10 Year Term Life Insurance Review

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Most likely you’re here today because you’ve decided purchasing a 10-year term insurance product is important.

Perhaps you have a young family and know life insurance is crucial in protecting them. Or maybe you’re a senior looking for term insurance to protect against outstanding financial obligations.

Either way, if either circumstance describes you, then you’ll want to continue reading.

In today’s article, I’ll be doing a “deep-dive” discussion, all about…

10-Year Term Life Insurance Reviews

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Here’s An Overview Of Today’s Topics:

Who Buys 10-Year Term Life Insurance?

In this section, I want to detail the most common backgrounds of people who decide to purchase a 10-year term life insurance program.

In this section, I want to detail the most common backgrounds of people who decide to purchase a 10-year term life insurance program.

Why? Because the more you understand the underlying reason why other people buy term insurance, the better you’ll clarify your own reasons why a 10-year term insurance policy is best for you.

Let’s get started.

Single people

Whether they have kids or not, single people commonly select 10-year term insurance to protect against financial loss if they pass away earlier than expected.

One reason single people without kids purchase term insurance is because they expect to have family and children soon. They recognize getting life insurance now saves them money on premium versus waiting later.

Single parents with kids buy term life insurance to give their children a future if they die suddenly. Life insurance proceeds can help pay college tuition and provide security to your children, even beyond the grave.

Married people

Married people concerned about replacing lost income and covering debt purchase 10 year term insurance.

While younger couples will opt for longer-term policies like 20-year term and 30-year term, older couples 50 years and older more commonly purchase shorter-length term policies like 10-year term insurance.

Coverage is cheaper, and for many, the main goal is protection until or slightly after retirement, so a shorter-length term policy does the job.

Moving up in your career

Have you had several good years of upward career mobility?

If your income is up, now is a good time to consider adding more life insurance.

If you’re like most people, your standard of living increased with your income gains. Perhaps you’ve bought a new home recently, and spend more monthly to care for your family’s needs.

To protect your family from losing out on lifestyle improvements, you need to add more life insurance to make up the difference.

No matter if you’re going through career advancements in your 30s, 40s, or 50s, it’s important to add more life insurance protect your loved ones if you pass away earlier than expected.

Of those who already owned life insurance, LIMRA discovered 1 out of 5 people feel they do not have enough coverage.

And it’s likely with a little analysis, the number who realize MORE life insurance is important would be WAY up.

Bottom line, protect your family’s future and add life insurance. A 10-year term life insurance policy is affordable and simple for many to qualify for.

3 Reasons Why People Buy A 10 Year Term Policy

While there are many reasons people buy 10-year term policies, I believe most will fit into 1 of 3 of the most common reasons.

The reason I’m highlighting these top 3 reasons is to help you clarify your personal life insurance goals, while solidifying in your mind that a 10-year term policy is right for you.

1. Replace income

Have you ever thought about what would happen if your family lost your income?

In most circumstances, the loss of a primary income earner has a financially-devastating impact for years on the survivors.

This excerpt of story from a 15-year old boy on LifeHappens.org truly epitomizes what life is like when you lose your father and do not have life insurance:

My dad didn’t have life insurance, and life after his death was a major financial struggle for my mom and me. My mom worked all the time just to pay the bills and hold on to the house that my dad built for us. Life was tough, and there was the constant threat of losing the house.

From an early age I learned to do without, and this soon became the norm. I worked hard in school and around the house to help alleviate some of the tremendous stress and burden on my mom. Even when I was very young, I could see how stressful and difficult life was for my mom, and I didn’t want her to have to worry about me too.

Pretty sad case. Unfortunately, this story is all too-common among people who decide not to purchase life insurance.

The good news is that a 10-year term insurance policy can eliminate this sad story from happening to your family, while offering relatively less expensive coverage than other term insurance options.

2. Protect your retirement plan

Another popular reason why people purchase a 10 year term life insurance plan is to protect their retirement.

Those who purchase a 10 year term plan usually are in their 40s, 50s, or nearing retirement. They want an extra layer of life insurance protection to fund their family’s retirement goals if death happens earlier than expected.

3. Cover your mortgage, final expenses

Do you owe money on a mortgage? Are you worried about final expenses like funeral expenses?

People purchase 10-year term insurance to cover these obligations.

Did you know that death is one of the leading causes of foreclosure in America? A life insurance plan can make all the difference.

Commonly, I see older people in their 50s and above purchase term life insurance for this reason. They want to cover the final years of their mortgage, and also account for any final expenses upon their passing.

Bottom line, a 10 year term plan eliminates debts, mortgages, and final expenses if you die while the policy is in force. If you worry about leaving these obligations to your family, consider purchasing a 10-year term insurance policy.

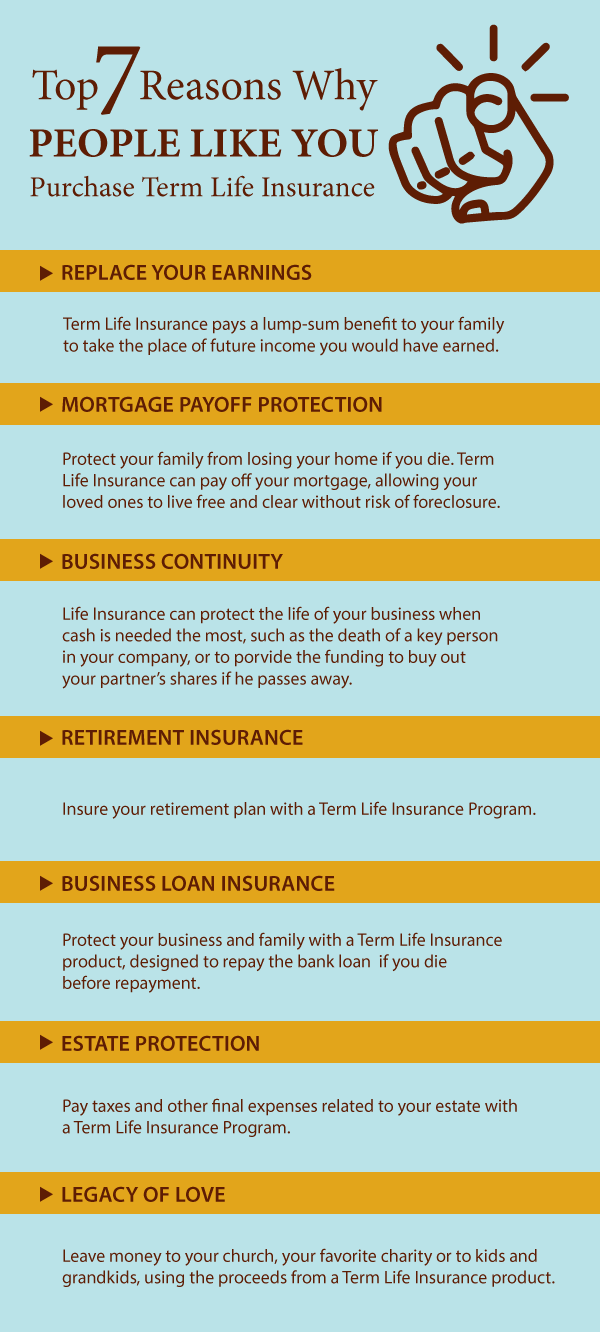

7 Reasons Why Most People Purchase Term Life Insurance

1.Affordable

If you are on a restrictive budget, you are not alone. Many people purchase term insurance because they can only pay a certain amount for their life insurance each month. Term insurance is the most affordable of all the insurance types. It is often less expensive than whole life insurance or universal life insurance, giving people the chance to get life insurance that is well within their budget.

2.Income replacement

Those who worry about what will happen to their family’s income should they pass away often turn to term insurance. Many financial expert suggest term insurance as a way to cover expenses and your income. To start they recommend having 10 times your annual earnings in coverage.

3.Retirement funding

If you are regularly paying into a retirement fund, have you ever thought about what would happen if you passed away unexpectedly? Term insurance is a great way to cover contributions to a 401K or other retirement savings plan.

4.Take care of loved ones

Most people who buy term life insurance have family they love and want to protect financially. If you don’t want to risk leaving a burden on your family, term life insurance can help cover the income loss your death would impose.

5.Custom length

Every person’s situation is different. That’s why term insurance is so attractive – it can be customized to the specific length of time that you require coverage. For example, if you have 20 years left on your mortgage you can get a 20 year term plan to cover that expense should you die before the house is paid off.

6.Simple insurance

For many, life insurance can be confusing. People simply want something that meets their needs and nothing more. Term insurance does not have any extras added to it that could potentially drive up the cost. The monthly payment remains the same. It is simply life insurance coverage for a set period of time.

7.Exams are optional

With the competitive nature of life insurance, many companies now offer coverage without an exam. This is good news for those that want to skip the visit from a doctor or have a fear of needles.

Pros Of 10 Year Term Life Insurance

Let’s spend time summarizing how a 10-year term life insurance policy would benefit you the most.

Length of time

If your insurance goals match a 10 year time period, then a 10 year term life insurance is the way to go.

Examples where 10-year term makes sense include:

- You’re in your 50s or 60s (or beyond – you can get term life insurance as a senior) and you’re concerned about income-replacement or covering obligations.

- You’re a business owner, and want to cover a key man or fund a buy-sell agreement with your partner.

- To collateralize a bank loan.

Convertibility

Have you ever considering that you still may need life insurance after the 10-year term is up?

If so, many plans offer conversion options that turn a portion of your term insurance into permanent life insurance that doesn’t cancel with age.

Many people arrive late in life with less money than they expected. Covering obligations like burial costs become a real concern.

This is where converting your 10-year term insurance plan to permanent coverage makes sense. You can keep enough coverage to pay your final expenses, all without having to pass medical underwriting.

That’s right. The neat thing about converting term insurance is that you do not have to submit yourself to health questions. It is guaranteed!

If you think you may need coverage after your 10-year term insurance plan ends, make sure you ask about getting a conversion option on your policy.

Additional riders

Ten year term insurance policies offer a variety of add-ons, or riders, to enhance the value of your policy.

For example, you can add accidental coverage to increase your payout if you die by accidental means.

You can add a disability premium waiver rider, which forgoes premium payments as long as you are sick or ill and cannot work.

You can also add critical illness riders which pay a cash benefit if diagnosed with a stroke or cancer. You can even get your premiums refunded after a period of time using a a return of premium rider.

Make sure you ask about these riders if interested.

Affordability

A 10 year term life insurance plans generally less expensive compared to longer term insurance policies.

If you are budget-conscious and worried about spending too much, consider a 10 year term plan to get some coverage on the books.

Drawbacks Of 10-Year Term Insurance

I’ve spent time detailing the benefits of a 10 year term life insurance plan, but there are occasions when this plan does not make sense.

In this section, I address 4 reasons why a 10 year term life insurance plan would not make sense.

1. The length of time

One of the biggest drawbacks to a 10 year term life insurance plan is that it only lasts 10 years.

It’s likely that if you’ll need life insurance beyond 10 years, that a 10-year term insurance plan is not the best choice.

For example, let’s say you just took out at mortgage and owe payments for the next 30 years. You decide to buy a 10-year term insurance policy.

While SOME coverage is better than NO coverage, you are short 20 more years of covering your mortgage payments.

Bottom line, if 10 years of term insurance coverage is not enough, consider longer term policies, such as 15-year term, 20-year term, or 30 year term life insurance to increase your term coverage length.

2. Premium concerns

Are you concerned about spending too much money on life insurance?

One reason you may pass on purchasing term insurance is that you’re worried it costs too much.

Here’s a few ideas on to lower your 10-year term life insurance premium:

- Work with a broker. A broker can shop your case with multiple life insurance companies to see who will offer the best price and coverage. Many times you can save hundreds of dollars this way versus buying from a one-trick pony agent that offers minimal choice.

- Start with less coverage. One quick way to lower your cost is to lower your coverage amount. Remember, some life insurance is better than no life insurance. You can always add more later as your budget allows.

3. Term Insurance Not An Option

There are circumstances where you may not have access to a 10-year term insurance policy.

Typically this is because you’re too old or your health doesn’t qualify.

No worries! There are other types of life insurance products available.

Consider looking at guaranteed universal life insurance coverage and final expense burial insurance. Both plans allow you to start coverage up to 85 years old, with some burial insurance plans allowing coverage start dates all the way to 90 years old!

For those with serious health issues, there are guaranteed acceptance life insurance policies that ask no health questions and guarantee approval if you’re are between 40 and 85 years old.

4. You’ll probably outlive the policy

The odds are high you’ll outlive a 10-year term policy.

This is why you must consider your reasons for purchasing life insurance.

It’s important to discuss with your agent what your insurance goals. And if your goals require a permanent solution, a temporary solution like term insurance isn’t the best answer.

For example, if you need a pension income replacement plan in your retirement years for your spouse, a 10 year term won’t solve the problem if you outlive the policy.

Thoughts On Getting The Best Life Insurance Policy For You

As we get close to wrapping up, let’s discuss 5 best strategies to getting a 10-year term life insurance policy that fulfills your needs.

1. Laddering strategy versus once policy

Have you heard of the laddering strategy to purchasing life insurance?

Here’s how it works.

Instead of purchasing one longer-term term life policy, you purchase multiple policies of different lengths to better reflect what you owe as your principal balance decreases.

What’s the benefit of this approach? Simply put, you could potentially save thousands of dollars in premiums spent on a life insurance policy that better reflects what you truly owe.

Here’s why I don’t like the strategy.

First, it is very difficult to plan over very long periods of time. All of us will run into unexpected circumstances in our life. Who’s to say you won’t need more coverage later in your life?

And even if you don’t, wouldn’t you agree it was worth the extra expenditure to ensure against the worst case scenario?

There are things we can foresee, and others that we can’t. Life insurance is about risk management. That’s why I believe it is in your best interest to purchase a life insurance plan for the longest length possible.

Moral of the story… purchase the life insurance plan that best reflects your goals and gives you maximal peace of mind.

2. Consider Universal Life Plan

If you’re an older individual, you may need longer amounts of coverage than a 10-year term insurance product can provide.

However, as you age into your 60s and 70s, there are very few term insurance options that last longer than 10 to 15 years.

What do you do if you need coverage for longer periods of time?

Consider purchasing a universal life insurance plan.

Universal life insurance can extend coverage beyond the normal term insurance length, allowing for longer-term coverage protection.

Keep in mind it is important to properly design a universal life insurance plan to make sure it lasts the entire time you need it. There are many seniors who took out universal life insurance years ago who are losing it well into their retirement due to skyrocketing premiums.

The good news is there are universal life insurance plans that include a no-lapse rider. Basically, the plan cannot cancel as long as you pay premiums in a timely manner.

Give us a call at 888-626-0439 and we’ll tell you more.

3. Permanent Life Insurance product

What if you’re scared about outliving your 10-year term insurance?

If your life insurance goals require a permanent solution like covering funeral expenses, consider purchasing a final expense life insurance policy.

4. Exam or no exam?

Are you wondering if you have to take an exam to qualify for a 10-year term life insurance policy?

If so, let’s answer that now.

Bottom line, it depends.

Some companies will require it. Others will not.

In most cases, whether or not you must complete an exam depends on how much coverage you purchase, and how old you are.

However, there are circumstances where taking an exam when it’s optional gives you a better chance for a lower premium.

You see, life insurance underwriters are more comfortable offering the most competitive premiums when they have up-to-date information on applicants.

Therefore, if you’re willing to take an exam when optional, the higher the likelihood you’ll get the lowest premiums if you’re in tip-top shape.

What if you’re not in good health?

Assuming your health is not so bad to eliminate the chances of qualifying for a 10-year term insurance program, a non-medical term policy might be your best bet.

With a no-exam policy, the life insurance company determines your eligibility for coverage based on your medical records.

In exchange, you get a faster turn-around on a decision and avoid doing an exam altogether.

The biggest downside to a no-exam policy is the rate may be higher than a fully underwritten policy (assuming you’re healthy).

For example, my current term life insurance plan required an exam. Compared to what I’d pay for a non-exam term policy, I am saving around $1000 a year.

Bottom line, if you’re in good shape, consider taking an exam. If you’re not in good shape or hate exams, opt for the non-medical application process instead.

5. Work with a broker, not a captive agent

It’s always important that in your process of looking for life insurance that you ask for help from a broker.

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

A broker works with a variety of life insurance companies. They offer the best chance for the most competitively-priced 10-year term life insurance program.

In many cases, the offer you receive is far superior than what your car insurance agent would offer. Why? Because they only offer one option for life insurance, which may not be the most competitive.

Also, car insurance companies offering life insurance are notoriously picky with underwriting. This means you may end up with a decline while another company would take you.

Work with a broker like us here at Buy Life Insurance for Burial. We’re able to help you shop around and give you the best price and coverage depending on your health and age.

I hope that you found this article enjoyable and that it has prompted you to take action. Whether you want to fund a retirement, cover mortgage payments, or simply leave a legacy to a favorite family member or charity, term insurance is a great way to do just that.

By calling us direct at 888 626-0439 you can get a no obligation quote and start the process today. We are here to help and would be happy to discuss your term insurance options with you. It takes less than 10 minutes and is absolutely free!

You can also send us a message here and we will be happy to get in touch. Let us know what you are interested in and we will contact you within the next 24 business hours with more specific information.

Thanks for reading and we look forward to hearing from you.

Chart examples for 10 year Term Life Insurance

What follows below are 10 year term life insurance examples for different price coverage amounts from age 25 all the way up to age 75. I’ve also included some universal life plans to age 100 above the ages that we cannot get term life insurance plans on the books anymore.

$100000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-smoker |

|---|---|---|---|---|

| 25 | $17.37 | $8.49 | $15.05 | $6.88 |

| 26 | $17.37 | $8.49 | $15.14 | $6.88 |

| 27 | $17.37 | $8.49 | $15.31 | $6.88 |

| 28 | $17.46 | $8.49 | $15.39 | $6.88 |

| 29 | $17.46 | $8.49 | $15.57 | $6.88 |

| 30 | $17.46 | $8.49 | $15.65 | $6.88 |

| 31 | $18.06 | $8.54 | $16.08 | $6.88 |

| 32 | $18.58 | $8.59 | $16.60 | $6.89 |

| 33 | $19.18 | $8.60 | $17.03 | $7.05 |

| 34 | $19.52 | $8.60 | $17.54 | $7.05 |

| 35 | $19.61 | $8.60 | $17.97 | $7.05 |

| 36 | $20.47 | $8.77 | $18.74 | $7.78 |

| 37 | $21.41 | $9.03 | $19.47 | $8.00 |

| 38 | $22.45 | $9.29 | $20.29 | $8.00 |

| 39 | $23.56 | $9.47 | $21.18 | $8.00 |

| 40 | $24.77 | $9.63 | $22.09 | $8.00 |

| 41 | $26.06 | $10.04 | $23.16 | $9.05 |

| 42 | $27.52 | $10.43 | $24.27 | $9.05 |

| 43 | $29.07 | $10.86 | $25.64 | $9.05 |

| 44 | $30.79 | $11.20 | $27.09 | $9.49 |

| 45 | $32.68 | $11.20 | $28.59 | $9.96 |

| 46 | $34.92 | $12.35 | $30.26 | $10.41 |

| 47 | $37.32 | $12.95 | $32.05 | $10.89 |

| 48 | $40.08 | $13.59 | $34.11 | $11.42 |

| 49 | $43.09 | $14.28 | $36.23 | $12.00 |

| 50 | $45.80 | $15.03 | $38.49 | $12.63 |

| 51 | $49.83 | $15.99 | $41.17 | $13.39 |

| 52 | $54.27 | $17.03 | $44.07 | $14.21 |

| 53 | $58.91 | $18.18 | $47.19 | $15.10 |

| 54 | $64.16 | $19.44 | $50.57 | $16.06 |

| 55 | $70.00 | $20.81 | $54.22 | $17.11 |

| 56 | $75.25 | $22.51 | $58.31 | $18.17 |

| 57 | $81.10 | $24.40 | $62.74 | $19.31 |

| 58 | $90.35 | $26.48 | $67.53 | $21.86 |

| 59 | $98.29 | $28.79 | $72.73 | $23.55 |

| 60 | $106.97 | $31.35 | $78.36 | $25.63 |

| 61 | $116.09 | $34.73 | $85.09 | $27.57 |

| 62 | $126.02 | $38.55 | $92.45 | $29.70 |

| 63 | $131.84 | $41.84 | $125.52 | $41.84 |

| 64 | $143.96 | $47.02 | $135.70 | $46.96 |

| 65 | $157.47 | $52.58 | $142.38 | $46.96 |

| 66 | $173.03 | $58.54 | $165.70 | $58.54 |

| 67 | $190.58 | $64.77 | $182.54 | $64.77 |

| 68 | $210.27 | $71.47 | $185.11 | $68.17 |

| 69 | $232.63 | $79.03 | $206.70 | $75.92 |

| 70 | $257.91 | $87.54 | $230.87 | $75.92 |

| 71 | $286.55 | $97.78 | $257.96 | $94.43 |

| 72 | $319.15 | $109.31 | $288.23 | $103.20 |

| 73 | $356.38 | $121.19 | $353.24 | $121.78 |

| 74 | $398.78 | $138.03 | $398.78 | $132.35 |

| 75 | $447.46 | $155.59 | $402.82 | $145.94 |

$250000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $28.38 | $12.81 | $21.93 | $8.60 |

| 26 | $28.59 | $12.81 | $22.36 | $8.62 |

| 27 | $28.59 | $12.81 | $22.57 | $8.66 |

| 28 | $28.81 | $12.81 | $23.00 | $8.70 |

| 29 | $28.81 | $12.81 | $23.22 | $8.74 |

| 30 | $29.02 | $12.81 | $23.65 | $8.78 |

| 31 | $29.67 | $12.81 | $24.29 | $8.82 |

| 32 | $30.31 | $12.81 | $24.72 | $8.86 |

| 33 | $30.74 | $12.81 | $25.37 | $8.86 |

| 34 | $31.39 | $12.81 | $25.80 | $8.86 |

| 35 | $32.03 | $12.81 | $26.44 | $8.86 |

| 36 | $35.47 | $13.52 | $28.81 | $10.22 |

| 37 | $38.89 | $14.19 | $30.90 | $10.53 |

| 38 | $41.28 | $14.19 | $32.92 | $11.18 |

| 39 | $44.07 | $14.77 | $35.02 | $11.61 |

| 40 | $46.87 | $15.20 | $37.28 | $12.25 |

| 41 | $50.09 | $15.93 | $40.14 | $12.25 |

| 42 | $53.75 | $16.79 | $43.25 | $13.54 |

| 43 | $57.83 | $17.74 | $46.64 | $13.76 |

| 44 | $62.13 | $18.83 | $50.33 | $14.77 |

| 45 | $67.08 | $20.25 | $54.35 | $15.69 |

| 46 | $72.02 | $21.48 | $57.98 | $16.55 |

| 47 | $77.40 | $22.77 | $61.68 | $17.41 |

| 48 | $83.42 | $24.28 | $65.95 | $19.63 |

| 49 | $89.87 | $25.73 | $70.59 | $21.05 |

| 50 | $97.10 | $27.50 | $75.43 | $22.47 |

| 51 | $105.44 | $29.86 | $80.70 | $23.89 |

| 52 | $114.53 | $32.49 | $86.26 | $25.77 |

| 53 | $124.44 | $34.76 | $93.31 | $29.15 |

| 54 | $135.25 | $38.08 | $100.37 | $31.30 |

| 55 | $147.04 | $41.80 | $108.15 | $33.67 |

| 56 | $160.00 | $44.50 | $118.03 | $34.83 |

| 57 | $173.90 | $47.54 | $127.28 | $37.62 |

| 58 | $207.90 | $53.96 | $137.60 | $46.91 |

| 59 | $228.76 | $59.77 | $149.21 | $51.13 |

| 60 | $251.55 | $65.92 | $161.89 | $56.33 |

| 61 | $271.97 | $73.23 | $176.08 | $61.19 |

| 62 | $294.12 | $81.40 | $191.99 | $66.52 |

| 63 | $306.04 | $88.56 | $279.20 | $88.56 |

| 64 | $337.71 | $99.54 | $314.24 | $97.39 |

| 65 | $372.71 | $109.65 | $348.21 | $109.65 |

| 66 | $404.75 | $124.83 | $379.60 | $120.83 |

| 67 | $438.52 | $136.65 | $409.49 | $136.09 |

| 68 | $480.41 | $148.56 | $434.73 | $147.36 |

| 69 | $524.05 | $164.80 | $478.50 | $164.80 |

| 70 | $570.76 | $184.04 | $522.45 | $182.05 |

| 71 | $633.17 | $209.39 | $615.97 | $202.10 |

| 72 | $695.52 | $238.83 | $627.07 | $222.95 |

| 73 | $759.38 | $273.61 | $627.07 | $243.59 |

| 74 | $829.25 | $310.37 | $678.50 | $275.69 |

| 75 | $980.68 | $357.11 | $786.25 | $357.11 |

$500000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $50.31 | $16.77 | $38.70 | $11.95 |

| 26 | $52.03 | $16.77 | $39.56 | $11.95 |

| 27 | $52.03 | $16.77 | $39.99 | $11.95 |

| 28 | $52.03 | $16.85 | $40.60 | $11.95 |

| 29 | $52.03 | $16.87 | $40.85 | $11.95 |

| 30 | $52.03 | $16.87 | $40.85 | $11.95 |

| 31 | $54.18 | $16.87 | $43.43 | $12.10 |

| 32 | $55.47 | $16.87 | $44.26 | $12.19 |

| 33 | $55.90 | $16.87 | $45.07 | $14.19 |

| 34 | $56.33 | $16.87 | $45.89 | $14.19 |

| 35 | $56.33 | $17.48 | $46.50 | $14.62 |

| 36 | $61.06 | $18.42 | $49.07 | $15.05 |

| 37 | $65.36 | $19.50 | $52.49 | $15.91 |

| 38 | $70.09 | $22.14 | $56.33 | $16.77 |

| 39 | $75.03 | $23.65 | $60.18 | $17.63 |

| 40 | $79.98 | $24.94 | $64.88 | $18.49 |

| 41 | $87.43 | $25.80 | $70.09 | $19.78 |

| 42 | $95.03 | $26.66 | $76.44 | $21.07 |

| 43 | $103.20 | $28.81 | $80.70 | $22.12 |

| 44 | $112.23 | $30.53 | $87.11 | $23.56 |

| 45 | $122.55 | $32.25 | $94.38 | $25.41 |

| 46 | $132.01 | $36.12 | $101.22 | $27.15 |

| 47 | $142.76 | $39.13 | $109.34 | $29.03 |

| 48 | $154.80 | $39.13 | $118.75 | $32.46 |

| 49 | $167.70 | $43.34 | $129.01 | $34.61 |

| 50 | $182.32 | $47.64 | $139.81 | $37.19 |

| 51 | $198.66 | $51.38 | $148.67 | $40.76 |

| 52 | $217.15 | $56.67 | $157.12 | $45.06 |

| 53 | $237.36 | $57.16 | $166.41 | $50.22 |

| 54 | $259.96 | $63.10 | $178.02 | $55.04 |

| 55 | $283.04 | $70.26 | $189.63 | $57.62 |

| 56 | $307.28 | $76.69 | $209.32 | $61.92 |

| 57 | $332.50 | $84.11 | $228.97 | $66.65 |

| 58 | $364.13 | $95.46 | $255.20 | $75.59 |

| 59 | $397.05 | $105.35 | $281.66 | $81.18 |

| 60 | $434.67 | $116.53 | $309.81 | $87.63 |

| 61 | $477.42 | $129.43 | $336.31 | $111.47 |

| 62 | $525.39 | $144.05 | $362.27 | $123.62 |

| 63 | $578.40 | $156.61 | $511.27 | $156.61 |

| 64 | $635.68 | $175.47 | $582.22 | $172.00 |

| 65 | $716.11 | $196.72 | $649.73 | $187.05 |

| 66 | $782.74 | $218.18 | $710.14 | $216.29 |

| 67 | $850.71 | $237.25 | $710.14 | $237.25 |

| 68 | $943.40 | $266.73 | $710.14 | $250.99 |

| 69 | $1034.53 | $298.05 | $794.85 | $297.56 |

| 70 | $1136.16 | $333.25 | $889.45 | $333.25 |

| 71 | $1257.61 | $378.21 | $995.66 | $369.37 |

| 72 | $1385.89 | $432.46 | $1114.34 | $405.92 |

| 73 | $1511.45 | $480.93 | $1247.21 | $458.38 |

| 74 | $1651.20 | $557.45 | $1351.83 | $522.02 |

| 75 | $1903.61 | $647.26 | $1549.29 | $538.36 |

$1000000 Banner Term Insurance Monthly Rate Chart – 10 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $85.14 | $31.99 | $67.08 | $18.29 |

| 26 | $85.14 | $31.99 | $68.82 | $18.29 |

| 27 | $85.14 | $31.99 | $70.53 | $18.29 |

| 28 | $85.14 | $31.99 | $70.53 | $19.19 |

| 29 | $85.14 | $31.99 | $72.24 | $19.19 |

| 30 | $85.14 | $31.99 | $72.24 | $19.26 |

| 31 | $87.72 | $32.42 | $75.68 | $19.33 |

| 32 | $90.30 | $32.68 | $77.40 | $19.40 |

| 33 | $92.88 | $32.68 | $77.40 | $24.51 |

| 34 | $95.46 | $33.80 | $79.12 | $25.37 |

| 35 | $98.04 | $34.57 | $81.70 | $25.37 |

| 36 | $106.64 | $34.57 | $87.54 | $25.37 |

| 37 | $116.10 | $34.74 | $94.38 | $27.09 |

| 38 | $124.70 | $41.71 | $102.33 | $28.81 |

| 39 | $134.16 | $44.29 | $109.77 | $30.53 |

| 40 | $142.76 | $47.73 | $119.18 | $33.11 |

| 41 | $158.53 | $51.77 | $128.58 | $35.69 |

| 42 | $174.50 | $51.77 | $141.04 | $36.98 |

| 43 | $192.14 | $51.77 | $153.08 | $40.85 |

| 44 | $211.60 | $60.03 | $165.97 | $43.43 |

| 45 | $233.10 | $66.65 | $180.57 | $46.87 |

| 46 | $252.75 | $71.81 | $195.18 | $50.31 |

| 47 | $274.08 | $77.83 | $209.41 | $54.61 |

| 48 | $297.25 | $79.12 | $220.92 | $58.91 |

| 49 | $322.42 | $86.00 | $237.17 | $62.35 |

| 50 | $349.76 | $92.88 | $255.98 | $69.23 |

| 51 | $383.11 | $103.20 | $273.08 | $75.25 |

| 52 | $419.69 | $106.21 | $291.89 | $81.27 |

| 53 | $462.25 | $106.21 | $314.97 | $93.31 |

| 54 | $503.81 | $118.25 | $339.77 | $104.40 |

| 55 | $552.06 | $134.59 | $367.98 | $115.58 |

| 56 | $600.98 | $147.49 | $396.20 | $123.32 |

| 57 | $654.26 | $161.25 | $428.69 | $131.92 |

| 58 | $712.32 | $186.19 | $502.67 | $142.24 |

| 59 | $775.56 | $205.11 | $568.29 | $154.28 |

| 60 | $844.46 | $227.38 | $632.31 | $166.32 |

| 61 | $927.72 | $254.99 | $672.95 | $229.62 |

| 62 | $1019.23 | $286.81 | $711.99 | $259.72 |

| 63 | $1041.72 | $303.51 | $962.34 | $288.96 |

| 64 | $1155.44 | $340.90 | $1062.10 | $319.06 |

| 65 | $1285.40 | $384.68 | $1152.40 | $349.16 |

| 66 | $1433.31 | $418.30 | $1313.22 | $398.70 |

| 67 | $1601.75 | $458.90 | $1474.04 | $398.70 |

| 68 | $1785.79 | $534.92 | $1612.29 | $398.70 |

| 69 | $1958.65 | $598.99 | $1781.92 | $471.19 |

| 70 | $2151.29 | $674.67 | $1956.50 | $558.40 |

| 71 | $2367.15 | $762.82 | $2201.17 | $632.62 |

| 72 | $2608.81 | $882.36 | $2416.26 | $707.78 |

| 73 | $2880.57 | $1010.07 | $2416.26 | $760.24 |

| 74 | $3185.21 | $1130.47 | $2761.67 | $822.37 |

| 75 | $3488.73 | $1535.93 | $3093.42 | $1234.53 |