How To Get Life Insurance With Bad Credit

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Blemished Credit Records? Declined Or Rated Up In Your Life Insurance Application?

You’ve tried to get life insurance. Here’s the surprise: It’s not just your health or lifestyle that matters. Your current credit situation also needs to look good. This has an immediate bearing on your eligibility for some kind of life insurance coverage.

Is this you? The following article will give you some tips and tricks. You’ve been turned down elsewhere. What can you do to better your chances of qualifying for life insurance?

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Today’s Topic Overview:

- Why Bad Credit Matters When Applying For Insurance Coverage

- How Bankruptcy Affects Qualifying For Life Insurance

- How to Improve Your Chances Of Qualifying For Life Insurance With Bad Credit

- Improving Your Credit Score

- Consider Working With A Broker

- Next Steps

Why Does Bad Credit Matter When Applying For Insurance Coverage?

This is your first foray into looking at life insurance options. You’re wondering, does bad credit affect eligibility for life insurance?

The short answer is, yes. It has an immediate direct impact on your eligibility. Many people will inform you that having a poor credit score has denied them life insurance coverage.

Why would this be the case? A life insurance company profits by issuing coverage. They need to feel comfortable that an individual will keep a plan. That they won’t run into credit or funding problems to pay for their bills.

Someone takes a life insurance plan out, keeps it for a year and then drops it. In most cases, this is a dramatic loss to the life insurance company. They have spent an enormous amount of money on the policy.

They’ve paid an insurance agent. They’ve paid people to underwrite the application. They’ve paid for the administration of your policy.

Say that you don’t pay your bills in a timely manner. You can’t afford it. If you end up losing your coverage then it hurts the insurance companies. As a long-term consequence, they may have to raise rates for other people.

Insurance companies don’t want that business. It’s frustrating for you to experience, especially if you’re trying to take steps to improve your credit.

The simple solution that many insurance companies employ is to simply not deal with anyone that has bad credit below a certain score.

How Does Bankruptcy Affect Qualifying For Life Insurance?

A recent bankruptcy will have an immediate impact on your eligibility for life insurance. If you’re currently going through bankruptcy, it’s unlikely a life insurance will consider you.

Get through 6 to 12 months of a repayment plan on a chapter 7. The likelihood of applying for life insurance successfully will then go up tremendously. You’ve successfully filed the bankruptcy. Your debt has been dislodged. There’s been a period of time since.

This section will give you a few tips as to how to give yourself the best chances of success to get life insurance. It will help improve those chances today.

Recently bankrupt? It will also cover what you can do over the next 6 to 12 months.

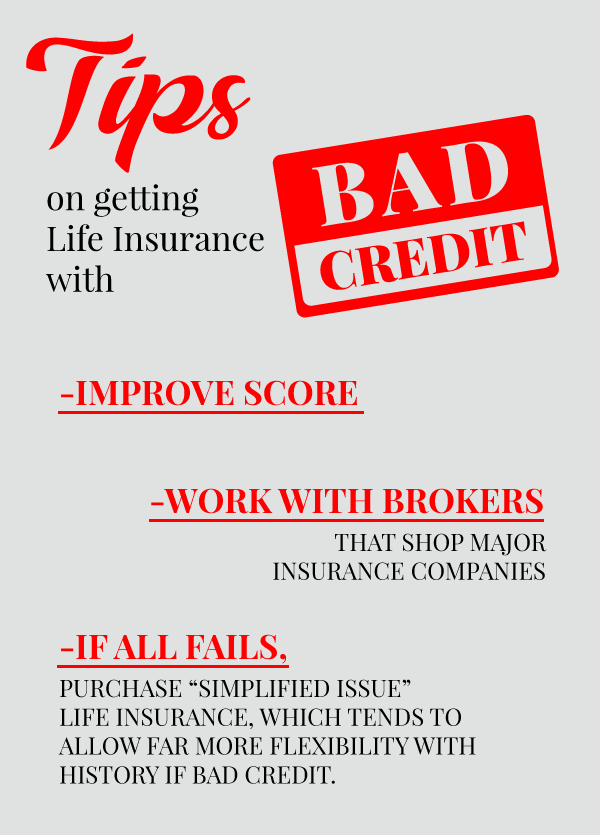

Improve your Credit Score

First, take measured steps to improve your credit score. It’s fairly simple. Pay your debts on time. Pay your bills on time. Do what you can to clear up any credit issues that you have.

Call up your creditors and offer a substantial discount to clear the credit and wipe it off your score. You’ll be surprised. Many of them will take a large discount on what you owe them if you call and offer a settlement.

They purchase your debt from the company that you originally owed at pennies on the dollar. Their goal is to get as much as they can out of you.

Don’t be afraid to negotiate. Even if you offer a small marginal amount, they’ll be more than happy to take it. Clearing up that credit has a great impact on your credit score.

Consider buying simplified issue life insurance. Traditional life insurance plans like term insurance require an examination. They will investigate your credit history and probably decline you.

Simplified issue is one of the few life insurance types that don’t consider your credit score in determining if you’re insurable or not. They only ask questions based on your health over the past two years. A lot of people who have difficulty with traditional life insurance plans go through easily with a simplified issue plan.

This is a good way to get some kind of life insurance policy on the books now. You can re-approach coverage in the next year or two, once your score has improved. You can then add a traditional policy on and replace the old simplified issue plan.

$50 a Month – Guaranteed Universal Life Insurance

$100 a Month – Guaranteed Universal Life Insurance

$150 a Month – Guaranteed Universal Life Insurance

This is a great strategy. You know you need life insurance. You may not get what you want today. But you will definitely get what you need right now.

Even if it’s just enough to take care of basic final expenses, as most simplified issue plans are designed to do, it’s much better than nothing! It can also be surprisingly inexpensive to pick up one of these plans.

Consider Working with a Broker

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Certain life insurance companies will look at credit issues in a more scrutinizing manner than others. What you may not know is that there are additional options for life insurance coverage.

An insurance agent only represents one or very few companies. They only have very limited options to show you. What you want to do is work with an insurance company that works with a variety of life insurance companies.

We at BuyLifeInsuranceForBurial.com work with dozens of life insurance companies. What we attempt to do is look at your individual circumstances and custom tailor you a package.

We base it on which companies look at your application and deems it to be acceptable. Then we bring you the one that’s going to give you the best overall value. The best price for what you can afford and what you’re looking to accomplish.

Next Steps

If this is interesting to you and you’d like to learn more about how we can help people with bad credit score with life insurance, visit my website. You can go to buylifeinsuranceforburial.com and grab a free quote.

I do ask that you message me first. You can do that by clicking the contact box; the one at the top or the bottom, and send me a quick message. Or just call me. The best way to reach me is (888) 626 0439, and speak with me live.