Life Insurance And Autoimmune Disease: [Lupus, Arthritis, MS, Crohn’s]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

In This Article, I’m Going To Talk About How Do You Get Life Insurance With An Autoimmune Disease

You or your loved one has some sort of autoimmune disease. You’re worried about your or their eligibility to get life insurance coverage approved. If this describes you, then this is an article that you need to read.

Today’s Topic Overview:

- A List Of Autoimmune Diseases

- Eligibility For Life Insurance Based On These Autoimmune Diseases

- Case Study Examples

- Stories From The Field

- The Top 5 Reasons People Buy Universal Life Insurance

- Rheumatoid Arthritis

- Systemic Lupus

- Celiac Disease

- Crohn’s Disease And Ulcerative Colitis

- Arthritis

- Multiple Sclerosis

- Types Of Life Insurance Available For Those With An Autoimmune Disease

- Next Steps

A list of autoimmune diseases

We will go into detail about the different types of autoimmune diseases that many people have. We’ll see how each of those diseases affect your eligibility when applying for coverage.

We will talk about the different types of life insurance programs available with an autoimmune disease. We will then break down the details. Find out when those programs would be useful. Under what circumstances you would like to use them.

Here’s a brief overview of the different autoimmune diseases. You won’t find a detailed breakdown or condition list for each of these disorders. If you have them, there’s no reason for me to explain to you what they do and how they work. That would be a waste of your time.

The most common autoimmune diseases that people experience include:

- Multiple Sclerosis

- Rheumatoid Arthritis

- Lupus

- Pernicious Anemia

These are the most common to deal with.

We’ll also talk about:

- Celiac Disease

- Crohn’s Disease

- Ulcerative Colitis

If you would liek to find out what kind of insurance you might qualify for, please give us a call at (888) 626-0439. You can also send us a message using our contact us box found on this page. You will be under no obligation to buy. A customized quote is quick and absolutely free.

Your eligibility for life insurance based on these autoimmune diseases

Let’s do a deep dive breakdown about your eligibility for life insurance coverage. It depends on your specific type of life and the kind of autoimmune disease that you have.

You’re on a quest for buying a life insurance product with an autoimmune disease. One of the most important things that you need to consider is to work with a broker. An insurance broker is someone who shops around to find the best price and value of coverage.

It’s not just about finding a good price. It’s also about finding a company that will give you the best value for the type of coverage that you’re looking for.

Here at BuyLifeInsuranceForBurial.com, we specialize in working with a variety of different life insurance carriers. Our mission statement is to look at all the options available. Then we can give our clients the best available type of coverage that we can find.

We’re not married to one particular company. We try to go out and find the type of company that’s going to give the best overall amount of coverage for our clients, at the best possible rate.

Stick with us as we describe the different types of plans. We will give you a breakdown of what is most likely possible in getting you coverage.

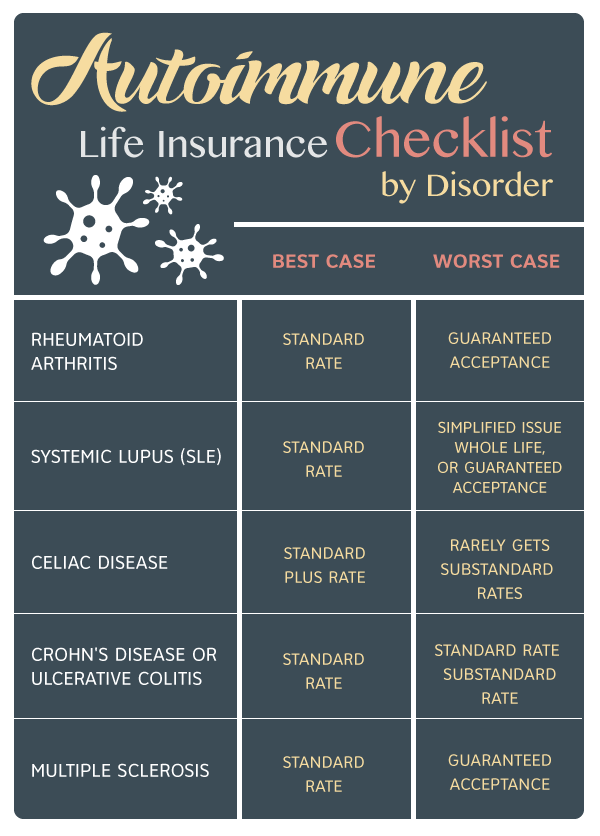

Rheumatoid Arthritis

Rheumatoid arthritis is one of those diseases that can vary dramatically in its severity. I have a client who has severe rheumatoid arthritis. Her mother had it as well. Her mom was bedridden for many years. The treatments did very little to help her out.

My client is suffering from rheumatoid arthritis enough to be classified as disabled. It’s slowly progressing in its severity and harmfulness as she ages into her late fifties.

Rheumatoid arthritis in a best-case scenario is something that can possibly get a standard or regular rate. What do we mean by standard or regular rate? If we look at a traditional type of product (like a term or permanent plan), either an exam or a non-med product, this is the rating class that you may be eligible for.

There are things that the insurance companies are going to look for in order to give this kind of rate. Whether or not you’re taking any immunosuppressive medication; if there is any debilitation.

Then they’re going to look at your overall health. The number of years since you were originally diagnosed with rheumatoid arthritis. These factors will determine if a regular or better rate is going to be issued.

If you have more severe rheumatoid arthritis like my client’s mother has, what you’ll find is that you may be rated at a substandard rate. You’ll have a higher price associated with it.

You may be forced into the situation where you may only qualify for a final expense plan. This is also known as a simplified issue whole life plan or a guaranteed acceptance life insurance plan.

Systemic Lupus

It’s a similar situation as with rheumatoid arthritis. Eligibility for life insurance with systemic lupus comes down to the treatment and date of diagnosis.

Say it’s a long time since the date of diagnosis. Combine that with a level of mildness or lack of treatment. Together it may give you a standard or regular rate for our traditional life insurance products available.

Say that your lupus has progressed and causes problems with your ability to move and get around. Or it’s caused other health problems. You may be limited to a simplified issue life plan or a guaranteed acceptance life insurance product. This is a last-ditch effort for coverage.

Celiac Disease

With celiac disease it’s fairly simple to get coverage, generally speaking, assuming that the rest of your health is in good shape. You should have a standard plus or better rate available to you as long as there are no underlying symptoms and no evidence of malabsorption.

Let us know how long ago you received your diagnosis. If more time has passed since you were diagnosed, the likelihood of a preferred rate may be higher. If you have progressive celiac disease or if your conditions are getting worse, you may only be eligible for guaranteed acceptance or simplified issue products.

Crohn’s Disease And Ulcerative Colitis

Looking at a regular or standard rate, the difference in rating depends upon when the original diagnosis was. Getting anything better than that is very difficult. I would not count on getting a price point that’s going to be much more competitive than a standard rate.

Say you have a flare up or worsening condition within the past 12 months of applying for insurance. You may find a substandard rating is the only one available to you. A simplified issue product may be a better choice.

Arthritis

Arthritis is something that in many cases doesn’t have a dramatic effect on your capability to qualify for life insurance. However, there are cases where you may find that your eligibility to qualify for anything better than a standard is minimal.

You have progressive or highly degenerative arthritis that causes issues with normal activities of daily living. You use strong medications to treat your arthritis. Many people who suffer from severe levels of arthritis may qualify with much more ease for a simplified issue product. These ask fewer health questions. In the worst case scenario, we can apply for a guaranteed acceptance life insurance plan.

Multiple Sclerosis

Multiple sclerosis is something that can get a life insurance approval. It depends on the type of multiple sclerosis. If it’s a relapsing or remitting type of disease. If it’s chronic, malignant, or benign.

The date of diagnosis and the frequency of episodes all have an impact on your eligibility for coverage. You may find that multiple sclerosis with worsening conditions ends up with a substandard rating at a higher price point rate.

You’re very likely eligible for the simplified issue side of the business. Say your multiple sclerosis has progressed and causes limitations in activities of daily living. This is a worst-case scenario, but you can still apply for a guaranteed acceptance life insurance plan.

If you are interested in getting a free quote, please get in touch. You can call us at (888) 626-0439 or send us a message using our contact us box found on this page. You’ll speak to a friendly representative who can give you more information regarding what your premium might be.

Case study examples

Final Expense Coverage and Legacy

The reason a client of mine recently got in touch was to request information about how life insurance works because he simply wanted to take care of his loved ones.

Part of his goal was to leave money behind to his grandkids to help them have funds to get started on their own with a car or down payment on a house. He also wanted to leave money to his kids to help take care of any final expenses he might have.

This client was in generally good health except that he suffered from an autoimmune disease and was a smoker. We shopped a number of providers to find quality coverage for this client and were successful in getting coverage he was very pleased with.

Though some health issues are hard to ensure, and some applicants will be declined, we do our best to find a solution to the hard to insure cases that come our way by shopping a number of providers who work with a variety of health conditions.

Burial Insurance with a History of Cancer

An older gentleman called us about a year ago looking for quality burial insurance. He wanted to make sure his wife and kids would not be burdened with the expense of funeral home and burial costs if he died sooner than expected.

His goals were clear, but finding coverage was not as straightforward since this gentleman had an autoimmune disease and had survived a bout with cancer.

Despite his health conditions, we shop a number of providers to find quality, affordable coverage that met this client’s goals.

Though we can’t guarantee your application will be accepted, we do our best to find a provider that will work with you despite chronic health issues.

Types of life insurance available for those with an autoimmune disease

I’ve mentioned and referenced some different types of life insurance already. At this point, I want to describe the different kinds of plans available to you. To show you the worst-case scenario to the best-case scenario, depending on how severe your autoimmune disease is.

Stories from the field

Back in 2014, I met a nice gentleman for whom I wrote up a small burial plan. He mentioned that his mother was in desperate need of burial insurance too, more so even than him and proceeded to tell me that his mother, Mrs. Sanders, was 81 years old and had just recently had heart surgery.

I visited Mrs. Sanders in her home and learned that she had worked for most of her life, having only recently retired because of her heart condition.

Interestingly enough, what happened was that she actually had life insurance which covered a good portion of her concerns but there was an unexpected twist as to how her coverage was taking effect.

Mrs. Saunders had an annually renewable term insurance plan that had continued to go up in price each year. She found that she could no longer continue to make payments on the plan and had found out that the plan would cancel at age 90.

When she began making payments about 20 years ago, her monthly premium was $50 to $60. Since that time the payment had gone up to $300 a month. Clearly, with a nice older lady like Mrs. Sanders being in a position of not working and not having a fixed income, she had to make some hard choices about what she could and could not afford, and so the insurance had to go.

Unfortunately, with her history of heart problems she wouldn’t qualify for first day coverage and would have to wait 2 to 3 years to have coverage go into affect.

This is a tough position that you don’t want to be in if you can help it. This is why I shared this story with you. Mrs. Sanders made a good decision to buy life insurance. She could have died at any point and she would have been fully covered.

However, the long-term damage done by the wrong kind of life insurance can be very negative. That’s why it is so important to make sure your life insurance meets your goals.

That’s why we here at Buy Life Insurance for Burial ask about your goals to make sure we find a type of life insurance that will give you the coverage you want when you need it most.

Guaranteed Issue Insurance Plan

For the most severe autoimmune diseases, guaranteed issue is what I would call my trump card. It is the last choice I use to try to qualify somebody for life insurance. No health questions are asked. For somebody in severe shape, is this is going to be their only option for coverage.

$50 a Month – Guaranteed Universal Life Insurance

$100 a Month – Guaranteed Universal Life Insurance

$150 a Month – Guaranteed Universal Life Insurance

What is the purpose of a guaranteed issue coverage plan? It’s for when somebody thinks it’s absolutely vital to get life insurance on the books. They understand that there will be a waiting period before the coverage comes into effect. They just want enough to take care of burial expenses.

This is never the first choice. It is the last card you have in qualifying for insurance coverage. It is the choice that I suggest only after all other options have been exhausted.

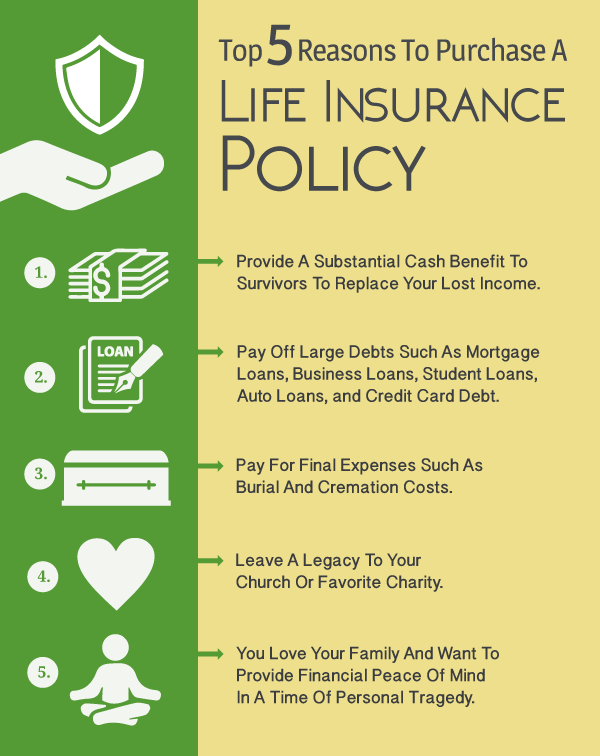

The top 5 reasons people buy universal life insurance

1.Flexible payments

Unlike term life insurance or whole life insurance, universal life insurance provides the ability to alter your payments up or down according to your financial circumstances.

For example, let’s say you have a rough year financially but you don’t want to lose your universal life insurance policy. You could request to adjust your rate down for a period of time so that you could keep the policy. You would not be able to do this with a whole life or term life insurance plan.

* Note that flexible payments do have an impact on the level of coverage and its ability to stay in force. Consult with your agent to find out more about how to design a program that accomplishes your goal while keeping the flexible payment arrangement.

2.Flexible coverage

You can adjust the coverage amount for your universal life insurance upwards or downwards based on how much coverage you intend to put into the policy and how long you want the coverage to be in effect. You can have some programs that are permanent in nature that last throughout your entire lifetime or you can have shorter term coverage that provides permanent coverage for a set period of time.

Again, there are lots of ways to skin a cat when it comes to universal life insurance so talk to a broker like us at Buy Life Insurance for Burial so that we can better describe your options to you.

3.Maximum, permanent death benefit using a no-lapse rider

One of the things I like to use with my older clients to maximize their death benefit options is what’s called a no-lapse universal life insurance policy or a guaranteed universal life insurance policy. Both are the same thing. The concept is simple. The policy requires that you maintain the same premium throughout the lifespan of the policy and in exchange the guaranteed universal life policy is designed to not lapse because of a certain age that is reached.

This gives you the ability to cover yourself until age 121 which effectively is longer than anybody ever lives and gives you permanent protection. The biggest advantage when compared to most other common types of permanent life insurance, which is whole life insurance, is that the death benefit payout is much larger than what you would find from a whole life insurance plan.

This gives you the ability to maximize your beneficiaries death benefit proceeds as opposed to a whole life plan which would minimize the cash value acquisition of the policy.

4.Principle protection with upside market exposure

There’s been a very big surge in interest in what’s called index universal life plans. These are universal life plans which can be custom tailored by price, coverage amounts, and coverage length, but also are designed to build cash value reserves based on how the market performs.

The added advantage of putting your money into the market directly is that you have principle protection. Essentially what this means is that you don’t experience the downside forces of the market, only the upsides in a limited fashion. What this allows you to do is have a portion of your retirement plan, the most common use for universal index life, experience exposure to positive market years but have minimal exposure to the down years.

For those of you looking for safety and want some kind of retirement strategy that allows for safety and the benefits of the upside of the market, the universal life plan may be something to consider.

5.Designed to meet practical realities of clients

The reason universal life insurance plans were created was that it was very difficult to imagine a client always having the same level of income expectations his entire life. When problems arose it was obvious that many people would lose their coverage that they had paid diligently or have to start anew, possibly paying much higher premiums than they had in prior years.

A universal life plan was ultimately designed with the realities of a person’s life in mind. It’s designed to give quality coverage but have the needed flexibility to allow individuals to keep it for the long term.

Simplified Issue Whole Life Plan

When to use simplified issue whole life? When you can’t get somebody qualified for a fully underwritten product and you don’t want to have them wait in a two year waiting period.

The autoimmune conditions mentioned above can very easily qualify for simplified issue whole life coverage. The benefit of these products is that the price never goes up. It’s never canceled due to age or health.

In many cases, you don’t have to wait for a full two years before you’re fully protected. The simplified issue whole life plans will protect you for natural and accidental deaths from the first day.

It all depends on factors related to your disease as well as other unrelated health factors. Contact us here at BuyLifeInsuranceForBurial.com if you think this is something that can help you out.

Let’s look at a different standpoint. You’re looking for something more than simply a final expense plan. An income replacement plan, a mortgage protection plan (to pay your mortgage off when you pass away), or life insurance for your family.

You may need something beyond a basic type of simplified issue final expense plan. There are two different types of plans that can accomplish these goals.

Rates For $10,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

$150,000 Whole Life Insurance, Life Pay

$250,000 Whole Life Insurance, Life Pay

Non-Medical Life Insurance Plan

These can be bought in a term insurance type of policy and also in permanent life insurance like whole life universal. The benefit of these plans is that no exams are necessary to get a decision on eligibility.

The one problem is that many of these plans have black and white decision making regarding autoimmune diseases. You may find that, even if you don’t have a progressive state of your autoimmune disease, you’re flat out declined because you have the disease.

If that’s the case, you have two options. You can find another non-medical carrier or you can proceed to the second option, which is a fully underwritten plan.

Fully Underwritten Plan

This requires you to do an exam. The details generated on getting the decision on your life insurance are specific and up to date. You’ll find that there is that much more flexibility in qualifying for the plan. The underwriter is extracting a lot more information on you than they would do with a non-medical policy to make their underwriting decision.

My twin girls Emily and Eva thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Next steps

My recommendation is to talk with a broker like us at BuyLifeInsuranceForBurial.com. We need to get a good idea of what your unique health situation is like. It may be extreme, it may not be.

The best way to find out is to talk to us. It’s a 5 to 10-minute conversation. Then we can give you an idea of what your options would be with the different life insurance companies that we represent.

If you’re interested in qualifying for life insurance as a sufferer of an autoimmune disease, visit my website. You can go to buylifeinsuranceforburial.com and grab a free quote.

I do ask that you message me first. You can do that by clicking the contact box; the one at the top or the bottom, and send me a quick message. Or just call me. The best way to reach me is (888) 626 0439, and speak with me live.

Thanks for stopping by and reading this article. I hope it has proven useful. If you have any remaining questions or would like to find out what you might qualify for, please give us a call at (888) 626-0439.

Alternatively you can send us your request using the contact us box found on this page. We hope to hear from you!