9 Steps to Get Life Insurance for Grandparents

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

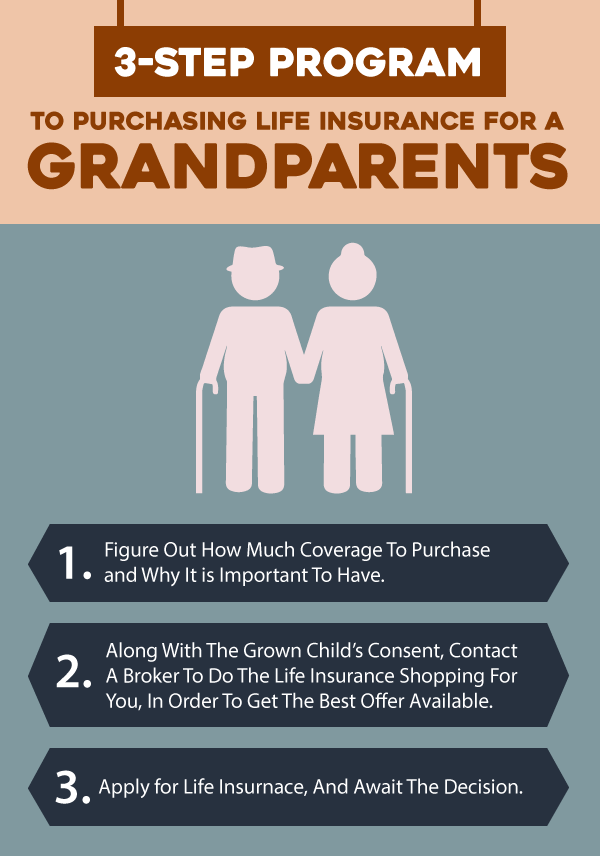

In This Article I’m Going To Talk About The Process Grandchildren May Undertake To Purchase Life Insurance For Their Aging Grandparents

Most likely you are reading this article today because you have grandparents that are reaching their sixties, seventies, even eighties, and you know they are not carrying life insurance. This could potentially mean that you and your siblings or even your parents might have to come out of pocket to pay for final expenses. Your concerned about this scenario and wonder what options are available in the form of life insurance coverage to protect your grandparents. If this is the case, then you’ve come to the right article.

My goal is to detail nine steps that you can take to get quality life insurance coverage for your grandparents to take care of things such as final expenses and replace retirement income.

Most of all, life insurance can give peace of mind in knowing that you will not be held financially responsible if your grandparents pass away and need financial assistance to take care of their final expenses.

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Here’s An Overview Of Today’s Topic:

- Establish Why You Want Life Insurance

- Gain Consent

- Life Insurance Goals

- Find A Broker

- Select The Policy With The Best Underwriting Outcome Potential

- Decide Whether Or Not Exams Are Important, Depending On What Kind Of Life Insurance You Do Get

- Carefully Determine Beneficiary Arrangement

- Decide On A Plan B Upfront

- Await Your Decision

- Burial Insurance Rates, Age 40 to 90

1st Establish why you want life insurance

It’s really important when you’re looking for life insurance to have a clear, crystallised reason in your mind as to why you want to purchase life insurance for your grandparents. Again, life insurance is designed to remove financial burden from the people we love.

When I talk to my clients, I tell them that life insurance truly is an act of love.

We buy life insurance to protect those around us from our financial obligations, because often when we pass away, there’s still remaining debt, as well as final expenses that need to be taken care of. We don’t want to leave those final debts to the people we love. So as a grandkid looking for life insurance coverage on your grandparent, you need to figure out what exactly you’re looking to accomplish.

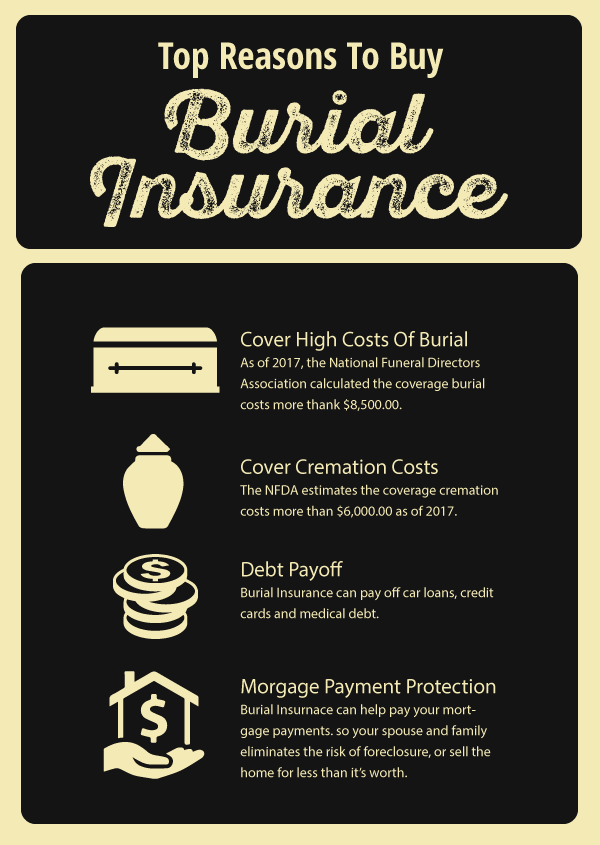

- Do you just want enough money to take care of a burial or cremation?

- Are you worried about a surviving spouse not having enough income?

- Is there a large amount of debt still owed?

We will talk about different types of plans that can alleviate these concerns in just a moment.

2nd Gain consent

This is a common mistake that many people make when they start looking for life insurance coverage for their grandparents. They don’t understand that in order to purchase a life insurance plan on someone else, you must gain the permission of the person you’re looking to insure to make sure that they’re in full support and willing to sign off on health history checks and background searches to determine insurability.

You simply cannot purchase a life insurance plan for someone else without their consent. The only exception to this would be if you were a parent looking for life insurance coverage on your child who is a minor.

Before you start making inquiries into insurance plans, make sure you talk to your grandparents about why you feel life insurance protection is important and make sure you have their total support and commitment to the process of buying.

Otherwise, what may happen is that you spend an inordinate amount of time trying to figure out what policy would be best, only to discover further down the road that they already have insurance or don’t necessarily need or want insurance. Even if they do not have life insurance coverage or refused to have you support them, it’s better to find that out sooner rather than later.

3rd Life insurance goals

Now, let’s say you have support from your grandparents and you know you need to take care of some sort of final expense when they pass away. So how much coverage should you get?

If your goal is to have enough coverage to pay for burial or cremation costs, I typically recommend somewhere between $10,000 to $15,000 in life insurance coverage to protect you from having to come out of pocket for any of their final expenses. This is approximately the average of what most people pay, whereas some areas of the country may pay less, and others will pay more.

We here at Buy Life Insurance for Burial can help identify a competitive average price of what you can expect to pay and alter that coverage up or down depending on your budget.

Alternatively, if you’re looking to buy a life insurance plan to pay a lump sum to your grandparent’s surviving spouse to help replace lost income, that too is an option. When a grandparent dies, they often leave behind a widow or widower who will feel the lose of not only their spouse, but also their monthly contribution to expenses.

Having life insurance can provide a lump sum of money to the surviving spouse so that they don’t have to dramatically alter their lifestyle. We typically use whole life insurance plans or guaranteed universal life insurance plans to accomplish this goal.

Once you establish your goals, you will need to analyze your budget to make sure you can afford the monthly cost involved and continue to make payments over the life of the policy. This amount can be $50, $100, $250 a month or more.

I’ve heard of all sorts of budget amounts – the important thing is that you have a good idea what you’re comfortable paying and perhaps find out if your grandparent’s are capable of contributing an amount each month to those payments.

4th Find a broker

Now that you have your grandparent’s consent, know what your goals are, and know how much coverage you can afford, it’s time to talk to a broker.

We here at Buy Life Insurance for Burial work with grandkids all the time to help them find quality life insurance for their grandparents.

The reason you want to deal with a broker is that brokers can shop around to see which companies offer the best deal overall. For an elderly person who tends to be over the age of 60, there may be health problems involved. Even the age may have an effect on coverage prices.

When you work with us at Buy Life Insurance for Burial, we know which companies are available to help you accomplish the final expense coverage or income replacement goals you have in mind for your grandparents.

5th Select the policy with the best underwriting outcome potential

Depending on what kind of life insurance coverage you get, you may discover that your ability to qualify for life insurance may be limited or may not be affordable, especially if you’re doing a non-medical exam where instant approval is not given.

You want to pick the company that has the most flexible underwriting for your grandparents. Always take suggestions from your broker and complete the application that offers the best underwriting potential in order to get yourself the best chance of approval at the best price.

6th Decide whether or not exams are important, depending on what kind of life insurance you do get

You may find an exam is unnecessary if you purchase a burial life insurance policy or a policy to pay for cremation. Typically the policy sizes for this type of coverage are small enough not to warrant an exam. Exams tend to cost companies money and many will just lighten requirements for smaller amounts of coverage as long as general health records and history look okay.

If you get larger amounts of coverage, such as an income replacement plan through guaranteed universal life coverage, you may be asked to do an exam depending on how much you purchase. Alternatively you may be asked to take out what is called a non-medical policy, which pulls more detailed medical history and doctor’s information from your records.

I would say the odds are low that a senior will be required to do an exam for a smaller policy. However, the larger that policy gets, the more likelihood you’ll have to get an exam. An exam usually involves blood being drawn, a blood pressure check, health history, questionnaire completion, and in some cases, for a larger policy, an EKG or stress test.

7th Carefully determine beneficiary arrangement

It’s really important that you not only think thoroughly about who you want your beneficiaries to be, but that you also regularly manage those lists.

Make sure that beneficiary information is up to date. I’ve gotten requests from many people to help them choose their beneficiaries and what I would recommend to anybody is to make sure you pick the beneficiary that would best follow out your orders as it relates to what you want your life insurance policy to do.

Obviously, if you’re looking for an income replacement plan and you want that to go to your beneficiary, say your spouse, as long as they’re alive, that certainly makes sense. However, if your beneficiary is a child and your relationship with that child changes between the time you name them beneficiary and 10 years down the road, you may be giving money to someone who would not respect your wishes.

I’ve seen this change happen over time with clients and recommend that they ensure they update their beneficiary information so that they can avoid being caught in a position where the beneficiary is somebody that is as a spouse or child that they’ve fallen out of favor with.

8th Decide on a plan “B” upfront

One of the realities about life insurance, especially if it’s something other than a simplified issue burial insurance plan, is that non-medical and fully underwritten plans generally have more write ups and potentials for decline. So it’s important to have a sober conversation with your life insurance broker.

Buy Life Insurance for Burial can discuss with you the likelihood of additional costs and offer alternate plans to get the best coverage possible.

It’s best to handle additional costs and other issues now, when you first apply, by doing a second application to see which company can offer you potentially the best options for coverage and minimize your chances of being declined.

9th Await your decision

My twin girls Emily and Eva thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Waiting for your decision can take anywhere from 15 minutes all the way up to several weeks or months. It just depends on what kind of coverage you get and what kind of underwriting processes is involved. If you opt for a cremation or burial type of final expense life insurance plan, it’s likely that your coverage will receive an immediate decision after your phone interview is completed or within several days of faxing in your application.

Final expense insurance tends to have fast underwriting wait periods.

If you do a non-medical application, it may take four to six weeks for a decision. A fully underwritten plan may take two plus months and beyond depending on the complexity of information requested in determining a decision.

Burial Insurance Rates, Age 40 to 90*

Rates For $5,000 in Burial Insurance

Rates For $10,000 in Burial Insurance

Rates For $15,000 in Burial Insurance

Rates For $20,000 in Burial Insurance

Rates For $25,000 in Burial Insurance