30 Year Term Life Insurance Review

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Most likely you’re here today because you’re investigating 30 year term life insurance options.

Maybe you’ve decided that a 30 year term length will be suitable for the particular insurance goals that you have.

However, you want to make sure that your ultimate choice is the best overall value of coverage for the best possible premium.

If this describes your circumstance, then you have found the right page!

I’m going to cover a number of factors involved with getting the best value for a…

30 Year Term Life Insurance Policy

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Here’s An Overview Of Today’s Topics:

- Who Buys 30 Year Term?

- Reasons Why People Get 30-Year Term

- When 30-Year Term Insurance Doesn’t Make Sense

- Pros Of 30 Year Term Life Insurance

- Strategies For Purchasing a Policy

- Quotes And Next Steps

Who Buys 30-Year Term Life Insurance?

Let’s talk about the kinds of people who insure with a 30-year term life insurance program.

Understanding why people buy will help you solidify in your mind if the same choice is right for you. That way, you’ll have a better understanding why life insurance is important for your goals.

Basically, I want to build your confidence in your ultimate purchase decision, whether that be 30 year term life insurance or if you end up getting a 10-year term, 15-year term, or 20-year term insurance product

So, let’s get started!

Single without kids

Are you single without children?

If so, a 30-year term life insurance may make perfect sense.

Let’s first discuss why owning life insurance without kids is worth considering.

First, one of the best times to purchase insurance is when you’re single.

The odds are high you’ll marry and/or have children later in life. And life insurance is extremely important in helping your family along if you pass away suddenly.

Second, buying earlier in life usually means an easier time qualifying for coverage. Younger typically means healthier. Plus rates are cheaper, too.

Single with kids

If you are single and have children from another relationship, protecting yourself with life insurance is critical to their welfare.

There are a few reasons why.

First, you may be an ex-spouse paying child support. If you pass away, your support disappears and your child’s financial stability is gone.

Second, you may be a single-parent raising your children. You need life insurance protection to provide for your children’s welfare, pay for college, etc.

Married

What’s the most common event in life that motivates purchasing life insurance?

Getting married!

Here’s why…

Now that you’re married, you have concern over someone else’s security other than your own.

And this concern only grows with time and as your family expands with children.

And the consequences of losing you and your earning power become more and more potentially devastating if you pass away.

This is why many married couples select a 30-year term life insurance policy to protect the life they will build. It helps leave your family and loved ones with peace of mind upon your passing.

While life insurance can never replace you, it can replace much of your economic value.

It gives your family and loved ones a much better chance at sustaining a comfortable lifestyle if you were to suddenly pass away.

Up and coming professionals

If you’re a professional advancing in your career, congratulations!

Along with your enhanced earning power you’ve received, your need for life insurance has increased, as well.

Why? Likely your advancing income has allowed you to upgrade your home, purchase newer vehicles, and life a better lifestyle.

Without adequate life insurance coverage, your family stands to lose it all if your income disappears if you were to pass away unexpectedly.

All of these advancements in your life warrant purchasing additional life insurance coverage.

You may already have life insurance currently. If so, great! A second, supplementary policy to enhance your coverage is a good idea. And a 30-year term policy can do the trick.

Retirement or near retirement

Thinking about retirement? Yes – life insurance is still important!

While are limitations in term length for seniors at certain ages, there are still many term life insurance products at shorter lengths that can help.

Why look at a 30-year term life insurance product near retirement?

My experience shows me that concern over significant debts is the main driving concern.

People don’t want their family to pay out of pocket if they happen to pass away before the debt is paid off.

Most common debts include mortgage debt or they’re concerned about paying final expenses.

A 30 year term insurance product may be a good idea if you want to ensure these obligations are covered.

Reasons Why People Choose A 30-Year Term Policy

In this section, we’re going to talk about 6 different reasons why people decide to purchase a 30 year term life insurance product versus other types of life insurance.

This section will help you understand the main motivations that encourage people to invest a portion of their monthly income towards a life insurance plan.

It will help you reinforce your own reasons and feel more confident about your decision.

Income replacement

Insuring your income if you pass away earlier than expected is the predominant reason why people purchase life insurance.

But, it’s ESPECIALLY why people purchase a term insurance plan.

Allow me to explain.

My story getting term insurance

I decided to purchase a 30 year term insurance plan when I was in my early thirties.

My career as a life insurance agent was booming and my income was rapidly rising.

I recognized that I had at least another 30 years before I would retire, and wanted to protect my wife and four children if I happened to pass away due to a sudden death like an accident, since I spent a lot of time driving to appointments.

Considering my goal of replacing my income and giving my family peace of mind, I selected a 30-year term life insurance product.

If I died at any point during that time, my wife receives the money.

And with that money, she can continue to make sure our children are provided for, and our lifestyle we built is protected.

Have you thought about this scenario yourself?

What would happen if you died before reaching retirement? Would your family suffer financially?

If so, for many people, a 30-year term insurance program makes perfect sense.

A 30 year term life insurance product is the longest term-product available. It gives you multiple decades of protection.

Retirement

Did you know life insurance can protect your retirement plans, too?

Each month, I contribute a fixed sum of money into my retirement plan and IRA.

But what happens if I die early and my family’s retirement needs aren’t fully funded?

I believe EVERY life insurance policy design should consider your current retirement plan contribution.

It makes perfect sense to allocate more coverage to cover your yearly contributions.

You don’t have to take out another life insurance, but you should factor higher coverage to accommodate.

Mortgage protection

Across the board, Americans’ biggest debt is their mortgage.

Therefore, it makes sense to insure their lives to protect against the chance of losing the home upon suddenly passing away.

And since most mortgages are 30 years in length, buying a 30-year term life insurance policy to cover the mortgage matches perfectly.

What if you’re mortgage is less than 30 years? You can custom-tailor a term policy from 10 to 25 years in length.

Lastly, with a private mortgage protection life insurance policy, your beneficiary is in complete control of the death benefit.

That means she can use the money however she want, and is not forced to pay the mortgage off if she elects not to.

Leave a legacy

Have you considered buying term life insurance to leave a legacy to your church or favorite charity?

Many people decide that giving money away at their death is a good way to make an impact and leave a legacy.

How does it work?

You name a percentage of your 30 year term insurance policy to the organization of your choice.

When you pass away, the organization receives the money. It’s that simple.

Business continuity

Do you own a small business? Are you, your business partners, or a key employee so vital to the business’s successful function that with an untimely death, it could affect the business’s continuity?

If so, consider covering both yourself and your partner with life insurance to protect the longevity of your business.

Imagine for a moment your partner or key employee passed away. They possess vital information, contacts, and relationships with vendors and clients.

How would their deaths affect your business’s profitability?

In many cases losing your business partner or key employee to a sudden death can have dramatic consequences on the health of your business.

If your business partner passes away, his heirs assume ownership and now have decision-making rights. This can have adverse effects on your business.

The solution is to create a properly-funded buyout agreement with your partner where the survivor will purchase the deceased heirs’ shares the company.

Specifically, I recommend one that stipulates upon the death of a partner, his or her shares are purchased through a life insurance product.

Life insurance coverage for both partners provides a source of capital to fund the buyout, without worrying about bank financing or tapping into personal funds.

Life insurance provides a marketplace for heirs to sell out the business and extract tangible value while maintaining the ability for the business to thrive.

This same concept applies to covering a key person in your organization.

If you have an important sales manager, operations manager, or executive in your business, and would suffer dearly with their sudden loss, insuring them with life policy provides a source of cash to help weather any financial loss.

Loan collateralization

Interested in financing your business with a bank loan?

In the interest of protecting it’s loan, the bank may require you to pledge a life insurance policy against the loan to ensure the principal balance is repaid.

A 30-year term life insurance policy may help out tremendously.

The process is quite simple. You just take out a life insurance policy on yourself.

Then, you or your business pays the premiums. In exchange, the bank is the beneficiary stated on the policy. If you pass away the bank gets the proceeds.

When You Should NOT Buy A 30-Year Term Policy

One of the greatest things term insurance provides is the ability to adjust the length of coverage to match your goals.

Therefore, there are circumstances where a 30-year term insurance policy may not do the best job, whereas something sorter in length works better.

Let’s jump into a few situations where a shorter term policy length or even a different life insurance product may work better.

Match your term insurance with your coverage timeline goals

Listen up! This is VERY important.

Always work to match your term life insurance policy to your specific goals.

Term insurance is best utilized to cover “temporary obligations.” More specifically, a temporary concern is something that you do eventually outgrow or overcome.

For example, paying off debts like your mortgage or business loan is a temporary obligation. Why? Because with enough time, you’ll pay them off.

It’s important to establish the nature of your temporary obligation, how long you can expect the obligation to last, then determine if a 30-year term life insurance policy is the most sensible solution.

Example

Let’s say your main reason in purchasing life insurance is solely to pay off your 20-year mortgage upon an early demise.

What happens if you select a 30-year term policy for protection?

You will be paying for an additional 10 years of coverage that isn’t needed.

Now, this example is subject to opinion.

I believe more coverage for a longer time is generally a better route to take.

Life has a way of hoisting new financial obligations as you age. I suggest my clients max out their life insurance term because of this simple truism.

Plus… we don’t know what tomorrow will bring for our health, either!

When term insurance isn’t best

When analyzing life insurance goals, some discover that term is NOT the solution.

Instead, they find out their life insurance goals require lifelong, permanent protection, such as providing income to a surviving spouse or paying burial costs.

In other words, they discover the need for coverage that doesn’t cancel due to age or health.

If that’s the case, consider adding a permanent life insurance program like burial insurance or guaranteed universal life for lifetime life insurance coverage.

Remember, term insurance terminates

Always remember that term insurance WILL terminate (or dramatically increase in price) once you outlive the initial 30 year (or any period of time) term.

This reminder is important because if you still need life insurance coverage, permanent coverage like whole life or universal life may make more sense.

Moral of the story… think long and hard about your life insurance goals. And feel free to call Buy Life Insurance For Burial for advice at 888-626-0439.

Advantages Of A 30-Year Term Life Policy

Let’s shift gears and discuss the advantages of 30-year term life insurance coverage.

Pro #1 – Length of coverage

A 30-year term life insurance product offers the longest length of coverage available for term products.

If you have temporary obligations like a mortgage or income replacement concerns, a 30-year term policy offers the longest and most comprehensive form of coverage.

Pro #2 – Conversion Option

Do you think one day you’ll need some level of permanent life insurance protection?

The good news is your term life insurance may provide the solution in the form of a conversion option.

A conversion option allows the insured to “convert” a portion of his term policy into a permanent policy without evidence of insurability.

That means if you think you’ll need a policy later in life to cover final expenses, a 30-year term policy may do the trick. AND have the added benefit of NOT requiring any health questions to take out the new policy.

Pro #3 – Living Benefits

Many 30 year term policies offer living benefit riders which may benefit you while alive.

Here are a few examples:

- Disability waiver rider – Covers the cost of your premiums if you are sick or get hurt and cannot work.

- Income rider – Pays a monthly cash benefit to you if you are sick or hurt and cannot work.

- Accidental death benefit rider – Pays an increased amount of coverage if you die because of an accident.

- Chronic illness riders – pays a lump-sum cash benefit to you if diagnosed or experience certain illnesses like cancer, or heart issues.

Which riders are suitable for you ultimately depends on your goals.

At Buy Life Insurance for Burial we will help you work through your concerns and figure out which one of the options may work best for you.

Dave’s Strategies In Buying The Best 30-Year Term Policy

In this section, I’d like to bestow my knowledge to you in the arena of getting the best deal on a 30-year term life insurance product using 4 specific strategies.

Let’s get started.

#1 – When age is a factor

There are circumstances where 30-year term life insurance coverage simply isn’t available.

In many circumstances, this is due to an older person such as a senior is looking for term life insurance. Most companies do not offer 30-year term life insurance coverage to seniors older than 60.

Regardless, there are alternative life insurance options that can extend coverage to 30 years and satisfy your insurance goals.

For these scenarios, I like using guaranteed universal life insurance coverage.

A guaranteed universal life plan offers a fixed premium payment as long as you continue to pay in a timely fashion, and in exchange will not lapse until it reaches the end of the coverage period.

This plan may make perfect sense if your ultimate goal is longer-term protection.

Feel free to reach out to us at 888-626-0439 and we’ll show you some numbers.

#2 – Laddering policies versus one policy

I’ve come across life insurance agents recommending a laddered approach to life insurance, where you take out 3 term policies lasting 10-, 20-, and 30-years, instead of one 30-year policy.

The argument is that this strategy reduces premiums considerably over the course of 30 years versus owning a singular 30-year term life insurance policy

Here’s why I think this strategy STINKS…

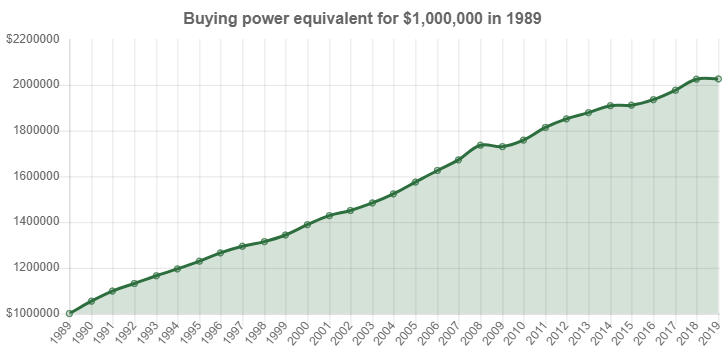

Inflation

According to the US Bureau of Labor Statistics, it takes approximately $2,000,000.00 in 2019 dollars to buy what $1,000,000 in 1989 would purchase.

In other words, inflation has doubled the price of goods over the past 30 years.

Here’s my point…

If you follow a laddered term insurance strategy in 1989 and died in 2019, your purchasing power on the death benefit would go much less further than if you were fully insured with one policy.

Price increases on everything are inevitable. Beyond that certainty, no one knows what the future holds. Why take an unnecessary chance on skimping out on coverage?

Down here in the South, we call the laddering strategy, “stepping over dollars to pick up pennies.”

My recommendation for my clients is to buy the BEST plan, and not necessarily the cheapest one.

And in many circumstances, maximizing coverage length to 30-years is the superior choice.

Life throws us curve balls and we don’t know what to expect one year to the next. I simply think it’s a safer play to make sure you get the most amount of coverage for the lowest price.

#3 – Exams

Should you take an exam?

Despite exams being optional for many 30-year term insurance products, I recommend my healthy clients opt for taking an exam.

Going through a medical exam requiring blood specimens, a physical, and a meeting with the doctor provides the opportunity for the most competitive premiums.

Many of my healthy clients who complete a fully underwritten 30-year term life insurance exam pay up to 50 percent less than what a non-medical exam offers.

Why is this the case?

Life insurance companies reward better rates to healthy applicants that provide the most up-to-date health information available.

When you do an exam, you undergo a physical, have blood withdrawn, and take a health questionnaire.

This provides the life insurance company with ample information, and provides more confidence in offering lower rates if you’re approved for coverage.

So, consider an exam if you are in good shape!

However, the only exception to this is if you’re buying a smaller amount of coverage, like under $500,000.

In this circumstance it may be a better idea to do a non-medical exam because of the price.

Last, if you absolutely do NOT want to take an exam and want a sizeable amount of coverage…

Do not despair. There are ways to get high levels of life insurance coverage without submitting yourself to an exam.

Call me at 888-626-0439 and I’ll be happy to assist.

#4 – Buy from a broker, not a captive agent

My twin girls Emily and Eva thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

This is really important.

Independent agents have access to a variety of life insurance companies.

Captive agents do not. They typically work for one life insurance company.

Here’s why this matters. Each company looks at your health differently, and may rate your conditions higher than others.

Even issues like height and weight, blood pressure, and cholesterol. Some companies are notoriously difficult in achieving competitive premiums with these minor health issues, while others are more flexible.

If you had these types of health issues, wouldn’t you want access to a life insurance company that would offer a better premium rate?

If you want to minimize the chances of unnecessarily high 30-year term life insurance premiums, make sure to partner with a broker like us at Buy Life Insurance For Burial.

Next Steps

I hope you have found what you were looking for as far as information on term life insurance goes. If you have any lingering questions, don’t hesitate to get in touch.

Life insurance is an important investment, one that shouldn’t be missed.

We are here to help, whatever your life insurance goals might be.

It’s very easy to start the process. Simply call us direct at 888 626-0439.

You will talk to a life insurance professional who can give you a free, no obligation quote over the phone.

Alternatively, you can send us a message with your contact details here to receive a free quote.

Thanks for your interest and we hope to hear from you soon.

Rate chart comparisons

In this example, I’m going to show 30 year term life insurance products for male and female smokers AND nonsmokers from age 25 to 55.

You will also find rates for universal life products that will cover until age 100 for those that can’t qualify because of an age issue.

These are sample, preferred plus rates, subject to change. Please note that in order to see if you qualify for these rates you must first fill out an application and take an exam.

Rates With Banner Life

$100000 Banner Term Insurance Monthly Rate Chart – 30 Year Term

| Age | Male, Smoker | Male, Non-smoker | Female, Smoker | Female, Non-smoker |

|---|---|---|---|---|

| 25 | $26.49 | $12.79 | $19.35 | $11.18 |

| 26 | $27.09 | $12.79 | $19.95 | $11.27 |

| 27 | $27.69 | $12.88 | $20.55 | $11.35 |

| 28 | $28.38 | $12.92 | $21.16 | $11.35 |

| 29 | $28.98 | $12.96 | $21.76 | $11.44 |

| 30 | $29.58 | $12.99 | $22.36 | $11.52 |

| 31 | $30.79 | $13.17 | $23.48 | $11.63 |

| 32 | $31.99 | $13.35 | $24.68 | $11.71 |

| 33 | $33.11 | $13.54 | $25.80 | $11.80 |

| 34 | $34.31 | $13.73 | $27.00 | $11.89 |

| 35 | $35.52 | $13.93 | $28.12 | $11.97 |

| 36 | $38.70 | $14.66 | $30.53 | $12.62 |

| 37 | $41.88 | $15.46 | $32.94 | $13.33 |

| 38 | $45.06 | $16.32 | $37.96 | $14.11 |

| 39 | $48.25 | $17.25 | $40.74 | $14.96 |

| 40 | $51.43 | $18.26 | $41.80 | $15.88 |

| 41 | $58.05 | $19.28 | $47.11 | $16.56 |

| 42 | $64.67 | $20.38 | $50.75 | $17.28 |

| 43 | $71.38 | $21.56 | $54.70 | $18.04 |

| 44 | $77.48 | $22.84 | $58.99 | $18.85 |

| 45 | $83.97 | $24.21 | $62.09 | $19.71 |

| 46 | $89.87 | $26.35 | $69.13 | $21.33 |

| 47 | $96.21 | $28.55 | $75.11 | $23.13 |

| 48 | $103.03 | $30.96 | $80.93 | $24.85 |

| 49 | $110.25 | $33.71 | $87.89 | $26.92 |

| 50 | $116.62 | $36.81 | $94.86 | $28.90 |

| 51 | No Result | $41.71 | No Result | $31.39 |

| 52 | No Result | $47.73 | No Result | $36.21 |

| 53 | No Result | $54.95 | No Result | $41.08 |

| 54 | No Result | $61.49 | No Result | $45.67 |

| 55 | No Result | $68.63 | No Result | $50.83 |

$250000 Banner Term Insurance Monthly Rate Chart – 30 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $55.90 | $18.49 | $38.70 | $15.48 |

| 26 | $57.40 | $18.70 | $42.14 | $15.69 |

| 27 | $58.91 | $18.92 | $42.35 | $15.93 |

| 28 | $60.20 | $19.30 | $42.35 | $16.15 |

| 29 | $61.70 | $19.48 | $43.86 | $16.36 |

| 30 | $63.21 | $19.56 | $45.36 | $16.73 |

| 31 | $65.57 | $20.05 | $47.30 | $17.18 |

| 32 | $67.94 | $20.57 | $49.23 | $17.64 |

| 33 | $70.52 | $21.06 | $50.95 | $18.07 |

| 34 | $72.88 | $21.67 | $52.89 | $18.68 |

| 35 | $75.25 | $22.02 | $54.82 | $19.01 |

| 36 | $81.98 | $23.39 | $59.75 | $20.03 |

| 37 | $88.65 | $24.70 | $64.24 | $21.06 |

| 38 | $95.89 | $26.28 | $70.01 | $22.24 |

| 39 | $103.76 | $27.84 | $75.78 | $23.39 |

| 40 | $111.37 | $29.41 | $82.14 | $24.49 |

| 41 | $123.34 | $32.49 | $89.89 | $26.38 |

| 42 | $135.49 | $35.26 | $98.02 | $28.31 |

| 43 | $148.89 | $37.99 | $107.92 | $30.46 |

| 44 | $163.68 | $40.85 | $118.31 | $32.75 |

| 45 | $177.80 | $44.29 | $129.74 | $35.17 |

| 46 | $194.71 | $47.73 | $140.06 | $38.14 |

| 47 | $210.69 | $51.38 | $151.24 | $41.35 |

| 48 | $228.01 | $58.66 | $163.35 | $44.90 |

| 49 | $246.80 | $64.07 | $176.45 | $48.74 |

| 50 | $267.17 | $69.83 | $190.64 | $52.20 |

| 51 | No Result | $79.14 | No Result | $56.54 |

| 52 | No Result | $89.65 | No Result | $66.45 |

| 53 | No Result | $99.05 | No Result | $74.49 |

| 54 | No Result | $110.72 | No Result | $81.91 |

| 55 | No Result | $123.63 | No Result | $90.52 |

$500000 Banner Term Insurance Monthly Rate Chart – 30 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $95.89 | $30.96 | $66.22 | $24.70 |

| 26 | $99.76 | $31.11 | $69.66 | $25.13 |

| 27 | $103.20 | $31.50 | $73.10 | $25.55 |

| 28 | $107.07 | $31.54 | $79.55 | $25.98 |

| 29 | $110.51 | $31.97 | $82.56 | $26.41 |

| 30 | $114.38 | $32.21 | $85.14 | $27.13 |

| 31 | $120.40 | $33.13 | $89.44 | $27.69 |

| 32 | $125.99 | $34.08 | $93.31 | $28.55 |

| 33 | $132.01 | $34.57 | $95.03 | $29.40 |

| 34 | $137.60 | $36.21 | $98.90 | $30.26 |

| 35 | $143.62 | $37.11 | $102.77 | $31.39 |

| 36 | $156.94 | $39.73 | $111.91 | $33.25 |

| 37 | $169.50 | $41.88 | $120.46 | $34.96 |

| 38 | $183.10 | $46.07 | $130.50 | $37.52 |

| 39 | $197.82 | $49.49 | $140.97 | $39.66 |

| 40 | $213.76 | $53.45 | $152.22 | $42.44 |

| 41 | $235.03 | $58.47 | $166.38 | $45.88 |

| 42 | $257.69 | $63.91 | $181.59 | $49.49 |

| 43 | $285.15 | $68.54 | $198.69 | $53.79 |

| 44 | $314.02 | $74.13 | $217.20 | $58.21 |

| 45 | $345.72 | $80.54 | $237.48 | $62.95 |

| 46 | $374.82 | $87.89 | $258.68 | $68.59 |

| 47 | $405.17 | $94.77 | $281.80 | $74.52 |

| 48 | $442.79 | $104.83 | $307.04 | $81.44 |

| 49 | $482.12 | $114.72 | $334.21 | $88.76 |

| 50 | $524.01 | $129.77 | $362.42 | $96.68 |

| 51 | No Result | $146.24 | No Result | $107.75 |

| 52 | No Result | $165.89 | No Result | $122.22 |

| 53 | No Result | $188.94 | No Result | $135.36 |

| 54 | No Result | $214.05 | No Result | $152.86 |

| 55 | No Result | $239.68 | No Result | $171.74 |

$1000000 Banner Term Insurance Monthly Rate Chart – 30 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $187.48 | $51.40 | $126.42 | $40.42 |

| 26 | $203.82 | $52.24 | $132.86 | $41.28 |

| 27 | $203.82 | $53.30 | $139.70 | $43.00 |

| 28 | $203.82 | $54.20 | $146.20 | $43.86 |

| 29 | $210.70 | $55.91 | $153.08 | $45.58 |

| 30 | $217.58 | $56.67 | $159.96 | $46.44 |

| 31 | $228.76 | $58.47 | $167.70 | $47.82 |

| 32 | $239.94 | $60.18 | $175.44 | $49.54 |

| 33 | $251.12 | $61.40 | $183.61 | $51.26 |

| 34 | $262.30 | $63.60 | $191.66 | $52.98 |

| 35 | $273.48 | $65.91 | $199.52 | $55.04 |

| 36 | $303.58 | $71.30 | $215.79 | $58.82 |

| 37 | $330.79 | $76.02 | $232.04 | $62.44 |

| 38 | $358.46 | $87.29 | $252.56 | $67.34 |

| 39 | $388.50 | $95.03 | $273.73 | $71.90 |

| 40 | $421.08 | $102.77 | $296.13 | $77.14 |

| 41 | $463.74 | $112.23 | $322.67 | $84.02 |

| 42 | $509.06 | $122.55 | $350.88 | $91.59 |

| 43 | $563.95 | $130.63 | $385.94 | $99.85 |

| 44 | $621.74 | $143.53 | $421.85 | $108.70 |

| 45 | $676.82 | $159.27 | $461.03 | $118.16 |

| 46 | $743.33 | $174.84 | $502.45 | $129.36 |

| 47 | $804.03 | $189.37 | $547.63 | $141.18 |

| 48 | $878.42 | $228.97 | $596.91 | $162.11 |

| 49 | $956.03 | $252.19 | $650.67 | $179.31 |

| 50 | $1039.03 | $288.96 | $702.62 | $196.94 |

| 51 | No Result | $332.30 | No Result | $241.01 |

| 52 | No Result | $370.14 | No Result | $262.99 |

| 53 | No Result | $370.14 | No Result | $262.99 |

| 54 | No Result | $420.37 | No Result | $297.99 |

| 55 | No Result | $471.62 | No Result | $335.74 |