Best Term Life Insurance For Seniors [Rates, Secrets Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Are you a senior looking for term life insurance?

Perhaps you are shopping for coverage on yourself or for a loved one.

If this describes you, you’ve arrived at the right website!

In this article, we’re going to have a detailed discussion of…

The Best Term Life Insurance For Seniors

We’ll also discuss rates, and how to qualify.

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation on best term life insurance for seniors. Enjoy!

Here’s An Overview Of Our Discussion On The Best Term Life Insurance For Seniors:

- How Does Term Life Insurance Works For Seniors?

- Best Term Options Available for Seniors

- Insurance Riders, Definitions And Types Available

- Exam or No Exam?

- How Much Term Can A Senior Qualify For?

- If Your Health Is Bad

- How To Qualify

How Does Term Life Insurance Work For Seniors?

Let’s jump right in and answer the question…

“How does term life insurance work for senior citizens?”

Term life insurance is simple. Commonly described as “pure insurance,” term life insurance provides a lump-sum death benefit to your beneficiary if you die while the term policy is in force.

Applicants for term life insurance have access to different term lengths. Most popular include:

The longer the term period, the longer you are covered.

Level premiums are important.

When seniors consider purchasing term life insurance, they need to ensure their premium payments remain the same throughout the term.

In most cases, purchasing term life insurance through brokers like Buy Life Insurance For Burial, your term remains constant through the length of your term life insurance.

But this is not always the case with some companies.

Junk mail life insurance companies like AARP, Globe Life, and Trustage offer senior term life products with “escalating” premiums that increase approximately every 5 years.

Avoid those and find life insurance companies that will provide a predictable, unchanging premium throughout the term’s lifetime.

Term is for large financial obligations

Compared to universal life insurance or burial insurance, term insurance provides seniors the most coverage per dollar of premium.

That’s why seniors use term life insurance to cover large obligations like mortgages or other financial obligations.

Term works for seniors

Once approved, term life insurance for seniors works no differently than any other term insurance product.

Just because you are a senior citizen doesn’t change the rules of how term life works!

At any time you pass away during the term period, you’re covered. Your beneficiary receives the entire death benefit, no matter if a natural or accidental cause of death takes you out.

Being a senior is the point I’m trying to make. The bottom line upon death during the term death benefits are paid directly to the beneficiary. Whatever your reason for purchasing it, which we’ll get into in a moment, whoever that beneficiary is, will receives the money.

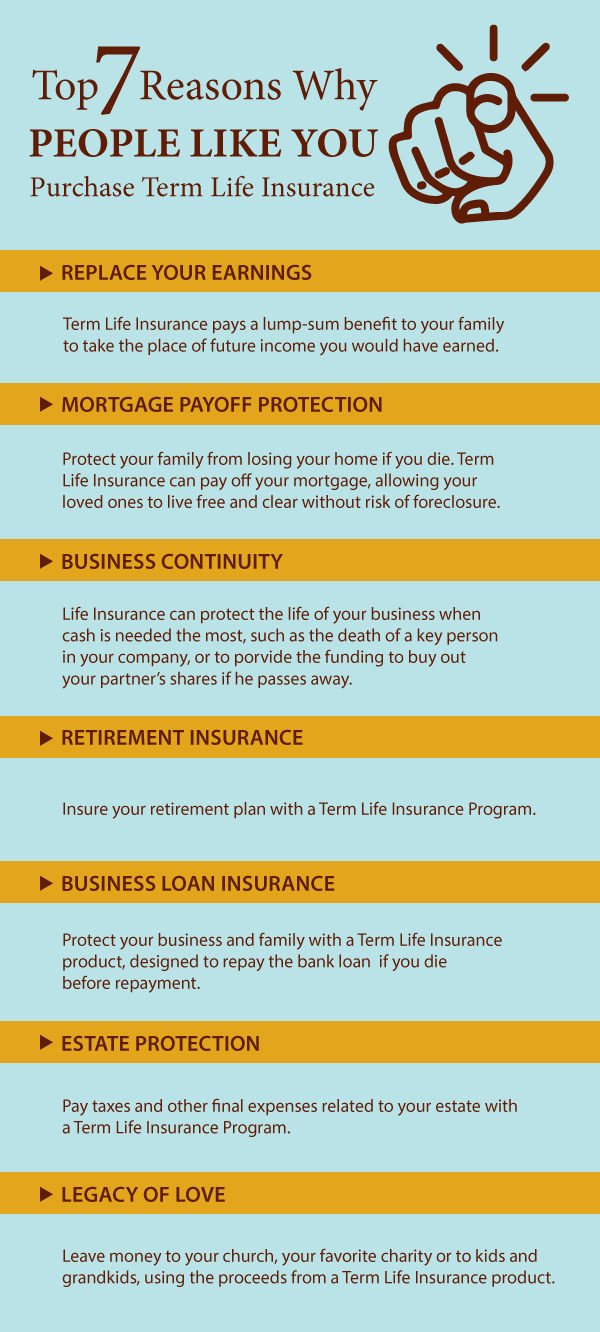

Reasons Why Seniors Choose Term Life Insurance

Why should seniors consider buying term life insurance?

Why should seniors consider buying term life insurance?

There are definitely good reasons why seniors buy term life insurance.

And while term is not the most appropriate life insurance option in every circumstance, it does a fantastic job in specific situations where a large financial obligation exists.

Funeral expenses

On occasion, seniors purchase term life insurance to cover funeral expenses.

Personally, I think this is the WORST reason to buy term life insurance .

Why? Because term life insurance terminates. You may outlive the term, but you cannot outlive life.

Death is a permanent problem. And whole life burial insurance makes more sense because it cannot cancel due to age or health. It’s permanent coverage.

Nevertheless, seniors buy term life insurance in order to get a better premium.

Many times, they cannot afford whole life burial insurance premiums, opting for term life instead.

Income Replacement

Replacing a spouse’s income upon passing is a prime reason why term life insurance is a sensible purchase decision.

Let’s walk through a hypothetical scenario to explain the benefits.

You’re married, and both you and your spouse draw Social Security.

Reviewing your monthly living expenses, you need both Social Security checks to keep your head above water.

Now imagine your spouse passes away.

While you income may not drop in half, a big chunk of your monthly income disappears.

Ask yourself this…

“How does losing your spouse’s income affect your lifestyle? Can you handle paying your bills? Will you have to cut back?”

If you fear the worst… if you worry you’ll have to cut back and survive at a lower standard of living, consider buying term life insurance to replace your spouse’s income when he passes away.

Gift Of Love

Beyond final expense and income protection coverage, seniors purchase term life insurance as a “gift of love” to someone important in their life.

Do you want to leave money to a child or grandchild when you pass away? An affordable term life insurance plan may be the trick.

I’ll give you a perfect example.

When my grandfather died, he left a $7,000 life insurance policy to my mother.

Mom had no idea about this life insurance plan, but it was well-timed. Mom desperately needed her roof replaced, and the life insurance payout handled the expense completely.

Mom was thrilled that she didn’t have to dig into her savings to pay the roofing bill.

So… if you like the idea of surprising a loved one with a special surprise when you die, consider getting term life insurance.

Mortgage Protection Plan

Do you owe money on a mortgage? What if you die before paying it off?

A term life insurance plan may pay off your mortgage and protect against foreclosure if you die before paying it off.

You can also use a mortgage protection term policy to pay the monthly mortgage payments over a period of time.

It works like this.

You purchase a term life insurance plan. Instead of paying down the mortgage balance, you bank the insurance proceeds, using it to pay the monthly mortgage payment instead.

This strategy buys time, allowing your spouse space to get settled, and sell the house at top dollar. Without this policy, your spouse may be forced to sell the house at a discount to get out before foreclosure occurs.

Best Term Life Insurance Options Available For Seniors

Now that we know why seniors purchase term life insurance, let’s discuss the best term insurance options.

Like any applicant applying for term life insurance, seniors have multiple term-length options.

If you’re a younger senior, you’ll likely have longer-length term insurance options available. 20-year term insurance is accessible to those in their 60s, while it’s rare to see 30-year term lengths much beyond the early 60s.

This isn’t the case with older seniors.

As you age into your late 60s and 70s, term insurance length options reduce. Seniors in this age range commonly purchase 10- and 15-year term length policies.

What does an older senior do if he needs coverage longer than 15 years?

Consider universal life insurance.

Universal life insurance allows applicants to custom-tailor their coverage to lengths longer than traditional term life for seniors offers.

It’s a solution we use when longer term options aren’t available.

Sample Rates With Banner Life

$100000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-smoker |

|---|---|---|---|---|

| 25 | $17.37 | $8.49 | $15.05 | $6.88 |

| 26 | $17.37 | $8.49 | $15.14 | $6.88 |

| 27 | $17.37 | $8.49 | $15.31 | $6.88 |

| 28 | $17.46 | $8.49 | $15.39 | $6.88 |

| 29 | $17.46 | $8.49 | $15.57 | $6.88 |

| 30 | $17.46 | $8.49 | $15.65 | $6.88 |

| 31 | $18.06 | $8.54 | $16.08 | $6.88 |

| 32 | $18.58 | $8.59 | $16.60 | $6.89 |

| 33 | $19.18 | $8.60 | $17.03 | $7.05 |

| 34 | $19.52 | $8.60 | $17.54 | $7.05 |

| 35 | $19.61 | $8.60 | $17.97 | $7.05 |

| 36 | $20.47 | $8.77 | $18.74 | $7.78 |

| 37 | $21.41 | $9.03 | $19.47 | $8.00 |

| 38 | $22.45 | $9.29 | $20.29 | $8.00 |

| 39 | $23.56 | $9.47 | $21.18 | $8.00 |

| 40 | $24.77 | $9.63 | $22.09 | $8.00 |

| 41 | $26.06 | $10.04 | $23.16 | $9.05 |

| 42 | $27.52 | $10.43 | $24.27 | $9.05 |

| 43 | $29.07 | $10.86 | $25.64 | $9.05 |

| 44 | $30.79 | $11.20 | $27.09 | $9.49 |

| 45 | $32.68 | $11.20 | $28.59 | $9.96 |

| 46 | $34.92 | $12.35 | $30.26 | $10.41 |

| 47 | $37.32 | $12.95 | $32.05 | $10.89 |

| 48 | $40.08 | $13.59 | $34.11 | $11.42 |

| 49 | $43.09 | $14.28 | $36.23 | $12.00 |

| 50 | $45.80 | $15.03 | $38.49 | $12.63 |

| 51 | $49.83 | $15.99 | $41.17 | $13.39 |

| 52 | $54.27 | $17.03 | $44.07 | $14.21 |

| 53 | $58.91 | $18.18 | $47.19 | $15.10 |

| 54 | $64.16 | $19.44 | $50.57 | $16.06 |

| 55 | $70.00 | $20.81 | $54.22 | $17.11 |

| 56 | $75.25 | $22.51 | $58.31 | $18.17 |

| 57 | $81.10 | $24.40 | $62.74 | $19.31 |

| 58 | $90.35 | $26.48 | $67.53 | $21.86 |

| 59 | $98.29 | $28.79 | $72.73 | $23.55 |

| 60 | $106.97 | $31.35 | $78.36 | $25.63 |

| 61 | $116.09 | $34.73 | $85.09 | $27.57 |

| 62 | $126.02 | $38.55 | $92.45 | $29.70 |

| 63 | $131.84 | $41.84 | $125.52 | $41.84 |

| 64 | $143.96 | $47.02 | $135.70 | $46.96 |

| 65 | $157.47 | $52.58 | $142.38 | $46.96 |

| 66 | $173.03 | $58.54 | $165.70 | $58.54 |

| 67 | $190.58 | $64.77 | $182.54 | $64.77 |

| 68 | $210.27 | $71.47 | $185.11 | $68.17 |

| 69 | $232.63 | $79.03 | $206.70 | $75.92 |

| 70 | $257.91 | $87.54 | $230.87 | $75.92 |

| 71 | $286.55 | $97.78 | $257.96 | $94.43 |

| 72 | $319.15 | $109.31 | $288.23 | $103.20 |

| 73 | $356.38 | $121.19 | $353.24 | $121.78 |

| 74 | $398.78 | $138.03 | $398.78 | $132.35 |

| 75 | $447.46 | $155.59 | $402.82 | $145.94 |

$250000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $28.38 | $12.81 | $21.93 | $8.60 |

| 26 | $28.59 | $12.81 | $22.36 | $8.62 |

| 27 | $28.59 | $12.81 | $22.57 | $8.66 |

| 28 | $28.81 | $12.81 | $23.00 | $8.70 |

| 29 | $28.81 | $12.81 | $23.22 | $8.74 |

| 30 | $29.02 | $12.81 | $23.65 | $8.78 |

| 31 | $29.67 | $12.81 | $24.29 | $8.82 |

| 32 | $30.31 | $12.81 | $24.72 | $8.86 |

| 33 | $30.74 | $12.81 | $25.37 | $8.86 |

| 34 | $31.39 | $12.81 | $25.80 | $8.86 |

| 35 | $32.03 | $12.81 | $26.44 | $8.86 |

| 36 | $35.47 | $13.52 | $28.81 | $10.22 |

| 37 | $38.89 | $14.19 | $30.90 | $10.53 |

| 38 | $41.28 | $14.19 | $32.92 | $11.18 |

| 39 | $44.07 | $14.77 | $35.02 | $11.61 |

| 40 | $46.87 | $15.20 | $37.28 | $12.25 |

| 41 | $50.09 | $15.93 | $40.14 | $12.25 |

| 42 | $53.75 | $16.79 | $43.25 | $13.54 |

| 43 | $57.83 | $17.74 | $46.64 | $13.76 |

| 44 | $62.13 | $18.83 | $50.33 | $14.77 |

| 45 | $67.08 | $20.25 | $54.35 | $15.69 |

| 46 | $72.02 | $21.48 | $57.98 | $16.55 |

| 47 | $77.40 | $22.77 | $61.68 | $17.41 |

| 48 | $83.42 | $24.28 | $65.95 | $19.63 |

| 49 | $89.87 | $25.73 | $70.59 | $21.05 |

| 50 | $97.10 | $27.50 | $75.43 | $22.47 |

| 51 | $105.44 | $29.86 | $80.70 | $23.89 |

| 52 | $114.53 | $32.49 | $86.26 | $25.77 |

| 53 | $124.44 | $34.76 | $93.31 | $29.15 |

| 54 | $135.25 | $38.08 | $100.37 | $31.30 |

| 55 | $147.04 | $41.80 | $108.15 | $33.67 |

| 56 | $160.00 | $44.50 | $118.03 | $34.83 |

| 57 | $173.90 | $47.54 | $127.28 | $37.62 |

| 58 | $207.90 | $53.96 | $137.60 | $46.91 |

| 59 | $228.76 | $59.77 | $149.21 | $51.13 |

| 60 | $251.55 | $65.92 | $161.89 | $56.33 |

| 61 | $271.97 | $73.23 | $176.08 | $61.19 |

| 62 | $294.12 | $81.40 | $191.99 | $66.52 |

| 63 | $306.04 | $88.56 | $279.20 | $88.56 |

| 64 | $337.71 | $99.54 | $314.24 | $97.39 |

| 65 | $372.71 | $109.65 | $348.21 | $109.65 |

| 66 | $404.75 | $124.83 | $379.60 | $120.83 |

| 67 | $438.52 | $136.65 | $409.49 | $136.09 |

| 68 | $480.41 | $148.56 | $434.73 | $147.36 |

| 69 | $524.05 | $164.80 | $478.50 | $164.80 |

| 70 | $570.76 | $184.04 | $522.45 | $182.05 |

| 71 | $633.17 | $209.39 | $615.97 | $202.10 |

| 72 | $695.52 | $238.83 | $627.07 | $222.95 |

| 73 | $759.38 | $273.61 | $627.07 | $243.59 |

| 74 | $829.25 | $310.37 | $678.50 | $275.69 |

| 75 | $980.68 | $357.11 | $786.25 | $357.11 |

$100000 Banner Term Insurance Monthly Rate Chart – 20 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $19.26 | $9.00 | $15.74 | $8.23 |

| 26 | $19.61 | $9.01 | $16.17 | $8.23 |

| 27 | $19.95 | $9.01 | $16.60 | $8.23 |

| 28 | $20.30 | $9.02 | $16.94 | $8.23 |

| 29 | $20.64 | $9.02 | $17.37 | $8.23 |

| 30 | $20.98 | $9.03 | $17.80 | $8.23 |

| 31 | $21.93 | $9.04 | $18.66 | $8.27 |

| 32 | $22.96 | $9.06 | $19.52 | $8.32 |

| 33 | $23.91 | $9.08 | $22.09 | $8.37 |

| 34 | $24.94 | $9.09 | $22.69 | $8.43 |

| 35 | $25.89 | $9.12 | $22.79 | $8.49 |

| 36 | $27.69 | $9.40 | $24.67 | $8.79 |

| 37 | $29.42 | $9.73 | $26.49 | $9.11 |

| 38 | $31.28 | $10.09 | $27.68 | $9.46 |

| 39 | $33.28 | $10.48 | $29.35 | $9.82 |

| 40 | $35.43 | $10.89 | $31.14 | $10.20 |

| 41 | $37.75 | $11.79 | $33.04 | $10.76 |

| 42 | $40.33 | $12.74 | $35.09 | $10.76 |

| 43 | $43.17 | $13.76 | $37.28 | $11.96 |

| 44 | $46.35 | $14.85 | $39.63 | $12.58 |

| 45 | $49.79 | $16.03 | $42.15 | $13.25 |

| 46 | $53.58 | $17.09 | $44.87 | $14.05 |

| 47 | $57.79 | $18.23 | $47.78 | $14.92 |

| 48 | $62.52 | $19.47 | $50.91 | $15.88 |

| 49 | $67.68 | $20.79 | $54.27 | $16.94 |

| 50 | $73.44 | $22.21 | $57.88 | $18.09 |

| 51 | $80.07 | $24.08 | $62.61 | $19.39 |

| 52 | $87.38 | $26.11 | $67.25 | $20.65 |

| 53 | $95.55 | $28.37 | $72.33 | $21.99 |

| 54 | $104.75 | $30.87 | $77.83 | $23.45 |

| 55 | $115.07 | $33.61 | $84.02 | $25.04 |

| 56 | $122.98 | $36.89 | $90.64 | $27.02 |

| 57 | $131.58 | $40.46 | $97.95 | $29.17 |

| 58 | $140.95 | $44.38 | $106.04 | $31.50 |

| 59 | $151.19 | $48.59 | $114.98 | $34.04 |

| 60 | $162.37 | $53.07 | $124.87 | $36.87 |

| 61 | $174.67 | $60.86 | $135.97 | $41.35 |

| 62 | $188.00 | $69.26 | $148.26 | $46.26 |

| 63 | $202.70 | $78.21 | $161.94 | $65.32 |

| 64 | $218.78 | $87.99 | $177.25 | $73.13 |

| 65 | $236.50 | $98.52 | $194.45 | $82.39 |

| 66 | No Result | $116.53 | No Result | $105.95 |

| 67 | No Result | $134.48 | No Result | $122.64 |

| 68 | No Result | $156.62 | No Result | $125.59 |

| 69 | No Result | $185.67 | No Result | $143.46 |

| 70 | No Result | $206.22 | No Result | $163.72 |

$250000 Banner Term Insurance Monthly Rate Chart – 20 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $36.03 | $12.97 | $30.10 | $11.39 |

| 26 | $37.31 | $13.01 | $30.31 | $11.45 |

| 27 | $38.59 | $13.05 | $30.53 | $11.45 |

| 28 | $39.77 | $13.05 | $32.03 | $11.45 |

| 29 | $39.77 | $13.05 | $32.03 | $11.61 |

| 30 | $39.77 | $13.05 | $32.03 | $11.61 |

| 31 | $43.64 | $13.16 | $35.76 | $11.76 |

| 32 | $44.50 | $13.26 | $36.67 | $11.76 |

| 33 | $45.58 | $13.76 | $37.52 | $11.94 |

| 34 | $46.65 | $13.76 | $38.81 | $11.97 |

| 35 | $47.73 | $13.87 | $39.94 | $12.04 |

| 36 | $51.17 | $14.69 | $42.89 | $12.64 |

| 37 | $55.47 | $15.63 | $45.79 | $13.26 |

| 38 | $59.34 | $16.65 | $48.42 | $13.69 |

| 39 | $64.28 | $17.77 | $51.85 | $14.34 |

| 40 | $69.65 | $19.01 | $55.91 | $15.39 |

| 41 | $75.68 | $20.57 | $59.97 | $16.27 |

| 42 | $82.34 | $22.31 | $64.46 | $17.78 |

| 43 | $90.08 | $23.29 | $70.73 | $19.07 |

| 44 | $98.68 | $25.42 | $76.54 | $20.79 |

| 45 | $107.71 | $27.78 | $82.63 | $22.51 |

| 46 | $116.74 | $29.90 | $89.22 | $23.98 |

| 47 | $125.77 | $32.19 | $95.67 | $25.52 |

| 48 | $135.88 | $34.12 | $101.86 | $28.16 |

| 49 | $146.75 | $37.46 | $109.77 | $30.10 |

| 50 | $158.29 | $40.44 | $118.96 | $32.21 |

| 51 | $171.12 | $44.65 | $128.15 | $35.10 |

| 52 | $185.65 | $48.44 | $138.41 | $38.29 |

| 53 | $203.82 | $52.93 | $151.24 | $40.33 |

| 54 | $222.63 | $58.25 | $164.49 | $44.40 |

| 55 | $244.01 | $63.38 | $179.67 | $48.50 |

| 56 | $265.74 | $70.24 | $193.56 | $52.97 |

| 57 | $287.88 | $78.64 | $209.38 | $57.87 |

| 58 | $312.61 | $89.01 | $228.83 | $64.76 |

| 59 | $339.70 | $99.04 | $249.14 | $71.04 |

| 60 | $370.01 | $110.28 | $272.44 | $78.83 |

| 61 | $403.55 | $126.85 | $296.37 | $87.41 |

| 62 | $437.02 | $142.30 | $323.52 | $98.14 |

| 63 | $465.02 | $161.80 | $357.08 | $155.57 |

| 64 | $494.09 | $184.07 | $392.14 | $163.49 |

| 65 | $527.44 | $208.55 | $432.11 | $183.18 |

| 66 | No Result | $247.46 | No Result | $234.99 |

| 67 | No Result | $275.43 | No Result | $271.76 |

| 68 | No Result | $315.19 | No Result | $301.00 |

| 69 | No Result | $363.56 | No Result | $345.50 |

| 70 | No Result | $409.45 | No Result | $382.27 |

Types Of Insurance Riders Available

Let’s move our discussion on term life insurance riders, and why you should consider adding them to your policy.

Riders are simple. They are “add-ons” or “upgrades” to your life insurance policy. Riders provide additional benefits beyond the term life insurance death benefit payout.

Let’s talk about the most common riders seniors add to their term life insurance policies.

Critical Illness Riders

Critical illness riders pay a lump-sum cash benefit to you upon diagnosis of specific diseases or illnesses.

The most common critical illnesses covered include strokes, heart attacks, heart surgery, and cancer. Policies will differ in their coverage options.

What’s nice is that you don’t have to die to enjoy this benefit. This is why we call critical illness riders a “living benefit.” You don’t have to die to realize the critical illness payout.

Why seniors add critical illness riders

Critical illness riders provide an excellent source of additional money to pay for expenses surrounding the critical illness.

For example, if you are diagnosed with cancer, you can expect a litany of expenses. Travel expenses, doctor bills, hotel bills, even purchasing a new wardrobe if you lose weight on chemotherapy. Much of this expense exists outside a senior’s normal monthly budget, which is why a critical illness rider can help you immensely.

Return of premium rider

What if you could buy a term life insurance policy and have the premiums returned to you once you reach the end of the term?

There’s a rider that does that!

It’s called a return of premium rider.

And while the rider cost may be substantial, return of premium riders are appealing to people who like the idea of getting their money back at a later date.

And why not, after all? You’ve paid those premiums in for years WITHOUT dying.

Accelerated death benefit

An accelerated death benefit rider allows you to use a portion of your policy’s death benefit while alive if you are medically diagnosed with a terminal illness.

The benefit is that you have the ability to manage your final affairs while alive, without waiting to die first.

Last thoughts on riders

Riders are like upgrades to your new car purchase. Expect to pay more than the regular life insurance rate to add these riders on.

Also, riders are truly optional. You can add those you like and decline riders that you don’t. It’s truly a custom-tailored experience.

Exam Or No Exam

Perhaps you’re interested in term life insurance and wonder if an examination is optional?

Here’s what it comes down to.

Seniors applying for term life insurance may or may not require an exam for consideration.

It comes down to (a) the amount of coverage you apply for, and (b), the insurance company you select.

What To Expect On Term Life Insurance Exams

When all is said and done, life insurance exams are relatively painless.

If required, term life insurance exams require the following:

- Physical examination by doctor or nurse practitioner.

- Specimen sample (typically blood, sometimes urine).

- Answering a series of health questions.

The entire process either takes place in the examiner’s office or in the comfort of your home.

When my wife and I added to our life insurance coverage, we opted to have the exam at home.

I relaxed comfortably on my couch while the nurse took blood. I had passed out a few years back at the doctor’s office while getting blood withdrawn, so staying at home and relaxing during a life insurance exam sounded perfect to me.

Get Term Life Insurance Without An Exam

Due to many applicants having exam reluctance, life insurance companies have developed what’s known as non-medical term life insurance.

The concept is simple.

You complete your application for term life insurance, and the life insurance company determines your eligibility for coverage based on medical records alone.

This process largely eliminates the need for a physical. That way, your term life insurance application is streamlined and much smoother.

Reasons To Get An Exam

Opting for a life insurance exam is a good idea if you’re in fantastic shape.

With non-medical life insurance, you sacrifice the lowest prices for convenience. Life insurance companies “bake in” a higher price into their non-medical life insurance, since they could potentially miss up-to-the-minute health issues an exam would detect.

This stands in contrast to term life insurance policies requiring an examination. If you are in excellent health, the insurance company will rewards you with very low term life insurance rates.

To an extent, requiring an exam remains optional. Seniors applying for lower amounts of coverage ($100,000 and under) most likely will NOT have an option for an exam, while those above that number will be REQUIRED to take an exam.

Understand your age and the company selected will alter these parameters.

That’s how we can help at Buy Life Insurance For Burial. We can shop the different term life insurance options for seniors and find the company that will give you the best offer.

How Much Term Can A Senior Qualify For?

Bottom line, you can qualify for as much term life insurance coverage as you can afford.

As long as you work with an independent life insurance agent like us at Buy Life Insurance For Burial, we have access to carriers that will custom-tailor as large a term life insurance policy as you’d like.

Minimums for senior term life insurance start at $25,000 to $50,000 in coverage, depending on the life insurance company.

Don’t want an exam? Expect to stay under $400,000 in coverage as a young senior, with this maximum decreasing with the senior’s age.

Term Life Insurance For Seniors In Bad Health

What if your health isn’t the greatest?

Perhaps you’re less worried about exams, and more worried about whether you can qualify for any term life insurance product.

Bottom line, it depends on the specifics of your health.

Let me give you examples of bad health. Seniors typically get declined for coverage with these health conditions.

However, you may easily qualify for simplified issue whole life insurance, or a guaranteed acceptance life insurance plan.

Potentially declinable conditions include:

- COPD (Chronic Obstructive Pulmonary Disease),

- Severe diabetes,

- Insulin dependency,

- Recent cancer, heart, liver and kidney problems.

- Recent hospitalization (depends on why you were hospitalized)

- Memory loss issues.

How To Qualify For Term Insurance

My twin girls Emily and Eva thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Interested to see how you can qualify as a senior for term life insurance?

Here’s what you need to do.

Call Buy Life Insurance For Burial at 888-626-0439 now. Or send me a message here.

We’ll be able to draw up a quote based on your goals and health history within 10 minutes of our phone conversation. There’s no obligation to buy and the information is free.

Thanks for stopping by and reading this article.

I hope it has been useful in your search for more information.

If you have any remaining questions, please get in touch. Just call (888) 626-0439 or send us a message here.

Take care and we hope to speak with you soon!