What Does $9.95 A Month Get You With Colonial Penn Life Insurance?

Most likely you’re reading this article because you’ve seen endless amounts of Colonial Penn television commercials, you’ve gotten endless amounts of junk mail from Colonial Penn, and you’ve heard about this $9.95 plan and are wondering exactly how it works.

What we are going to be doing in this post is pulling back the curtain and explaining exactly to you how the Colonial Penn Life Insurance $9.95 Plan works, so you can decide if it’s a good fit for you, or not.

We help people across the nation who are looking for a high-quality final expense burial insurance program and want an organization to shop and look for the best deal. If you’d like a free quote, go to buylifeinsuranceforburial.com, or better yet, call directly at 888-626-0439.

Let’s jump right into this conversation about the $9.95 plan with Colonial Penn, and what do you exactly get?

Real quick, this is the commercial you see all the time with Jonathan Lawson, now that Alex Trebek has passed away, about the special $9.95 plan, how it’s inexpensive, it takes care of funeral expenses, it’s the greatest thing since sliced bread.

And what we’re going to be doing here today is really going through the rate charts to tell you exactly what $9.95 gets you with Colonial Penn. We’re going to actually break it down, more than just the amount that you get, but some of the issues with the Colonial Penn plan itself.

The $9.95 Unit

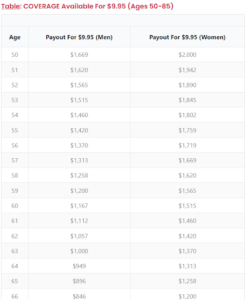

If you go to getsure.org’s website they’ve got a blog article up about Colonial Penn Life Insurance Rate Chart By Age, so they’re showing the $9.95 plan.

And what a $9.95 unit is, that’s sometimes what it’s referred to, is it’s a function of the age of the prospect, and how much age they have and how much, therefore, the coverage they’ll get.

So for example, $9.95 per unit, the unit changes by the age of the person. A younger person gets more coverage per dollar spent on a life insurance plan than somebody who’s older. Because they’re younger, they are eligible for more coverage, and they’re likely not going to die as soon. So usually, you can get more coverage on a younger person.

If you look on a chart here, for example, one unit that’s $9.95 for a male that’s 50 years old is, according to getsure.org, $1,669, for a female, it’s $2,000. And again, as we progressively go down, it starts to get less at 60, 70, and then 80. One $9.95 unit for a male at 80 is $426, and likewise, for a female at age 80 is $608.

You might be wondering:

- “Well, who needs 400 and some odd change dollars in coverage? I want to get more than that. Do I have to spend more?” Absolutely!

What happens when you call Colonial Penn, they’re going to ask you, “Well, how many units do you want to buy?” An example, if it’s a male 80 years old and it’s $426 per unit, and you want to get $10,000 in coverage, well, that’s going to be easily more than 20 units, probably closer to 25.

So you’ll take that $9.95 and multiply it by 25, that’s a lot of money. You’re looking at about $200 to $250 for $10,000 in coverage.

What really the unit thing is, at the end of the day, is just a gimmick. It’s just a way to make something sound better than it is because nobody’s going to go out there and buy $400 in coverage or even just $2,000 in many cases. People need more coverage mostly to cover funeral expenses, and other final expenses that may be unexpected, to account for inflation because funeral and cremation expenses are definitely going up just like everything else is these days. So people invariably buy more units than just one.

And again, this is how Colonial Penn gets you on the phone. Everybody’s enticed by something that sounds affordable and sounds cheap, but when you start doing the math like shown on that chart, it gets a lot, more expensive and you end up spending way more than just $9.95.

Guaranteed Acceptance

There are other issues here when it comes to Colonial Penn’s plan, and this is with its Guaranteed Acceptance plan, the biggest gotcha with the plan that mostly is sold, what’s called the Guaranteed Acceptance plan with the Colonial Penn, it’s not the unit thing, that’s another issue altogether.

But the biggest problem is that the coverage does not cover you fully for the first two years if you die from natural causes. Everybody who applies for the Guaranteed Acceptance Life Insurance plan, in great shape or in terrible shape, must wait two full years before the full amount of coverage comes into effect. This is what’s called the Guaranteed Acceptance plan. Health doesn’t matter, but in exchange, who knows how bad off you are, so everybody has to wait two years.

If you were healthy and you took it out and it was within those two years, you’re not going to be fully protected. This is a problem because for those people who are healthy enough, and many times, a lot of people think they’re not healthy, but they are, there are programs out there with other companies that can offer potentially first-day full natural death and accidental death too from the first payment date.

This is important because we don’t know what tomorrow brings us. Who knows what’s going to happen tomorrow? Did we expect coronavirus to happen and affect so many people? Of course not. Likewise, we don’t know what’s going to happen to ourselves individually.

Final Thoughts

If you are healthy enough, in many cases people are, if you’re healthy enough, why not get first-day full coverage from the first day to protect final expenses, to protect for burial, cremation, and funeral cost?

And that’s exactly what we do at Buy Life Insurance For Burial. We shop the highly rated carriers that are out there in the final expense burial insurance business, and to give you the best combination of price and coverage, which in many cases, unlike Colonial Penn, gives you full coverage from the first day if you qualify for it.

And if this is something of interest to you and you want a no-obligation quote, no pressure to buy, or anything like that here’s what you need to do. Just call up 888-626-0439. You’ll speak to a live operator who is very friendly and will be absolutely happy to help you get a quote very quickly, within a couple of minutes.

Or you can go get a free quote at the website, it’s buylifeinsuranceforburial.com.