15 Year Term Life Insurance Review

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Are you interested in getting a 15-year term life insurance program?

And are you trying to learn more about the facts so you can select the best 15 year term policy for you or a loved one?

If you’re answer is YES to either question, you’re at the right place! Today’s article is all about…

A Detailed Review Of 15-Year Term Life Insurance Coverage

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Overview

- Who Gets A 15-Year Term Policy?

- Why Get A 15-Year Term Program?

- When a 15-Year Term Policy Doesn’t Make Sense

- Pros

- Cons

- Getting The Best Deal

- Too Old For Term?

- Rates. Next Steps

3 Most Common Buyers Of 15-Year Term Insurance

Let’s start with discussing WHO most commonly purchases term life coverage.

The reason I’m starting here is the help clarify in your own mind where you see yourself among these examples.

By referencing common circumstances, it’s likely you’ll fit into one of these categories. And knowing where you fit helps make the decision to get a 15-year policy much easier.

Worst case, if you don’t fit anywhere, it indicates another life insurance option may make more sense. And if you find yourself in that situation, keep reading as we’ll discuss alternatives later.

1. Single people

Are you single with or without kids?

Either way, a 15 year term life insurance product may be the perfect fit.

Here’s a few reasons why…

If you’re single and considering life insurance, you’re probably younger in age and considering the future.

They day may come you start a family. Imagine… what would happen if you pass away early, leaving your family in a financial breakdown?

If that thought troubles you, getting life insurance is a sound idea. And getting a 15-year term insurance policy in place is a good way to get coverage started.

And then there are those of you who are single with children. Have you thought about what would happen to your children if you died suddenly?

As you know, children are expensive. Between raising them and sending them to college, it costs the average family hundreds of thousands of dollars over the course of your child’s first 20 years.

If you pass away, your children lose much of their opportunity to get ahead and succeed. And having a 15-year term life insurance policy in place would help them remain in a position to succeed and not suffer unnecessarily.

2. Married

Are you married, with or without kids?

If so, congratulations! For most, marriage is the first even that gets people seriously thinking about purchasing life insurance.

Why? Because now you have someone who depends on you! And when you add children to the mix, the need grows larger.

If you pass away unexpectedly, your family’s lives will change permanently. And it’s likely that they will suffer financially, too.

One of the leading causes of foreclosure is death. Your debts – credit cards, loans, etc. – now become apart of your estate. This means your family has to pay!

And how are they going to do that when they have lost your income?

As you can see, NOT having life insurance can cause irreparable harm. A 15 year term life insurance policy does a great job of covering these obligations while giving your family peace of mind.

3. Mid-career and beyond

Have your recently received a promotion and an increase in your income?

Studies show that debt rises with an income increase. Thus the need for life insurance also increases.

If you’re like most of my mid-career level clients, you already have some life insurance through work or an individual policy. And with your income increasing, you’ll need supplemental coverage.

Purchasing an additional life insurance policy to improve your overall life insurance program is a good option to consider.

While most think term is best suited for young people, a 15-year term life insurance program is a sensible idea if you’re a senior and are retired or close to retirement and need income replacement coverage.

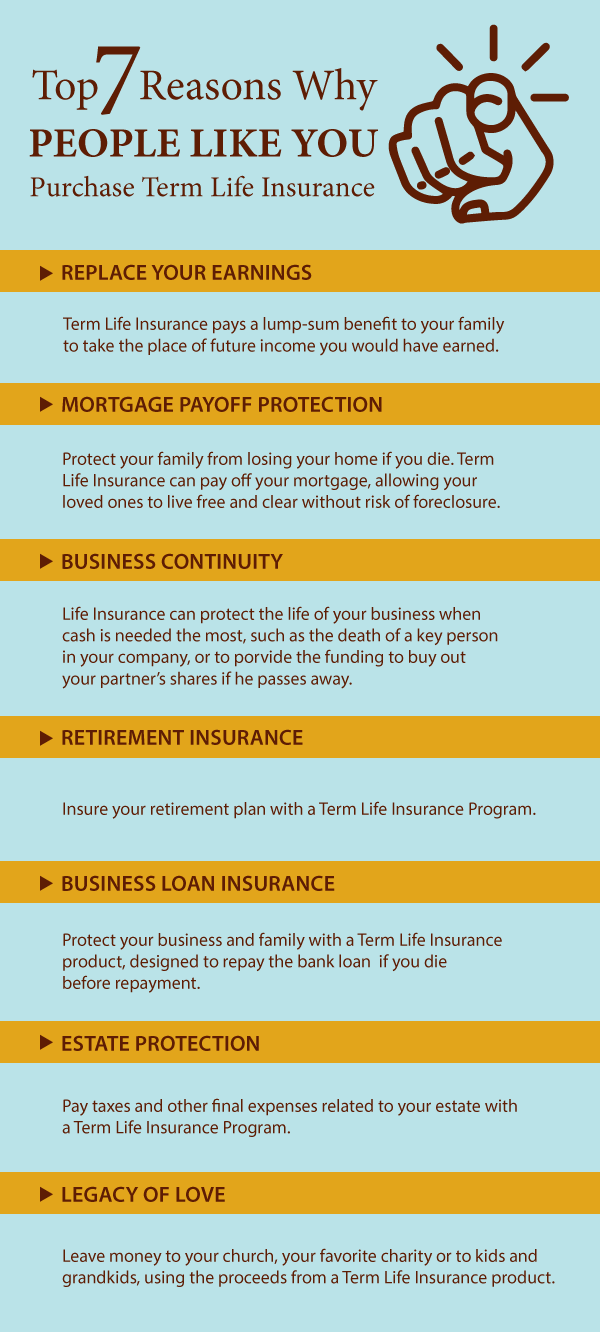

Top 7 Reasons To Buy 15-Year Term Life Insurance

Now that we know WHO buys 15-year term life insurance, let’s talk about WHY those people choose these plans.

In my experience, there are 7 top reasons why people select a 15-year term life insurance program, so let’s dive in to explaining those now.

1. Mortgage protection

Do you owe money on your home? Have you thought about what would happen to your home if you passed away unexpectedly?

One of the biggest reasons why people buy life insurance is to pay off debts like a mortgage in case of an unexpected death.

If you were to pass away without adequate life insurance, your family is at risk of losing the home to foreclosure. This is where life insurance comes in handy.

Life insurance pays your beneficiary and is used to pay debts off like your home mortgage.

Your family benefits because they can use the life insurance payout to pay off the mortgage and own the home free-and-clear without risk of losing the home to foreclosure.

Alternatively, your family has a large lump sum to continue paying the mortgage while they prepare the house so it can be sold for a maximum amount of money.

While 15-year term life insurance goes a long way in helping cover the home, you may want to custom-tailor your life insurance longer depending on the length of your mortgage. Options for term coverage include 20-year term and 30-year term.

2. Income replacement

Picture in your mind… how would your family survive with your earning power gone?

In my family, I bring home the primary source of income. And if that’s wiped out? Without life insurance, my family would be in deep trouble.

Not having life insurance coverage in place to cover your income is a big risk. If your earning power is gone, it can have a lasting negative effect on your family.

Replacing your income upon an early demise is a critical reason why life insurance is so important.

A 15 year term life insurance program can provide income replacement coverage relieve an otherwise guaranteed financial disaster for your family.

Without life insurance, your family will not only be grieving your loss, but also grieving how quickly their financial life turns upside down.

A 15 year term life insurance product can provide a large multiple of your annual income in one lump-sum payment.

This sum can be put into savings or invested however your survivors desire.

How much life insurance do I need to replace my income?

Financial gurus like Dave Ramsey and Suzy Orman suggest purchasing ten times your annual income in life insurance coverage.

With 10 times your income paid out to your family, they’ll have enough to maintain bill payments, pay off outstanding obligations, and live comfortably for many years to come.

3. Retirement funding

If you are planning for retirement, ideally a portion of your income is funding a 401k or another retirement program.

If you pass away, your family loses both your future income earning power as well as the ability to fund your family’s retirement and realize the power of compound interest on your investments.

A portion of your life insurance should cover your on-going savings goal.

4. Supplemental life insurance retirement plan

Did you know you can use certain types of life insurance to grow a retirement plan without the downside risks of a bad stock market?

We call these types of plans “supplemental life insurance retirement plans.”

These are insurance products that supplement (not replace) your existing retirement strategy, Typically, whole life insurance product or a universal life insurance is used to develop cash values, pay dividends, and grow larger over the course of time.

Long term, supplemental life insurance retirement plans develop substantial cash value which can be used for tax-free withdrawals in retirement (or at any time).

5. Leave a legacy

Some buy life insurance to fund causes they believe in.

For example, if you are a church member and want to leave behind money when you die, you can name your church as the beneficiary.

Same goes with leaving money to a charity. If you value a certain charity, you can leave the death benefit to the name of the charity.

Of course, you can always name name family members such as kids or grandkids as the beneficiary, too.

6. You are a business owner or entrepreneur

If you’re a small business owner, self employed, or an entrepreneur, consider purchasing life insurance to account for certain aspects of doing business.

For example, if you are in business with a partner, it’s a good idea to consider a buy out plan that’s funded by a life insurance product.

The buyout plan stipulates that upon the passing of the partner that the partner’s shares are purchased by the surviving partner.

Imagine if your business partner passed away unexpectedly. How would you pay his heirs? You may seek financing, but the cost of principal and interest may cut into your operating budget. Plus, without your partner, banks may hesitate to loan.

Here is where life insurance coverage comes in handy. A 15 year term life insurance product may be the perfect solution to funding a buy-sell agreement with your partner.

All you need to do is name your estate as the beneficiary on your policy, have the corporation pay the premium, and get legal assistance in setting up the terms and conditions to the buy-out arrangement.

Upon your passing, your family receives the death benefit in exchange for selling the shares of the business to the surviving partner.

A buy-sell agreement allows for the business to continue and the surviving family to be properly paid upon the passing of the partner.

A 15-year term policy is useful if your bank requires you to carry life insurance to cover your business loan.

If you happen to pass away before paying back the loan, your 15-year term life insurance policy would pay the loan principal off.

And if your loan is paid off before the term expires, you can keep the policy for yourself and change the beneficiary to your loved ones.

When A 15-Year Term Doesn’t Make Sense

A 15 year term life insurance product is great for many situations, but not always the best choice.

In this section, I play the “Devil’s advocate” and offer situations where a 15-year term insurance policy is not the best life insurance product solution.

Does it solve your insurance problem best?

When you buy any type of term life insurance, you must make sure it matches your goals.

Before selecting a 15 year term policy, you need to analyze the reason why you want a policy matches the length of time the issue needs coverage.

Here’s what I mean…

Let’s say you are 30 years old and you’re looking at a 15 year term insurance product.

You want life insurance to replace your income and protect your family if you pass away earlier than expected.

With a 15 year term, your coverage lasts until age 45.

The question you must ask is – will you still need life insurance after my term policy cancels?

I argue YES. At 45, you’re 20 years away from retirement and still need life insurance coverage.

Worst case scenario, what if you end up becoming sick or ill and you cannot qualify for a new policy?

Look at the nature of the obligation and match your life insurance coverage to its time period.

In this circumstance, a 30-year term life insurance is a better choice, as you’d have coverage all the way until 60 years old.

Budget Problems

Perhaps you’re at a point in your life where your budget is tight.

Maybe you’re not making as much income as you’d like. Or you’re near retirement and sensitive to higher prices.

In this scenario, you may find that a 15 year term may be too expensive.

There are a couple of things you can do instead.

First, look at getting a quote on a 10-year term life insurance product. Shorter time period term policies usually are less expensive than longer lengths of time.

Remember that SOME life insurance is better than NO life insurance.

If my clients can’t afford a 15 year term life insurance product, but still want coverage, I advise they consider a shorter term instead.

Too Old

Occasionally, 15 year term coverage is not available due to advanced ages.

You see this most commonly when applying for life insurance between 60 and 70 years old.

If this is the case, you may want to consider a 10 year term life insurance product.

Alternatively, you may consider other types of life insurance to lengthen the amount of time you’re covered.

If longer-term life insurance is necessary, consider a guaranteed universal insurance policy or a whole life burial insurance plan. Both are designed never to cancel as long as the premium is paid.

Pros Of A 15-Year Term Life Policy

Let’s talk about the the positive aspects of a 15 year term life insurance product.

Length of coverage

A big advantage of 15-year term policies is its ability to cover a variety of different financial obligations.

From business loans, mid-life retirement planning, and mortgage protection, a 15-year term life insurance program provides adequate protection at a fair price.

Conversion option

Many 15-year term policies offer guaranteed convertibility.

This is huge. As you near the end of your term policy, you have the right to take a portion of your policy and convert it into whole life insurance without evidence of insurability.

In other words, if you get sick or ill and cannot qualify for a new life insurance plan, this option gives you the right to keep SOME of your coverage without having to reapply. Your acceptance is guaranteed.

Additional riders

Do you know a 15-year term life insurance program may offer benefits while you’re alive?

Many policies offer add-on benefits called riders that benefit you while alive.

The most common riders include:

- Additional coverage for accidental death

- Cash benefits when diagnosed with issues like a stroke, heart attack, or cardiac event

- Waiver of premium payments if deemed disabled.

- And many others.

To know which rider may be suitable for you, it’s important to discuss your options with an agent.

We at Buy Life Insurance for Burial can help identify what your goals are and help you pick which riders would work best.

Affordable

Compared to 30-year term, universal life or whole life, 15 year term life insurance products charge a lower monthly premium.

If your goal is to get an affordably priced life insurance plan, I usually recommend a 15 year term life insurance product, as it has some of the best overall rates and coverage package availability.

Top 7 Reasons People Buy Term Insurance

1.Affordable policy

If you are on a restrictive income, term insurance is a great option. When compared to other types of coverage such as whole or universal life insurance, term insurance is moderately priced and manageable for most budgets.

2.Income replacement

Replacing an income is the concern of many individuals, especially if you are married or have kids. Term insurance is a great way to cover income should you pass away sooner than expected. Most financial gurus recommend ten times your annual earnings as a starting point for replacing your income in an effective manner.

3.Retirement funding

If you are putting money into a 401K or other pension plan, term insurance can add to that savings should you pass away. This can make a significant difference in the life of those you love over the long term, especially if you have a spouse who does not have a retirement fund of their own.

4.Loved ones

People most often purchase term insurance to protect the ones they love. If you are concerned about leaving behind financial responsibilities, term insurance does a great job of covering the cost of living, bills, and final expenses.

5.Custom length

Term insurance can be customized to any term length you require. This means if you have a 30 year mortgage, you can get a 30 year term policy. Or if you have 10 year bank loan, you can get a 10 year term policy. Being able to customize term insurance to meat your specific needs makes it a unique and desirable form of insurance.

6.Pure insurance need

Term insurance serves one specific, important purpose – it pays a death benefit upon your passing to your beneficiary. There are no extra costs involved, making it a very straightforward type of life insurance.

7.Exams are optional

If you don’t like the thought of needles or getting a physical, did you know you can do an exam free application? Life insurance no longer requires an exam to qualify for coverage. Underwriters can pull your medical records and rely on recorded information to process your application.

Drawbacks to a 15-Year Term Life Insurance Policy

Although a 15 year term life insurance product does a great job of meeting many goals, it is not the right solution for everybody.

There are a few reasons why a 15 year term life insurance product may actually be a bad decision altogether.

Let’s cover those reasons now.

You may out live the policy and still need coverage

This all goes back to buying life insurance to ultimately meet your insurance goals.

If your goal is to have permanent protection because your ultimate reason for buying life insurance is to pay for final expenses like your burial or cremation, a 15 year term life insurance product probably doesn’t make sense.

Why would this be the case? Simply because you may outlive your 15 year term life insurance and still have your final expenses to pay!

The truth is many people outlive their term insurance.

Life insurance companies take a chance on you, hoping that you’ll outlive the plan so that they won’t have to pay out.

The likelihood of a 15 year term plan being there when you need it for final expense coverage is low.

In fact, buying a term insurance policy to solve a permanent problem like final expenses doesn’t make much sense, right?

Always match the life insurance product type you’re looking for with the goals that you seek to solve.

Price increases are inevitable

Some 15-year term life insurance policies don’t cancel. Instead, the premium skyrockets through the roof!

If you’re in a situation where you value a fixed price that fits your budget, you may find a 15 year term life insurance product once you outlived the term period, does not meet that goal.

Tips For Buying The Right 15-Year Term Policy

Let’s talk about different ways to secure the best deal for a 15 year term life insurance program.

I have 5 tips could have a measurable impact on the life insurance premium you’ll pay.

1. Always buy your 15 year term life insurance from an independent agent

This is one of the most powerful ways that you can lower your premium.

If you buy your 15 year term insurance product from a one-company agent, it’s likely you’ll pay too much or receive inadequate coverage.

As opposed to one-company agents, independent agents represent a variety of life insurance companies.

The benefit they provide is more options for pricing and coverage, meaning you’ll most often get more bang for your buck.

This is how we operate at Buy Life Insurance for Burial. It’s in our best interest to get you the best deal. That way you’re a happy client!

2. Consider getting an exam

Are you in good physical shape? Are you looking for a substantial amount of life insurance?

If so, it may make more sense for you to take an exam.

In certain circumstances, taking an exam allows you access to better premiums if you’re in tip-top shape.

For example, when I applied for the life insurance, I saved over a $1000 a year compared to the no-exam option for coverage. That’s a lot of money!

3. Scared of exams?

Exams for some people are scary. You will have blood drawn. A nurse practitioner or doctor will ask you a series of health questions, too. In addition, you’ll have your blood pressure checked.

Here’s the thing. If you’re not in good shape, or horrified of an exam, no problem. There are other options called non-medical life insurance that will allow you to apply for life insurance coverage without taking an exam.

4. Too old?

My twin girls Emily and Eva thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Last but not least, if you find you’re too old for a 15-year term policy, consider looking at a 10-year term policy instead.

Otherwise, if you need coverage for 15 years or longer, check out a guaranteed universal life insurance plan or a final expense life insurance plan.

This is very useful if you have more permanent obligations to cover, such as your debt, a mortgage, and final expenses. And it can replace your pension payments to your spouse in the event of your death.

Rates, Next Steps

In this section we are going to cover different price ranges available for ages between 15 and 55 for 15 year term insurance .

These are preferred rates from a ranked company. And of course your eligibility for these rates is subject to your underwriting and application. These rates are subject to change at any time.

Rates for $100,000 in Coverage

Rates for $250,000 in Coverage

Rates for $500,000 in coverage

Rates for $1,000,000 in Coverage

Rates for 2,000,000 in Coverage

Thank you for stopping by and reading.

I hope you found this information useful.

If you would like to find out what options you might have for life insurance, feel free to give us a call at (888) 626-0439.

It’s a no-stress way to find out what you might qualify for and we get any remaining questions you might have answered by an expert in the field. You will be under no obligation – the quote is free.

Give us a call today or send us a message. Thanks again for stopping by!