Is Colonial Penn A Good Burial Insurance Plan?

So, you’ve clicked on this article because you’re interested to see if Colonial Penn is a good burial insurance program.

The purpose of this post is to answer this question based on 10-plus years of helping people with burial and final expense coverage and to give you all the facts necessary to decide for yourself if the Colonial Penn Burial Insurance program truly is right for you.

If you’d like to get a free quote at no obligation, go to buylifeinsuranceforburial.com, or you can call us at 888-626-0439.

Colonial Penn Insurance Plan and Commercial

Let’s talk about Colonial Penn.

First of all, you’ve probably seen those commercials on TV.

This is Mr. Jonathan Lawson, who used to or took the place of Alex Trebek to talk about the $9.95 burial insurance program through Colonial Penn, the three P’s, price, price, price, and all of that.

And you’re probably wondering, is it all really stacked up? Does it really sound as good as it actually is made out to sound?

So, first of all, let’s talk about what makes it good and then we’re going to talk about what I would call the fine print issues to again give you transparency for yourself to decide if it’s really good for you or not.

Colonial Penn Pros

Colonial Penn is a reputable company. They’ve been around a long, long time, for decades. They definitely do pay claims as they describe. They’re a very good company with a very well-established brand, and that cannot necessarily be said for every single life insurance company. So that has to stand for something.

1. Guaranteed Acceptance Product

One of the good things about Colonial Penn is that there are no questions asked with its guaranteed acceptance product.

Now, Colonial Penn offers different kinds of coverage. In this case, this is the most popular plan that’s sold on TV or through the mail, and basically, the way it works is very simple. No matter what your health is, you are guaranteed to be approved for coverage, as long as you can pay for it and as long as you fit within the range of ages that are available.

So, what does that mean?

That means no matter what health state you’re in, good or bad, or anything in between, Colonial Penn will absolutely take you. And that is a good idea because not all burial insurance coverage is eligible depending upon the client’s or the person’s health.

If you have a series of health issues, you may not be eligible for some burial insurance products, but with Colonial Penn, acceptance is guaranteed. So you’re definitely going to get coverage or a policy with them as long as you can afford it and as long as you’re within the age range of acceptability.

2. Insurance Is Never Canceled

Another advantage that Colonial Penn’s Burial Insurance program has is that it never cancels due to age or health.

The idea behind this is that your coverage can never be canceled. This is what we see in a lot of what’s called term life insurance products, which are great in certain circumstances, but when you need the plan to cover for death, of which we don’t know when it’s going to happen, then a term insurance plan traditionally is not a good idea.

Why? Because you could outlive it and not have any insurance whatsoever.

So, the fact that the Colonial Penn Burial Insurance program doesn’t cancel due to age, and it doesn’t cancel due to health, means there is a level of certainty when it comes to buying this plan and knowing that you are covered for something.

3. Guaranteed Lifetime Rate Lock

Also, another benefit of the Colonial Penn Burial Insurance program is that the price never goes up.

They talk a lot about this in the commercial, the price lock, and the idea behind the price lock is that as soon as you take out the program, the premium is fixed and can never increase for any reason. This is great because if you’re on a fixed income, like many people who are in their later years, you don’t want rate increases and be in a potential position where you cannot afford the premium that has escalated to a higher level.

So again, a good benefit of Colonial Penn is that the quote you’re priced at is going to stay the same as long as you pay the premium and as long as you keep the policy.

Colonial Penn Cons

So now, let’s talk about the drawbacks of Colonial Penn’s Burial Insurance program because not all insurance programs are going to be best suited for every single individual. You cannot take any kind of life insurance and say across the board, for millions of Americans, that it is the absolute best fit.

So what you have to decide for yourself as a person looking for insurance is to decide if this particular program that Colonial Penn offers through their Guaranteed Acceptance Burial Insurance program really is the best suited for you.

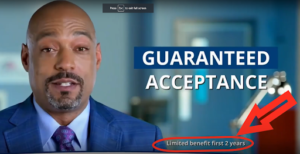

1. Guaranteed Acceptance

The biggest issue with the guaranteed acceptance product is the fact that it is a guaranteed acceptance product. What does that mean?

Well, when you are allowing anybody in any health to be approved for coverage, what happens is that from an insurance perspective, you have to calculate the risk that the client may die in 10, 20, 30 years from now, or 10, 20, 30 seconds from now.

When you take anybody on, the way that an insurance company works is that they’re going to estimate the risk associated with the average person that applies and then design the product so that it’s profitable to the company so that they win. Because if they take one premium out and the large majority of the people die after a premium and you do that about 10, 20, 50, 100,000-plus times, the company’s going to lose a lot of money, and then all the rest of the insurants, who tend to be a little bit healthier, are going to have a problem with that because the company may go under.

There’s this balance that you have to have when you sell insurance. And the way that Colonial Penn mitigates this risk is that they just don’t allow everybody to be fully covered with the guaranteed acceptance product. In fact, nobody is covered for the full death benefit for two full years.

So what does that mean? If you take out the Guaranteed Acceptance Burial Insurance program, no matter if you’re in perfect shape or about to die, you must wait two full years before the full amount of coverage pays out for natural causes of death. It does pay full benefit for accidental.

So that means you’re really not covered for two years. You have to hope and pray that nothing bad happens naturally to you, because otherwise what you get returned back to you is the premiums you paid in plus 7% interest.

That barely covers much other than cremation and a Folgers can, and if you want to be buried and have a nice service, $1,000 doesn’t go far with the average funeral of $10,000 and more in many markets, and very much so increasing year by year, especially with all this inflation we’ve had in the recent past couple of years.

You might think: “Hey, at least I can get coverage.” And that’s true, but what we have found at Buy Life Insurance For Burial is that most people out there can actually qualify for higher levels of coverage and higher quality of coverage in the form of first-day full natural death coverage.

If you’re eligible health-wise, you may qualify for first-day full coverage from the first payment for the full amount. Let’s say we take Colonial Penn, where we know there’s a two-year waiting period policy, but you can also qualify for one of the many products that we have for first-day full coverage and both plans are $10,000 plans.

- Colonial Penn, if you die after the first premium payment, pays back your premium plus 7% interest.

- If you’re eligible for first-day full coverage, would pay the full $10,000 out assuming you fully told the truth and everything was honest from the get-go.

Hopefully, the obvious benefit here you see, with a first-day full coverage plan, you have more coverage faster. You relieve the burden and the concerns of your loved ones that much better. If you get something where you’re forced to wait two years, and some people are forced to wait two years, and sometimes Colonial Penn is best for them, then you put this risk on your family, your loved ones, to come up with the money to bury you or to pay your final expenses.

2. The Offer Is Standard

Also, some of the benefits of Colonial Penn’s Burial Insurance program are actually the same with most other burial insurance programs that are out there.

For example, if you buy a simplified issue whole life insurance program, which is essentially the Colonial Penn Burial Insurance product, all prices are locked in, the rates never go up for any reason, and because they’re whole life type products, they never cancel due to age or health. And the truth is, there are dozens upon dozens of insurance companies that offer the same kind of burial insurance products that Colonial Penn does with that added potential, dependent upon your health, that you can be fully covered from the first day.

Recap

So, what’s the moral of the story?

Very simple. Before buying a Colonial Penn plan, see if you can possibly qualify for first-day full coverage elsewhere. That is exactly what we do at Buy Life Insurance For Burial. We work with reputable companies, name brand companies with sometimes 100-plus years in the business, that depending on health may qualify you for first-day full coverage.

Here’s what you need to do if you’re interested in getting a free quote, go to buylifeinsuranceforburial.com. You’ll see a quote form, just fill it out.

Or you can just call us at 888-626-0439, you’ll speak to friendly professionals, and they’ll be happy to give you some quotes.