20 Year Term Life Insurance Review

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Most likely you’re here today because you’re looking for term life insurance for yourself or a loved one.

You may also be considering a 20-year term life insurance program as the appropriate life insurance choice.

Bottom line, you’re looking for answers to your questions.

If this describes your circumstance, then this article will be very useful to you.

In this article, I’m doing a detailed analysis of…

How To Get A Quality 20 Year Term Life Insurance Product

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Here’s an overview of what we’ll discuss today…

- Who Buys 20-Year Term Insurance?

- Reasons To Choose A 20-Year Term Policy

- Why A 20 Year Term May Not Be Right

- Pros And Cons

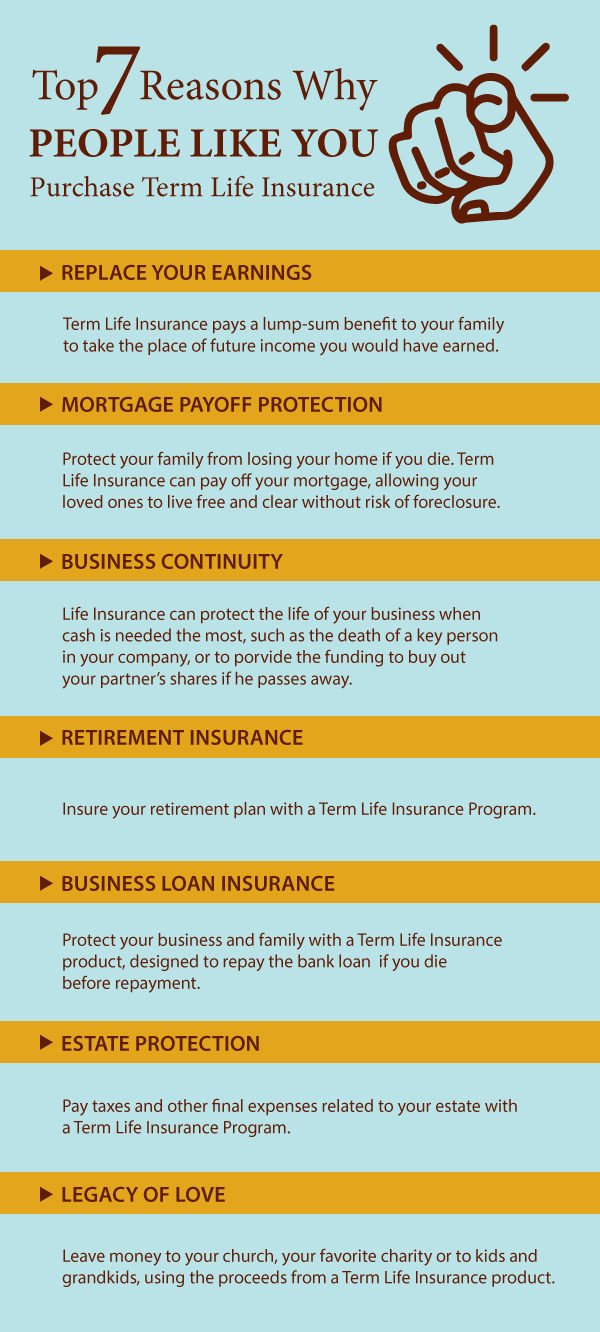

- Top 7 Reasons People Buy Term Insurance

- Tricks To Get The Best 20-Year Term Policy

- Rates, Next STeps

Most Common 20-Year Term Life Insurance Buyers

In this section, I will describe the typical person who purchases a 20-year term life insurance policy.

My experience is that the more you understand the life experiences of people who buy life insurance, the more clearly you’ll understand which life insurance policy makes most sense for you.

That way you’ll figure out if a 20-year term life insurance policy is really your best bet, or if something like burial insurance or a shorter-term policy like a 10-year term makes more sense.

Single with no children

Are you single, unmarried, and without kids?

Purchasing a 20-year term life insurance plan makes a LOT of sense.

Here’s why. Eighty percent of people 25 and older will eventually marry. And over 70% of women 30 and older have children.

Purchasing term life insurance to protect your family if you die sooner than expected is one of the most common reasons why people buy life insurance.

And with rates less expensive if you’re younger, why not take advantage of very low rates and your excellent health and get life insurance while it’s still easy to do?

Divorced with children

If you’re divorced with children, you should consider purchasing life insurance. Especially if you’re paying child support, or if you depend on child support to take care of your children.

A life insurance plan can replace child support payments if you or your ex-spouse passes away unexpectedly.

While life insurance can’t replace you, it can replace the economic stability you provide your kids and give your family a much better lease on life.

Married with or without children

Getting married is a large motivator to purchase life insurance coverage.

Marriage is an outward sign that you are committed to loving somebody till death do you part, and beyond!

You untimely death will cause emotional and financial turmoil. And life insurance protects your spouse against financial disaster.

We just don’t know when we will die. It could happen when we are old and have lived a full live. Or it could happen tomorrow.

A 20 year term life insurance product can help protect your spouse against this uncertainty. It offers peace of mind should anything happen to you.

It’s a great plan to start off with when you are newly married, giving you coverage for a long time. A 20-year term policy will provide an income replacement to your spouse and family should anything happen to you.

Career growth

Many people we talked to at Buy Life Insurance for Burial are looking for life insurance because they are experiencing growth in their career. They’re getting promotions, climbing the corporate ladder, and earning a higher income.

Typically with a higher income comes higher levels of financial obligation.

Sometimes people purchase a new home, move up economically, and find they are now under higher obligation.

This is a perfect reason to purchase life insurance. More money equals more problems!

If you pass away unexpectedly, a 20 year term life insurance product will prevent many financial catastrophes from your family. You’ll ensure they’re well taken-care of and can free them from the stress of money problems caused by the loss of a loved one.

Retirement

Getting close to or already at retirement?

You may find your debts are still around even as you get older.

If this describes you, a 20-year term policy may help cover debts like mortgages and final expenses.

Here’s why term coverage for an older person may make sense.

First, more seniors now than ever have mortgages as they entire retirement. And with 1 out of 3 Americans having nothing saved for retirement, many with mortgages will lose the home to foreclosure when a spouse passes away and cannot afford the payment.

Think about it. Could your spouse handle paying the mortgage on her own?

If you’re concerned, a 20 year term life insurance product provides fantastic protection for older Americans and can cover large debts like mortgages, loans, and final expenses.

Replace your income in retirement

Do you and your spouse require BOTH of your retirement checks to survive?

Have you imagined what would happen to your spouse if passed away and had to survive on ONE check?

If that paints a grim picture, you can use a 20 year term life insurance plan to replace your retirement income for many years after your passing.

For example, if you have a non-transferable pension, a life insurance plan can provide a lump sum death benefit for your spouse to supplement the lost income from your pension,

7 Reasons To Own A 20-Year Term Life Insurance Policy

Now we’ve spent time describing the type of people who get life insurance, I want to share 7 of the most common reasons why people choose a 20-year term policy over other coverage options.

Understanding other people’s motivations help you clarify your own.

Let’s get started…

1. Mortgage protection

Studies show that the biggest reason why people purchase a life insurance product is because they want to cover obligations such as their mortgage, with mortgages usually being the single largest debt that a family incurs..

So, it makes sense to buy a life insurance plan to pay off your mortgage and alleviate the financial burden from your family. that coordinates around your mortgage to make sure that it’s paid off.

To help, we have access to what’s called a mortgage protection life insurance program. The idea is that it protects your family from the potential of losing your home should you pass away unexpectedly.

Most don’t require exams (more on that later), and only require checking your medical records to determine insurability.

Once the plan is in place, you have peace of mind, knowing your home and family is protected from foreclosure and financial disaster.

2. Income replacement

Have you ever thought what would happen if you or your spouse passed away and lost that income?

Losing a loved one is tragic. Add to that the woes that come from an economic upheaval, and you’re in a world of hurt.

Dying without life insurance causes all sorts of problems. Funeral bills, car loans, and mortgage debt stack up because the family loses half or more of its household income. Commonly, the surviving house has to sell the home or foreclose, and childrens’ lifestyles are permanently (sometimes irreversibly) changed.

What’s the solution?

Purchase life insurance of course! But further, many money gurus like Dave Ramsey and Clark Howard agree that 10 times your annual income in life insurance coverage is a good amount to start with.

By covering 10 times your income in life insurance, you ensure your earning power remains many years beyond your passing. It gives your family time to recover and develop a plan to continue economically without you. It also allows your family to maintain their standard of living without worrying about how they will pay bills and other expenses.

3. Retirement protection

If you pass away before you reach your retirement, you’ll also lose funding you would have set aside in your pension plan or retirement program.

Buying life insurance is a great way to insure against those future contributions towards your retirement fund that you otherwise would have put aside.

Imagine dying 20 or 30 years away from your eventual retirement goal.

One of the beauties of financial planning is the miracle of compound interest. Given enough time, compounding interest grows your principle into a very large balance over a long period of time.

But without you properly funding your retirement plan, your family will lose out on that benefit if you die early in life.

Insurance will work to replace that future compound benefit with a lump sum benefit that will hopefully accumulate something similar to your retirement amount.

4. Leave a legacy

Do you want to leave money behind to your church, charity, or favorite grandson?

You can do that with life insurance.

The way you do this is fairly simple.

First, you take out a life insurance plan as normal. Then you name the beneficiary to the church, charity, or grandson.

This leaves a death benefit behind if you die within the 20 year term period of time to the named organization of your choice.

A lot of people feel good about this because it’s a way that they can provide some sort of benefit to an organization they’ve grown to love and trust. Or to take care of a grandkid’s future expenses like college tuition.

5. Estate protection

If you own a large estate, you may have the risk of paying a large ta upon you or your spouse’s passing.

Take a look at a 20-year term life insurance program as a way of providing liquidity to pay estate-related taxes instead of liquidating assets to satisfy Uncle Sam’s insufferable appetite for your money.

6. Cover a key person

If you’re a small business owner or entrepreneur, carrying life insurance is extremely important. And not just on yourself and your family, but also to cover your business.

Consider a key person in your business. Imagine what would happen if this person passed away unexpectedly? Could you see your business suffer financially from this key person’s loss?’

If so, consider a life insurance policy to cover that key person.

A 20-year term life insurance policy provides money to replace the losses from the death of the key person, and provide liquidity while finding and training a replacement.

Life insurance provides a death benefit to the corporation where the key person is insured. The corporation makes the premium payments and receives the death benefit.

7. Loan collateralization

Thinking about seeking financing for your business?

Most likely the bank will require you to purchase life insurance to pay off the loan if you pass away unexpectedly.

A 20-year term life insurance policy provides long-term life insurance protection to the bank, and facilitates the process of getting business financing completed.

Plus, if you pay off the loan balance, you can keep the policy, and switch up the beneficiary to a loved one.

If you like what you’ve read so far, why not give us a call for a free, no obligation quote at (888) 626-0439. You’ll speak to a friendly representatives who can provide you with more information and a quote. Alternatively, you can send us a message using our message box and we will respond directly within the next 24 business hours.

Is A 20-Year Term Really The Best Option For You?

Since everyone has unique life insurance goals, there are circumstances where a 20-year term life insurance product is not the best option.

There may be other products that will serve your purposes better.

In this section, I’m going to talk about the limitations of a 20 year term life insurance product.

I want you thinking in more depth if a 20-year term is REALLY the best bet, or if another life insurance program is actually more suitable.

Length of time considerations

My goal with my clients is to help you select life insurance coverage that aligns with your personal goals.

People buy life insurance because they recognize their potential for financial problems.

Some problems are temporary in nature. Some are permanent. Therefore how LONG your life insurance lasts in relation to your goal is REALLY important to consider.

For example, a permanent problem we all have to face is the cost of burial. Everyone is going to die some day! Therefore, a burial insurance policy or guaranteed universal life insurance product may make more sense to cover funeral expenses.

However, if your problem is temporary such as the paying off debts like your mortgage, term insurance is fine as you (hopefully) will pay off your mortgage one day.

Match your term to the right length of time

Here’s my point.

Make sure your term life policy matches perfectly to the length time you’ll have you’ll have the risk.

For example, if you have a 20 year mortgage payment plan, a 20 year term life insurance plan makes perfect sense.

However, if your mortgage is 30 years long and you’re looking at 20 year term, that will leave you with 10 years without coverage.

In this case, a 30 year term life policy makes more sense.

Shorter could be better, too

Covering for longer than is needed doesn’t make sense either.

If you have a business loan that has a five year payback, a 20 year term life insurance plan may not be the best option.

However, if you have a reason to keep the coverage after your loan is repaid, then a longer term is sensible.

If you’re period of coverage requirement is less than 20 years, check out a 10-year term life insurance program instead.

Too expensive

Perhaps a 20-year term life insurance doesn’t fit your budget.

If that’s the case, let’s look at alternatives. Because getting NO coverage does NOT solve the problem!

Reduce the coverage amount

You can reduce the premium size by reducing the coverage amount. This means you can pay less and do not have as much coverage.

For example, let’s you you originally wanted a 20-year, $250,000 term life insurance policy.

Because the premium is out of your budget, you opt for a $150,000 20-year term life insurance policy instead.

The good news is that you have some coverage in force. And assuming your health doesn’t change, you can always add more when your finances allow

Reduce the term length

Alternatively, you can keep the same amount of coverage, but reduce the term time from 20 tears to 15 years or 10 years in length.

Too old

For some groups looking for term life insurance such as seniors, you may not have access to applying for a 20-year term life insurance product.

If age is a factor for you, you can consider purchasing a smaller plan like a 10-year term policy. Also, guaranteed universal life insurance for a longer period of coverage may do the trick, as well as a burial insurance policy designed never to cancel due to age or health.

Advantages Of A 20-Year Term Policy

In this section, let’s discuss advantages of a 20 year term life insurance product, and why purchasing is a smart decision for many.

Length of time

As long as the obligation you have in mind has a 20 year time horizon, a 20 year term life insurance product is a perfect solution.

Again, my goal for my clients is to match the type of term insurance product they purchased with the obligation time period.

If you see a time horizon of 20 years or less, then it’s a good idea to buy a 20 year term insurance policy.

Permanent protection

Many 20 year term life insurance products have the option to convert into what’s called permanent protection.

This means that you can take a portion of your term life insurance and turn it into a permanent plan that does not cancel due to age.

This insurance usually has a locked in rate feature as well, and doesn’t require you to go through medical underwriting, either.

This is great if you have a potential need later in life after your term insurance expires to cover for permanent problems related to things like final expense coverage.

Additional riders

Many 20 year term life insurance products offer the opportunity for additional benefits called rider. Examples include:

- Disability waiver. Waives the premium payments if you are hurt, ill, and cannot work.

- Accidental coverage. Pays double to triple the amount of coverage if your death is accidental.

- Chronic illness riders. Pay a cash-benefit to you if you’re diagnosed with cancer or cardiac event.

Drawbacks Of 20 year Term Life Insurance

What are some of the drawbacks of a 20 year term life insurance plan?

There are circumstances where a 20 year term life insurance plan may not be the right choice.

Temporary protection

Keep in mind that all life insurance companies are carefully approve folks for coverage, and expect most who are covered to outlive the policy.

That’s right. It’s likely that they’re betting that you’ll outlive the 20 year term life insurance plan.

What do you do if you need longer coverage than a 20-year term offers?

Consider a higher amount of term life insurance, like a 30-year term insurance.

Also, you may want to consider investigating a guaranteed universal life plan or a burial insurance plan, too, if you’re main goal is to ensure a death benefit is paid out upon your passing at ANY age.

Remember. Our goal is to match your insurance needs with the appropriate insurance product. There are times where a 20 year term insurance product doesn’t match your needs because you require coverage beyond the 20 year term period of time.

Twenty year term is not permanent coverage. So if you need coverage for something that is long term, like business continuity insurance, a pension protection plan, or if you need final expense protection, its likely a 20 year term insurance plan isn’t right for you.

Again, if the risk is there that you may outlive the coverage and still have a need for it, you need to seriously consider a permanent plan instead.

Price increases are inevitable

Once you outlive the length of time in which a term insurance is guaranteed, you either see a cancellation of the coverage or a dramatic increase in premium.

If you don’t like the idea of price increases or cancellations coming down the pike, a permanent product may be a better choice, as it gives you permanent protection and usually guarantees your premiums remain the same.

Top 7 Reasons People Buy Term Insurance

1.Cost

Many people purchase term insurance because it is one of the most affordable types of insurance. Term insurance allows people to get affordable, quality life insurance in place while meeting their budgetary needs.

2.Income replacement

The primary reason why people buy term life insurance is to make sure their financial obligations are taken care of if they pass away earlier than expected. If you have a family or are married, income replacement is especially a concern. Term insurance can cover the expense of a mortgage, bills, and the cost of living if you pass away unexpectedly to ensure your family or spouse is taken care of financially.

3.Retirement funding

One of the great things you can do with a term life insurance plan is to continue to fund your retirement plan if you pass away earlier than expected. A lot of people have retirement plans but never consider what would happen to that plan if they died. To ensure your spouse or family can benefit from your retirement plan, it’s important to get a life insurance plan in place.

4.Love

Love is one of the biggest motivating factors for buying life insurance. We love our spouse and our kids. We want them to be provided for when we pass away. Life insurance ensures those you love do not have to struggle financially after you’re gone.

5.Custom length

Term insurance is a unique type of life insurance that can be customized to meet the clients specific needs. Whether you have a 10 year financial commitment or a 30 year commitment, you can decide the length of time your term insurance will last.

6.Pure insurance need

Term life insurance is ultimately good for one purpose – to pay a death benefit upon your passing within the term time. Term insurance has no added extra costs and is one of the most affordable types of coverage.

7.Exams are not required

Life insurance used to require exams, but that is no longer true. You can get term insurance without ever having a physical exam or seeing a doctor. This is great news for those who prefer to take the non-medical application route.

My Tips To Help You Get A Great Deal On A 20-Year Term Policy

I’m going to talk about five strategies to help you get the the lowest price 20-year term policy possible.

Follow one if not all of these recommendations to give yourself the most optimal chance for the best overall package deal.

Laddering strategy versus one policy

Some insurance agents recommend that you take out multiple life insurance plans instead of one policy.

This is called “laddering” your policies.

For example, say you have a total of $500,000 in coverage split between a 10 year term and 20 year term at $200,000 and the other is $300,000, respectively.

The idea behind laddering is that your coverage amount drops with the reduction of your obligations. In exchange, you pay less premium over time than keeping one policy for $500,000 in coverage.

While the concept sounds good on paper, here’s the problem with it.

The likelihood of your obligations and needs for life insurance typically increase with time.

As we get older we often find that our income increases. Our lifestyle requires more financial capability to maintain, too. And in turn our need for life insurance increases that much more.

My recommendation is to always maximize the amount of coverage you can get for the longest period of time.

If you have determined that 20 years on your term insurance product is a good place to start, I don’t see any reason to reduce that amount of coverage to take out a second plan and save a couple of bucks.

I’ve worked in the insurance business since 2011. Time and again I see people need more coverage than they think they originally needed, so approach the laddering option with caution.

Too old for 20 year Term Insurance?

As my clients get older it becomes more difficult to find 20 year term life insurance coverage.

The solution is to consider a permanent life insurance product, or a universal life plan that covers to age 80, 90, and beyond.

This acts similar to a term life insurance product and can provide a temporary life insurance solution for a longer length of time.

Understand that the longer your universal life policy lasts, the higher the premium will be.

But this may be the only option for some of you out there that still need life insurance coverage for 20 years or longer, and can’t find it any other way.

Exam versus no exam

Will your 20-year term life insurance require an exam?

The good news is that for many, an exam is optional.

However, my suggestion is that if you’re in good shape, and take few medications, is to take the exam if offered.

The reason for this is simple.

Life insurance companies determine rates and eligibility based on the history of your health. The more information a life insurance company can gather on you, the more willing they are to offer you a more competitively priced policy.

If you opt for a no-exam life insurance policy, then your life insurance company won’t have the most up to date information on you.

It’s likely that they’ll bake in a higher price point to accommodate for potential risks like an unknown disease that they otherwise would have caught if they did an exam.

This is pivotal because if you do an exam and you pass it, the price differences can be substantial.

I literally saved more than a thousand dollars a year with my life insurance, simply because I opted for a one-time blood withdrawal, health questionnaire, and blood pressure check as part of my exam.

I encourage my clients, if they are healthy, to do an exam to get the best overall deal and maximize their coverage.

Let us help!

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

At Buy Life Insurance for Burial,we don’t represent just one company like many insurance agents out there.

We represent a multitude of companies.

We take our clients’ cases and shop them to see who’s going to give you the best price and the best amount of coverage.

The advantage of this is that many times we can work with companies that are more willing to work with certain sets of health, hobbies or professional issues that some companies turn down.

There is no one size fits all solution in the life insurance business, though many companies would like for you to think this is the case.

Often if you get stuck with a one size fits all life insurance company, you’re going to pay a higher premium and not have as much coverage versus other options.

Why do that to yourself? You wouldn’t go pay $20,000 for a brand new car if you could purchase it elsewhere for $10,000, right?

That’s how life insurance works. We want to get you the best overall package and working with a broker like us here at Buy Life Insurance for Burial allows for that to happen and gives you the best chance for the best overall deal.

Rates, Next Steps

What follows are 20 year term life insurance rates for different coverage amounts for males and females, age 25 to 55. I will also show you some universal life plans for those whose age makes it more difficult to qualify for a 20 year term with Banner Life.

$100000 Banner Term Insurance Monthly Rate Chart – 20 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $19.26 | $9.00 | $15.74 | $8.23 |

| 26 | $19.61 | $9.01 | $16.17 | $8.23 |

| 27 | $19.95 | $9.01 | $16.60 | $8.23 |

| 28 | $20.30 | $9.02 | $16.94 | $8.23 |

| 29 | $20.64 | $9.02 | $17.37 | $8.23 |

| 30 | $20.98 | $9.03 | $17.80 | $8.23 |

| 31 | $21.93 | $9.04 | $18.66 | $8.27 |

| 32 | $22.96 | $9.06 | $19.52 | $8.32 |

| 33 | $23.91 | $9.08 | $22.09 | $8.37 |

| 34 | $24.94 | $9.09 | $22.69 | $8.43 |

| 35 | $25.89 | $9.12 | $22.79 | $8.49 |

| 36 | $27.69 | $9.40 | $24.67 | $8.79 |

| 37 | $29.42 | $9.73 | $26.49 | $9.11 |

| 38 | $31.28 | $10.09 | $27.68 | $9.46 |

| 39 | $33.28 | $10.48 | $29.35 | $9.82 |

| 40 | $35.43 | $10.89 | $31.14 | $10.20 |

| 41 | $37.75 | $11.79 | $33.04 | $10.76 |

| 42 | $40.33 | $12.74 | $35.09 | $10.76 |

| 43 | $43.17 | $13.76 | $37.28 | $11.96 |

| 44 | $46.35 | $14.85 | $39.63 | $12.58 |

| 45 | $49.79 | $16.03 | $42.15 | $13.25 |

| 46 | $53.58 | $17.09 | $44.87 | $14.05 |

| 47 | $57.79 | $18.23 | $47.78 | $14.92 |

| 48 | $62.52 | $19.47 | $50.91 | $15.88 |

| 49 | $67.68 | $20.79 | $54.27 | $16.94 |

| 50 | $73.44 | $22.21 | $57.88 | $18.09 |

| 51 | $80.07 | $24.08 | $62.61 | $19.39 |

| 52 | $87.38 | $26.11 | $67.25 | $20.65 |

| 53 | $95.55 | $28.37 | $72.33 | $21.99 |

| 54 | $104.75 | $30.87 | $77.83 | $23.45 |

| 55 | $115.07 | $33.61 | $84.02 | $25.04 |

| 56 | $122.98 | $36.89 | $90.64 | $27.02 |

| 57 | $131.58 | $40.46 | $97.95 | $29.17 |

| 58 | $140.95 | $44.38 | $106.04 | $31.50 |

| 59 | $151.19 | $48.59 | $114.98 | $34.04 |

| 60 | $162.37 | $53.07 | $124.87 | $36.87 |

| 61 | $174.67 | $60.86 | $135.97 | $41.35 |

| 62 | $188.00 | $69.26 | $148.26 | $46.26 |

| 63 | $202.70 | $78.21 | $161.94 | $65.32 |

| 64 | $218.78 | $87.99 | $177.25 | $73.13 |

| 65 | $236.50 | $98.52 | $194.45 | $82.39 |

| 66 | No Result | $116.53 | No Result | $105.95 |

| 67 | No Result | $134.48 | No Result | $122.64 |

| 68 | No Result | $156.62 | No Result | $125.59 |

| 69 | No Result | $185.67 | No Result | $143.46 |

| 70 | No Result | $206.22 | No Result | $163.72 |

$250000 Banner Term Insurance Monthly Rate Chart – 20 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $36.03 | $12.97 | $30.10 | $11.39 |

| 26 | $37.31 | $13.01 | $30.31 | $11.45 |

| 27 | $38.59 | $13.05 | $30.53 | $11.45 |

| 28 | $39.77 | $13.05 | $32.03 | $11.45 |

| 29 | $39.77 | $13.05 | $32.03 | $11.61 |

| 30 | $39.77 | $13.05 | $32.03 | $11.61 |

| 31 | $43.64 | $13.16 | $35.76 | $11.76 |

| 32 | $44.50 | $13.26 | $36.67 | $11.76 |

| 33 | $45.58 | $13.76 | $37.52 | $11.94 |

| 34 | $46.65 | $13.76 | $38.81 | $11.97 |

| 35 | $47.73 | $13.87 | $39.94 | $12.04 |

| 36 | $51.17 | $14.69 | $42.89 | $12.64 |

| 37 | $55.47 | $15.63 | $45.79 | $13.26 |

| 38 | $59.34 | $16.65 | $48.42 | $13.69 |

| 39 | $64.28 | $17.77 | $51.85 | $14.34 |

| 40 | $69.65 | $19.01 | $55.91 | $15.39 |

| 41 | $75.68 | $20.57 | $59.97 | $16.27 |

| 42 | $82.34 | $22.31 | $64.46 | $17.78 |

| 43 | $90.08 | $23.29 | $70.73 | $19.07 |

| 44 | $98.68 | $25.42 | $76.54 | $20.79 |

| 45 | $107.71 | $27.78 | $82.63 | $22.51 |

| 46 | $116.74 | $29.90 | $89.22 | $23.98 |

| 47 | $125.77 | $32.19 | $95.67 | $25.52 |

| 48 | $135.88 | $34.12 | $101.86 | $28.16 |

| 49 | $146.75 | $37.46 | $109.77 | $30.10 |

| 50 | $158.29 | $40.44 | $118.96 | $32.21 |

| 51 | $171.12 | $44.65 | $128.15 | $35.10 |

| 52 | $185.65 | $48.44 | $138.41 | $38.29 |

| 53 | $203.82 | $52.93 | $151.24 | $40.33 |

| 54 | $222.63 | $58.25 | $164.49 | $44.40 |

| 55 | $244.01 | $63.38 | $179.67 | $48.50 |

| 56 | $265.74 | $70.24 | $193.56 | $52.97 |

| 57 | $287.88 | $78.64 | $209.38 | $57.87 |

| 58 | $312.61 | $89.01 | $228.83 | $64.76 |

| 59 | $339.70 | $99.04 | $249.14 | $71.04 |

| 60 | $370.01 | $110.28 | $272.44 | $78.83 |

| 61 | $403.55 | $126.85 | $296.37 | $87.41 |

| 62 | $437.02 | $142.30 | $323.52 | $98.14 |

| 63 | $465.02 | $161.80 | $357.08 | $155.57 |

| 64 | $494.09 | $184.07 | $392.14 | $163.49 |

| 65 | $527.44 | $208.55 | $432.11 | $183.18 |

| 66 | No Result | $247.46 | No Result | $234.99 |

| 67 | No Result | $275.43 | No Result | $271.76 |

| 68 | No Result | $315.19 | No Result | $301.00 |

| 69 | No Result | $363.56 | No Result | $345.50 |

| 70 | No Result | $409.45 | No Result | $382.27 |

$500000 Banner Term Insurance Monthly Rate Chart – 20 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $65.31 | $19.57 | $54.18 | $16.58 |

| 26 | $66.17 | $19.57 | $54.61 | $16.58 |

| 27 | $67.45 | $19.57 | $55.04 | $17.00 |

| 28 | $68.73 | $19.57 | $55.91 | $17.00 |

| 29 | $70.44 | $20.00 | $57.19 | $17.00 |

| 30 | $72.15 | $20.00 | $58.04 | $17.37 |

| 31 | $74.72 | $20.00 | $60.18 | $17.43 |

| 32 | $77.28 | $20.42 | $62.75 | $17.86 |

| 33 | $80.27 | $21.32 | $65.35 | $17.86 |

| 34 | $84.12 | $21.55 | $69.16 | $17.86 |

| 35 | $88.40 | $22.57 | $72.66 | $18.29 |

| 36 | $94.81 | $24.23 | $77.83 | $19.57 |

| 37 | $103.63 | $25.80 | $83.49 | $20.55 |

| 38 | $111.48 | $28.14 | $88.82 | $21.89 |

| 39 | $120.89 | $30.39 | $93.95 | $23.18 |

| 40 | $131.15 | $32.68 | $100.37 | $25.20 |

| 41 | $143.54 | $35.69 | $109.34 | $27.39 |

| 42 | $156.37 | $38.70 | $118.32 | $29.63 |

| 43 | $172.61 | $39.32 | $129.01 | $31.99 |

| 44 | $189.29 | $43.59 | $140.12 | $35.00 |

| 45 | $207.60 | $48.64 | $152.22 | $38.40 |

| 46 | $223.49 | $52.91 | $162.78 | $41.02 |

| 47 | $240.59 | $57.62 | $174.75 | $43.60 |

| 48 | $264.45 | $60.97 | $188.86 | $49.12 |

| 49 | $284.65 | $68.28 | $204.25 | $53.32 |

| 50 | $308.56 | $73.52 | $221.35 | $58.35 |

| 51 | $337.08 | $81.44 | $238.45 | $62.35 |

| 52 | $366.15 | $89.18 | $257.69 | $68.37 |

| 53 | $397.05 | $97.78 | $281.63 | $71.55 |

| 54 | $433.82 | $107.67 | $306.42 | $78.43 |

| 55 | $475.71 | $118.29 | $335.06 | $85.49 |

| 56 | $512.48 | $131.75 | $362.85 | $94.73 |

| 57 | $554.37 | $145.94 | $394.49 | $103.33 |

| 58 | $605.67 | $161.42 | $433.39 | $124.27 |

| 59 | $659.54 | $180.77 | $474.00 | $136.93 |

| 60 | $721.10 | $204.89 | $520.60 | $150.93 |

| 61 | $770.69 | $235.60 | $569.76 | $169.66 |

| 62 | $826.69 | $267.12 | $625.76 | $191.13 |

| 63 | $895.94 | $304.70 | $695.02 | $261.57 |

| 64 | $968.19 | $342.01 | $767.27 | $301.30 |

| 65 | $1048.99 | $394.31 | $849.77 | $349.25 |

| 66 | No Result | $457.33 | No Result | $440.32 |

| 67 | No Result | $521.07 | No Result | $512.56 |

| 68 | No Result | $602.34 | No Result | $516.21 |

| 69 | No Result | $703.31 | No Result | $657.47 |

| 70 | No Result | $800.61 | No Result | $729.71 |

$1000000 Banner Term Insurance Monthly Rate Chart – 20 Year Term

| Age | Male, Smoker | Male, Non-Smoker | Female, Smoker | Female, Non-Smoker |

|---|---|---|---|---|

| 25 | $124.70 | $31.99 | $96.95 | $24.27 |

| 26 | $125.56 | $32.05 | $97.80 | $24.27 |

| 27 | $126.42 | $32.34 | $98.90 | $25.13 |

| 28 | $130.29 | $36.33 | $100.61 | $25.13 |

| 29 | $133.71 | $36.33 | $102.93 | $25.13 |

| 30 | $136.28 | $36.33 | $104.64 | $25.98 |

| 31 | $141.41 | $36.33 | $108.06 | $26.84 |

| 32 | $146.54 | $36.33 | $113.19 | $27.69 |

| 33 | $152.52 | $40.42 | $117.47 | $31.17 |

| 34 | $160.22 | $40.76 | $123.45 | $32.03 |

| 35 | $168.08 | $41.11 | $129.40 | $32.89 |

| 36 | $180.74 | $42.57 | $139.55 | $34.61 |

| 37 | $194.35 | $46.01 | $150.52 | $37.19 |

| 38 | $210.70 | $46.78 | $161.93 | $40.63 |

| 39 | $227.76 | $50.22 | $174.75 | $43.21 |

| 40 | $246.49 | $54.74 | $189.11 | $46.96 |

| 41 | $271.75 | $60.53 | $205.53 | $51.94 |

| 42 | $299.93 | $67.45 | $222.63 | $57.19 |

| 43 | $331.22 | $72.24 | $245.39 | $62.35 |

| 44 | $365.19 | $80.79 | $266.59 | $68.37 |

| 45 | $403.06 | $91.05 | $291.89 | $75.03 |

| 46 | $435.15 | $98.74 | $311.55 | $80.41 |

| 47 | $474.72 | $107.29 | $334.64 | $87.07 |

| 48 | $509.06 | $117.47 | $362.00 | $91.50 |

| 49 | $552.66 | $128.67 | $391.07 | $100.10 |

| 50 | $601.14 | $141.41 | $424.41 | $110.42 |

| 51 | $651.84 | $154.32 | $462.25 | $119.97 |

| 52 | $709.13 | $169.71 | $500.95 | $131.15 |

| 53 | $779.24 | $186.81 | $539.84 | $136.95 |

| 54 | $851.91 | $206.47 | $587.72 | $150.65 |

| 55 | $935.16 | $227.85 | $642.44 | $167.27 |

| 56 | $997.26 | $255.76 | $694.59 | $185.06 |

| 57 | $1066.52 | $284.14 | $753.59 | $205.05 |

| 58 | $1152.87 | $325.37 | $826.26 | $233.49 |

| 59 | $1242.65 | $365.59 | $902.36 | $261.87 |

| 60 | $1345.25 | $411.08 | $988.71 | $294.55 |

| 61 | $1442.72 | $465.29 | $1079.34 | $352.17 |

| 62 | $1553.01 | $525.80 | $1181.94 | $390.01 |

| 63 | $1688.96 | $604.15 | $1308.48 | $566.95 |

| 64 | $1830.89 | $688.43 | $1441.01 | $632.31 |

| 65 | $1982.10 | $781.74 | $1592.34 | $705.20 |

| 66 | No Result | $1060.53 | No Result | $845.38 |

| 67 | No Result | $1159.37 | No Result | $980.61 |

| 68 | No Result | $1159.37 | No Result | $980.61 |

| 69 | No Result | $1348.65 | No Result | $1265.06 |

| 70 | No Result | $1537.62 | No Result | $1405.24 |

These prices are subject to change and are based off of preferred ratings. In order to potentially qualify for these rates, you have to submit an application and your rates will be subject to your underwriting decision. These are for examples purposes only.

Next Steps

I certainly hope this article has proved useful. If you find that you still have questions or would like to find out what your monthly premium might look like, please get in touch.

We can be reached by sending a message here or by calling (888) 626-0439. You will speak with a knowledgeable expert in the field who can answer any questions you might have at no obligation.

A free quote takes less than 10 minutes, so give us a call today! Thanks for stopping by.