The Insider’s Guide to Buying Life Insurance for Your Grandchildren

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

In This Article I’m Going To Be Specifically Discussing Strategies For Purchasing Life Insurance To Insure Your Grandchildren

Most likely you’re reading this article today because you’ve seen all sorts of advertisements displayed by Gerber Life Insurance, Globe Life Insurance, and other companies that talk about different options to cover your grandchildren with life insurance.

Perhaps you have been doing your own research to figure out which kind of program would best fit your goals and you want to know what your options might be.

If this describes your circumstances, then this article will be perfect for you because we’re going to go into detail about all the different aspects of life insurance for grandchildren so that you’ll have a better understanding of what your options are and whether or not getting life insurance for a grandchild is truly a good idea.

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Specifically We’ll Discuss Some Of The Following Topics:

- How Does Coverage Work?

- Why Should People Consider Buying Coverage For Their Grandchildren?

- What Are The Different Types Of Products Available And How Much Coverage Should You Get?

- Coverage Without Parental Consent?

- How Much Medical Underwriting Is Necessary?

How does coverage work?

How does life insurance for your grandchildren work?

Life insurance coverage for grandchildren works in a similar way to how normal life insurance coverage works for adults.

Simply put, one takes out an application with a life insurance company, applies to get coverage, and in exchange the life insurance company requests medical records to determine insurability.

Based on the outcome, the policy is issued to cover the grandchild for however much the grandparent decides. As we’ll discuss momentarily, there are different kinds approaches with different kinds of insurance to accomplish your goal. But first, let’s talk about the reasons why grandparents decide to insure their grandkids.

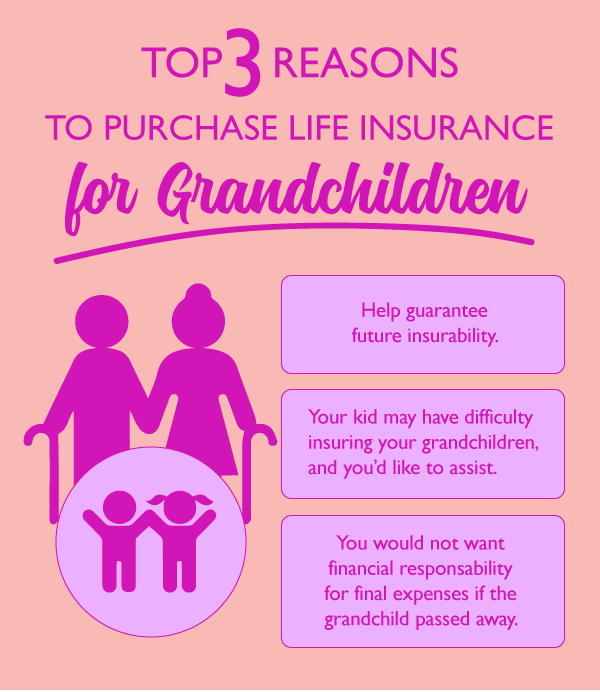

Why should people consider buying coverage for their grandchildren?

There are a number of reasons why grandparents might consider insuring their grandchildren. One of the best things about ensuring grandchildren is that in most cases children tend to be pretty healthy. They don’t take medications, nor have they lived long enough to suffer from chronic diseases.

In most cases getting a grandchild insured is typically an easy process. Let’s explore some of these factors.

Help guarantee future insurability

Insuring your grandchild may help guarantee their future insurability. Whether you buy a whole life insurance plan that’s designed never to cancel due to age or health, or if you pick up an additional rider on your existing coverage or new life insurance policy that grants them privileges to extend their coverage and add to it without evidence of insurability, this is a win-win situation.

In the future your grandkids may find it more difficult to get or pay for coverage due to disease or illness, but if you purchase insurance for them when they are young they will already have something in place.

Economic protection

If the grandchild were to pass away, insurance acts as an extra protection to cover expenses.

Maybe you feel that your grandchildren need extra protection and don’t necessarily get enough coverage, or any coverage, from their existing parents. Having insurance in place gives you the peace of mind that your grandchild will be covered.

Buying a life insurance plan on your grandchildren is fairly inexpensive and it’s a great way to get more protection. It takes care of things such as paying for final expenses, guaranteeing insureability at future dates. It can also help an individual design a plan in which they can accumulate cash value and have access to that plan to pay for things such as college, student debt, down payment on a house or even help them get started in their career.

Children at risk

One of the reasons you may want to buy life insurance for your grandchildren is that they might live in a high crime area. I know a lot of people that live in areas that are known nationally for being high violent crime areas and children are no exception to being exposed to this kind of violence.

Having life insurance coverage in some ways get you some level of peace of mind in knowing that there’s coverage in place to protect against the worst thing happening.

Grandparents who are primary caregivers

Another reason why grandparents buy life insurance for their grandkids is because they are the grandkids primary caregivers.

Whether the parent is in the picture or not, as a grandparent you may encounter a situation where your grandkids are not going to be insured unless you insure them.

Maybe the parents have been recently divorced. Maybe they don’t have a job or don’t work, and you know if the kids were to die from some unexpected circumstance that the price the parents would pay for the burial would roll up to you. This is a good reason to own life insurance on your grandkids.

Potential to increase in value

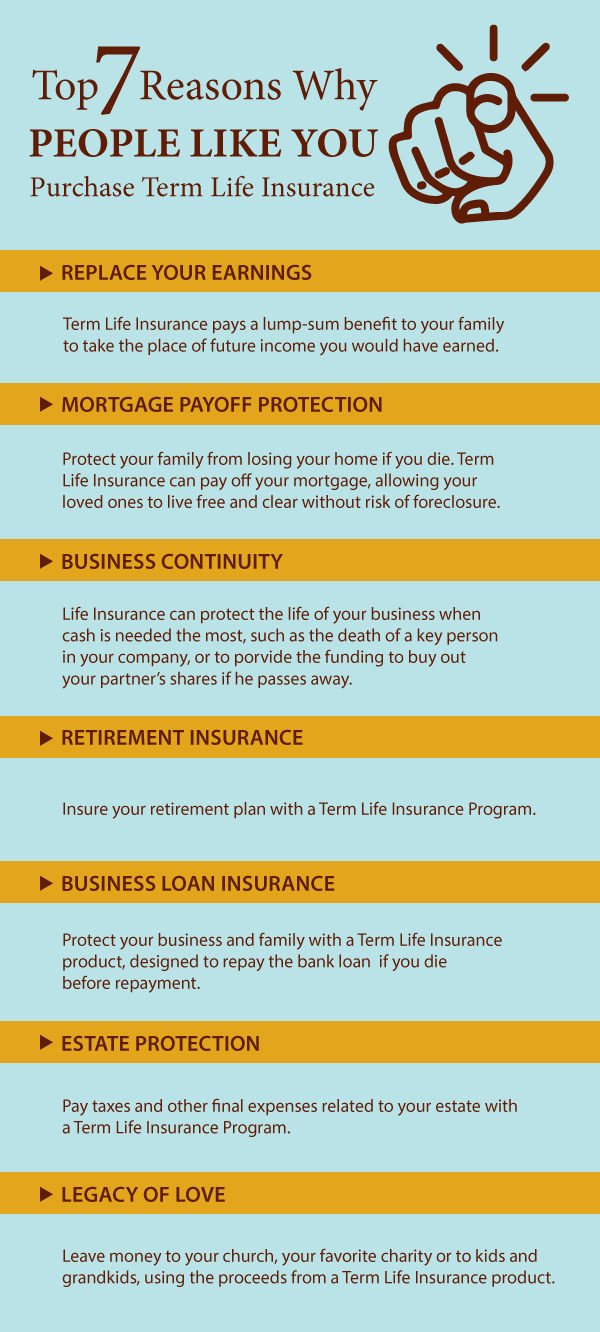

One reason that some people buy a life insurance policy is to get access to cash value. Many types of plans that we’ll talk about, such as whole life insurance plans or the index universal life plans for children, allow for a cash value accumulation vehicle that can be used towards paying for things such as college loans, living expenses later in life, as well as any other things. Insurance can act almost like a bank account without interest or without necessarily having to file a loan.

How much life insurance coverage should you get?

The amount of life insurance coverage you get should depend on ultimately what kind of goals you want to accomplish in getting life insurance on your grandchildren.

If your main goal is just to get enough protection to take care of final expenses, some amount of $30,000 or less will probably be sufficient. This payment would be paid to the beneficiary on the policy upon the child’s passing, and those monies would be used to pay for final expenses such as the burial or cremation costs or any sort of additional expenses surrounding the child such as medical debt.

It’s unusual to get a much larger amount of death benefit coverage just because life insurance coverage typically requires evidence of an economic loss if the particular person were to pass away.

For example, if a worker who brings home $100,000 a year in income were to pass away and leaves behind a family where the surviving spouse doesn’t work, we can prove that this is a very good reason to have high coverage life insurance in place. Whereas with a child that isn’t necessarily the case because they don’t provide economic value, so a lot of these plans may have smaller limitations on coverage, especially if it’s just a cover for something like final expenses.

The other option is to get more coverage, but usually these plans are programmed to be not so much death benefit programs that pay out, but rather as a designation to generate cash value for future reasons, and we’ll discuss that right now. There’s primarily three different ways in which a grandparent like yourself can purchase life insurance on your grandchild. Each of these ways will correspond with what you want to ultimately accomplish.

Whole life insurance

Whole life insurance is designed to never have rate increases. Coverage never cancels due to age or health, and in most circumstances the person is fully covered from the first day for unnatural and accidental causes. This is the most common form of life insurance that people purchase.

This is what Gerber Life offers through their grow up plans. These plans are designed to pay a death benefit and accumulate a small amount of cash value as time passes.

This makes perfect sense when the client only wants a small amount of coverage to pay for final expenses and they don’t want to pay a lot of money to do it.

And in most cases the best child life plans can cost approximately $5 a month. Whole life insurance can be a great value for the amount of money you pay and is something we here at Buy Life Insurance for Burial can help you with.

Rates For $10,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

$150,000 Whole Life Insurance, Life Pay

$250,000 Whole Life Insurance, Life Pay

Riders

Are you currently looking to purchase a life insurance plan on yourself? If so, it may be a valuable investment for you to add on an additional benefit to your plan for a children’s term life insurance rider. These plans are even less expensive than a whole life insurance plan. However, they operate slightly different from other plans.

The coverage typically lasts until the child turns 20 years old and then at that point the child has to take over the payments on the plans and they can add to the plan a larger coverage amount.

This method is especially great if you want to keep the lowest price possible while insuring a lot of grandchildren. With riders you can add multiple grandchildren to a plan without paying exorbitant fees you would find with individual coverage for each grandchild.

Universal life

If you are interested in cash value accumulation, a unique way to get life insurance coverage on your grandkids is to utilize what’s called an index universal life product to accumulate high cash value amounts over a set period of time. The cash value is not necessarily used exclusively for the death benefit. It can be used for things such as college expenses, down payments on homes and other expenses experience later in life.

A universal life plan is generally a permanent life insurance product. The way that the cash values is accumulated is much safer than direct investments in that you benefit when the stock market is up but do not experience loss in a market decline.

What’s neat about this type of plan is that you can buy one of these plans on your grandchildren and, given enough time, you can accumulate tremendous amounts of cash value of which the grandchild can use towards any sort of purposes that they want to take care of such as college expenses or help with a down payment.

Since money is accumulated over time as compound interest, the cash value is very substantial. You can find these plans for as little as $50 a month up to $100 a month. And we’ll be happy to show you some illustrations as to what exactly can be done with these types of plans if you contact us at Buy Life Insurance for Burial.

$50 a Month – Guaranteed Universal Life Insurance

$100 a Month – Guaranteed Universal Life Insurance

$150 a Month – Guaranteed Universal Life Insurance

Coverage without parental consent

My twin girls Emily and Eva thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

What about situations where for whatever reason you do not have permission from the parents to insure your grandchildren? It depends on what kind of life insurance you ultimately purchase. There are companies we represent that offer whole life insurance coverage for the grandchildren that don’t require consent from the parent. All you have to do is complete an application, list the child’s name and birth date, and sign off on the plan.

The life insurance company provides life insurance protection for the grandchild. No parent has to give authorized permission in order for this to happen. Generally speaking, you will have to find a special plan to insure your grandchild without parental consent – but it is possible.

How much medical underwriting is involved when insuring grandchildren?

The nice thing about insuring grandchildren is that since children are generally healthy and young, there’s very little underwriting required.

There’s not going to be any exams required. Medical records will be requested to determine insurability, but beyond that insuring grandchildren is one of the quickest applications out there, as is the response time. Don’t expect the exams and long drawn out procedures to determine insurability, especially if the child is healthy.

If this is something that interests you and you’d like to learn more about your options for life insurance coverage on your grandchildren, feel free to reach out to us at Buy Life Insurance for Burial. You can either contact us via message to request a quote or you can call us directly at (888) 626-0439 and we’ll be more than happy to help.