Six Top Tips for Getting Life Insurance on Your Significant Other

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

In This Particular Article, I’m Going To Discuss Six Top Tips That You Need To Know To Get Quality Life Insurance Coverage

Perhaps you are reading this article because you’re searching for information on getting life insurance on a significant other, but you are not married.

Maybe you are engaged to be married or you live as domestic partners. Maybe you just have a boyfriend or girlfriend and you’re concerned about their welfare as well as their family if they were to pass away and leave final expenses behind.

Specifically, We’ll Cover The Following Topics:

- The Importance Of Having An Insurable Interest

- Scenarios To Avoid Getting Declined

- Self-insure Your Significant Other As A Beneficiary And Vice Versa

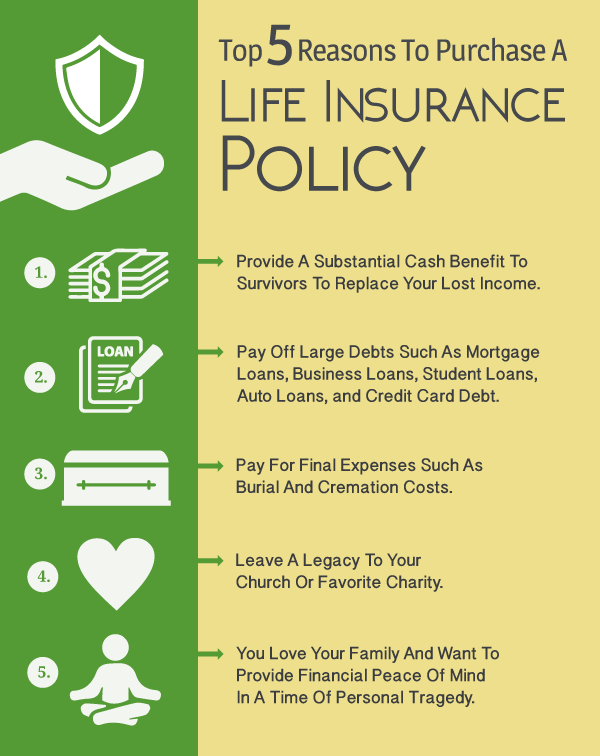

- The Role Insurance Can Play In Your Finances

- Attaining Domestic Partnership Status To Help Attain Insurance

- Types Of Life Insurance Available To Significant Others

- Burial Insurance Rates, Age 40 to 90*

The importance of having an insurable interest when applying for life insurance for a significant other

Perhaps you’ve never heard of the term insurable interest. It’s a pretty simple concept.

Insurable interest designates the importance of the relationship that causes an individual to feel the need to insure the other individual in the relationship.

What I meant by that is for anybody to take insurance out on an individual, there must be a compelling reason why it is important to insure that particular individual.

Let me give you a couple of scenarios where one would have an insurable interest and one where one would not. I will explain the differences and then after that we’ll talk about how this applies to buying life insurance on a significant other.

Imagine you are looking for life insurance on your business partner. Both of you jointly own a business together. His job is to meet with customers and your job is to create the product. If either one of you were to pass away, wouldn’t you agree that the death of either one of you would have a major impact on the ability of your business to thrive?

Potentially it would have a significant impact on your ability to continue sales volume and growth, which could eventually lead to the failure of your business. There is an interest on the part of both parties to insure each other because with the death of one partner there would be an adverse impact on the other, as well as a negative impact to the business.

Likewise, there is no reason why one would want to offer the other any sort of financial gain by insuring them because in a business setting losing a partner could be detrimental to the business, so there is a resistance to having the person pass away.

Now, let’s talk about not having an insurable interest.

Let’s say that you are interested in getting life insurance on a celebrity. This person is in good shape and healthy, but you want to profit upon their passing. Can you get life insurance on a celebrity that you are not related to? The answer to this question, obviously, is no.

Why? Because if the celebrity dies, it has no immediate impact on your economic ability. You are not related to the person and therefore there’s literally no loss to your financial situation if that celebrity dies.

Believe it or not, when insurance was first invented there are stories of people insuring complete strangers to try to profit from their death. As you can imagine, it was potentially hazardous to have life insurance operate in this way and the practice was soon done away with.

It’s important to be able to prove you have an interest in the person you want to insure.

While this may sound like a no brainer, let me give you a couple more examples where an insurable interest would be considered acceptable.

Joint investment ownership

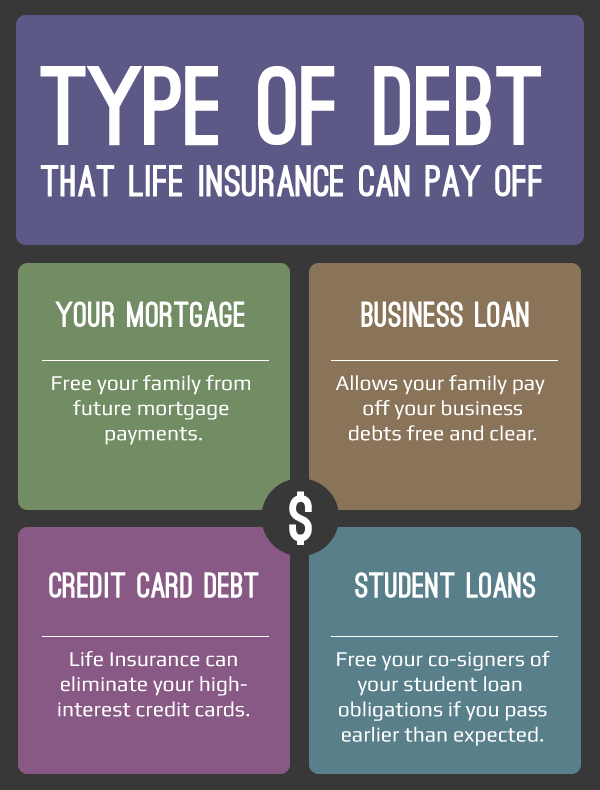

If you and your significant other own a home together, are partners in a business, or have some sort of joint asset together, this potentially will be considered an insurable interest and will allow you to take out some sort of life insurance.

Joint debts

If both of you are co-signers on a mortgage, car loan, or any financial obligation, this constitutes an insurable interest for both parties. The motivation to cover each other in this case is to make sure those debts don’t pass on to the survivor.

Kids

If you have kids together, they would be a great insurable interest. It proves that there is some sort of family relationship that connects you to your significant other.

Legal obligations

If you or your significant other have a legal obligation together in the form of a lease, this would prove to be potentially an insurable interest.

Avoid these situations to prevent getting declined

There are circumstances where getting life insurance on a significant other may prove detrimental and potentially cause you to be declined. Let’s talk about a couple of those circumstances so you can better prepare yourselves for the application process.

Living separately

Living separately will cause underwriters to question your insurable interest and your reason for buying life insurance.

When you’re applying for life insurance it’s important that you are living together. This will prove that there is some level of insurable interest for both of you.

Just met

If you just met the love of your life last weekend and you want to get insurance, most likely underwriters will question your motives.

Even though you love this person very much, it’s very unlikely that a life insurance company is going to be comfortable with you getting insurance on someone you’ve just met.

If you don’t have a history with your significant other it’s unlikely that the life insurance company will view your relationship as an insurable interest.

Self-insure your significant other as a beneficiary and vice versa

One strategy you can employ instead of trying to take life insurance out on somebody else is that both of you take life insurance out on each other and each name the beneficiary as the other person.

This simply accomplishes the same goal. It’s easier to name beneficiaries on life insurance than it is to justify interest, especially if your relationship is new.

Insuring fiances is normally okay

I’ve sold life insurance since 2011 and I’ve come across all sorts of individuals who were engaged and ultimately to be married at a future point. I haven’t had one opportunity where getting life insurance on a fiance proved impossible.

Most life insurance companies are comfortable with engaged couples buying life insurance on each other, if you’re engaged and you can legitimately call each other fiance, then you should have little to zero difficulty in getting coverage.

Attain registered domestic partnership status

Let’s say your in a relationship but for whatever reason you do not intend to get married at any point in the future. However, you recognize that both of you are significant others and love each other and are committed to a long-term relationship.

In this scenario, one strategy to get life insurance out on each other is to attain domestic partnership status. The availability of domestic partnership status varies from state to state, but it is worth looking into if you have no plans of getting married but need to prove your long term relationship status.

Once you have domestic partnership status, it’s a bit easier to apply and get life insurance on a significant other, especially if you’ve experienced issues trying to apply for insurance in the past and have been declined.

Types of life insurance available for significant others

No two insurance products are the same. In the following section, I’m going to review the most common life insurance options to buy for a significant other.

Term life insurance is the most common way to insure individuals as well as significant others. Term insurance usually lasts between 10, 20 and 30 years. With low premiums it’s the cheapest form of life insurance relative to other options. There’s no cash value to a term insurance policy.

Term life coverage is most commonly used for temporary situations such as income replacement, paying down financial obligations like a mortgage, and for funding retirement plans.

The percentage of individuals who get approved for term insurance is fairly high as long as you meet the requirements mentioned earlier regarding domestic partnership status, and being able to prove insurable interest.

Permanent Life Insurance

Permanent life insurance, which may take the form of whole life or universal life insurance is designed never to cancel and typically does not have rate increases.

Permanent plans are designed to cover permanent problems. If you have a financial problem that must be covered when you die, a permanent plan may make more sense.

Most commonly permanent life insurance plans such as whole life are used to fund final expenses such as burials and cremations. Universal life plans are also great as supplemental retirement plans.

A guaranteed universal life plan is designed to payout upon death and usually pays more than the traditional whole life insurance plan.

The likelihood of qualifying for a permanent type plan is equivalent to what you would find with term life insurance. As long as you can match all the criteria mentioned earlier, it’s likely you will be able to get approved for this type of insurance.

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Simplified Issue Products

If you find yourself in special circumstances where you don’t qualify for typical insurance, simplified issue products offer some flexibility.

What is a simplified issue product?

Simplified issue whole life insurance grants a little bit more leeway than one would normally see with more fully integrated types of products.

If you have difficulty applying for life insurance on your significant other, you may want to take a second look at a simplified issue whole life insurance, especially if all you’re looking for is a policy to cover final expenses. If this is something you think you might be interested in, Buy Life Insurance for Burial can help.

Burial Insurance Rates, Age 40 to 90*

Rates for $5,000 in Burial Insurance

Rates for $10,000 in Burial Insurance

Rates for $15,000 in Burial Insurance

Rates for $20,000 in Burial Insurance

Rates for $25,000 in Burial Insurance