John Hancock Final Expense With Guaranteed Acceptance Review

You are probably reading this because you just finished watching a commercial for John Hancock, either on TV or possibly even on YouTube, or you’ve seen this ad in the past.

It sounds like a good product, right?

It might even sound like something you could potentially buy for:

- Yourself

- Your Mom or Dad,

- Your Grown Child, or

- Your Siblings

But you’re wondering if it would be the right kind of plan for your specific needs.

If you are wanting to get more information to determine if this is something that makes sense for you and your family’s life insurance goals, you’ve come to the right place!

This article will provide a quick overview of the product so you can decide for yourself if the John Hancock Guaranteed Acceptance plan is right for you.

And if it’s not the right fit, I’m also going to share some alternative options to consider.

Quick Navigation Article Links

What Does John Hancock Final Expense Insurance Do?

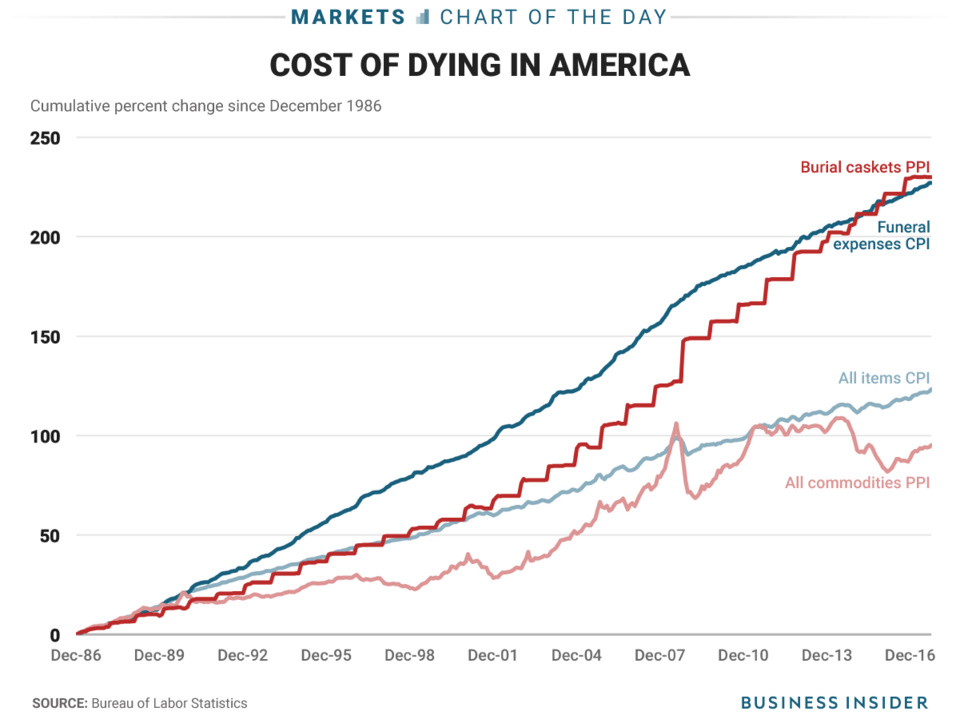

This product is really designed for people who are looking to pay for funeral or burial expenses.

The John Hancock life insurance website specifically talks about burial costs between $8,000 and $9,000.

Also, it discusses how it’s guaranteed acceptance insurance program can help you pay for those expenses.

While it’s true this specific type of insurance can cover final expenses, there is some “fine print” to cover regarding the amount of money you may receive. More on that soon!

How Do You Get John Hancock Final Expense Insurance?

John Hancock TV commercials talk about “covering final expenses so that your loved ones don’t have to.”

If you are reading this article, you’ve probably started to seriously think about final expense life insurance and wonder how the whole sign up process works.

If you do a Google search for:

- John Hancock final expense, or,

- John Hancock guaranteed acceptance life insurance,

You’ll find the sign-up page where you submit your personal information.

If you fill the form out, a representative will call you and give you all the information you want to know about how the plan works.

This is typically how a lot of life insurance companies work.

Once they have your information, they will contact you to go over the specifics.

The Pros Of John Hancock Final Expense

Bottom line, John Hancock is a great company.

They have been around a very long time with generally very positive feedback.

Some pros of this particular product include:

- No health questions asked.

- No medical questions or exams.

- Guaranteed acceptance, meaning no matter your health you’re approved as long as you’re within the age range.

- The payments never go up.

- The coverage never goes down for as long as you live.

- Designed to give you peace of mind without having an agent come to the home, as you can do it over the phone or online.

- Coverage can start as low as $13.40 a month, but there is fine print involved here, which we will get to in a moment.

The Cons Of John Hancock Final Expense

Based on the pros, John Hancock’s burial insurance program doesn’t sound too shabby, right?

As I said earlier, there’s always the fine print to consider.

Reading the bottom of the John Hancock Final Expense page, it says:

Benefits are limited in the first two policy years (110% of premiums paid). However, full benefits in the first two years would be paid if accidental death were to occur.

What does this mean?

It’s specifically saying if you die within the first first 24 months of your policy, what you paid in is refunded to you plus 10% extra interest. That’s 100% of the premiums plus 10%.

In other words, let’s say you die in the 10th month of your program.

You have a plan for $10,000 that costs you $50 a month.

That means you would get back your monthly payments (10 months multiplied by $50 = $500, plus 10% interest.)

Bottom line, in this example, your beneficiary doesn’t get $10,000 if you die from natural causes in month 10.

She only gets back what you paid in plus an additional 10%. In this case, it’d only be $550.

Yikes!

Essentially, this means you do not have coverage for the first two years, unless you die from an accidental death.

Do you know when your final day is gonna be?

There are obviously some problems with this, right?

What happens if you die earlier than expected?

Of course, none of us think we’ll die earlier, but how many people do you know that suddenly died without any sort of a warning?

You know, maybe your friend or relative had a stroke, cancer, a massive heartattack.

Death happens unexpectedly for a lot of people, even those who might consider themselves in good health.

The Real Problem With This Type Of Coverage?

The problem with John Hancock’s guaranteed acceptance program?

No peace of mind for the first two years!

Sure. It’s fine once you get past the first two years…

But what if you don’t?

You may be wondering…

“Are there alternatives that are better than John Hancock’s final expense program?”

Thankfully for most, the answer is YES!

But before we discuss that, I want to address another really important point…

Not-So-Healthy People May Qualify More Easily Than You’d Think

There’s a big misconception with final expense insurance.

A lot of people think when they look at burial insurance or final expense insurance that even if they have only a few minor health problems, they probably won’t qualify for final expense coverage.

That is not the case.

And it is certainly not worth waiting two years to make sure you have coverage… just because you think you won’t qualify for anything else.

There are a lot of companies out there that offer the enticement of guaranteed acceptance – AARP, Colonial Penn, and many others offer this type of “no-questions asked” insurance.

But the concept of having to wait two years before you have coverage does NOT fare well with me as a life insurance professional.

Why?

I have access to all sorts of companies that even people in ill health may be able to qualify for with first day full natural death coverage.

I’ve insured all sorts of people with different health issues, from:

- the perfectly healthy to,

- people who have COPD, who’ve had a history of cancer, heart problems, diabetes, and neurological problems like lupus, or,

- who are very old, even people up to age 90!

There are ways to get full coverage in most cases, where as the option that John Hancock and others offer you is not the best option because they’re force-feeding you one option.

Where you have one option, it’s likely you’re not getting the best option.

What’s The Solution?

This is where I invite you to check out what I have to offer.

I’m a broker for burial insurance and life insurance, much like the kind that John Hancock offers, with the exception I am not affiliated with only one company.

Instead, I’m affiliated with many. Which means I shop many companies to find you the best deal.

Depending on the state, I can work with up to 15 companies to offer you the best coverage for the best burial insurance quote available.

What my team is able to do is look at your health and then shop the major carriers to see who out there may be able to offer you first-day full coverage for natural death along with full accidental death coverage, too.

Many times we can do this at a much better price than is offered through companies like John Hancock and other burial insurance companies.

Get A Second Opinion!

Before you pull the trigger, even if you really love John Hancock and think they’re a great company, I would advise you to always get a second opinion.

There’s always the chance something better is out there!

It doesn’t cost you anything to do this, it only takes 10 minutes, and it may be the best decision you make.

The easiest way to find out if we are a good fit is to call us at 888-626-0439. You’ll either speak live with myself or you’ll speak with one of my team members.

We’ll collect information on you, talk about what you’re looking for and in five to 10 minutes we can give you a quote so you can see what your options are. There’s no pressure to buy either – the choice is up to you!

Otherwise, fill out the “Request A Quote” form on the side of your screen if you’re on a home computer. Or if you’re on a smartphone, click the arrow button at the top of the page to request a quote that way.

I hope you found this article useful! Thanks for reading!

Disclaimer: We are not in any way affiliated with John Hancock. In fact, we are a direct competitor of theirs. This article is our personal review of their agent sales career opportunity and our personal opinions of the company. If you are looking to contact John Hancock directly, call them at 1 (800) 829-6341.