12.81 | $26.44 | $8.86 |

| 36 | $35.47 | $13.52 | $28.81 | $10.22 |

| 37 | $38.89 | $14.19 | $30.90 | $10.53 |

| 38 | $41.28 | $14.19 | $32.92 | $11.18 |

| 39 | $44.07 | $14.77 | $35.02 | $11.61 |

| 40 | $46.87 | $15.20 | $37.28 | $12.25 |

| 41 | $50.09 | $15.93 | $40.14 | $12.25 |

| 42 | $53.75 | $16.79 | $43.25 | $13.54 |

| 43 | $57.83 | $17.74 | $46.64 | $13.76 |

| 44 | $62.13 | $18.83 | $50.33 | $14.77 |

| 45 | $67.08 | $20.25 | $54.35 | $15.69 |

| 46 | $72.02 | $21.48 | $57.98 | $16.55 |

| 47 | $77.40 | $22.77 | $61.68 | $17.41 |

| 48 | $83.42 | $24.28 | $65.95 | $19.63 |

| 49 | $89.87 | $25.73 | $70.59 | $21.05 |

| 50 | $97.10 | $27.50 | $75.43 | $22.47 |

| 51 | $105.44 | $29.86 | $80.70 | $23.89 |

| 52 | $114.53 | $32.49 | $86.26 | $25.77 |

| 53 | $124.44 | $34.76 | $93.31 | $29.15 |

| 54 | $135.25 | $38.08 | $100.37 | $31.30 |

| 55 | $147.04 | $41.80 | $108.15 | $33.67 |

| 56 | $160.00 | $44.50 | $118.03 | $34.83 |

| 57 | $173.90 | $47.54 | $127.28 | $37.62 |

| 58 | $207.90 | $53.96 | $137.60 | $46.91 |

| 59 | $228.76 | $59.77 | $149.21 | $51.13 |

| 60 | $251.55 | $65.92 | $161.89 | $56.33 |

| 61 | $271.97 | $73.23 | $176.08 | $61.19 |

| 62 | $294.12 | $81.40 | $191.99 | $66.52 |

| 63 | $306.04 | $88.56 | $279.20 | $88.56 |

| 64 | $337.71 | $99.54 | $314.24 | $97.39 |

| 65 | $372.71 | $109.65 | $348.21 | $109.65 |

| 66 | $404.75 | $124.83 | $379.60 | $120.83 |

| 67 | $438.52 | $136.65 | $409.49 | $136.09 |

| 68 | $480.41 | $148.56 | $434.73 | $147.36 |

| 69 | $524.05 | $164.80 | $478.50 | $164.80 |

| 70 | $570.76 | $184.04 | $522.45 | $182.05 |

| 71 | $633.17 | $209.39 | $615.97 | $202.10 |

| 72 | $695.52 | $238.83 | $627.07 | $222.95 |

| 73 | $759.38 | $273.61 | $627.07 | $243.59 |

| 74 | $829.25 | $310.37 | $678.50 | $275.69 |

| 75 | $980.68 | $357.11 | $786.25 | $357.11 |

Start Small

You may also want to consider starting with a smaller whole life insurance product.

If $50,000 is too much, look at a $5,000, $10,000, $15,000, or even $25,000 plan.

Again, eat the elephant one bite at the time. There is no reason why you can’t start with a little insurance and then add more over time.

I talked to a gentleman yesterday in Tennessee.

He’s been a client of mine for 4 years. I started him off with $5,000 in coverage. Now he’s worked up to $17,500.

He owns three policies now, and purchased those has his finances got better.

There’s nothing wrong with that! That’s a better way than just waiting around and then maybe, possibly, hopefully in the next three or four years getting the big policy.

Why is that bad? Your health may change. You’re making a big gamble. You could start off with something minor and then grow it from there.

Again, bottom line, something is better than nothing.

Next Steps

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

As we conclude our conversation, the process to qualify for a $50,000 whole life insurance program is very simple.

Pick the agent you want to work with.

I nominate myself. =)

After you’ve selected your agent and they’ve listened to your needs, let them quote you your options.

If you like what you see, the next step is to apply over the phone or via the internet. Maybe even do a paper application.

You really don’t need an agent face-to-face anymore to handle your life insurance coverage.

Usually after several days or weeks, your coverage is approved, and then several weeks later you’ll receive your policy.

That’s it! You’ve got your coverage, you’re approved, and you’ve got peace of mind.

Working With Buy Life Insurance For Burial

If you like what you’ve seen, and you’d like for me to help you or a loved one out, the best way to reach out to me is one of two ways.

Call me directly at 888-626-0439. Why? Because I help people out constantly every single day, and I can always grab the phone because it’s just me who works with you. So if you don’t reach me, leave me a voicemail, and then I’ll get back to you as quickly as possible.

Otherwise, send me a message here. We’ll follow up in 1 business day.

Thank you!

We at Buy Life Insurance for Burial hope this article was informative and that it answered all your questions on buying $50,000 in whole life insurance. Thank you for reading!