How to Get Life Insurance for Autoimmune Diseases

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

We’ll Cover Many Of The Different Types Of Autoimmune Diseases That People Commonly Suffer From That May Affect Eligibility When Applying For Coverage

The reason you are reading this article today is because you or your loved one has some sort of autoimmune disease and you’re worried about the eligibility to get life insurance coverage approved. If this describes you, then hopefully you will find this article useful.

We will also talk about the different types of life insurance programs available for an autoimmune disease and then break down the details as to when those programs would be useful and under what circumstances most people use particular types of coverage.

Here’s An Overview Of Today’s Topics:

- Autoimmune Diseases You May Have Been Diagnosed With

- Most Common Autoimmune Diseases

- What Is My Eligibility For Life Insurance Based On These Auto Immune Diseases?

- What The Insurance Companies Are Going To Look For In Order To Give This Kind Of Rate May Include, But Is Not Limited To

- Types Of Life Insurance Available For Those With Autoimmune Disease

- Burial Insurance Rates, Age 40 to 90*

Autoimmune diseases you may have been diagnosed with

In this section I’m going to talk briefly about the different auto immune diseases that are often diagnosed. You won’t find a detailed breakdown or condition list of each of these disorders because if you have them, there’s no reason for me to explain to you what they do and how they work. That would be a waste of your time.

Instead, let’s talk about how your autoimmune disease may affect your application process.

Most common autoimmune diseases

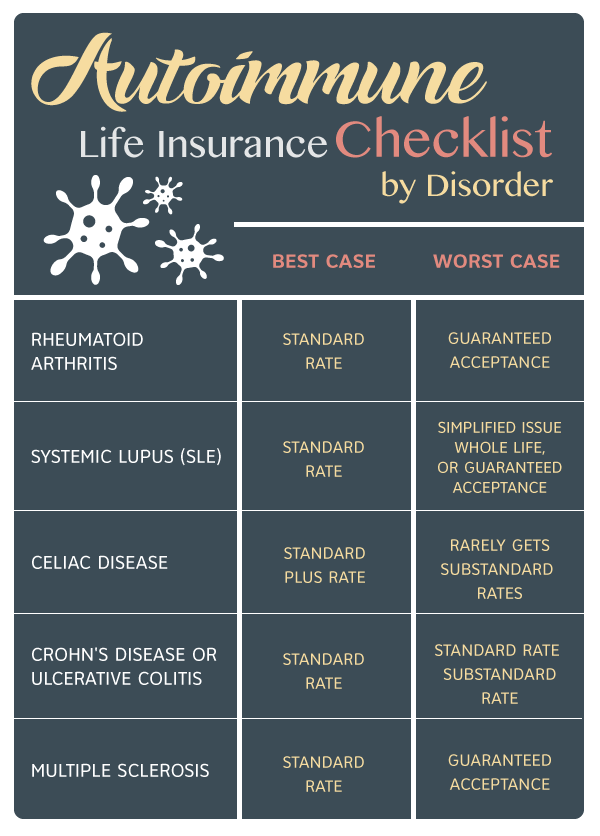

The most common autoimmune diseases people experience include multiple sclerosis, rheumatoid arthritis, Lupus, and pernicious anemia. There are many others besides this that are out there, but these are the ones that are the most common. We’ll also talk about celiac disease, Crohn’s, and ulcerative colitis.

What is my eligibility for life insurance based on these auto immune diseases?

Let’s talk about your eligibility for life insurance coverage, depending on what specific type of auto immune disease you have.

One of the most important things that you need to consider in your quest for life insurance is to work with what’s known as a broker. An insurance broker is someone who shops around to find the best value of coverage, but they are not just focused on finding a good price. They also want to find the highest quality of insurance available within your price range.

Buy Life Insurance for Burial specialise in working with a variety of different life insurance carriers. Our mission is to look at what the options are in order to give our clients the best type of coverage that we can find available.

We’re not married to one particular company, which allows us to go out and find a company that is going to give the best overall amount of coverage to our clients at the best possible rate. So stick with us as we described the different types of plans, and then give you a breakdown of what most likely is possible for coverage based on your criteria.

Autoimmune disease – Rheumatoid Arthritis

Rheumatoid arthritis is one of those diseases that can range dramatically in its severity. I have a client who has severe rheumatoid arthritis and her mother had it as well. Her mom was bedridden for many years. The treatments did very little to help her out while her daughter, who’s my client, is suffering from rheumatoid arthritis enough to be classified as disabled and it’s slowly progressing in severity as she ages into her late fifties.

Rheumatoid arthritis, in a best case scenario, is something that can possibly get a standard or regular rate.

When we say standard or regular rate, what we mean by that is that if we look at a traditional type of product, like a term or permanent plan, that’s either an exam or non-med product, this is the rating class that you may be eligible for.

What the insurance companies are going to look for in order to give this kind of rate may include, but is not limited to

- Whether or not you’re taking any immunosuppressive medication

- The degree to which debilitation has occurred

- Your overall health

- How Many Years Its Been Since You Were Originally Diagnosed With Rheumatoid Arthritis

- Types Of Life Insurance Available For Those With Autoimmune Disease

If you have more severe rheumatoid arthritis like my client’s mother, what you’ll find is that you may be rated at a sub standard rate where you have a higher price associated with your premium. Or you may be forced into a situation where you may only qualify for a final expense plan, also known as a simplified issue whole life plan or a guaranteed acceptance life insurance plan. More on that later.

Autoimmune disease – Systemic Lupus

Similar to rheumatoid arthritis, eligibility for life insurance with systemic lupus comes down to the treatment and date of diagnosis. The longer the time since the date of diagnosis, in combination with the type of treatment you are receiving, will determine your rate.

Generally those with systemic lupus qualify for a standard or regular rate for traditional life insurance products.

However, if you’re Lupus has progressed and causes problems with your ability to move and get around or has caused other health problems, you may be limited to a simplified issue life plan or a guaranteed acceptance life insurance product as a last ditch effort for coverage.

Autoimmune disease – Celiac disease

It’s fairly simple to get coverage if you have Celiac disease, assuming the rest of your health is in good shape. Generally a standard plus or better rate should be available to you as long as there’s no underlying symptoms or evidence of malabsorption. As time passes, the likelihood of a preferred rate may be higher.

Your premium will likely be based on how long its been since you were originally diagnosed with celiac disease. Again, you may find that you can get an even better rate as more time passes.

If you have progressive celiac disease or if you’ve found that you’ve had worsening conditions, you may only be eligible for guaranteed acceptance or simplified issue products.

Autoimmune disease – Crohn’s disease and Ulcerative colitis

With Crohn’s disease and ulcerative colitis our best case scenario is a regular or standard rate. The difference in rating depends upon when the original diagnosis was, getting anything better than that is very difficult.

I would not count on getting a price point that’s going to be much more competitive than a standard rate. If you end up having some sort of flare up or some sort of a worsening conditioning within the past 12 months of applying for insurance you may find a substandard rating is the only one available to you, or you may find a simplified issue product would be a better choice.

Autoimmune disease – Arthritis

Arthritis is something that in many cases doesn’t have a dramatic effect on your capability to qualify for life insurance. However, if you have a progressive or highly degenerative arthritis that causes issues with normal activities of daily living or you use strong medications to treat your arthritis, you may find that your eligibility to qualify for anything better than a standard is minimal.

Many people who suffer from severe levels of arthritis may qualify much easier with a simplified issue product that asks less health questions.

Also in a worst case scenario, if the arthritis is severe, a guaranteed acceptance life insurance plan is often something you can qualify for when you don’t qualify for anything else.

Autoimmune disease – Multiple sclerosis

In many cases, coverage will be dependent on whether or not it is a relapsing type of disease. If it’s chronic, malignant, and/or benign.

Of course, like many of the conditions mentioned earlier, the date of diagnosis and the frequency of episodes all have an impact on your eligibility for coverage. You may find that multiple sclerosis ends up with a substandard rating at a higher price point than what you would find if you were otherwise healthy.

It’s very likely you are eligible for a simplified issue product and very likely you will have an easier time qualifying for a simplified issue product if your multiple sclerosis has progressed and causes a limitation in activities of daily living.

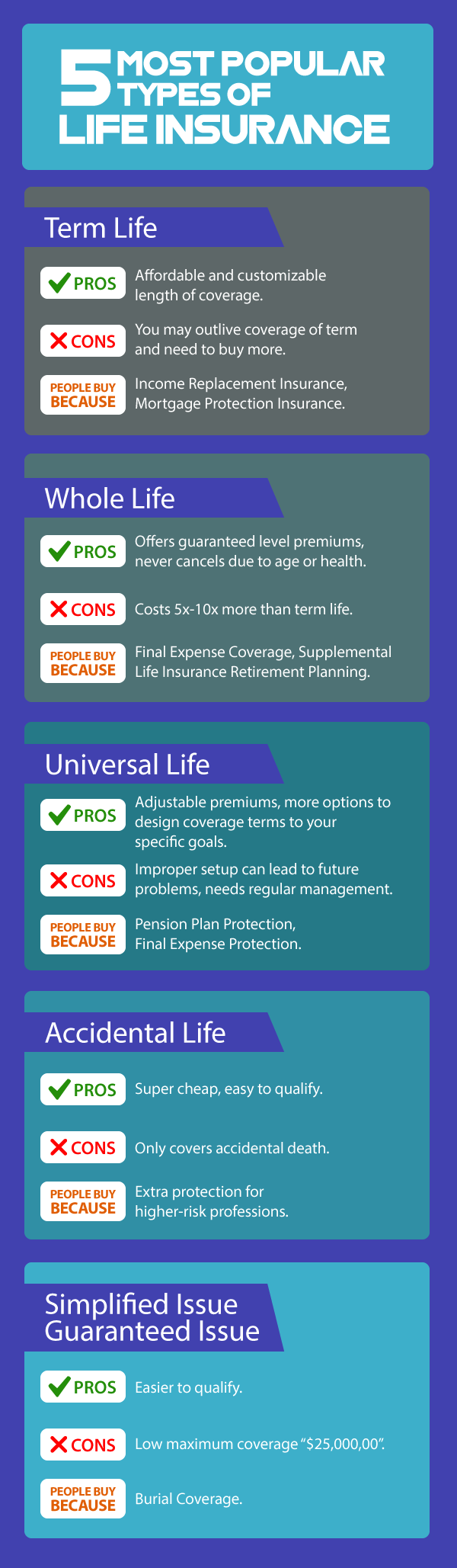

Types of life insurance available for those with autoimmune disease

In this section I’m going to talk about what types of life insurance programs are available to you. We’ve mentioned most of these already, but I want to provide more of a description of what types of ratings you can expect to get for someone who suffers from an autoimmune disease and is searching for life insurance.

But at this point I want to describe the different kinds of plans available to you and the worst case scenario to best case scenario in reference to how severe your autoimmune disease might be.

Guaranteed Issue Insurance Plan

For the most severe autoimmune disease, guaranteed issue is what I would call my trump card.

It is the last choice I use to try to qualify somebody for life insurance. The reason is that no health questions are asked. For somebody who is in severe shape, this is going to be their only option for coverage.

The main purpose for a guaranteed issue coverage plan is to provide coverage for those who think it’s absolutely vital to get life insurance on the books, but just want enough coverage to take care of burial expenses and understand that there will be a waiting period until the coverage comes into effect.

Again, even though this coverage is listed first, it should by no means be a first choice. In fact, it is one of the last cards you should play in qualifying for insurance coverage. I only suggest it as a last choice after all other options have been exhausted.

Simplified Issue Whole Life Plan

Simplified issue whole life is a great option when you can’t get somebody qualified for a fully underwritten product, but you don’t want to wait the two year period for coverage.

The many conditions I’ve mentioned above, such as multiple sclerosis, systemic lupus and rheumatoid arthritis can very easily qualify for simplified issue whole life coverage. The benefit with these products is that the price never goes up and never cancels due to age or health.

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

And in many cases, you don’t have to wait a full two years before you’re fully protected. The simplified issue whole life plans will protect you for natural and accidental death from the first day.

Again, it depends on some factors related to your disease as well as other health factors not related to your auto immune disease. So contact us at Buy Life Insurance for Burial if you think this is something you are interested in.

Some policies will provide coverage beyond a final expense plan, such as an income replacement plan or a mortgage protection plan to pay your mortgage off when you pass away.

You may need something more beyond just a basic type of simplified issue, final expense plan. There’s two different types of plans that can accomplish these goals:

Non-medical Life Insurance Plan

The first is a non-medical life insurance plan.

As described, there’s no medical exam required with these types of life insurance plans. Typically people buy these in a term insurance type of policy.

Permanent life insurance, like whole life universal, is another option. The benefit of these plans are no exams are necessary to get a decision on eligibility. The one problem you may run into as somebody looking for life insurance with an autoimmune disease is that many of these plans have a black, white decision process with metrics on different diseases.

You may find that even if your autoimmune disease isn’t in a progressive state, that you’re still flat out decline because you have an autoimmune disease. If that’s the case, you have two options.

Fully Underwritten Plan

You can find another non-medical carrier or you can proceed to the second option, which is a fully underwritten plan.

This requires you do an exam. An exam often allows individuals to qualify for many more options than if they did a non-medical application. This is because it gives the underwriters a lot more information so that they can make a much more calculated decision based on your current health.

My recommendation is to talk with a broker like us at Buy Life Insurance for Burial. A 5 to 10 minute conversation is all it takes. We will get a good idea of what your unique health situation is and be able to see what your best options might be.

Burial Insurance Rates, Age 40 to 90*

Rates for $5,000 in Burial Insurance

Rates for $10,000 in Burial Insurance

Rates for $15,000 in Burial Insurance

Rates for $20,000 in Burial Insurance

Rates for $25,000 in Burial Insurance