The Insider’s Guide To Globe Life Insurance [Fine-Print Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you want to accomplish. If you prefer to talk live, call 888-626-0439 to speak with me directly.

Today’s Topic Is A Detailed Review Of Globe Life Insurance

Most likely you’re here today because you are considering buying a life insurance plan either for yourself, your loved ones like your dad or mom, and you’ve seen advertisements from Globe Life Insurance repetitively through the years-it’s usually through the mail. You want to know what Globe Life Insurance is and the best route to purchase a personal life insurance policy.

If that is why you are here, then I assure you that these questions will be answered and you’ll know a lot more about the product and be able to make a much better decision what globe life insurance does actually make sense for what you’re looking to accomplish.

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation on the Ultimate Globe Life Insurance review. Enjoy!

Quick Overview Of What To Expect Today:

- An Overview Of Globe Life Insurance Including What They Do And How They Find Customers And Their Practices For Generating Business

- What Globe Life Insurance Offers, Visit Their Website, Look At Their Products, Go Through A Process Of Filling Out An Application Just To Show You What The Options Would Be If You Decided To Apply With Them.

- What Product Is Best Suite For Each Individual Person, Depending On What It Is That You’re Looking To Accomplish

- Alternatives To Globe Life Insurance

- Final Thoughts And How To Qualify For A Life Insurance Program To Cover Burial Costs

- Next Steps

Globe Life Insurance

Globe Life is hard not to miss. If you receive the paper for years or if you peruse the internet or watch TV or if you’re over more likely 40 or 45 years, you’re probably constantly getting Globe Life Insurance advertisements weekly, maybe monthly. It might be driving you nuts and you wonder how many trees they’ve spent on sending junk mail.

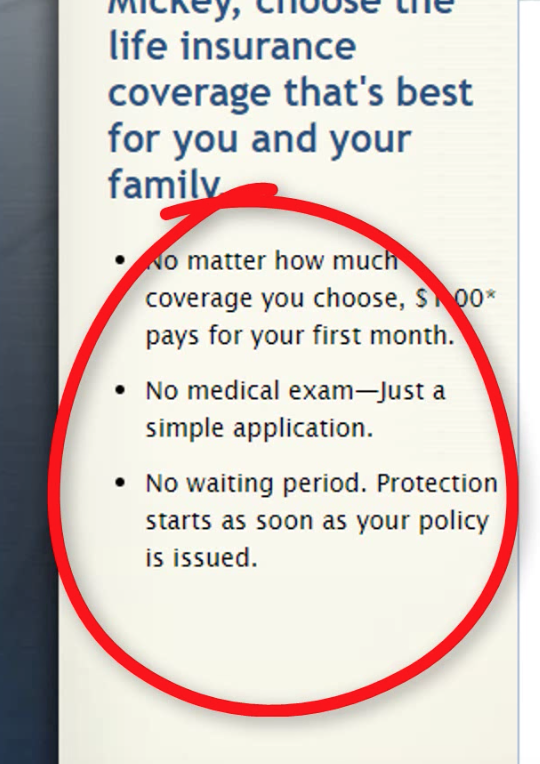

Globe Life primarily operates directly to the consumer, which means there’s not really any agents directly out in the field selling Globe. They do a direct mail order type of life insurance product. What they are most notable for, if you can recollect their advertisements, you’ll see the $1 buys you so much coverage.

In fact, if you look through their website, you’re going to see the same thing. That’s their stick – starts for a cheap price just to get you in the door to get you covered. Then we’ll go up to the normal prices.

Let’s go into specific offers that Globe has as far as life insurance goes. We can just recap what they do, how they work, and then actually take you through what to expect.

Globe Life offers particular type of life insurance products you’ve probably seen a many times.

- Term Life Insurance product for adults

- Whole Life Insurance for children.

What we’re going to do is start by describing the product a little bit more in depth. I’m going to take you through the website, look at the application process, and then take a look at some of the fine print , so you can learn better about how these particular programs work.

Globe Life Term Insurance review

Here’s the thing with term insurance and support and understand this, and I’ll validate all this here in a minute. And this is true for globe. This is true for any company that offers term life insurance.

Term is short for terminating life insurance. The concept behind term life insurance simple. It is pure insurance. There’s no cash value, there’s no underlying account that the idea behind it is that if you die within the period of time that the term is in a force or an effect, whatever the amount of coverage on the books is, we’ll pay out to your beneficiary.

The problem with term insurance is that it’s only good up to a certain point and all the money you put into it, if it’s designed just to be put in the pockets of the insurer, you outlive it. You don’t die when you’re supposed to. You don’t have coverage anymore while you end up dying outside of the term.

The company has no obligation to pay up. Globe has this interesting thing called a five year price increase. What that means is that when you first start with a global policy, you will have either a first period of one to five years where you won’t have the price increase and then they go up every five years thereafter.

For example, age of 65/ 70/ 75 years, the price increases start to ratchet up very high. In my experience – and this is no testament against Globe Life – I’ve had clients who are on a fixed income and it starts affordable when they’re in their early 60.

But when they get to the early or mid 70s and the price has gone up, they’re just not sure they can pay it anymore or if it’s even a good value to pay for. I mentioned all this because this is the reality a lot of people face is their social security doesn’t go up as fast as the Globe Life. Plus you could outlive it. That’s no good either.

Bottom line cancels at 80 years, you have the real risk of not having coverage when you most need it. These are things I’m telling you about how it works. What I want to do is show you how it works so you can see this for yourself. I think that’s the best way to convince yourself of whether or not the product is sensible for you.

Let’s take a look at the product design on their website so you can see for yourself along with the rates.

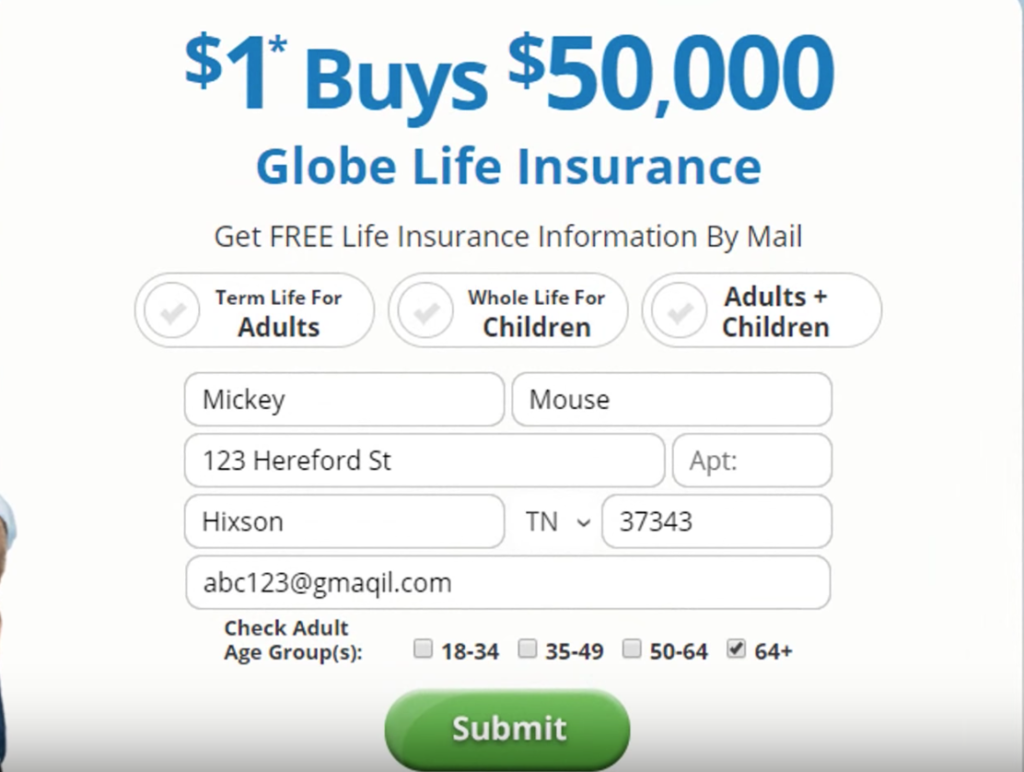

On Globe Life Insurance’s website, you can see at the top the $1 buys $50,000 offer. That’s pretty much the standard offer. We are going to go through the process of requesting information and you can see what happens. This is just some random information. I just filled out a bunch of fake stuff. I don’t want then to send me junk mail.

Fill the form with fake names and address. Let’s click submit. What this does is it take you to, what we call in the insurance business, lead generation screen. They will ask if I want to get children’s insurance and will I come back and take a look at this.

But we’re just going to go click on ‘No Thanks’. What I want to attempt to apply online and just to show you this process. We’re going to click on ‘Get Your Free Quote’. This is just the process where we begin to buy adult life insurance. Again, we’re talking about the adult term life insurance.

Let’s click on one adult in Tennessee and then we’re going to click continue.

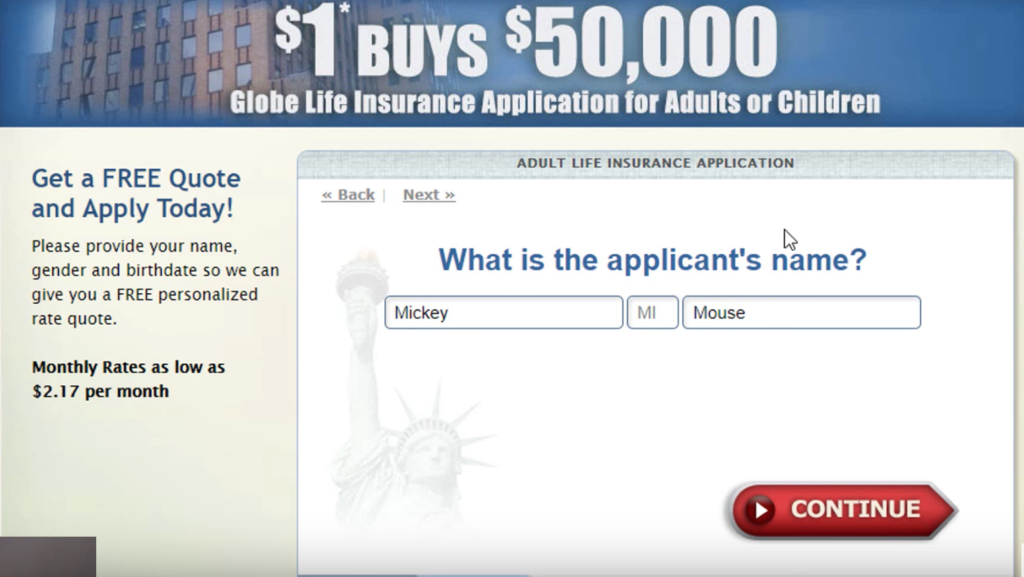

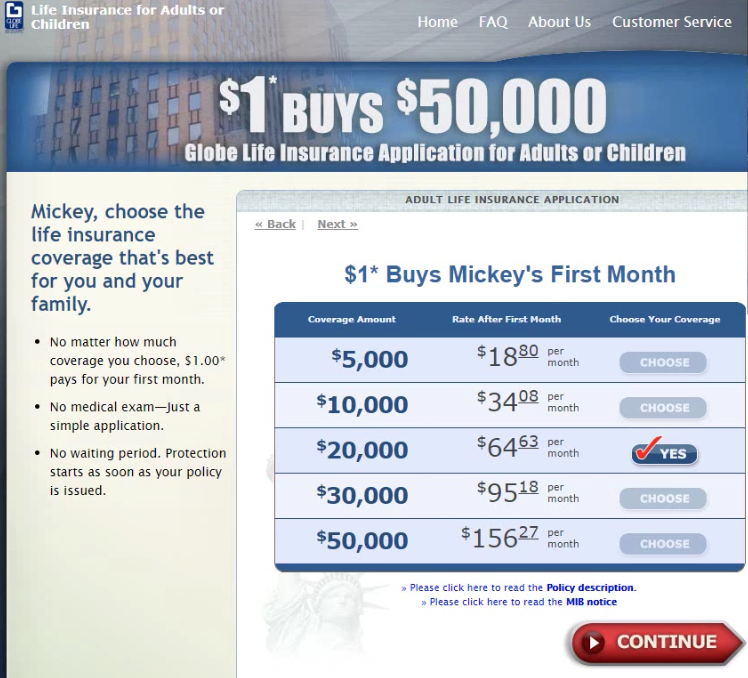

This brings us to our screen. We’re going to begin to fill out the insurance application course. I’m applying as Mickey Mouse. Click ‘Continue’ and let’s go ahead and put in some random birth dates – make him 68 years old.

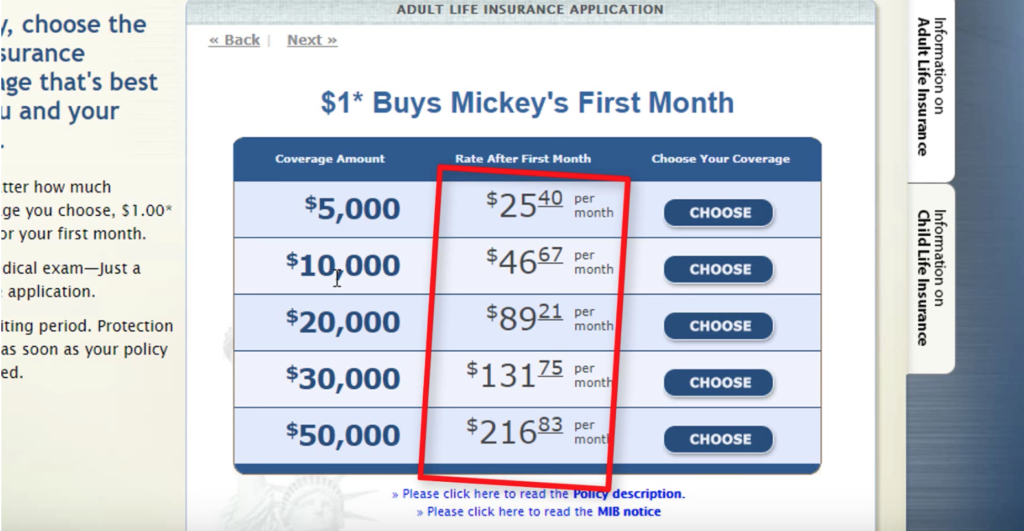

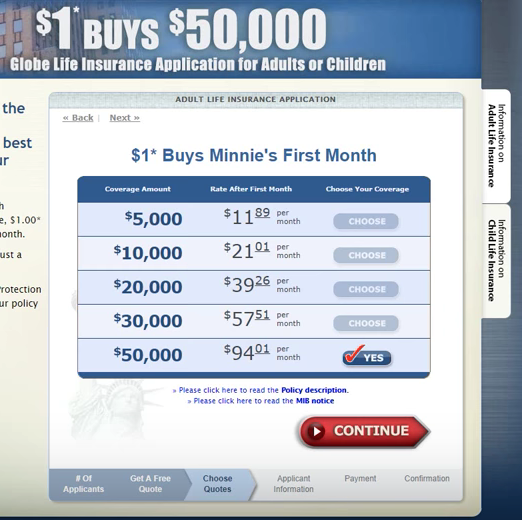

This is where I want to be $1 buys. Mickey’s first month – at his particular age that is 68 years for a male – what we’re looking at for term life insurance coverage. These rates don’t look bad on their surface except when we began to analyze further how this particular plan works.

Let’s take a look at the policy description to start here. You see at the bottom corner where it says ‘Please Click Here To Read Policy Description’. This is the smoking gun, I guess can say this is going to tell you everything you need to know about the product.

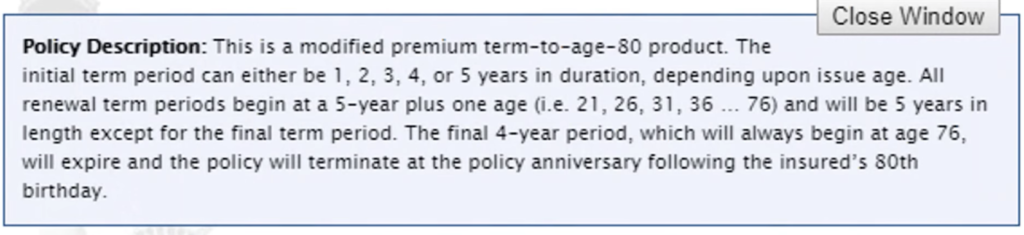

I’m going to spell out the policy description to you.

- This is a modified premium to term premium term to age 80 product. That means it ends at 80.

- The initial term period can be either 1, 2, 3, 4, 5 years in duration, depending on issue age. This means that the first price you pay, for example $2,540 will go up again at 71 years. So you’ve got many years before that, in this case 3 years and will be five years in length.

- All renewal term periods begin at a 5 year plus one age and will be five years in length except for the final term period. This final 4-year period, which will always begin at age 76 will expire and the policy will terminate at the policy anniversary following the insured’s 80th birthday.

There you have it. What this is saying is that this is term insurance that has price increases.

Just to point out you’ve got also met no medical exam. Simple application, going to take a look at the amounts of the health questions they ask and then take a look there too as well. We will come back to this and compare and contrast different options.

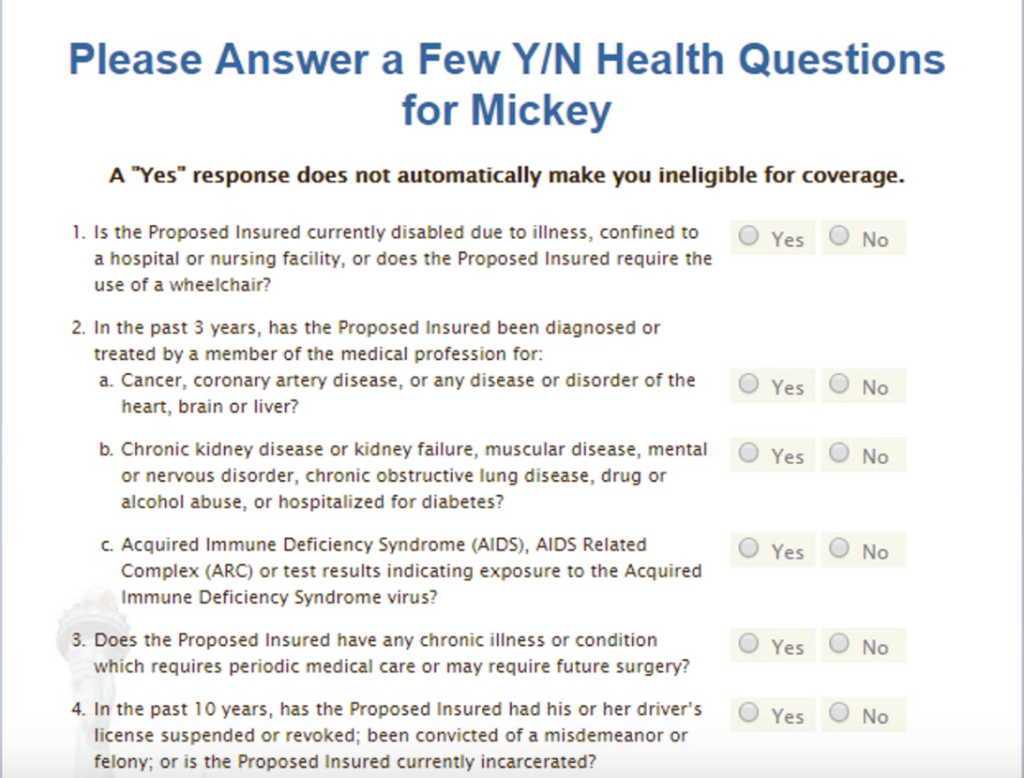

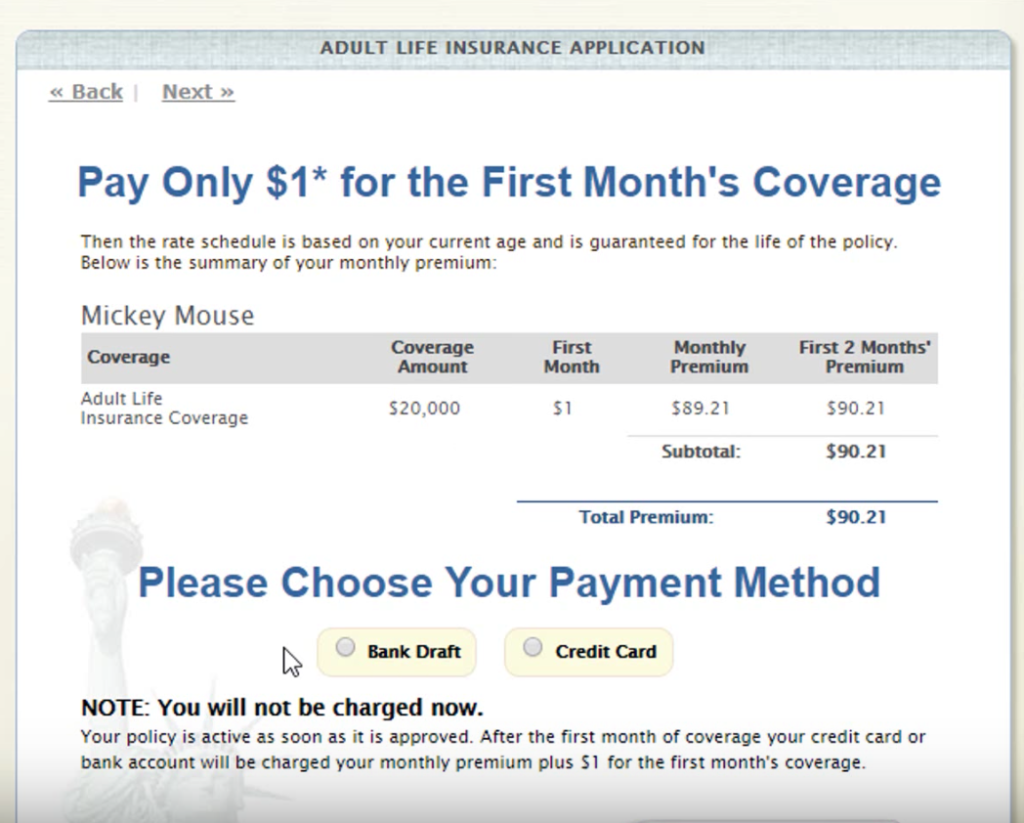

Let’s say that we want to buy a $20,000 in term insurance and they ask if you want to buy an accidental additional. I just choose ‘No Thanks’. We finally get to the point where we’re looking at a few health questions. I’m giving you an idea of if they qualify or not.

The one thing Globe does is like a lot of term insurance or life insurance products, they have different ratings for the, for the level of health that you have. You may qualify for their standard product, you may have rate increases depending on how you answer these questions. Notice it does say a ‘Yes’ response automatically make you ineligible for the product.

What I can say is that I am fairly certain now, I’m not a hundred percent sure, that a ‘Yes’ may increase the price at best case scenario. Whereas a worst case scenario you may be declined. It just depends.

For example, start with the first question – are you currently disabled due to illness, confined to a hospital, a nursing facility, or do you require the use of a wheelchair?

Second question is a three year history. Look back. In the past three years has proposed insured been diagnosed or treated by a member of the medical profession for cancer, coronary artery disease or any disease or disorder of the heart, brain or liver, chronic kidney disease, kidney failure, muscular disease, mental nervous disorder, chronic obstructive lung disease like COPD, drug or alcohol abuse or hospitalized for diabetes, Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC) or test results indicating exposure to AIDS?

Third question is – does the proposed insured have any chronic illness or condition which requires periodic medical care or may require future surgery?

Fourth questions is – in the past 10 years has the proposed insured had his or her driver’s license revoked, suspended, been convicted of a misdemeanor or currently incarcerated.

Does the proposed insured wanting to replace or change existing life insurance?

We’ll just make sure that there are no additional health questions and can continue to proceed. Let’s click continue.

What will happen at this point, once you submit your application and you set up your payment, is that they will actually draft you, but they will begin to underwrite your application. This means that they check your medical history to make sure that it actually does work.

That is how the term insurance product works. For the sake of putting this policy option together, I’m going to show you the 65-year old non smoker rate. We’re looking is for $20,000 term insurance for a male, 65 smoker at 64/63 per month. If we look at females, 65 year old non-smoker for these prices and coverage is what you see here.

That’s how Globe Life Term Insurance product works. This is a really good, thorough overview of what to expect. I’m just describing to you how the product works. There are some definite advantages you can find elsewhere with other products. I’m going to save that analysis a momentarily.

It’s really important if you’re looking for quality life insurance to consider a second opinion, much like you would if you were diagnosed with something and you weren’t sure that doctor know what he’s talking about. You need to make sure you have somebody else take a look to give you their opinion on what could be changed and improved.

Globe Life Insurance – Children’s Whole Life

Globe Life Term Insurance Children’s Whole Life sells this a lot.

- It’s permanent life insurance

- It does not cancel at a later date

- Premiums never go up

- Can’t cancel due to age or health

- It may or may not qualify because of the kids health.

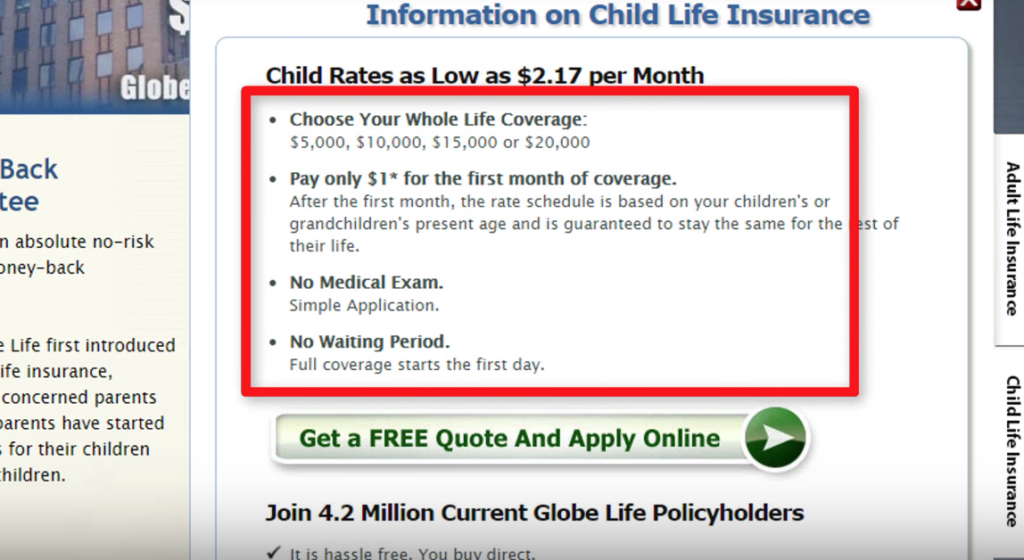

Let’s take a look at some rates and coverage options available for kids. On Globe’s website we’re going to submit for information for the whole life for children products.

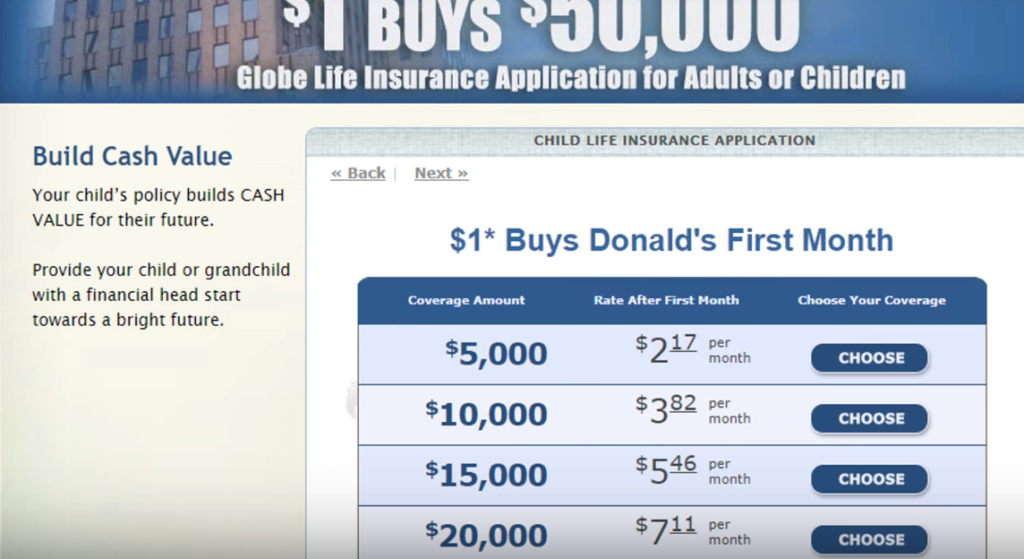

This time we’re going to go down here and we’re just going to do for one child and go ahead and begin to process an application. Same exact process this time. We put as Donald Duck’s information, click continue, choose Donald’s gender as a male. Enter birth date as five years old.

Here is how these particular plans work. You’ll notice there’s no fine print pop up box because whole life insurance is very simple product. It’s designed to build cash values indicated and then you pay the same premium for the entirety of the product. As long as it’s paid, you have coverage for the amount that you have on them. I’ve always thought that their prices are pretty good.

It’s a pretty standard product. There’s nothing way off base here with how the product works.

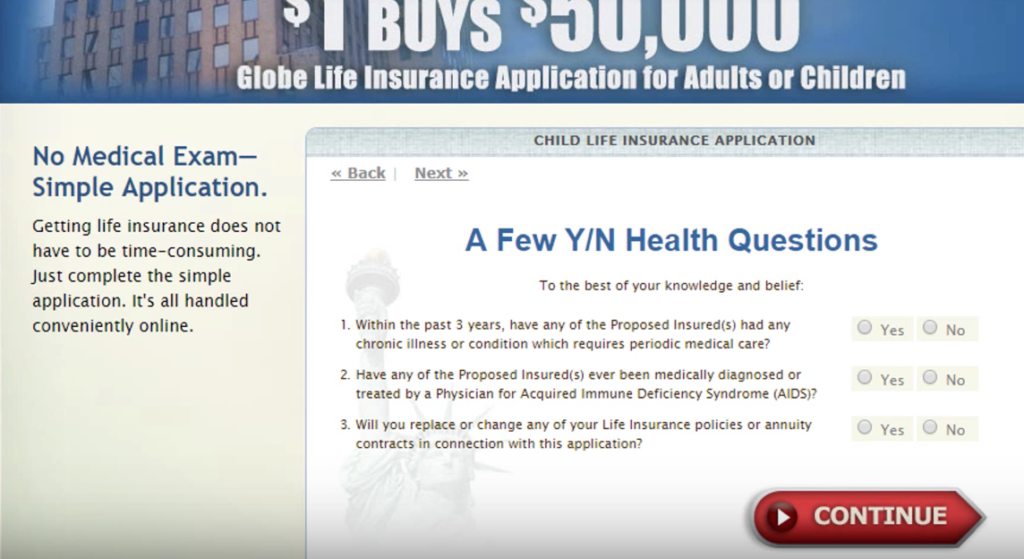

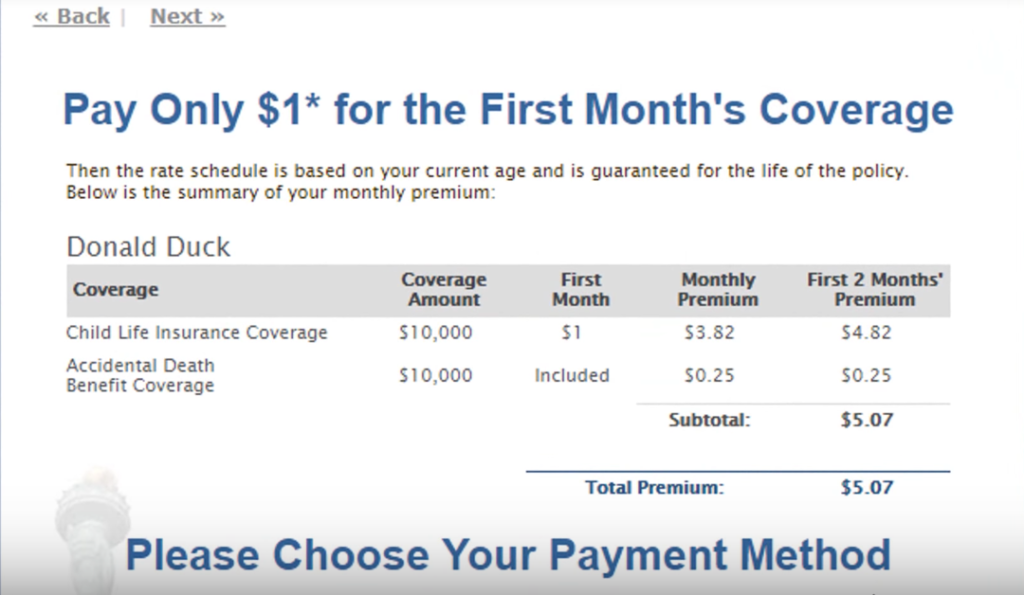

Let’s just say we want to do a $10,000 plan. You can choose accidental death benefit option; it’s cheap. I’d probably do that as a parent since it seems like a good deal. Fill up the form with some made-up information. Then we’re going to move to the health questions – very standard questions.

- Within the past three years, have there been any proposed insured’s, mainly the kids had any chronic illness or condition which requires periodic medical care.

- Have the any of the proposed insured’s ever been medically diagnosed as treating are treated by a physician for AIDS?

- Will you replace the life? Insure it? Are you going to replace life insurance with this?

That’s all you have to do in order to fill out the health questions. Then they give you a price which for $10,000 of child’s covered with an additional $10,000 in premium is five of us have actually for that’s two months at a time.

Now let’s take a look at your whole life insurance here. This just gives you an idea how it works.

- Once approved their benefits will never be reduced or cancelled, regardless of changes in health or occupation.

- As long as the premium has been paid on time, your child’s policy builds cash value for the future, no risk

- Money back guarantee.

- Full coverage starts from the first day. There’s no waiting period with this particular plan.

- No medical exam

I like this product. I don’t think there’s anything particularly wrong with it – it has good price and has permanent type of product to it. I’ll show you some options that may be something you may want to consider alternatively, comparable to it. You can make a determination if this is a good choice for her if you feel like something else is as well.

Why would people buy certain Globe Life Insurance products?

Let’s talk about why it would be appropriate in certain circumstances to purchase a particular type of Globe Life Insurance policy.

- Term Insurance Product: Let’s talk about the term insurance product first in mind. A lot of reasons people I’ve experienced purchased a Globe Life term insurance is because they’re price conscious. They see fairly competitive to a lot of the other stuff they’ll see in the mail, which tends to be higher priced because it’s whole life insurance instead of term since whole life is usually a little bit higher.

- Term Insurance has convenient amounts of coverage that for a lot of people are more easily affordable. People on a fixed income are more attracted to the Globe because it’s less of an expense and they want more than just playing on final expense coverage as well.

- Maybe they want to be buried and they just get what they can for as affordable as possible. But then they also want to get maybe additional money left behind for two kids or spouse and replace incomes.

- Children’s Whole Life Product: People just buy it because they feel protection is important in general and they want to protect her kids – nothing complicated. They just feel that it’s an important act to do.

Case Study Examples

First Child

A couple recently reached out to me because they just recently had their first child. There is something about having your first kid that makes you think seriously about the future and the long term importance of your child having financial security.

The couple was in generally good health, but the husband had a weight issue he was concerned would affect their rates. I assured them I would do my best to find coverage to meet their budget and was able to do just that.

By shopping among a number of providers I was able to get first day full coverage for both clients. Though I can’t guarantee the same outcome for everyone in the same situation and with the same weight concern, we certainly do our best to secure affordable coverage for all of our clients.

Looking for Additional Coverage

A gentleman reached out to me because he had recently received a significant promotion at his company. He was concerned that this increase in income would also cause his financial obligations to increase and wanted to add to the existing coverage he had in place.

This gentleman had a health history of high blood pressure and was taking medication to keep this health issue under control. He’d heard from some relatives that this could affect his eligibility and he was concerned that he would end up being declined.

Luckily this client decided to work with a broker like us. We were able to shop a number of options and get him first day full coverage to meet his coverage goal.

We can’t promise coverage for every applicant, but we certainly do our best to provide quality coverage for every client who contacts us by looking at a number of providers who work with different kinds of health conditions.

Alternatives to Globe Life Burial Insurance

Globe Life is not the only organization to offer life insurance by any stretch. You may want to consider the alternatives before making your decision.

You can buy permanent life insurance through a broker and an agent is one route that you can go as an alternative.

Let me explain some things. First of all a term life insurance plan equals terminating. When you take this plan out, you’re going to die at some point and it may be after the policy cancels or even worse you may not be able to afford the price increases that come down the line especially if you start older in life and you are in a senior age. You may be in a position where you ended up dropping this thing. This is a position you do not want to be in.

What a good idea is to do before committing to buying to a plan like Globe Life is to check a second opinion with a broker such as myself. The pros to being a broker is

- I shop around and try to find you the best price and the best coverage.

- I don’t deal with one particular company.

- My commitment is to finding an insurance policy that’s actually going to give you the best value of coverage and price that you can get the most benefit and also pay the least expense possible with the combination of that, assuming we can get qualified.

There’s really no cons to this approach. I work with many brand-name companies that you’ve all heard of and many times the rates tend to be tremendously better.

The reason I’m bringing up permanent life insurance is because I want you to consider permanent life insurance. I am going show some term life insurance options as well, being that most people buy Globe Life because of price sensitive and they want to make sure that they get the most bang for their buck.

They won’t buy term insurance product, but there’s inherent problems as we discussed. You have price increases coming down the line, you’ve got a potential point in the future where you’re going to get canceled. It’s better in my opinion, to buy a permanent plan if you’re looking for a final expense type of policy sooner in your life than later.

Let’s look at some price comparisons just to show you the difference that it’s not too stark of a contrast between pricing. You may have to pay a little bit more, but you have the long-term certainty that if you live a long life, you’ll never outlive it and waste all the premiums not being covered because now you’re canceled because you outlived globe plan.

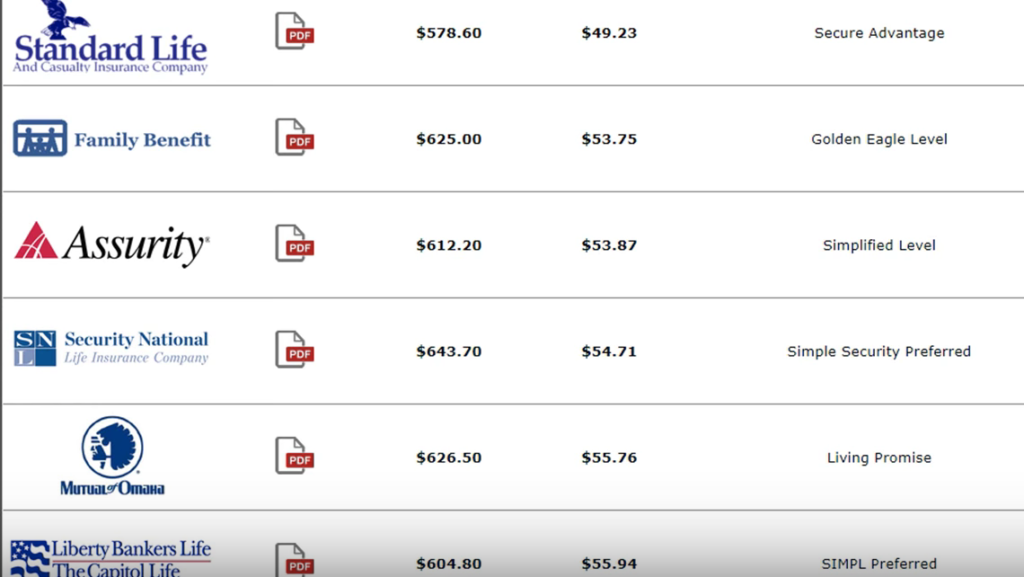

What we’re looking at is 65 year old, $10,000 whole life permanent coverage which cannot be canceled because of age or health. If you qualify, you will have first day full coverage and the rate stays the same. You can upgrade your plan and lock that premium in for the length of your life as long as you live.

Compare this to the last number we saw for the upper forties, low fifties, they’re comparing approximately $34 a month to the Globe Life Insurance plan for $10,000, but on a term basis and just for about $15 to $20 more a month.

One of the cons may be initially to this type of approach, is that you’ll pay more upfront, but you pay to prevent a potential, much larger loss or cost because you either can’t afford the price increases later on or that you actually outlived the coverage.

The other thing you’ve got to be aware of is that you may be in a circumstance where you can’t even qualify for the coverage. We’re looking at the health questions on Globe Life for two adults, 65 year old male and female nonsmoker.

For example, ‘is there is a three year look back on cancer, kidney problems, heart problems, and a potential diabetes issues?’. Just because you answer yes doesn’t mean you’ll be declined or ineligible, but you may pay a higher price.

I work with companies that in many cases just have a two year look-back, which means if you had something between two or three years ago, you may want to try and apply with one of my companies perhaps for a better price.

One of the things that you’re realizing you’re looking on here is the price you’re being showed is for ‘preferred’ – means it assumes you are in perfect shape. But there may be medications you’re taking or conditions that you’ve had that will cause a rate increase.

That’s true for mine as well. But I generally have a better idea and understanding of what you’re going to get approved for because I work with different companies and we can look at better the rates are going to be.

Now, I understand the important point and take away here is not to go into a detailed analysis of rates. I wanted to show you just how the prices compared and you’re definitely a few by a permanent plan.

It doesn’t matter if you’re in your 40s, 50s, 60, 70s, 80s, you’re going to pay more for a permanent whole life insurance plan and the reasons are simple.

- It’s because with whole life you’re buying guarantees,

- you’re buying a premium that’s fixed price. It never goes up.

- You’re buying coverage. It never cancels because of age or health

- Ideally you’re going to get fully protected from the first day if you can qualify for it.

All of that is a better improvement upon the globe life product, which means if you think about it, it’s just like buying a car with a warranty and upgrades in it. You’re going to pay a little bit more. And that’s the case here.

My argument is that while you may pay more now, in the long run you’ll pay a lot less because you’ve locked in coverage. You don’t ever have to worry about reapplying and potentially getting declined because your health changes or losing your globe life insurance because it’s unaffordable or you outlive it.

You eliminate all those costs down the line for a little bit more, which in many cases is just a couple of extra dollars a week. It gives you a lot more peace of mind if you really consider it.

Now, sometimes people who are looking at Globe Life really just want a term life insurance product. They’re not necessarily thrilled about possibly buying something that is a whole life insurance product. That’s fine.

What I’m going to show you a comparison of what else you could do if you just want, say $25,000, $50,000 in term life insurance and you wanted to get a lot of coverage but you wanted to pay an affordable price for it. We’re going to look at term life, will look at the prices that Globe will charge, and then we’re going compare that to some other products.

Then I’m going to tell you one other huge benefit to buying a product through broker like myself, that’s term insurance that you don’t get what the Globe Life product offers.

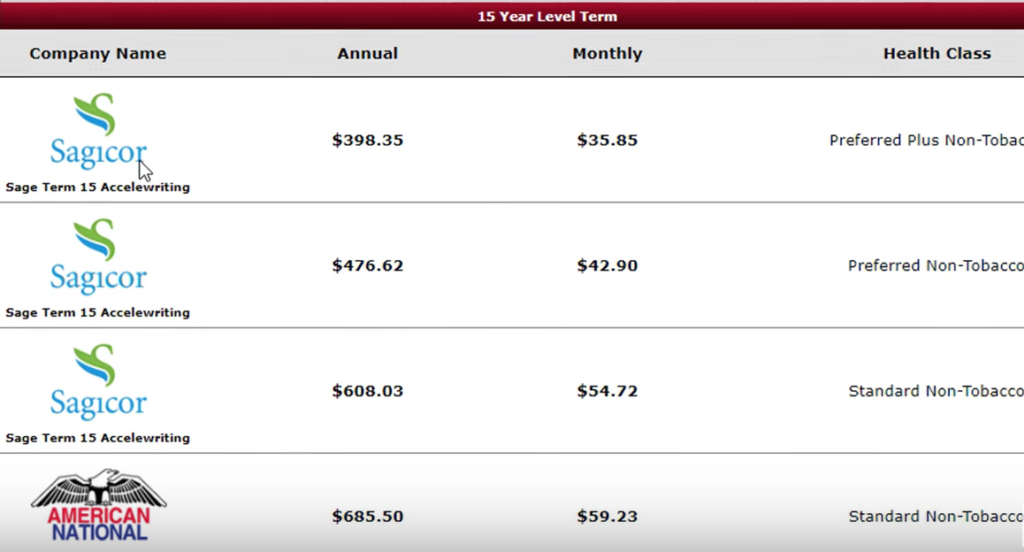

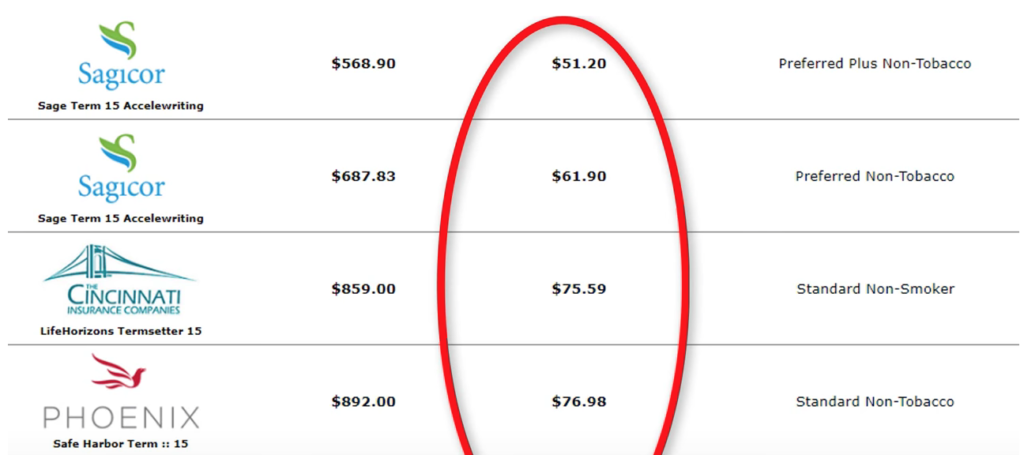

Let’s take a look at quotes for $50,000 in term life insurance on a 65 year old non-smoking female.

This is Globe Life’s projected rate if you qualify for that based on their health questions. For $50,000 you’d be paying $4 and one cent a month. To remind you guys that are reading this or watching, you’ve got the all renewal periods begin at a five year plus one age, which means that this is a premium increasing product that cancels at 80.This price will continue to go up.

Now compare this to what you could find through a broker or a quality company. You are looking at three companies or three products from one company. I really like called Sagicor for $50,000 in coverage for the same woman who is in perfect shape who would be with Globe Life instead of paying 94 and a penny, she could pay as low as $35.85 for $50,000.

Now check this out. The great thing about these plans do even better than just the price is that premium is locked in for the 15 years. So once you make it to 80, it’s still the same price. It ends – that’s just the way term insurance works. But you can see that one of these plans are a much better use of your money if you can qualify.

My twin girls Emily and Eva thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Now there’s three different plans – preferred plus, preferred standard, and there’s a rated one which would probably be a little bit higher, but even if you couldn’t qualify for one of these three and had to go to a step up, it’s very likely it’s still going to be under the price point that Globe Life is offering you.

You still get to keep the premiums in place because one thing we don’t know when you apply what the price increases are going to be and they usually they’re fairly substantial. You’re looking at prices. It’s increased at 66, 71 and 76 and they get pretty hefty as you get older.

Whereas with any of these plants here that we have, your premiums are locked in for those 15 years. The thing we can do is that if you really want a term insurance, there are options to extend your term insurance beyond 65.

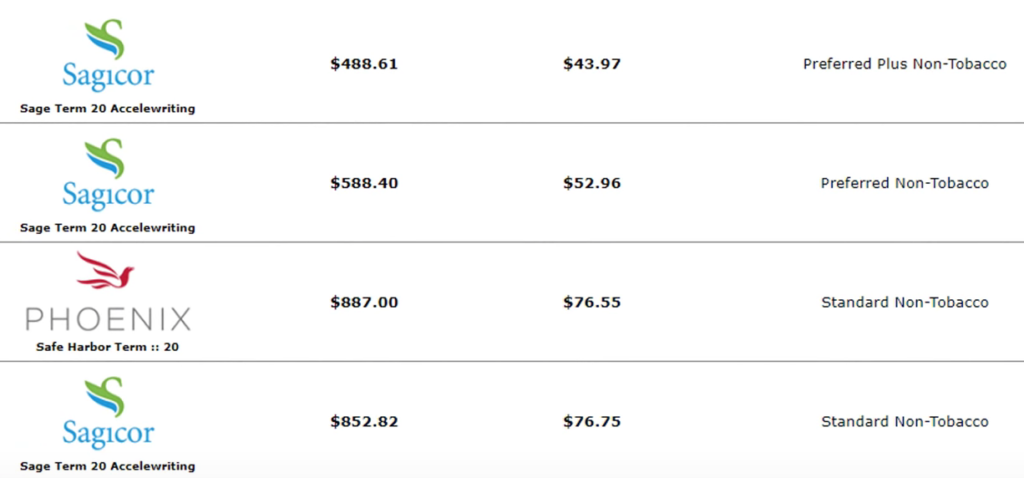

For example, we could go to 20 years potentially. I’ll just quickly show you a quote on the price difference.

It’s a little bit more. Maybe we could take you up to 20 years and have coverage till you’re 85. It’s a little bit difficult to get over 85, but we have products called guaranteed universal life insurance that will cover you beyond eighty five. That is more of a permanent type of product.

Let’s take a look at the male prices here. Male, 65, nonsmoker with, with Globe Life for $50,000 with $156 a month. If we take a look at a male at $50,000 on a 15 year basis just to get a good comparison, there is a stark contrast. You may pay as low as $51.20 a month, maybe higher if you can’t qualify.

But even so, if it was even higher than the standard price and you’re paying more like a rated case of a 100/120, you’re still paying less and you locked in your premiums for those 15 years. Same thing for males – looking at 20 years. We can do that as well.

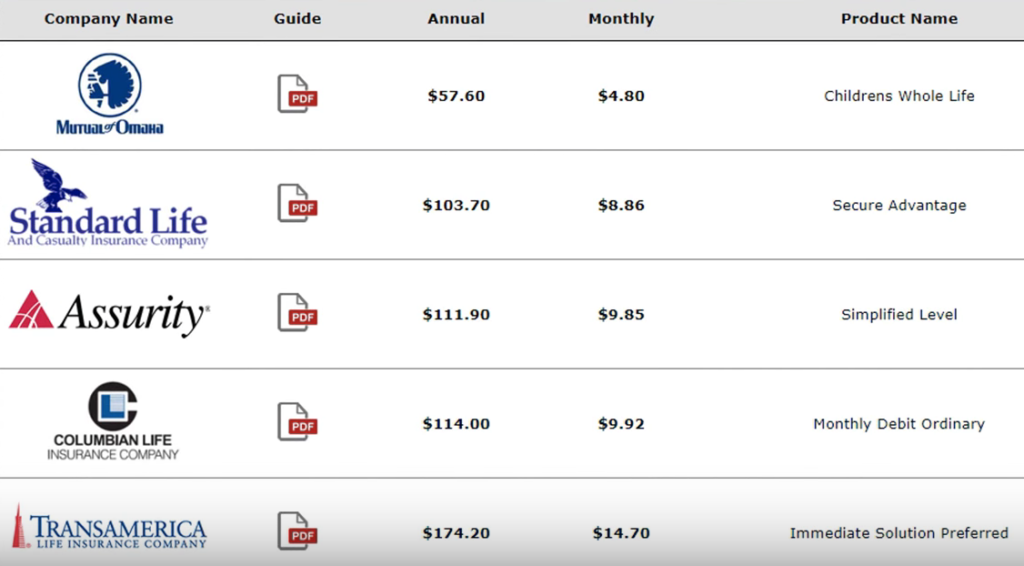

Last thing we’ll look at very quickly is just some children’s whole life comparisons as a broker actually feel like the globe product is good.

It’s just basic standard whole life insurance for kids and it’s very cheap. What you’re going to find is that most of what’s out there is going to be comparable to what Globe charges that’s how I’ve experienced it in the field.

I’ll go ahead and show you some prices just to compare. I’ll point out specifically mutual of Omaha. If you like the company, their price points are almost identical to the product that Globe Life sells.

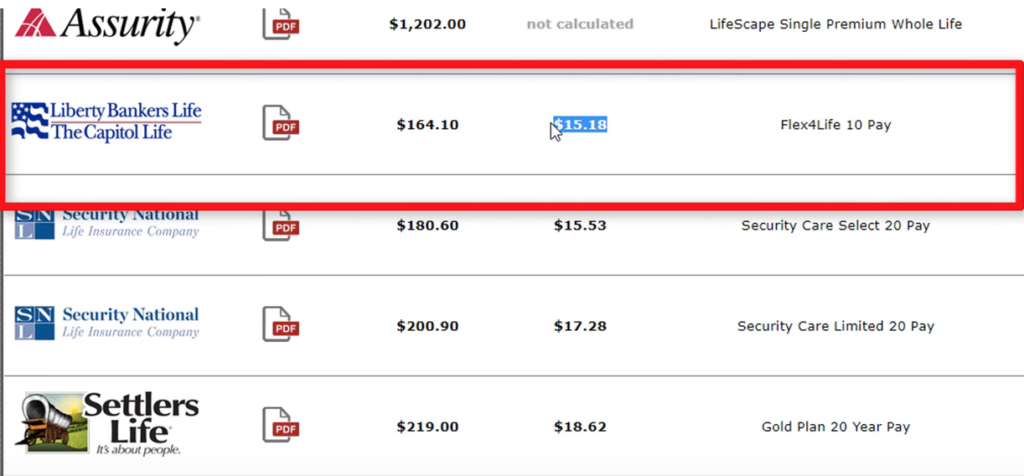

Now one little thing you can do is what’s called a limited pay plan where you pay for a particular period of time and then in 10 or 20 years you get done paying and never have to ever again. With whole life products for most circumstances, you’re going to be in a position where you pay this for life.

If you buy it through Globe Life your kid can pick it up, but then they have to pay it if they want to keep it. There are plans out there. These aren’t necessarily the ones I’d recommend, but to just demonstrate the point, we look at Liberty Banker’s Life.

You can literally pay 15 bucks a month, that’s 10 bucks more, but in 10 years you’d be done paying it. For around a $180 a year or $1,800 in 10 years, your child will get a $10,000 death benefit and they never have to pay a premium ever again after those 10 years are up. This is what we call a paid up plan.

Picture paying off your car. You still get to drive it after you pay it off if you own it. That’s the case and that’s how this is to you actually own the life insurance so you can get to an endpoint and your kid can run around with insurance and never have to pay a premium again. You don’t ever have to worry, should I go pick up another life insurance plan?

Paid up plans are really cool. This is just a concept demonstration. I actually don’t necessarily recommend these. There’s probably better ones out there, but I just want to point this out as an alternative to paying on a children’s whole life plan the rest of your life. I’m happy to run quotes for you and give you an idea of what your kid would qualify for. There’s usually no exams.

Stories from the Field

Back in 2014, I met a nice gentleman for whom I wrote up a small burial plan. He mentioned that his mother was in desperate need of burial insurance too and asked that I look at what we could do for her.

His mother, Mrs. Sanders, was 81 years old and only recently retired. She had worked at a local dry cleaners and had only retired because of heart problems that kept her from going to work every day.

Mrs. Sanders had a life insurance policy in place, but had been surprised by how it operated. She had recently found out that the policy would cancel when she turned 90. Worst of all, the plan had continued to go up in price each year.

She had started out with payments of $50 per month and was now paying $300 a month for $40,000 in coverage. This monthly premium was obviously too high for Mrs. Sanders to keep up with, especially since her retirement.

To further complicate the situaiton, because of her heart problems she was only able to qualify for coverage that required a 2 year wait period. Unfortunately we were not able to secure first day coverage, which meant Mrs. Sanders had to either take a chance and go 2 years without coverage or continue to pay on coverage that was unaffordable.

This is a tough position we never want to see our client’s face. That’s why it is so important to create a policy that works the way you need it to and meets your personal goals. Life insurance is an important decision and one that should not be taken lightly.

That’s why we emphasis the importance of working with a broker who can customize a policy to meet your specific needs and ensure there will be no hidden rate increases or cancellations if you intend to keep the policy long term.

Final thoughts

I’m going to give you some final thoughts wrapping up this particular comparison to the Globe Life Insurance, Term Insurance, as well as the Children’s Whole Life Insurance. The first thing I want to remind you is that this goal of this particular analysis wasn’t they give you a price guide for every single age.

I can do that. It’s quite tedious, to be honest with you, because the point in demonstrating this is I want to demonstrate just as a touchstone on how this product works. You’ve hopefully understood the basics of how it works now but I also want to compare it to the other options out there.

By using just one price, I’m able to give you an initial idea that with Globe Life Insurance, you’re paying a very large premium for a product that has price increases that may be inconvenient to you. There are other options you should be aware of without price increases within the term insurance, where you get a longer period of time and pay substantially less if you qualify.

If I were in your position, I would want to be informed of my options to see what’s the best use of my money. Globe Life is a fine product. There’s no criticism from the standpoint of the company. The only criticism I believe is important for the consumer is to know their options, to make sure that they choose the best coverage overall based on their circumstances.

There’s no better way than to compare and contrast and let the facts lay out as they do, so that you can make a determination of which works best for you. Same thing with the children’s whole life, great product they offer and it does a great job.

I think it’s a really important product to have and that’s why I showed the 10 pay or the paid up type of plans because a lot of people like the idea of pay this off if their children will always have covered and don’t have to worry about it, and for a small amount more. It’s not something that’s entirely out of bounds to consider.

How to qualify for a life insurance program to cover burial costs

I hope you enjoyed this particular program. The goal today, as we begin to wrap up is to give you the facts and information. If you feel it’s important to potentially qualify for something that I have to offer, maybe you’re more attracted to these whole life insurance plans.

Now that you’ve seen the price differential, maybe you’re just impressed by the conceptual differences between whole life, permanent protection in term insurance. You maybe didn’t know Globe Life was a term insurance or maybe you did, but you want to get a better deal for what you are willing to pay.

I highly recommend that you give me a call. Let me help you out with some options that are out there or just email me and let me show you what you may be able to qualify for to see if we can do a better job with the money you’re willing to put into some insurance.

Applying with my process is very simple.

- First, you just pick an agent. Of course I’ll nominate myself, , since I do this for a living.

- Second is the process we would work through is that I would ask you a series of health questions. I would look at periods that I think would be based best with your particular circumstances.

- Listen to what your goals are and then make a recommendation and a quote.

- Assuming you liked the quote, if it makes sense, we’ll begin to apply. That process typically requires no examination. Usually it requires an application, like what we were looking at on Globe’s website. Or you may complete a telephonic application where there’s no paperwork or anything like that.

- After several days or several weeks, usually it’s just within a couple of days you, if you’re approved, you get your coverage, notified that you’re approved and then several weeks later you get your policy and that’s literally the end of the story.

Next steps

Here’s what you need to do if you’d like the idea of potentially working with me to find you quality life insurance. You can visit my website buylifeinsuranceforburial.com. Click the contact box at the top or go down to the bottom and click the message, a chat box, and send me a message.

Let me run some quotes for you. Let me work with you. Tell me what you’re looking for.

You can call me on 888-626-0439. Please leave a voicemail if you don’t get me on always on the phone all day. You have to leave a message sometimes and I’ll get back to you pretty quickly.

I do hope you enjoyed the video. Please leave a comment if you liked it or if you found the information useful.

My name again is David, do for to buy life insurance or burial.com where I help people across the country with their life insurance needs on themselves. People they love.

Thank you so much for watching.