$75,000 Whole Life Insurance Review [Rates, Programs Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

The Purpose Of Today’s Topic Is To Review The Options Of How A $75,000 Whole Life Insurance Plan Works

You’re here today because you’re shopping to see what your options are for $75,000 in whole life insurance coverage. If this describes you, then you’ll definitely want to stick around.

Why? Because I’m going to take you through all of the things you need to consider before making a purchase decision on $75,000 in whole life insurance.

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the compete presentation on life insurance for burial costs. Enjoy!

Here’s An Overview Of Today’s Topic:

- What Is A Whole Life Insurance Policy?

- What Does A $75,000 Whole Life Insurance Policy Do?

- Simplified/Non Med $75,000 Whole Life Insurance?

- Story From The Field

- What If I Am In Good Health – Should I Get An Exam?

- What Are The Best Rates/Insurance Companies For A $75,000 Whole Life Insurance?

- Commonly Asked Questions When Buying $75,000 In Life Insurance

- Next Steps

What is a Whole Life insurance?

What exactly is a whole life insurance policy?

First, the premiums are fixed, designed to be the same forever as long as you pay the premiums. The nice thing about that is you have peace of mind.

That’s why whole life insurance is great because they define the period of time and the premiums, you know what to expect. Whole Life is another term we use for permanent life insurance.

Most people hate term insurance because it can be terminated or cancelled anytime. You could pay all this money and not getting any benefit out of it. Whereas whole life insurance doesn’t, as long you pay the premiums, you’ve the coverage. It is permanently there.

Maybe you are wondering, why do people buy whole life insurance policy? I think the number one reason is Peace Of Mind. People want to make sure something is going to be there when they pass away and a whole life policy does that.

Our role at Buy Life Insurance for Burial is to help people like you find the best competitively-priced life insurance options available. We want to make sure that your coverage fits your needs and that we provide the best possible coverage for you. To do this, we offer all of our clients a free quote that takes just 10 minutes.

For your quote, reach out to us via phone at (888) 626-0439.

Also, feel free to submit a message on the left-hand side of the screen. Within the next 24 hours, we will get back to you and address any of your questions.

Other options for whole life insurance

There are other options for whole life insurance. If you don’t want to pay what we call a single pay premium where you need to pay forever. You could get what’s called a paid-up plan. In paid-up plan option, you will pay only for a predetermined period of time, maybe 10 years, 20 years, or maybe one lump sum payment.

What does a $75,000 life insurance policy do for your family?

What exactly does a $75,000 whole life insurance policy do? There are several reasons why somebody would buy $75,000 whole life insurance. First, is funeral expenses. They want to have a predetermined plan to pay for burial expenses or a cremation.

Second, is income replacement. If you die and your spouse has to live it will be easier, your whole life insurance will provide. Many times these amounts of coverage are used more with people who are about to retire or retired. They are looking for a pre-determined amount to pay off upon death and whole life Insurance is the best for this because it never goes away.

Another reason why people buy whole life insurance, maybe you want to give money to a child or a grandchild to help them start in college or help them get off on their life.

$75,000 can be very beneficial in in many aspects. Perhaps you want to make a mortgage payment protection plan. If your mortgage is low enough in $75,000 you can pay the mortgage off. But the best thing, people buy whole life insurance, regardless of the amount of the coverage because there are permanent problems that need permanent solutions. If you know a problem will happen after you die. Whole life insurance is the answer for covering those problems.

How do you qualify for a $75,000 whole life insurance – exam or no exam?

When qualifying for a $75,000 whole life insurance plan, medical examinations are sometimes required, but not always. It depends on your present health status and the company where you want to get your policy.

The medical examination includes urinalysis, blood laboratory test, other company just require only your signature for approval. Some insurance companies will just check your medical records or will request a phone interview.

This is what we call simplified issue and it may be more appropriate. It depends on your circumstances in the underwriting profile. Now, a good reason to take an exam, it is an option, it will get you a lower price if you’re healthy enough.

If your health is in good shape, I do recommend you take the medical exam in getting your policy, by not doing this you will end up paying more on your premiums because the insurance company has limited data about your present health status. But if you are unsure whether to take the medical exam or not, feel free to ask me and I will share my opinions.

There’s a lot of insurance companies have better design on their products with more price competition in a way not require an examination. It really the option will give you that much of a price differential.

In most cases, it really depends on your health to qualify for $75,000 Whole life insurance. If there is a will, there is always a way.

There are two types of whole life insurance programs. The first-day full coverage and the return of premium coverage. Full coverage means you’re covered from natural and accidental deaths from the effective date of the full $75,000 whole life insurance plan. This is the ideal and best way to get coverage. The return to premium coverage, you need to wait 2 full years before full coverage on natural death. Why you need to wait 2 years before you can avail the full coverage?

If you had recent problems in your health like cardiac, cancer, lung disease and other ailments, this may be the only pathway to go to acquire an insurance coverage. You want to try to get those plans, which are what we call guaranteed acceptance or guaranteed issue life insurance.

Want more information? We offer no obligation quotes. If you would like a free quote, please contact us regarding life insurance or burial insurance. Our number is (888) 626-0439. Once on the line, you can talk to our friendly life insurance experts who will answer any of your questions.

We also have a location that you can directly message us. Please see the left or bottom side of your screen if you would like to submit a message to us. Feel free to ask us any questions or request more information there. We respond to our messages within 24 hours of recieving them.

Simplified/non-med $75,000 Whole Life Insurance

Let’s talk about the simplified non-med $75,000 whole life insurance. This is what we refer when an examination is not required.

Whenever you say simplified non-med that means there’s no fully underwritten.

When you get this kind of plan with $75,000 whole life, they’ll request medical and prescription records and use that information to determine if you are qualified.

The nice thing about this, if you’ve had a few health issues, you want to go this route instead of undergoing a fully underwritten exam.

Case Study

A case study of a gentleman 85 years of age, who got more than $75,000, whole life insurance and he had a history of a mini-strokes was on Plavix. He got in a situation where it wasn’t sensible to do a fully underwritten plan.

We did simplified non-med. He was approved and very happy with rates. So when you get a simplified or non-med plan, sometimes you get approved immediately, may take a couple of days, but many times you get the policy within the next couple of weeks.

Again, when you buy a $75,000 whole life insurance plan, it means you’re going a series of exams such as blood, urine analysis including a physical exam. Sometimes it’s a portion of it.

Story from the field

Often, I’ve noticed that when I’m running appointments, I tend to have odd encounters. This day was no exception.

I was heading to a town, North Ridge, just outside of Chattanooga to visit one of my clients. It was one of those towns where everything looks the same. Eventually, I got to the house that I believed to be the right one. When I got closer, I noticed a pink mailbox.

I thought, “Well, that’s not something you see every day.”

Just after that, I see a 1980s pink Cadillac in the driveway. When parked, I was greeted by a painted picture of a person wearing a jester hat and face paint. Sure enough, this was, indeed, the house.

I was let in the home by the client. Her name was Anita, and interestingly, her middle name was Lollipop. As I began to talk to her, she started to tell me about how she was in New Orleans when hurricane Katrina hit.

In New Orleans, caskets are kept above ground, and Anita used a casket to swim through French Quarter to escape Katrina. She made it tto an I-Pass where FEMA picked her up a couple days later in Al Gore’s private plane. She was then taken to Tennessee. And, she has been in Tennessee ever since.

It was a true, fascinating story.

I wanted to share this story with you because it turned out that this amazing lady was getting taken advantage of by her life insurance company at the time. For her funeral arrangement plan, she was paying about $250/month extra for an $8,000 funeral.

She didn’t really have health problems. There was a history of heart problems, but otherwise, she was in good health with no chronic issues, she was mentally sound, and she should have qualified for a better policy.

When I shopped around, I found that I could get her a policy that would save her $1,800/year. While she was disappointed that she had been taken advantage of, she was ecstatic to hear the number.

Sadly, this is the case with many seniors. Salespeople try to dress up their product to look like the best thing on the market, which is how they justify their unreasonably high rates, but this is all a rip-off.

In life insurance, know that there are premiums that are justified and unjustified. Here at Buy Life Insurance for Burial, we use a brokerage program to best help our clients.

Like we did for Anita, we shop around and compare the rates of various insurance companies to find you the coverage that best fits your needs. This way, you won’t get taken advantage of, and you won’t be paying extremely high rates like Anita was.

We were able to get Anita first day full coverage, which is sometimes difficult for an individual with heart problems like she had.

Please know that we can’t promise first day full coverage for everyone. Regardless, when working with Buy Life Insurance for Burial, we work with you to get you the best life insurance coverage for your personal needs. And, we can guarantee that you will get better coverage than what you find in mail order and TV insurance programs.

What if I am in good health – should I get an exam?

If you’re in good shape already, it’s going to give you a better premium rate. I’ve seen differences in prices. In fact, I looked at how much I’m paying for my life insurance relative to a non-med exam and the price difference was just incredible.

If you’re in tip-top shape, and you’re getting a lot of covers, forget the smaller coverage, it’s probably going to be optional. If you’re worried about this $75,000, it’s just going to depend on your age and health status.

The younger you are may make a little more sense maybe,when you’re older too, but that’s if you’re only healthy. So the circumstances just depend. If you do fully underwritten it will take weeks or months to get a decision.

And sometimes an exam where they draw blood and your analysis, they’ll do a profile on it. They may show a health issue you didn’t have or may exaggerate a health issue that may affect your eligibility for whole life insurance coverage.

Maybe they rate is up two or three times as much as it was proposed. Maybe you end up in a position to where you are not accepted. This happens a lot with these fully underwritten types of plans.

Examples 0f $75,000 Whole Life insurance rates

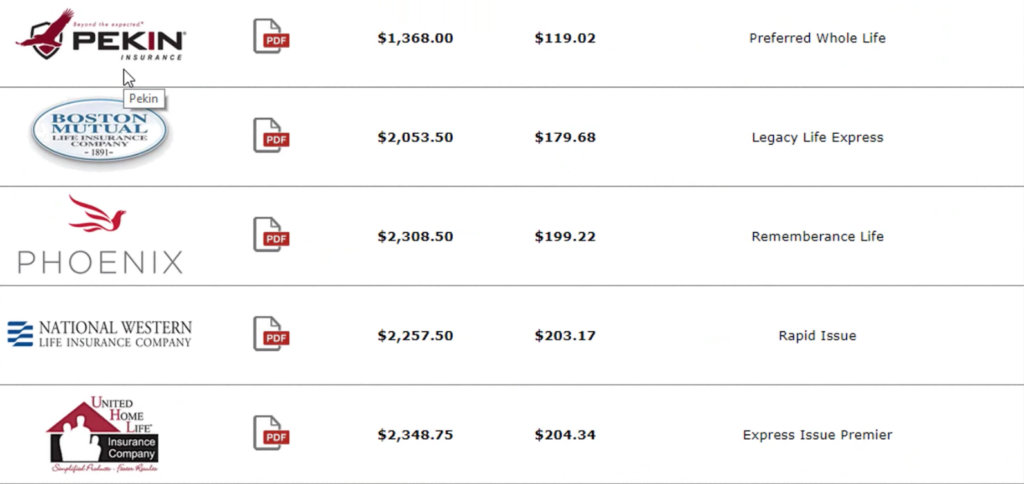

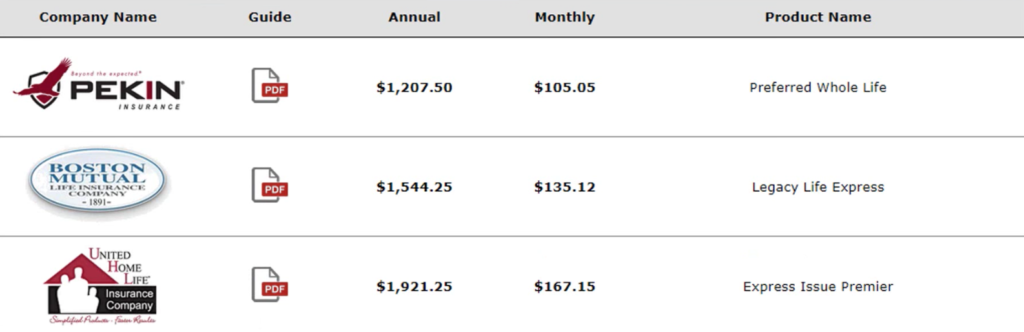

Let me show you some rates on $75,000 in whole life insurance so you can figure out what to expect. So very quickly, what we’re looking is a quick selection of companies that will do $75,000 on a simplified issue basis. And sometimes they’ll do an examination as well. So Pekin life for example, in Boston Mutual and Phoenix, these are fully underwritten, some of them are flight issue.

The higher the price usually means it’s simplified issue. This is a male 50 year old for 75,000 of coverage.

We look at a female at 50 years old, 75,000 in coverage, going to be looking at price ranges. So one thing I’ll make clear here is this isn’t a detailed investigation.

The pricing, you may be younger than 50, older than 50. The point is, I just wanted to show you what you’re looking at a mid-level price range for a whole life insurance plan for fully underwritten, simplified issue.

Again, your age and health are going to affect these prices. I want to show prices, but it’s hard for agents sometimes because we all know ultimately what you see is what you get because we don’t know what you are and the status of your health.

I don’t want to convey something that may not be the case that you will get it. But I just want to give you an idea of what to expect.

Ultimately we figure out what you would qualify for. You got to talk to me personally and you can call me at 888-626-0439 definitely willing and would be happy to help you out.

Let’s say you’ve looked at those prices and you just worried about the budget. Maybe you’re not sure, but the starting point doesn’t necessarily thrill you either based on what you saw. So look, if this is too expensive, here are some other thoughts I’d like to share with you.

Universal Life Plan

We got the old saying in the insurance business, how to eat an elephant? one bite at a time. So if you can’t get 75000 coverage, maybe you can start with something less. So here are some options you can do. Maybe instead of $75,000 in whole life insurance, you get what’s called guaranteed universal life plan.

The universal lie plan is very similar to whole life insurance rates never go up as long as you pay the premium. The coverage never goes down and has full coverage. If you qualify, you got to be in pretty good shape. It acts the same as whole life insurance and since it maximizes your death benefit for the least premium.

Universal life plan has a lower premiums. In many cases, it’s about 50 percent less than the premium compared to a whole life insurance plan. So a lot of people buy this coverage and I like writing them because they accomplish those goals.

Term Life Insurance

Maybe instead of getting 75,000 and whole life, you get a term life insurance plan for, 15, 20, 30 years, whatever the length of time is and what your budget is, and make sure that there are permanent life insurance conversion options.

You can take a portion of that term insurance or all and then convert it into a permanent whole life insurance plan. So it’s a way to get covered at a cheaper price, but has the option to turn that into a permanent plan later on in life as they get older.

The best way is to start with something smaller, maybe 10, 15, 25 or 50,000 in coverage or less. A lot of people I do business with, they start with small and then they build up to something bigger.

Example, the particular man I talked to, he is 84 years old, started with $25,000 in coverage and then over the course of the next year and a half, I had him $125,000 coverage. It was just something that was comfortable with, yet some debts to pay off.

That’s how a lot of people do it and you can definitely piecemeal multiple companies, multiple policies. There is no rule against that. The bottom line, something’s better than nothing. That’s how I operate my business. Start with something and get something on the books and budget is important.

Commonly asked questions when buying $75,000 in life insurance

What happens if I need more coverage?

We believe that it is important to have some level of insurance, no matter the amount. Sometimes, people may ask this question when they want more insurance, but they can’t afford it at the time. We are here to assure them that having something is better than having nothing.

We have many clients that start with an initial amount of insurance but add more to their books over time. This can be done as their budget allows, making sure they work towards the life insurance goals.

What happens if I need more coverage?

Typically, taking an exam is optional. Sometimes, in cases with larger amounts, like $500,000 or more, you will be required to take an exam. When you are under that amount, it is your choice.

Do I qualify even for $75,000 in life insurance?

This really depends on your health and age. Sometimes, when you are older, you are less likely to qualify for higher amounts of life insurance. This also applies if you have a chronic illness. Note that if you are just looking for enough insurance to cover your final expenses this rule may not apply to you. With lower amounts of life insurance, you are more likely to qualify for coverage.

Next steps

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Find an agent somebody you can trust. Hopefully, that’s me. Here’s how it would work. If you and I work together, we figure out what your goals are. I drop a quote for you, assuming you accepted it. In most circumstances, all we have to do is a phone interview or I just submit the application electronically.

Medical exams usually aren’t necessary. Certainly visit for me is not.

We do everything electronically over the phone and then you get insurance coverage after several days or weeks.

If you do a fully underwritten, you would then get your policy shortly thereafter.

Very simple, so let’s say you like the idea of qualifying for life insurance, what’s the next step? Go to buy life insurance for burial request a free quote.

You can click the contact box at the top or the chat box below. Send me a message of what you’re looking for and in a good time I can reach you. Then you can call me 888-626-0439 or you can just email me.

We here at Buy Life Insurance for Burial implore you to seek out life insurance today and make sure you are covered. We want you to achieve your life insurance goals. That may be to replace your income or have a burial plan in place. If you would like, we are here to help you, too.

The first step is just to call us at (888) 626-0439 for a 10-minute phone call. You will talk with one of our representatives that is an expert in the life insurance field. They will show you your options and explain how the offered programs work.

If phone calls aren’t for you, we have a message option, too. It is located on the left-hand side/bottom of the screen. You can submit your interest or questions there. If you do, please let us know the best way to contact you. We reply to our messages within 24 hours of getting them.

We thank you for finishing this article and hope that it was informative!