Does Life Insurance Pay for Death by Natural Causes?

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Most likely the reason you’re looking at this article is twofold.

First, you may be in the market to buy a life insurance plan. You’ve concluded it’s important to cover both accidental and natural death.

Why? Because we don’t know when or how we’re going to die.

Second, perhaps you are in the situation where you’ve lost a loved one such as a spouse or a relative and the policy they had did not pay out as hoped.

Whatever your reason for visiting this article, I hope to clear up any questions you might have when asking whether or not life insurance covers natural death.

Also, we’re going to discuss plans that do pay for natural causes. Finally, we’ll discuss problems that may arise with life insurance when the policy holder dies a natural death.

Here’s An Overview Of Today’s Topics:

What kind of life insurance doesn’t cover natural causes?

When you ask the question does life insurance cover natural death, there are a number of important things to consider.

Most importantly, you need to ensure how fully covered you are.

Generally speaking, there are two different types of life insurance plans available to you right now that will insure you, but not for natural death.

What follows is a short description of each of these plans, how they work, and who they would be most appropriate for.

Accidental Life Insurance Plan

As the description says, this is a life insurance plan that pays if you die from an accident, which means natural death is not covered.

For example, if a loved one dies after that 90 day period that the accident occurred, you may discover that the policy will not pay as you think it should.

In many cases, death MUST occur within that 90 day window of time to receive a pay out!

Who Accidental Death Coverage Is Good For

Accidental coverage is great high risk occupations or hobbies.

Take for example a truck driver or motorcycle rider. These are people exposed to the hazards and risks associated with driving a vehicle.

If this individual drives for prolonged periods of time it would only make sense that person is at greater risk of being involved in a car accident than someone who sits at a desk 9:00-5:00.

I like to ensure extra coverage for people who are in hazardous professions or engage in risky behaviors or risky hobbies because they are naturally at a greater risk of accidental death.

Accidental Coverage Is Supplemental To Natural Death Coverage

As a side note, I don’t think accidental coverage ever replaces the need for natural death coverage.

We all will die one day after all. And most people end up dying from natural causes.

That’s why I don’t think it is a prudent decision to only cover for accidental death.

Guaranteed Acceptance Life Insurance Plan

A guaranteed acceptance life insurance plan is a life insurance policy covering natural death only after several years have passed.

In other words, a guaranteed acceptance life insurance plan will pay full coverage on the amount that you purchase only after two years have passed since the effective date of the policy.

These life insurance natural death plans are what’s also known as modified plans or graded plans.

They don’t become effective for natural death coverage until two years have passed and you are able to prove that you can live past the two year period.

Why would somebody buy a plan like this?

Simply put, because their health is so poor that they just can’t get coverage any other way.

Does life insurance cover natural death from terminal illnesses?

You may be suffering from terminal cancer, Alzheimer’s, a conglomeration of heart, diabetic, kidney, liver issues, or some other major health issue.

If you want to get life insurance for natural death coverage and have a terminal illness, guaranteed acceptance insurance should be viewed as a last ditch option.

I don’t recommend this type of policy to many people, but there are exceptions.

The important takeaway here is that guaranteed issue does NOT cover you from the first day, which isn’t great if you have a terminal illness.

However, it might be the only life insurance natural death coverage you can qualify for.

If you’re generally healthy, there’s going to be a better option. So let’s transition and talk about life insurance that does pay for natural causes.

Does Term Life Insurance Cover Natural Death?

Now we come to the important question – does term life insurance cover natural death?

Agents are often asked does life insurance pay out for natural death, and their answer will inevitably cover the topic of term life insurance.

Approximately 80 percent or more of the population who purchase life insurance choose a term insurance plan.

When people ask does life insurance pay out for natural death, they are also asking “How much is it going to cost?”

The main reason I believe people arrive at term insurance when seeking a life insurance natural death plan is that the coverage is affordable.

Despite some of the limitations term insurance presents with the length of time coverage is enforced, the cost is lower than most other life insurance natural death coverage plans.

There is a high likelihood of outliving term insurance, but the premium is much less expensive and therefore more accessible to more people who worry about life insurance natural death coverage.

Something is better than nothing!

I believe some insurance is better than no insurance. So if you find that term insurance is the only type of life insurance natural death coverage you can afford at the moment, it is certainly better to get term insurance than nothing at all.

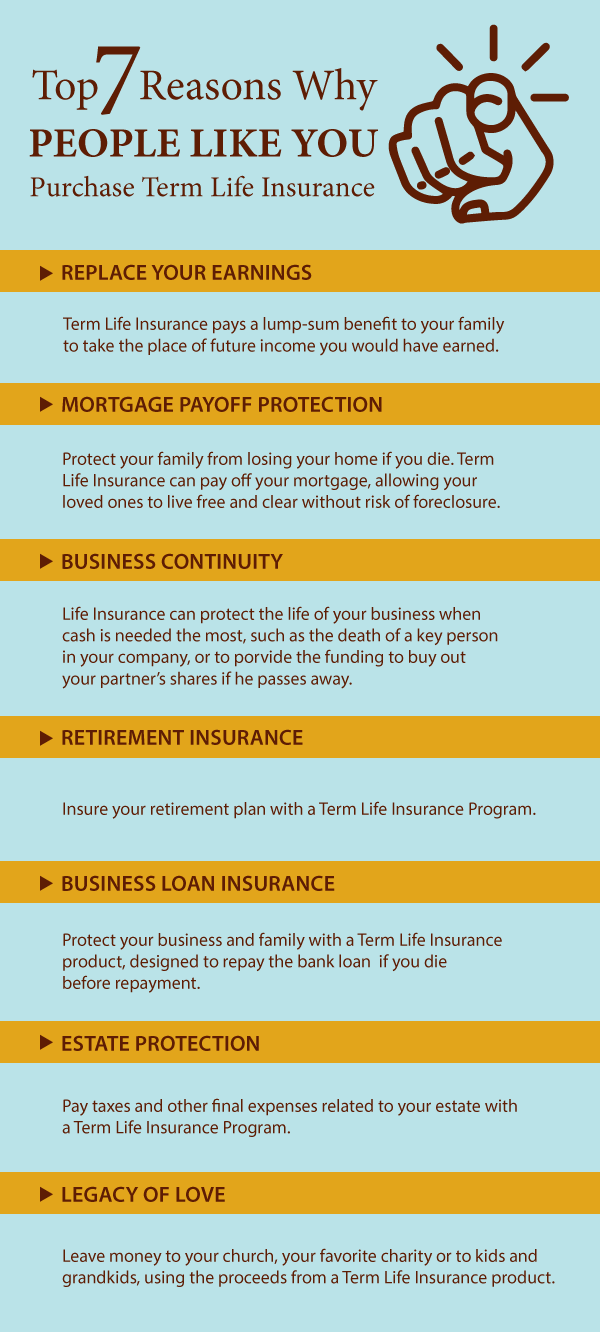

Most people who purchase term insurance need to cover temporary obligations.

When I say temporary obligations I mean concerns such as a mortgage, income replacement, or replacing what you would save for retirement.

These are all aspects in which a term insurance plan ultimately can cover for a set period of time in addition to your financial planning.

Term Life Insurance Coverage – 10 Year Term – $100,000 in Coverage

Term Life Insurance Coverage – 10 year Term – $250,000 in Coverage

Term Life Insurance Coverage – 10 year Term – $500,000 in Coverage

Term Life Insurance Coverage – 10 year Term – $1,000,000 in Coverage

Whole Life Insurance

Whole life insurance is the opposite of term insurance.

Unlike the temporary nature of term insurance, whole life insurance lasts your whole life and premiums generally do not go up.

Coverage never cancels due to age or health, and in most cases, if you medically qualify, you’re fully approved from the first day.

Most people who buy whole life insurance appreciate the peace of mind it affords as a life insurance policy covering natural and accidental death.

They need something that permanently covers them because they have permanent obligations.

And if you are worried and wondering does life insurance pay out for natural death, whole life insurance is a great option.

Why people buy whole life insurance

The most common permanent obligation that whole life insurance covers would include:

- Final expense coverage for burial or cremation

- Estate planning for the very wealthy

- Income replacement for retirees that fear their pensions won’t transfer to their spouses upon their death

I like whole life insurance for many reasons and wish more people were able to buy it, but the reality is that most people have a strict budget and simply can’t afford whole life insurance.

Unfortunately you do pay for the peace of mind in knowing you will always have life insurance natural death coverage.

Whole life tends to cost 5 to 10 times more than term insurance, ultimately leaving it for a minority of the population.

Rates For $10,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

$150,000 Whole Life Insurance, Life Pay

$250,000 Whole Life Insurance, Life Pay

Guaranteed Universal Life Insurance

This is a great life insurance natural death product that has all of the same benefits as a whole life insurance plan, but with more death benefit coverage, it’s also more difficult to qualify for in some circumstances.

It’s call guaranteed universal life insurance.

This type of life insurance covering natural death requires payment until you die.

The good news is you pay the same premium forever, unlike some universal plans that can change as far as the premium goes.

$50 a Month – Guaranteed Universal Life Insurance

$100 a Month – Guaranteed Universal Life Insurance

$150 a Month – Guaranteed Universal Life Insurance

Other reasons a life insurance policy won’t pay out for natural (or accidental) deaths

Even if you have a life insurance plan that protects you for natural death coverage and accidental coverage, there are going to be circumstances, rare as they may be, where the plan may not pay out as expected.

This can be due to existential reasons that may or may not be beyond your control.

What follows is a brief description of circumstances that could occur that would cause a life insurance natural death plan policy not to pay out.

This section is useful for those who may have experienced this firsthand and want to understand why or how it could happen so they can be better prepared when looking at their own insurance options.

Contestability

Contestability refers to the right a state government gives to each and every life insurance carrier to contest a claim.

In most states, if death occurs within the first two years from natural causes the company has the right to request an investigation.

This involves collecting as many medical records as they deem necessary from every doctor that you’ve ever visited.

They use this to determine if said amount of coverage should actually have been approved and should be paid out.

If your coverage is contested and held up, then your premiums are refunded plus interest, but the full death benefit is not paid.

If it is approved, then the full death benefit will be paid.

Every carrier contests death occurring within 2 years of policy issue

The important point to understand is that contestability is something that is there for every single type of life insurance natural death policy that is taken out within the first two years.

It’s not restricted to one particular carrier. Every company will do it.

Therefore, it’s vital that when you apply for life insurance natural death coverage that you are as transparent about your health as possible.

If you are reading this because you wonder does life insurance payout for natural death, it’s really vital you understand one important point.

When applying for life insurance natural death coverage you don’t want to inadvertently leave out information accidentally or purposely because that could have an adverse effect on your pay out.

Fraud

Fraud or an attempt at fraud may be contested by the life insurance company and cause the coverage to not be paid out.

It’s rare that this happens, but there have been some famous cases of people who have faked their own death in order to cash in on life insurance natural death proceeds to pay out to a family member.

In fact, there are even reports of families whose loved ones mysteriously disappeared, but miraculously came back 15 to 20 years later and the insurance company wanted their money back because obviously the person wasn’t dead.

Suicide

If you commit suicide within the first two years of your life insurance policy, the death benefit will not be paid out to your life insurance beneficiaries.

There are no exclusions to this rule and no work arounds. All insurance companies abide by this rule.

Exclusionary factors and other circumstances

You may purchase a life insurance plan with what’s known as an exclusionary rider.

It may state something along the lines of your life insurance natural death plan will not pay out in case death occurs according to X, Y, Z condition.

Simply put, what this means is that there are restrictions on your life insurance plan.

If you end up dying from a hazardous job or hazardous hobby or a health issue that you had when you took out the plan, then the company has every right not to pay in those circumstances.

Make sure during the process of applying that you understand if there are any exclusions included.

If you’re doing research for a policy that didn’t pay out on a loved one that passed away, look into whether or not they had this exclusionary writer included.

Sometimes it is included, but family members don’t realize the power it has to lower the chances of having a policy that does not pay out in natural death.

Always be honest

The best advice I can give anybody who’s wondering if their life insurance will payout for natural death is to honest on your life insurance application.

Life insurance companies have a lot of experience investigating claims and determining insurability. They know when they are being conned. So if you aren’t being honest, it’s very likely they will find out.

Honesty is the best policy.

While you may not get approved or rated where you’d like with some companies, there’s a high chance that you may find it easier to get coverage elsewhere, even with the same conditions honestly listed.

Ultimately, your not the one you need to worry about when it comes to life insurance natural death coverage, right?

It’s your family members that gain or lose based on your policy.

So it’s important to make sure that coverage is issued and on the books with all transparency versus fraudulent information.

This will help ensure your family doesn’t suffers the consequences of not having the life insurance they were counting on.