Tips on Getting Life Insurance for $25 a Month or Less

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

In This Article I’m Going To Give You Tips On Getting Life Insurance For $25 A Month Or Less

Most likely you’re reading this article today because you know the importance of purchasing life insurance either on yourself or somebody you dearly love, but you just can’t afford to spend a large amount of money per month to keep the policy on the books.

Perhaps you’ve been in a worse situation where you’ve had life insurance for a significant period of time, but because of circumstances in your life that were out of your control you had to drop coverage. As it stands today. You may be on an income that’s very restricted or you may be disabled or retired, so you cannot afford to spend a lot every month.

If this describes the circumstance that you find yourself in and you’re looking for life insurance with a $25 a month premium or less, you’ve come to the right place.

In this article I will explain options for life insurance coverage, as well as factors and tips that will help you potentially lower your premiums to meet your $25 a month budget. Most importantly this article will help you pick up life insurance coverage to protect the people in your life that you love.

Specifically, we are going to talk about six factors that make a big difference when it comes to keeping your premium at $25 a month. And at the end of our article I will give you some sample rates on term and permanent insurance for $25 a month or less for different age ranges.

Here’s An Overview Of Today’s Topic:

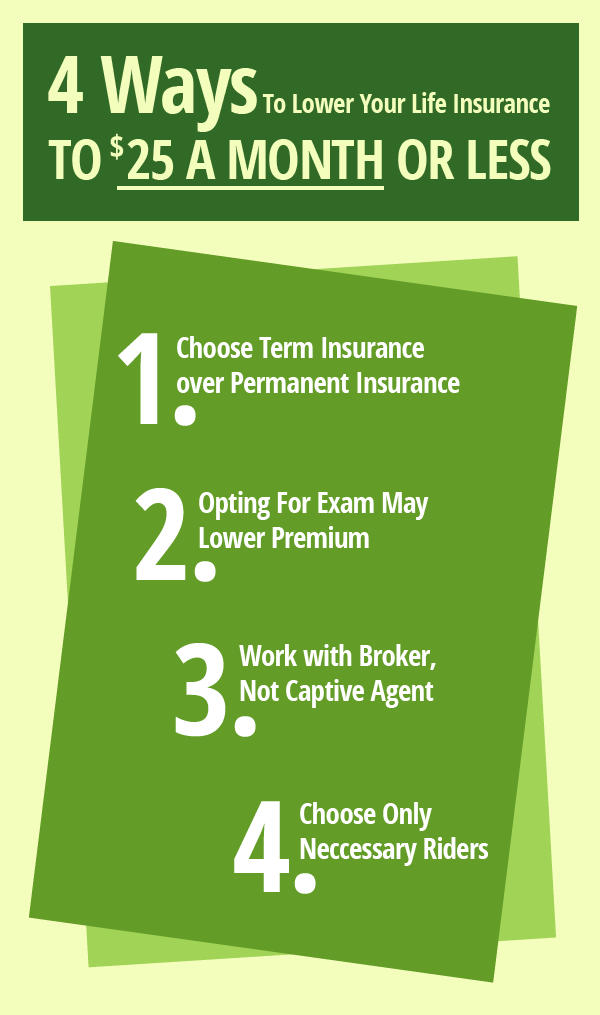

- Work With A Broker

- Something Is Better Than Nothing

- Term Insurance Is An Easy Way To Get Cheaper Insurance

- Pick A Shorter Term Insurance Plan To Lower Your Premium

- Choose Only Necessary Riders As An Additional Benefit

- Should You Get An Exam?

- Rates

Work with a broker

It’s important to understand that the actual process in which you search and shop for life insurance has one of the biggest impacts on what your ultimate premium cost.

Life insurance is typically sold via two different routes.

The first route and the most common is through a captive agent. Captive refers to agents that only represent one company. This means they can only offer one quote and have a limited amount of options to give their clients.

Simply put, if you have a combination of health factors, participate in risky hobbies, or are older when you apply for coverage you will have very limited options with a captive agent company that is unable to offer you more than one product.

Buy Life Insurance for Burial operates strictly as a broker, which means we function having access to dozens of life insurance companies so that we can take your individual case and see which of these companies will offer you the best package. We literally do the shopping for you, giving you the best overall deal.

Companies such as State Farm, Farm Bureau, or New York Life only operate with one company. While they’re good companies and well known, the options they provide are limited and may not be the best course of action for your coverage needs.

Something is better than nothing

One thing you’ll find as you consider your coverage options is that often we have to make compromises. This may mean that for the $25 a month budget you can only afford a certain type or amount of insurance even though it may not fit your goals.

Let me give you an example I experienced recently with a client:

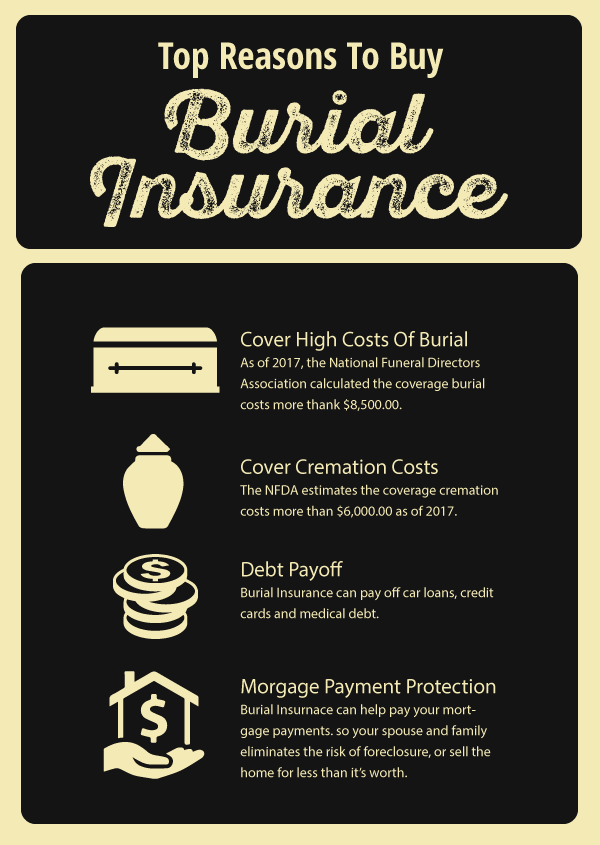

I talked to a gentleman in Arizona who was adamant that for $25,000 he should only pay $25 a month and that was all he could afford. Unfortunately considering the myriad of health issues he had, the best option we could provide was only $10,000 a month of coverage and this was the only option he had for his final expense coverage, which is why he needed life insurance.

Unfortunately he decided that it wasn’t worth getting anything for that price point because it wasn’t exactly what he wanted. That means he decided to continue without insurance in a state of bad health, knowing he could pass away at any time and not be insured.

When he dies, his spouse will have to bear the brunt of the burial cost – something that could be prevented if the gentleman was willing to compromise on his insurance goals and get coverage in place even if it wasn’t exactly the kind of coverage he set out to originally get.

I think this approach is foolhardy. I hope you can see this too. We all want the best. We all want the most, but that’s just not how life works sometimes. We have to make due with what we have. And in this case, if you got lemons, you make lemonade out of it, right?

Understand that in order to meet the budget you have to work with, you may not get the coverage that you want to get, but you can still get coverage. Ultimately that is our goal at Buy Life Insurance for Burial. We want to ensure you get the coverage you need because we want to be sure if something happens to you, you have some sort of coverage in place, even if it is minimal.

Term insurance is an easy way to get cheaper insurance

Term insurance is typically cheaper than permanent insurance.

While term insurance has shorter terms that only last for a period of 10, 20, or 30 years, it does cost less than a permanent insurance plan which lasts forever.

There’s a dramatic difference in premiums between a term life insurance plan and a permanent life insurance plan like whole life or guaranteed universal life.

It’s very likely if you’ve been shown a permanent life insurance plan that was $100 a month that you could get the same amount of coverage in a 10 or 20 year term insurance plan for a $20 to $30 a month premium. It’s literally that much difference in premium amounts. Why?

Because most insurance companies feel better about a lower price for a plan that ultimately will cancel due to a person reaching the end of coverage then basically being on the hook for a permanent insurance plan which has to pay out at some point when the owner dies.

Term insurance is probably the easiest method to immediately lower premium payments to a $25 a month range.

Pick a shorter term insurance plan to lower your premium

Going from a 30 to a 20 year to a 10 year term insurance plan will also positively affect the premium to get it down to the $25 a month premium. I recommend getting the longest amount of term insurance that you can afford.

Always get a term life insurance plan that you can most easily afford. Again, when it comes down to what you want and versus what you can afford, always look at what you can afford first versus not getting anything for at all.

Pick the plan that’s shorter in length, but that also fits your budget because it’s likely in the next several years, things will improve. Budgets will be better. Obligations will be paid off, and if you feel the need for more life insurance, you’ll probably be in a state where you can afford it and it will make sense to purchase more.

Choose only necessary riders as an additional benefit

Riders are additional benefits you can add on to insurance coverage.

Most common riders include things such as returning your premiums upon successfully paying the policy over a period of time, a disability benefit that pays if you get hurt and can’t work anymore, or a one time lump sum payment if you end up with a chronic illness, disease, or a heart event like a stroke or a heart attack.

While these are great benefits to add to a plan, they also cost an additional sum of money and we’re looking at a person who needs to keep their budget within $25 a month or less. Let’s face it, in many circumstances, those additional benefits will put the monthly cost over budget comfort level. So what’s the solution?

Only pick the riders that are absolutely necessary. I believe a disability waiver is the most important writer you can add to any life insurance policy if it’s available. What this allows you to do is wave premiums after a period of time if you become disabled and cannot work anymore.

I’ve seen many clients who have kept life insurance policies due to this perk, who otherwise would have lost coverage. The policy is of great value to them now because they don’t have to pay the premiums. Disability happens with so many people unexpectedly, so it’s an important rider to consider.

Should you get an exam?

The decision whether or not to get an exam is tough for some people who have a fear of needles. Some individuals suffer from what’s called white collar syndrome where their blood pressure raises and stress levels increase when they have to deal or discuss personal health issues with a doctor.

The reason why you may want to consider getting an examination is because ultimately life insurance products that require exams versus those that don’t generally have much better premiums.

Sometimes an exam isn’t necessarily dependent on the product, but sometimes it is. An exam can often allow you to qualify for a much better overall package deal. So why miss out on the opportunity to save literally 50 to 75 percent on your premium by taking an exam, then simply passing it up and paying more than you have to.

Rates

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

In this section, we’re going to show you some different rates for a term insurance plan at $25 a month or under.

We’re going to show you rates for ages 25 to 75 years old, male and female, smokers and nonsmokers at 10, 20, and 30 year preferred rates.

These are rates from a plus ranked company.

Understand that your rates may not be what you see in the chart below.

Ultimately, you have to apply to see what your rate will be.

Below you will find sample rates for whole life insurance plans that are under $25 a month. For those of you that are looking for a whole life insurance plan to pay for final expenses or to have permanent protection, you’ll see coverage amounts for $25 a month or less for people between the ages of 25 to 85.

Keep in mind that whole life insurance plans never go up and premium coverage never cancels due to age or health. In most cases, you’re fully covered the first day unless all you can qualify for what is called guaranteed issue. Remember your eligibility for coverage is subject to an application and consideration by the life insurance company. The rates you see here are from a highly ranked company.

Rates for Guaranteed Universal Life insurance for $25 a month