Qualify for Burial Insurance With Cerebral Palsy

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

In Today’s Article, I Will Discuss How You Or A Loved One Can Qualify For Burial Insurance With A Cerebral Palsy Diagnosis

Cerebral palsy is a congenital disorder affecting movement, muscle tone, or posture. Physicians diagnose more than 200,000 new cerebral palsy cases annually across the world.

Similar in how autism is described as an “umbrella disease,” cerebral palsy can affect a multitude of bodily functions. Some patients have more physical issues than others.

Here’s An Overview Of Today’s Topics:

- What Are The Causes Of Cerebral Palsy?

- Cerebral Palsy And Burial Insurance

- Mobility

- Epilepsy

- Intellectual Issues

- Age Considerations

- Burial Insurance Rates, Age 40 to 90*

- Let Me Help!

What Are The Causes Of Cerebral Palsy?

There is no known cause. Studies show complications at birth only explain a minority of cerebral palsy cases.

Cerebral Palsy And Burial Insurance

Qualifying for quality burial insurance for cerebral palsy patients depends on the type and severity of physical ailments.

Let’s break down line-by-line what physical ailments exist. Then, I will describe the likelihood of qualifying for burial insurance, based on each ailment.

Buy Life Insurance for Burial wants to help people like you. Our top priority is to make sure you meet your insurance-related goals, like covering burial or cremation.

Above all, we want to shop the most competitively priced options available in order to best provide you with the coverage you need. Let us start now by giving you a free quote.

Call (888) 626-0439 for your no-obligation quote now. You can submit a message, too. The form is located on the left-hand side of the screen. Once we get your message, we will reach out to you within the next 24 business hours.

Mobility

Studies show that one out of three CP patients cannot walk, with many of the remaining group having difficulty with independent movement.

If you or a loved one is wheelchair-bound due to cerebral palsy, most likely the only option for burial insurance coverage will be a guaranteed-acceptance whole life insurance program.

However, there may be an opportunity to qualify for another type of burial insurance coverage with better options. I’ll cover that in more detail below.

For those CP patients who can move independently with the help of a walker or other device, you may qualify for something better than a plan that requires a two-year wait before coming into full effect.

Ultimately, that will depend on several other health factors. And the best way to determine that is to call 888-626-0439. I’ll ask a few quick questions and tell you what your options are.

Epilepsy

25% of cerebral palsy patients have epilepsy and epileptic seizures. Here’s the good news.

You may qualify for quality burial insurance coverage, even with epilepsy and cerebral palsy. Keep in mind that figuring out what you quality for ultimately comes down to multiple health questions.

Intellectual Issues

50% of all cerebral palsy patients have some level of intellectual disability.

Intellectual disabilities and burial insurance are sometimes difficult to get quality coverage in place. Much depends on other health factors, including the applicant’s age at the time of the applications.

Additionally, it is probable you’ll need a carrier that accepts an application with a power of attorney. This is something I can assist with and have done many times in the past.

Case Study Examples

Getting approved with mental illness

My client reached out to me because he was worried that he would leave his wife in an uncomfortable financial situation when he passed away, even though he was only 55. Mr. Carter knew that his wife didn’t make the same amount of money as he did, and he wanted to make sure that she could maintain the lifestyle they built together.

There was just one problem, Mr. Carter was diagnosed with bipolar disorder. He worried that because he had a history of mental illness that he would be less likely to get coverage, which is why he reached out to me for help.

I applied our process, which meant that I shopped around the best-priced companies that offer the top quality insurance in order to find a burial plan that worked for Mr. Carter. In the end, I was able to approve him for first day full coverage. He was thrilled to know that his wife would be covered when he passed away, and it gave them both peace of mind.

Remember, we cannot promise that you will have the same outcome if you are in a similar situation to the Carters. We can promise that Buy Life Insurance for Burial dedicates ourselves to helping people like you find quality coverage that you can afford.

Taking care of her family

My client, Mrs. Stevenson, requested that I come to meet with her to talk about life insurance. She was 73 at the time, and she knew she was getting older. She wanted to make sure that her family was taken care of, even after she passed away. Moreso, she wanted to leave money for her grandchildren. She felt the best way to do this was to get a life or burial insurance plan.

Her budget was the only issue. She currently lived on a fixed income, and she didn’t make a lot of money. She needed to make sure that she could afford the policy and that the policy would accomplish her life-insurance goals. Luckily, that is our specialty. We want all of our clients to get affordable, quality life or burial insurance.

We shopped around for Mrs. Stevenson and approved her for first day full coverage. She told us how happy she was knowing that she could take care of her family even after she was gone. She knew that she was leaving them the money they deserved.

If you are the same position as Mrs. Stevenson, consider reaching out to us today. Know that we can’t promise you the same outcome, but we are waiting to go over your life or burial insurance options with you now.

Interested in what you’ve read so far? Do you have more questions on getting burial insurance with cerebral palsy? Would you like to learn more about your options? If so, give us a call. Our number is (888) 626-0439. When you call, we can go over your options with you and provide you with a quote for no charge.

Also, feel free to submit your question to us via message. You can send us a message or express your interest by submitting the form on the left or bottom sides of the screen. Let us know how we can contact you, too. Then, you’ll hear from us within the next 24 business hours to let you know what your options are.

Age Considerations

Perhaps the most difficult aspect of qualifying for burial insurance is getting coverage in place on a child with cerebral palsy. In my experience, most carriers will decline child applicants with cerebral palsy. Even if the symptoms are mild.

Luckily, there are some suggested workarounds.

First, make sure you take out as much coverage allowable at work on your child with cerebral palsy. Most life insurance at work does not ask health questions, as it is guaranteed-issue. The added benefit is that many times you’ll get superior quality of coverage for a nominal monthly premium.

Second, find a carrier that will allow you to add your child on as an additional insured.

I work with burial insurance carriers that allow parents and grandparents to get coverage on children and grandchildren for a low premium, with little to no health questions.

This is the suggested course of action when the child is otherwise uninsurable.

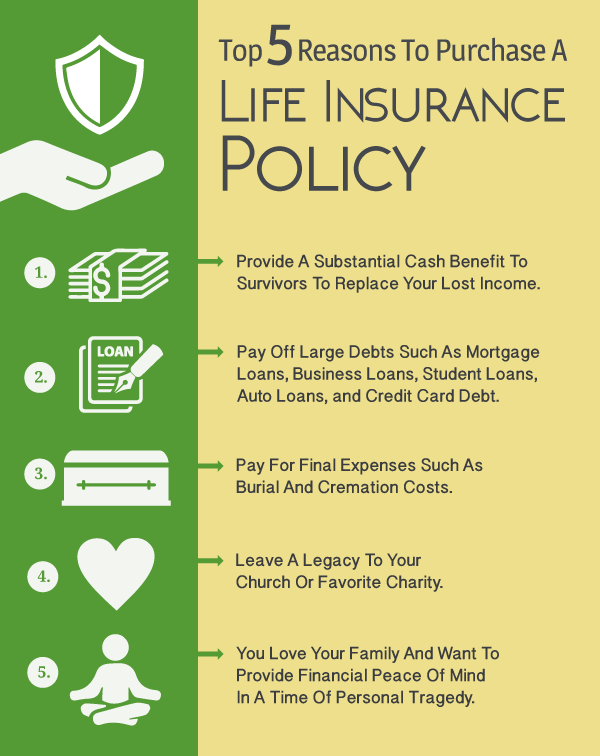

5 Reasons Why People Want Burial Insurance

1. Final expense costs are increasing

Burial insurance combats the rising problem of increasing final expenses. Over the past 20 years or so, cremation, burial, and funeral expenses have dramatically risen.

For example, a burial used to be $6,500 in the late-1990s. As of 2018, that figure has gotten to $8,700. Burial insurance helps you to avoid the inflation that has, and will continue to, happen because it makes sure that your burial plan is covered.

2. Affordable rates

When you work with a life insurance broker like us, it means that you get the most affordable prices. We are able to achieve this because we are partnered with many life insurance companies. We shop these companies to make sure that we find a policy that fits exactly what you’re looking for.

We can tailor your life or burial insurance plan to fit with your budget and financial situation. This is often why those on a fixed income want to get a burial insurance policy! It is a great solution.

3. It is forever

Buy Life Insurance for Burial will make sure that you get a burial insurance plan that is designed properly. We will make sure that your policy won’t cancel when you reach a certain age or when health complications arise.

With us, all you need to do is make sure you pay your premiums, and you are set for the rest of your life.

4. Policies can be tailored

We slightly mentioned this point in #2, but it is something we would like to expand on.

At Buy Life Insurance for Burial, we appreciate that everyone has their own unique needs. No two people are the same and, to us, that means that your burial insurance policy should reflect you.

We can tailor your burial insurance plan to specifically be designed to fit your goals. Also, we can take your budget into account, too.

There is a lot of flexibility here, and we work with you to find a policy that you will love. Customizability is why many people opt for burial insurance.

5. Protect all your savings

Last on this list is that you can use it to protect your savings. Many people have saved up money over the course of their lives, and they intend to leave this money to their families.

Some people realize that their final expenses might not be covered, which would cause their family to dip into the savings that they were left. Burial insurance is the perfect solution to this problem.

With burial insurance, all your final expenses will be covered, making sure that your savings are used for exactly what you intended them for: your family.

Burial Insurance Rates, Age 40 to 90*

Rates For $5,000 In Burial Insurance

Rates For $10,000 In Burial Insurance

Rates For $15,000 In Burial Insurance

Rates For $20,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

*Burial insurance premiums are subject to underwriting, based on rates as of 8/20/2018, from state-regulated life insurance companies offering final expense burial whole life insurance protection. Understand that in order to potentially qualify, you must submit an application to see if you’re eligible. Rates are subject to change. Give Buy Life Insurance For Burial a call at 888-626-0439 now to see what program you may qualify for.

Thanks for reading, and I hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Story from the field

My story that I want to share takes place from early on in my life insurance career. It happened on a warm day when I was just outside of Chattanooga.

I was going to meet a particular prospect, and I had a hard time finding her home. I was looking as I drove when I saw a house that caught my eye. I figured with my luck as an insurance agent, I would get to go to this one.

The home has a bright pink Cadillac in the driveway with a bright pink mailbox to match. And, when I got closer, there was even more.

In the yard was a large painting of a jester-like figure wearing clownish face paint. It was an interesting home.

It turned out I was right, it was the house I was looking for. When I met with the homeowner, she introduced herself. Her name was Anita Lollipop Jenson.

Please note for the purpose of this story, I have changed her last name to guarantee Anita’s privacy.

We get to talking, and she starts to tell me about her life. At one point, she lived in New Orleans, and it was when Hurricane Katrina hit.

It was a scary time, and she actually had to ride on top of an above-ground casket to get to safety. Luckily, she was picked up by one of Al Gore’s private planes. They brought her to Tennessee, and then, she had settled down here.

I just share this part because I think it is interesting, but I’m about to get to the serious part of the story.

We went through Ms. Jenson’s current policy, and I realized that she was being taken advantage of by a life insurance company. The policy she had was for an $8,000 funeral, but it was costing her an extra $250/month.

The insurance company told her that she had to pay this much because she had some heart ailments before. The truth was that besides that she was in great shape, and she should have qualified for something much better.

Thankfully, I caught this. I was able to set her up with a new plan with the same amount of coverage that was much more affordable. Actually, it ended up saving her $1,800/year.

This is the part of the story that is the serious bit. It is very disappointing how often seniors are taken advantage of by salespeople who want to make their product seem like it is the best thing on the market.

Truthfully, when you look at many of these cases, they cost much more than they should, and they don’t nearly cover enough. Ms. Jenson should never have been paying a premium that high.

Sadly, this happens all the time.

As I like to demonstrate in my articles, we operate what’s called a brokerage program. This gives the client an advantage because Buy Life Insurance for Burial is able to find you the best pricing and coverage regardless of what you need the life or burial insurance for.

This leads me to the two morals of this story:

-

Make sure you get a policy that works for you and your needs.

-

Guarantee this by working with a broker like us.

Let Me Help!

If you want quality burial insurance on you or a loved with cerebral palsy, here’s what to do.

Call me at 888-626-0439 now. Or, you can send me a message requesting a callback, or chat with me live now for some quotes.

Thank you for reading “Qualify for Burial Insurance With Cerebral Palsy.” We hope the content that we provided in this article was beneficial to you.

If you have any more questions or would like to learn more about your options, consider contacting Buy Life Insurance for Burial.

We always urge action amongst our clients because you never know what could happen tomorrow. We want to help you pay for final expenses, replace your income, or achieve any other life insurance goals you may have.

The process is simple, and it takes just 10 minutes.

To get started, call (888) 626-0439. When you do, you will speak with a Buy Life Insurance for Burial representative. They can answer any questions you have, provide you with a free quote, and explain how the program would work for you.

Also, feel free to send us a message. There are no obligations here either. All you need to do is tell us what information you are looking for or how we can help you.

Please leave us the best way to contact you, and we will answer your message within 24 business hours.

Again, thank you for finishing this article! We appreciate your interest.