The Truth About Getting Life Insurance as a Motorcycle Rider

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

In This Article I’ll Uncover The Truth About Getting Life Insurance As A Motorcycle Rider

Most likely you’re here today because you are looking for life insurance and you’re wondering if your hobby or profession as a motorcycle rider is going to have an impact on your eligibility to get life insurance coverage.

You might be wondering, does life insurance cover motorcycle death? How much is a motorcycle rider policy? Is it hard to get life insurance for riders?

We’ll cover all of these questions and more so you can get all the information you need to understand how motorcycle riders insurance works and how motorcycle riding impacts your eligibility for life insurance coverage.

Specifically, We’ll Cover The Following Aspects:

Life insurance for riders – Can motorcycle bikers qualify for life insurance?

The short answer to this question is yes. You can qualify for a motorcycle rider policy if you’re a motorcycle rider or professional biker.

The long answer is that it depends upon the circumstances in which you ride.

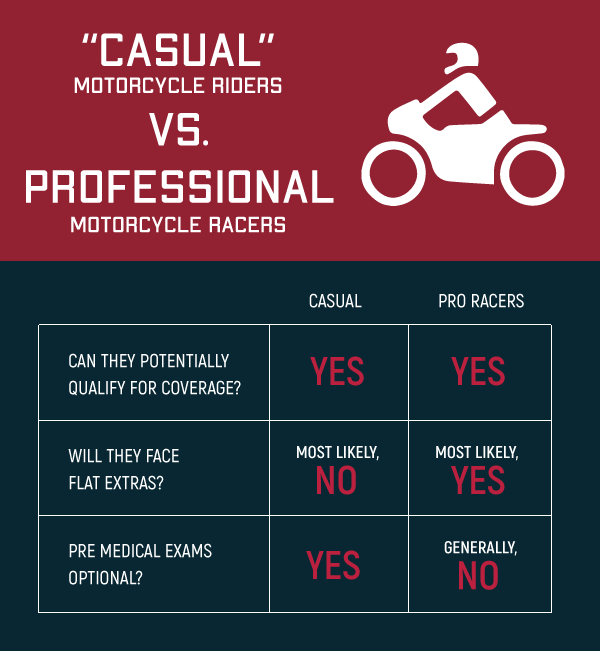

The biggest line in the sand when it comes to coverage and difficulty in qualifying depends on whether you ride casually versus ride professionally.

Let’s talk a little more about the difference.

Riding a motorcycle casually

When I say ride casually, what I mean by that is that occasionally, maybe on the weekends, you enjoy running the roads on your Harley or Yamaha for fun or even just as a commuting vehicle.

Life insurance underwriters consider this casual use and even though there is very large awareness to the risks involved with riding a motorcycle, the truth is that riding casually has no direct impact on your eligibility for qualifying for life insurance for riders.

So for those of you who ride casually, that’s the good news.

Riding a motorcycle as a professional

Riding professionally is defined as those who ride in competitions or on a more regular basis, typically as a bike racer or motocross biker.

If you are a professional rider you are probably wondering does life insurance cover motorcycle death?

Life insurance underwriters typically considered professional riding to be a higher risk.

If you ride professionally either as an amateur or professional, then you will probably experience some level of difficulty in qualifying for life insurance.

It’s not a foregone conclusion that you won’t qualify. But you will find that life insurance for riders is under more scrutiny when it comes to the details of your professional experience with motocross riding.

Be prepared to answer additional questions.

You may also experience what’s called a flat extra added to your plan.

This is where you pay a predefined amount on top of the motorcyle rider policy premium you’re rated for.

This can have a big impact on the affordability of the premium.

At Buy Life Insurance for Burial, our job is to shop the most competitive carriers to give you the best options.

If you are wondering does life insurance for riders cover motorcycle death you can rest assured we will find the best plan you can qualify for to ensure you have death coverage.

Looking at a number of carrier options is your best bet for finding great life insurance for riders.

We can help you find a carrier based on your specific circumstances to minimize the impact of any additional premium you may experience as an amateur or professional bike rider.

Factors that may limit your coverage options

Generally, there are three different aspects that can impact life insurance for riders.

Your health

As a biker, how is your health? Have you ever had any health issues? Do you currently take medications? Are you at a healthy weight?

These are among the questions that will be asked on your life insurance application.

Having health issues can have a negative impact on your eligibility to qualify for life insurance for riders.

Make sure you work with a broker at Buy Life Insurance for Burial that understands the factors that can affect coverage premiums and is able to find the best value premium among a number of carriers.

Your age

Age impacts eligibility for life insurance for riders.

Generally speaking, if you’re an adult between 18 and 85, you should have some sort of option available to you regardless of what your health is.

Most people end up getting what’s called term life insurance, which we will discuss more later. Term insurance offers eligibility to age seventy and above.

Age isn’t nearly as much of a factor as health, but understand that age will increase your overall premium over time.

So it’s wise to shop at a younger age to lock in a lower rate.

Your driving record

Yes, your driving record as a motorcycle rider will have an impact on your ability to qualify for life insurance for riders.

- Have you ever had any DUIs?

- Do you have any at fault accidents?

- Have you had any traffic violations?

- How long ago did any of these occur?

When it comes to life insurance for riders, these factors will have a direct bearing upon your eligibility for life insurance coverage and may play more of a role, even if you are a casual motorcyclist, as there is an inherent risk involved with driving a motorcycle.

Exam or no-exam?

One question we get a lot from bikers across the country is whether they should consider getting an exam to get life insurance for riders or whether they should do what’s called a no-exam life insurance plan, which doesn’t require a physical to apply.

Here are my thoughts on what you should do considering your circumstances.

If you are a casual biker, it’s totally up to you whether or not you want to do an exam.

Generally speaking, if you’re healthy, taking an exam will allow you to achieve better pricing than if you go the non-exam route.

Why is this the case? The more information that an insurance company has on your current health, the more comfortable they are going to be to issue you life insurance for riders at a lower preferred plus rate.

If an insurance company determines your eligibility for coverage based on your past records that aren’t necessarily up-to-date, there is a bit of risk involved, so they typically price higher on non-medical applications.

If you are generally in good health, I typically recommend taking an exam.

Considering the nature of your profession or hobby, you’re going to find that an exam will give you the best overall choices and premiums.

Examinations typically require a physical, blood withdrawal, and sometimes a urine analysis.

Types of life insurance available for bikers

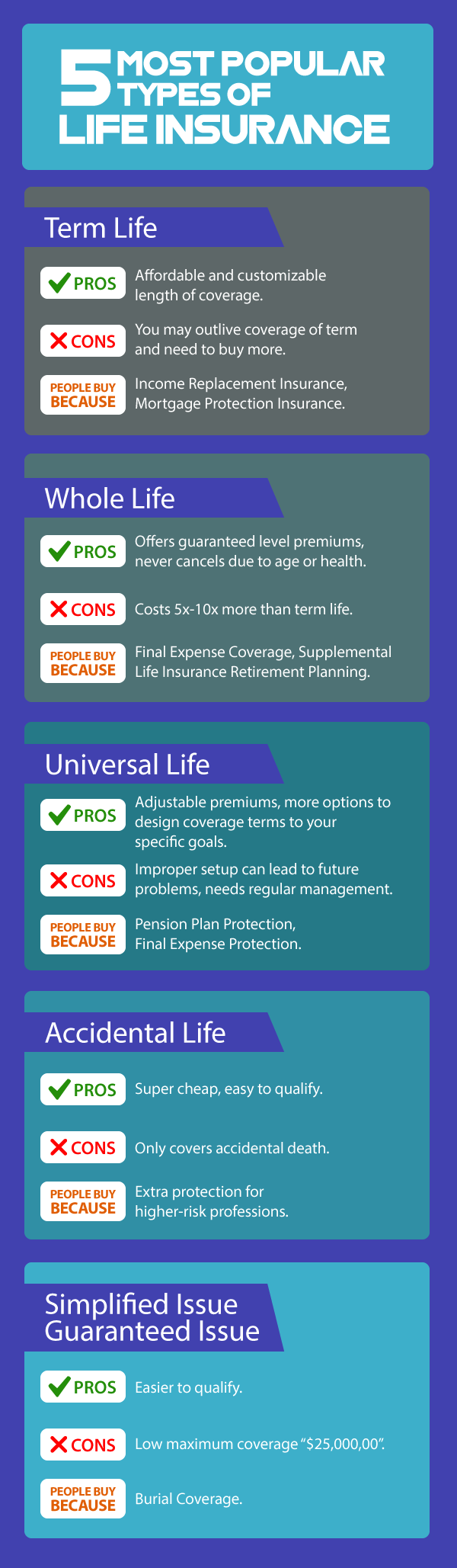

In this section, I’m going to talk about the different kinds of life insurance for riders options available for both amateur and professional bikers.

I’ll give you the pros and cons of each so that you can better understand what type of life insurance options will work best with what you’re trying to achieve.

Permanent Life Insurance

Permanent life insurance is designed to give you permanent protection.

Most people buy permanent life insurance for riders when they have a permanent expense they need to cover, like burial.

So if you are wondering does life insurance cover motorcycle death, looking into permanent coverage is a good idea.

Permanent plans are designed to make a payout at any point in your life and not to cancel because you’ve reached a certain preset age.

Also, people buy permanent life insurance plans in their latter years as an income replacement plan.

This allows them to make sure that a predefined death benefit is paid to a surviving spouse or family member to take care of financial concerns.

If you are looking to provide income replacement regardless of when you pass away I recommend a permanent policy.

Buy Life Insurance for Burial have access to a variety of different permanent life insurance plans that can help accomplish your goals.

Burial Insurance Rates, Age 40 to 90*

Rates For $5,000 In Burial Insurance

Rates For $10,000 In Burial Insurance

Rates For $15,000 In Burial Insurance

Rates For $20,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

*Burial insurance premiums are subject to underwriting, based on rates as of 8/20/2018, from state-regulated life insurance companies offering final expense burial whole life insurance protection.

Understand that in order to potentially qualify, you must submit an application to see if you’re eligible. Rates are subject to change. Give Buy Life Insurance For Burial a call at 888-626-0439 now to see what program you may qualify for.

Term Life Insurance is a short, temporary life insurance.

Term insurance provides a predefined death benefit at a level premium for usually between 10 to 30 years depending on what the client’s goals are.

The reason people buy temporary insurance is that they’ve got a temporary problem. A temporary problem is defined as something that will go away at a later date.

If you are questioning does life insurance cover motorcycle death , term insurance might not be the best longterm option.

Most notable temporary problems include:

- Mortgage

- Business loans

- Debts

- Income replacement for younger people

Remember the idea behind younger people getting income replacement is to replace what they would have saved and accumulated over a lifetime if they happen to die earlier than expected.

Most people that I deal with end up buying a term insurance plan.

It tends to be the cheapest type of plan with premiums that are 20 percent or less of what permanent insurance plans are.

Temporary insurance also tends to match the majority of goals that cause people to purchase insurance in the first place.

It allows them to get some kind of coverage on the books that also meets their budget requirements.

Term Life Insurance Rates, Age 25 to 75*

Term Life Insurance Coverage – 10 year Term – $100,000 in Coverage

Term Life Insurance Coverage – 10 year Term – $250,000 in Coverage

Term Life Insurance Coverage – 10 year Term – $500,000 in Coverage

Term Life Insurance Coverage – 10 year Term – $1,000,000 in Coverage

Summary

I hope this article has answered your questions regarding life insurance for riders. If you are a motorcycle rider looking for life insurance, hopefully you now have the important details in hand to make an informed decision.

Thanks for reading!

*Insurance premiums are subject to underwriting, based on rates as of 8/20/2018, from state-regulated life insurance companies offering final expense burial whole life insurance protection.

Understand that in order to potentially qualify, you must submit an application to see if you’re eligible. Rates are subject to change. Give Buy Life Insurance For Burial a call at 888-626-0439 now to see what program you may qualify for.