FinalExpenseProtect.com Guaranteed Acceptance [Commercial REVIEW]

It’s time for another final expense burial insurance commercial review. This time we’re going to be reviewing the guaranteed acceptance commercial from finalexpenseprotect.com. So, you the consumer, looking to get a burial insurance policy know exactly how these plans work and have time to understand it better. You can make the decision for yourself if the finalexpenseprotect.com guaranteed acceptance option is a good fit for you.

BuyLifeInsuranceForBurial.com helps seniors and people across the nation with their burial and final-expense needs. If you’d like a free quote, you can go to BuyLifeInsuranceForBurial.com There you’ll see a quote form. Just fill that out and you’ll see exactly what you can spend and what the price would be for a burial insurance program.

Also, you can call (888) 626-0439 and get all the information you need, faster.

We’re going to go through the comercial, and give you the information on how it works and read some of the fine print issues. Again, the whole reason for doing these reviews is really just to empower you with the knowledge to decide for yourself how you want to handle your final expenses, so that you’ve got all the facts in a slowed-down manner and can make a decision for yourself how you want to proceed with burial or life insurance coverage.

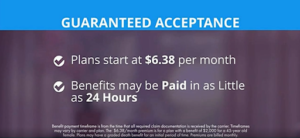

Guaranteed Acceptance

Let’s see what the comercial is trying to tell us with this screenshot:

- “Guaranteed acceptance”

Means that the program takes anybody who calls in, to qualify for it. So there are not the usual restrictions due to asking health questions and that kind of thing. No matter how healthy you are, or how sick you are, you are guaranteed to be accepted, as long as you’re between the age of 45 to 85 and you can qualify for up to 25,000. It doesn’t mean everybody’s going to get 25,000. They have plans that start a lot less than that. But, it’s trying to give you an idea of what the minimum and the maximum would be.

- “Benefit and premium amounts will not change, so long as premiums are paid on time.”

What they’re saying there is that you’ll keep everything you got when you first took it out, just as long as you pay your premiums. If you stop paying and your policy lapses, they’re not going to guarantee that you can ever get back what you had, because maybe your health changes.

- “Benefit amounts vary based on the choice of plan.”

What they’re suggesting here is there are some options here and you’re going to be in a position where, again, you might not get 25,000 based on the budget, if it’s too expensive for you and you can end up with something else instead.

No Medical Exams

That’s pretty much the norm for most burial insurance. There are no medical exams required. You don’t have to run on a treadmill, pee in a cup, or have blood taken. And health does matter to some companies, but some companies don’t care.

They’re called “guaranteed acceptance” because of this.

Guaranteed Acceptance

Again, that guaranteed acceptance, as we talked about, everybody’s guaranteed to be accepted within the range 45 to 85, as long as you can pay the premium, no matter what your health is.

Plans start at $6.38 a month. Well, if you read the fine print:

- “The $6.38 per month premium is for a plan with a benefit of $2,000 for a 45-year-old female.”

What the plans start at, and what they’re showing you, is the cheapest amount that it can be for the lowest amount of coverage. It’s the bare minimum possible. So, in other words, it’s likely if you’re not this person, guess what? It’s going to be more expensive, if you get more coverage, are older, are male, or smoke, in some cases.

- “Benefits may be paid.”

There’s a chance, but there’s no guarantee. So, remember what “maybe” means. “Benefits may be Paid.” “Paid” means they write the check. You may not get the money by then.

- “In as Little as 24 hours.”

The shortest amount of time it might pay out is within 24 hours after you apply for the death claim.

This is highly unlikely with most insurance companies. Why is this the case? For a couple of reasons. First of all, most insurance carriers need a death certificate from the coroner’s office or the county or whoever controls that, to actually confirm the person’s death.

The insurance companies need to verify the identity and that the person insured is actually dead. So, that’s the norm. And that process takes weeks. Now, it usually doesn’t take years, but it’s usually a process of a month to two months, depending on the insurance company.

There are some companies who will front the money faster because that’s just their benefit. But usually, it’s after two years are up and the client is out of what we call “contestability.” Now, if it’s a guaranteed-acceptance product that doesn’t apply. So yes, those death benefits may be paid and as little as 24 hours.

- “Benefit payment timeframe is from the time that all required claim documentation is received by the carrier.”

It’s like saying, “In my opinion, my wife delivered a baby in just literally two minutes.” Well, she was in labor for the last 20 hours. Right? So, was that delivery just two minutes? No. That delivery process that built up to the actual delivery was a 20-hour ordeal. And so, it’s a little not clear here when it says that you got to get all the claim documentation in and received by the carrier.

- Timeframes vary by carrier and plan.

Again, just depends.

- “Plans may have a graded death benefit for an initial period of time. Premiums are billed monthly.”

It means, basically, the same thing as it’s not full-death benefit coverage in the first two years. So, you may be in a position, as suggested by guaranteed acceptance already, where you don’t have first-day, full coverage from the first payment. So what if you die earlier than expected? Well, that means you might be in a position where your family doesn’t get full coverage. Where there are, in some circumstances, policies that will fully cover you from the first day.

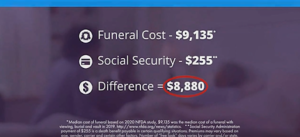

Funeral Costs

The funeral costs $9,135. This is from an NFDA National Funeral Directors Association study from 2020.

It’s 2022, late 2022, at the time of reviewing this comercial. This number’s actually higher. Inflation has caused prices of food to go up, and real estate to go up. And guess what? Burying and being cremated as well.

You need more coverage than that. And yes, a social security death benefit again, really only pays out in qualifying conditions. But, even if it did, how much is $255 going to make a difference? Very little impact. There’s definitely a need for insurance.

Again, the fine print down here says,

- “Premiums may vary based on age, gender, carrier, and certain other factors. The number of “free look” days varies by carriers.”

That means you can take the policy, depending on the carrier in the state, and have the opportunity to cancel it and not be charged. Or get your money back, if you decide to change your mind.

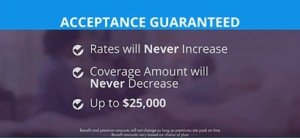

Rates and Coverage

This is just normal stuff for burial insurance for dozens upon dozens of companies. Named brand companies you all have heard of.

- Rates never increase. True for this product, true for most.

- The coverage amount will never decrease. True for this product, true for most.

- Up to $25,000. Again, it could be a lot less than that. True for most companies out here. So nothing really unique here, frankly.

And the 30-day free look is basically a 30-day money-back guarantee. If you don’t like it, return it. And it says “up to,” so it’s not guaranteed. It might be 10 in your state, or 20. And that’s really a state-by-state thing.

When Does the Coverage Begin?

Now, you notice how it says “Your coverage begins from the very first payment.” What it doesn’t say is how much of the coverage begins from the very first payment.

If it was always the case that the coverage began fully from the first day they would be saying, “Hey! Your coverage starts 100% full, for the entire amount of coverage, from the first day. No waiting period.” It would say that. But notice it didn’t. It said that your coverage starts from the first payment date.

But, that coverage for a guaranteed acceptance may just be equal to your money back, plus interest when you die, like many of these guaranteed acceptance plans are which is a two-year waiting-period policy for natural death. Or, if you die by any natural means, your money comes back to your beneficiary. The premium’s paid in, plus in many cases, it’s just about 10%, give or take. Not a lot back.

The Fine Print

-

- Not all plans are available in all states.

- Callers will be directed to licensed insurance agents with TZ Insurance Solutions – This is the call center that handles these inbound calls that you make and continues to try to sell you a policy

- Who can provide more information about the guaranteed issue, whole-life insurance plans. – So, they’re telling you exactly what it is.

- Offered by one or several carriers, each having an AM best rating of A+ or higher – That’s just a financial rating of the company. That’s a good thing. If it’s A+ or higher.

- Guaranteed issue, whole-life insurance is available to individuals between the age of 45 and 85

- Age qualifications varies by plan and carrier

- You will receive only the benefit amount in the policy issued – So, that’s just saying you’re going to get exactly what the policy says. If you die in the first two years and it says your premiums are returned, plus 10% interest, that’s exactly what you’re getting.

- In order for the policy premiums and benefits to remain in effect, the premiums must be paid on time – It’s normal stuff

- Premiums may depend upon the coverage amount selected – Normal stuff

- Your individual qualifications may vary by carrier and state. Plans may have a greater death benefit for initial period of time – Again, a limited amount of coverage for the first two years.

- Benefits are paid to the named beneficiary and can be used for any purpose – Right. So you can go blow it on a Hawaii trip instead of burying mom when she dies.

Final Thoughts

So, that is the finalexpenseprotect.com guaranteed acceptance commercial.

Some summarizing thoughts here. Very simple. These plans that are guaranteed acceptance are great if every other carrier is impossible to qualify for. This is what we’d call the trump card life insurance.

However, the problem is saying and, or, suggesting that this kind of plan is appropriate for everybody. Now, the commercial never really did that, but certainly, it did sell it like it’s the greatest thing ever. Right?

No matter what your health is, you should first investigate, before you look at something like this, to see what your options are to potentially qualify for first-day full coverage for natural and accidental death.

And the point is, is that regardless of your health, nobody knows when our final day’s going to be. So if you have the health, then why wouldn’t you qualify, or try to qualify at least, for first-day full coverage? And that’s what we do at BuyLifeInsuranceForBurial.com. We’re not going to stick you arbitrarily into a two-year waiting period guaranteed-acceptance program, that may not be in the best interest of your survivors. That truly won’t get you the peace of mind that you want.

Now, not everybody qualifies for first-day full coverage, but a lot of people do, who otherwise end up with one of these guaranteed-acceptance programs.

It’s very simple. Go to BuyLifeInsuranceForBurial.com. Run a quote on yourself, see what things cost but, more importantly, talk to us so we can run some numbers and underwrite your health. And in a matter of minutes, we can tell you what the possibilities are that you’re going to get first-day full-coverage.

So, call us at (888) 626-0439. We’ll tell you straight up if we can help you and get your first-day full coverage, or if something like guaranteed acceptance would actually be your best bet.