What Does Burial Insurance Cover [Funeral Rates Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Most likely you’re here today due to concerns about covering your funeral and burial costs.

Perhaps you have heard of a special type of life insurance called burial insurance, designed to cover those costs.

But you’re not entirely too sure about how it works.

If this describes you, you are at the right web page!

Because, in this article, I’ll discuss…

What EXACTLY Does Burial Insurance Cover?

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the compete presentation on what burial insurance covers. Enjoy!

Here’s An Overview Of Today’s Topic:

- What Is Burial Insurance?

- Definition Of A Pre-Need Funeral Policy

- Average Burial/Cremation Cost Breakdown

- Cost Of Pre-Need Insurance

- Cost Of Burial Insurance

- My Thoughts On Selecting The Right Plan

- 5 Beneficial Reasons to Get Burial Insurance

- Burial Insurance Rates

- Final Thoughts

What Is Burial Life Insurance?

Let’s answer the main question first.

“What is burial insurance?”

Simply put, burial insurance is life insurance.

Same thing goes for final expense life insurance or guaranteed acceptance life insurance. They’re all life insurance, plain and simple.

And what’s the main purpose of burial insurance?

Burial insurance pays a lump sum cash benefit to your beneficiary upon your passing. Then it is the beneficiary’s job to carry out your wishes regarding your funeral service.

One thing about life insurance is that not all insurance is the same.

There are 3 types of life insurance that act as burial insurance:

- Whole Life

- Term Life

- Universal Life

So let’s switch gears and get a basic understanding of the pros and cons of each insurance policy type

We here at Buy Life Insurance for Burial are dedicated to helping people like you get affordable life insurance to cover your final expenses. These are important things to consider when you are planning for your family’s future, and we are here to make it easier.

Feel free to call us at (888) 626-0439 for more information. We can provide you with a free, no obligation quote.

We can also be reached via message. To message us, submit the form on the left-hand side of the screen. After you submit, you should hear from us within the next 24 business hours.

Whole Life Insurance

You can think of whole life insurance as “insurance lasting your WHOLE life.”

Seniors looking for burial insurance like whole life insurance because:

- Rates never go up,

- Coverage never cancels due to age or health, and,

- You may qualify for first-day full natural death coverage.

In a nutshell, whole life insurance provides the ultimate in peace of mind. You have guarantees in price and coverage you can trust.

As you’ll see momentarily, this is MUCH better to cover final expenses than other insurance products without premium and coverage protection.

The main drawback to whole life:

- Higher premiums per dollar of coverage compared to term and universal life.

Due to the premium and coverage guarantees, you’ll see a higher price than what term or universal life will offer for the same monthly premium.

Nevertheless, whole life is the first choice for seniors looking for burial coverage.

Why? Whole life insurance offers more flexible underwriting, and offers peace of mind that other products cannot.

Most whole life products designed to cover burial expenses are known as simplified issue. This means is no examination is required.

Simply submit your application, and complete a 15 minute phone interview with the insurance company. Typically you get a decision the same day. Nice!

Simply put, the nature of death is certain. The time we go is not. Whole life is one of the few insurance policies providing lifetime protection and a premium guarantee, which is vital to fully protect your family from paying funeral expenses.

Term Life Insurance

Your second option to cover burial expenses is term insurance.

Term insurance is “terminating coverage.”

While term provides substantial coverage at a lower price than whole life, if you live long enough, you will see your term insurance terminate.

Lots of companies offer term life insurance to seniors to protect against final expenses.

AARP, Trustage, and Globe Life come to mind.

The one advantage term insurance provides is lower premiums relative to whole and universal life insurance.

However, there are significant drawbacks:

- Live long enough and you outlive your coverage. Remember, term insurance terminates. AARP and Trustage cancel at 80 years old.

- Term insurance may have premium increases. AARP, Trustage, and Globe Life experience premium increases approximately every 5 years. Not good for a fixed income senior.

Bottom line on term life insurance for seniors – while you gain more coverage for less premium, you lose the peace of mind that comes with whole life insurance.

You may outlive your term insurance and never benefit from it.

Term insurance for seniors only makes sense for financial concerns separate from burial expenses, such as covering a mortgage or other debts.

Universal Life Insurance

Universal life insurance, if properly designed, is a great product to pay for final expenses.

Improperly designed, you may end up like many senior citizens who have lost their universal life coverage later in life.

The only universal life product I offer seniors is called no-lapse universal life insurance.

Here’s the benefits of no-lapse universal life insurance:

- Premium guarantee: As long as you pay the same premium from the outset of the policy, the policy cannot cancel. This premium guarantee rider is what makes this type of universal life policy sensible. Without it, you end up risking the loss of your policy like so many seniors have gone through.

- More coverage than whole life: A no-lapse universal life insurance policy offers more coverage per dollar of premium when compared to whole life. Getting more for the same price is always good.

And the drawbacks:

- Harder to qualify for: All universal life insurance products require more in-depth underwriting than simplified issue whole life insurance. It’s likely that with any significant health issue that you may end up getting charged higher, or potentially declined with universal life, whereas whole life would approve you.

- Available for larger coverage amounts only: No-lapse universal life starts at $25,000 in coverage. If you need less, simplified issue whole life insurance products will do the trick.

What Is A Pre-Need Funeral Policy?

When you compare burial insurance to pre-need policies, there is a bit of a difference.

Sold through the funeral home, pre-need plans allow for pre-planning, price locks on funeral service items, and are offered in payment plans up to 10 years in length. And like all life insurance, if you die before full payment, the insurance kicks in and covers the difference.

Pros Of Pre-Need Insurance

Pre-need insurance offers several distinct advantages:

- Fixed premiums that never increase.

- Simplified underwriting – no examinations necessary.

- Price lock on funeral service items. Avoid escalating funeral prices.

- Ability to pay off immediately, or within a short period of years.

One of the biggest advantages with pre-need plans is the price-lock feature.

No matter how much funeral prices increase, your prices for most items of the funeral service are locked in to today’s rates.

Odds are you’ve seen prices go up for gas, food, rent, and electricity. Funeral expenses are no different.

Additionally, you get simplified underwriting with a pre-need plan.

Like burial insurance, there’s no examination required.

Lastly, you have no lifetime payment requirements with a pre-need plan. You can pay it in one lump sum, or spread it over several years.

The funeral home is the beneficiary on these policies. So the funeral home will be the only one paid when you pass away.

Cons Of Pre-Need Insurance

Let’s mention the drawbacks to pre-need insurance:

- Large premium for price lock.

- Less underwriting flexibility than burial insurance.

- No beneficiary control.

Personally, I believe the price-lock protection is a bit of a rip off. I’ll do the math later and show you how you’re almost paying DOUBLE for your funeral for this supposed price lock feature in 7- and 10-year pre-need payment plans.

Also, pre-need life insurance has notoriously strict underwriting standards.

I have had clients purchase pre-need with manageable health issues like depression or diabetes that forced into a two-year waiting period before the plan was in full effect.

This means if my client died by natural means within the first two years, she wouldn’t have full natural death coverage. Meaning the pre-need plan wouldn’t pay full benefits.

The last concern is that you have no control over the beneficiary. You must name the funeral home as the beneficiary.

If you want to leave a legacy or replace your income for your loved ones when you pass away, you’ll have to purchase a traditional life insurance policy in addition to the pre-need policy.

Average Cost Of Burial And Cremation

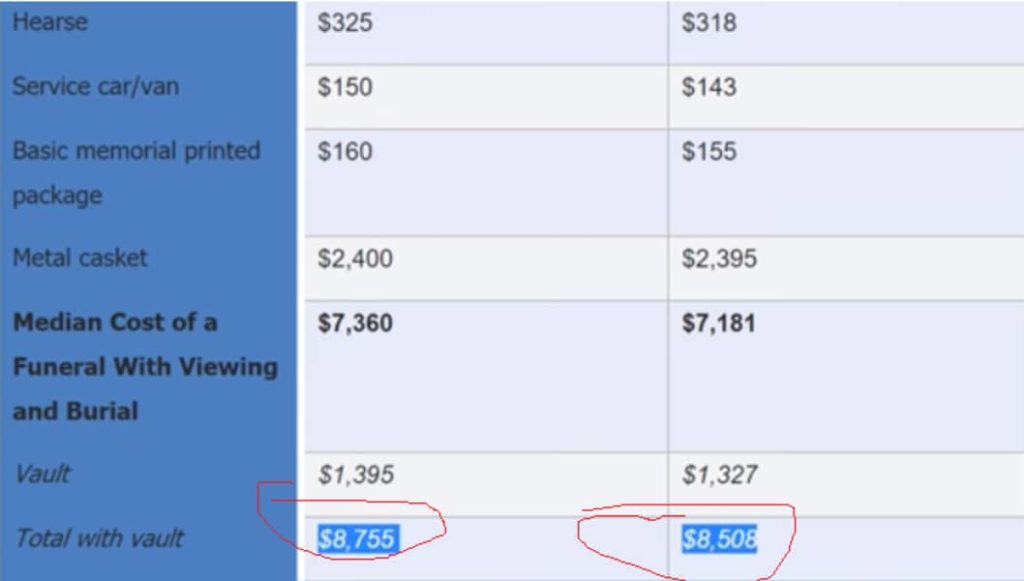

Now that we have a basic understanding of the different insurance products available to pay for a burial, let’s discuss average burial cost numbers as provided by the National Funeral Directors Association.

Direct your attention to the numbers circled in red.

This is the median cost of a burial in 2017 (cremation comes in just a second).

Median means there are exactly half of funeral that cost less, and half that cost more than the price shown.

So the price of $8,755 represents closely to what a typical funeral runs.

The column on the left represents the median cost in 2014. You can see the median cost over the last three years has gone up around $250.

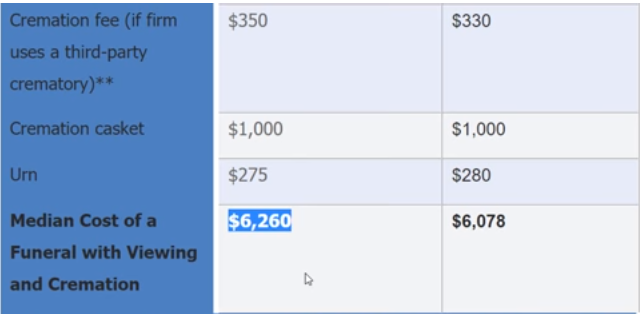

Now let’s take a look at median cremation costs.

You can see that the cremation costs have gone up from $6,078 to $6,260.

As explained earlier, the $6,260 price in 2017 represents the middle price.

In my experience, cremations usually are much less expensive. I’ve seen cremations less than $4000, even in big cities.

Plus, you can get your cremation bill lower if you opt for a direct cremation without all the pomp and circumstance.

The purpose in showing median pricing is to demonstrate how prices have increased.

Unfortunately, the NFDA took down their 10-year comparison, which showed that the prices went up about 20 to 25 percent between 2004 and 2014.

The Cost Of Pre-Need Insurance Plans

As a life insurance agent, I sell burial insurance plans.

Most people who work with me want burial insurance plans. But sometimes a burial insurance plan is not the best choice.

I want provide both perspectives on pre-need plans and burial insurance plans. That way, you can decide which program makes more sense.

And one of the best ways to clarify which insurance program works best is breaking down your cost.

Pre-Need Has Higher Premiums

Expect to pay a higher upfront cost for pre-need insurance compared to burial insurance plans.

My experience with pre-need plans is that your average pre-need monthly premium ranges between $150 to $250 a month if you opt for a 7- to 10-year payment plan.

I met a lady in Chattanooga, Tennessee back in 2012 paying $250 a month for her pre-need plan.

The mausoleum was priced at $5,000, and her funeral expense was $10,000. She was on a 10-year payment plan.

Expect To Pay Much More In Premiums Than The Funeral Cost On Longer-Term Plans

When quoted a pre-need plan for 1- to 5-year payment plans, many fixed income seniors balk at the price and consider a 7- or 10-year payment plan instead.

Here’s the problem with longer-term pre-need plans…

You end up paying nearly DOUBLE in premiums compared to the value of the funeral service.

Here’s another example of a client of mine.

She had a 10-year pre-need plan paying $150 a month that granted her a $10,000 value funeral.

Let’s do the math.

At $150 a month for 12 months, that’s $1,800 a year, right?

Then multiply that by 10 years, and she’s paying $18,000 in premiums for a $10,000 funeral benefit.

Ask yourself… is pre-need really a good value, if you’re paying nearly double the price for your funeral?

The Cost Of Burial Insurance Plans

Now let’s break down the cost of burial whole life burial insurance plans.

Cost comparison between burial insurance and pre-need insurance

Let’s take a person in his early 60s who wants a $10,000 insurance benefit. He is considered pre-need life insurance as well as burial insurance.

Odds are he’ll pay approximately $150 a month for a 10-year pre-need plan. But, compared to burial insurance, he’ll pay approximately $50 a month for burial insurance.

Burial insurance allows for multiple uses

Remember, with burial insurance, your beneficiary may use the policy for reasons other than the funeral.

If you want income replacement, you can do that.

For example, you can purchase a $25,000 or $50,000 whole life insurance plan, and dedicate $10,000 towards the burial, and the other $15,00 towards your spouse.

Live long enough, you may pay more premiums than coverage into the policy.

The con to the burial insurance plan is that you’ll pay a lot of money over the long run.

Here’s another case study.

Let’s say a 60-year-old man is approved to pay $50 a month for a $10,000 burial insurance plan.

He lives another 30 years and dies at 90. So he’s paid in for 30 years.

How much money has he paid in?

In this case, you take $50 a month, multiply it by 12, which gives you $600, and then you multiply it by 30.

Here we are again at $18,000 in total payments. So again, was this worth it? He paid $18,000 for a $10,000 benefit.

My Thoughts On Selecting The RIGHT Plan For You

On the one hand, you see the benefit of a pre-need plan. Pre-planning, price locks, and peace of mind.

However, you may want life insurance coverage for something other than funding your burial. Perhaps the pre-need premium seems steep.

And that’s why you like the idea of burial insurance. Pay a lower premium for peace of mind. But face the potential of paying more into the policy than its value if you live a long life.

How can you figure out what option is best?

In my experience, people fall into 2 camps: the price-conscious group and the value-conscious group.

Price-Conscious

The price conscious group are concerned primarily about price.

Most likely they’re seniors on a very fixed income. And when looking at two different options with vastly differently prices, they usually pick the more affordable option.

Reason being is that they don’t want to stretch their meager retirement further than it can go. Nothing’s worse than dropping valuable life insurance coverage because it becomes unaffordable.

Value-Conscious

The second group appreciates value first and foremost.

Typically, they have greater means to pay higher prices. This gives them the ability to prefer insurance options with specific end-dates. Therefore, pre-need is more attractive. You get it done in two or three years and be done.

Pre-need is best utilized when the payments are paid off under 3 years.

You may pay $300+ a month for a few years. But once it’s over, it’s over.

Consider Your Personal Insurance Goals

Your personal goals for insurance coverage dictate the right kind of plan to pick.

An while you’re either price- or value-conscious, one must also consider additional needs for life insurance beyond funding a funeral.

A client of mine was approved for a policy. Not only did she want her cremation funded, she also wanted the remainder of her policy left as a cash benefit to her spouse.

The wife had a pension plan through her job that she retired from, and the husband just had a very small Social Security check. When she dies, he won’t inherit her pension.

Why does this matter? If she goes first, he loses a tremendous amount of money. Thus leaving money in a life insurance plan becomes sensible to ease the transition.

Burial insurance plans do a good job accomplishing this. For example, you could purchase $50,000 in coverage, use a portion to pay for final expenses, and leave the rest to your survivors. You can’t do that with a pre-need plan alone.

Bottom line is this.

If you have other insurance goals beyond paying for the funeral, consider either (a) buying a burial insurance plan to handle these goals, or (b), buy both a pre-need policy and a life insurance policy.

5 Beneficial Reasons to Get Burial Insurance

1. Rates remain the same

If your burial insurance has a whole life insurance component, then your rates are 100% guaranteed. That means, they can never increase! The coverage will always be there in case something happens, and you never have to worry about rates increase due to your health or age.

2. Peace of mind

This ties into the conclusions of the last point. When you have burial insurance, you know there is something in place if the worst case scenario happened. One of the top reason people look for insurance, in general, is to have peace of mind.

In this situation, burial insurance protects you and your family. You know how your final expenses will be paid for, and you won’t have to worry about saving for them otherwise.

3. Cash value

Many people think cash value is important. Over time, after premiums are paid in, you can actually borrow money from your plan. For many, they feel comforted knowing that they have money stored up in case of an emergency and that they also have peace of mind about their final expense.

For them, it is a two-in-one deal.

4. Rates are fair

Buy Life Insurance for Burial is able to shop the market to find the perfect insurance policy for your unique financial needs, and we can tailor premiums to fit your budget. This is one of the many benefits that people receive when they work with brokers, like us, to get their burial insurance.

5. Exams are no longer required

With burial insurance, there are no needles or invasive tests. It is specifically designed to not need an exam.

The process allows you to submit an application that discloses your medical history, which is all the companies need in order to qualify you. It is simple, and it is often quick, too.

Burial Insurance Rates, Age 40 to 90*

Rates For $5,000 In Burial Insurance

Rates For $10,000 In Burial Insurance

Rates For $15,000 In Burial Insurance

Rates For $20,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

*Burial insurance premiums are subject to underwriting, based on rates as of 8/20/2018, from state-regulated life insurance companies offering final expense burial whole life insurance protection. Understand that in order to potentially qualify, you must submit an application to see if you’re eligible. Rates are subject to change. Give Buy Life Insurance For Burial a call at 888-626-0439 now to see what program you may qualify for.

Final Thoughts

Let’s wrap this up here.

I hope I answered your questions for you on what burial insurance covers and in what circumstances you’ll find one product is better than another.

If you’re interested in a pre-need plan, my recommendation is to call the funeral home locally that you trust to arrange a plan to be put together.

Pre-need plans are primarily sold through a funeral home because you’re tying in the costs of those items in the funeral.

You’ll need to talk to them and see what the costs are and what they would recommend. It’s like walking through a showroom and picking out the casket, the flowers, and the service.

You get it all written down in a contract, and then you take the policy out to ensure it. It’s very commonly sold through the funeral home.

But if you’re the type that feels a burial insurance plan is a better deal based on what you’ve learned, I can help you with that.

It doesn’t matter where you live as long as you live in the U.S. I can help you find a plan.

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

I shop around to find the best price and coverage for my clients.

I work with multiple companies, so even with health issues, it’s very common for me to be able to find quality life insurance coverage that will cover you.

If you’d like to contact me and let me help you out, there’s a couple of things you can do.

You can call me at 888-626-0439. I encourage you to leave a voicemail if you don’t get me instantly. I do talk to a lot of people all day long, and I will call you back typically within the next 24 business hours.

You can also go to my website and send me a message here to tell me what you’re looking for.

There is no obligation whatsoever. If I can help you, great. If not, that’s not a problem either. Then based on what I show you, you can decide if it’s something that makes sense for you.

Buy Life Insurance for Burial thanks you for reading this article. We truly hope that it helped you to learn more about burial insurance.

We want to remind you of the importance of burial insurance, and we urge you to get covered. It is so important to do this before it is too late. As you read above, there are many reasons why burial insurance is beneficial, and we want to make sure you and your family are covered.

Allow us to suggest that you get in contact with us because we are here to help you. We make the process easy, and the initial step takes only 10 minutes.

You can either call by phone or message us.

To reach us by phone, call (888) 626-0439. Our friendly representatives, who are life insurance experts, are waiting to share your options with you that best fit your needs.

To message us, submit the form on the left-hand side or bottom of the screen. All you have to do is tell us what information you’d like to know and the best way to contact you. A Buy Life Insurance for Burial will reach out to you within 24 to address your request.

Again, we thank you for finishing this article, and we look forward to helping you meet your life insurance goals.