Affordable Life Insurance Helpline [Commercial REVIEW]

So you’ve seen a commercial from the affordable Life insurance helpline on TV, and you’re wondering exactly the truth behind how this life insurance policy works. If you’re looking for the facts and a detailed analysis from a licensed insurance agent about how this program works, then this article is for you.

If you’d like a free quote and allow us to shop for you, where the best policies will be located for you and your state. Go to buylifeinsuranceforburial.com or just call directly at 888-626-0439.

Without further ado, let’s jump in and review this commercial from the Affordable Life Insurance helpline, and do a little digging to see what exactly it is, how it works, and if it stands up to our test of being a good quality life insurance product.

Low Rates

So, rates start as low as $5 a week. Does that mean you’ll actually pay $5 a week? Does that mean you’ll pay $20 a month or $31 a month? No. You see, what the statement is, just to be a hundred percent clear, it’s the rates are as low as $5 a week.

So that would be like the absolute minimum. And usually, the case is if there’s an absolute minimum, you likely aren’t going to pay the minimum unless you’re as young as possible and in the best of shape. In addition, typically females pay less than males.

Likely you’re going to pay more than this. This is just a way to tell you there’s a price and this is the minimum to maybe also excite you.

And possibly, maybe not intentionally, but misled as to what you’re going to pay. Maybe thinking you’re going to call in and pay 20 bucks and it’s probably going to be some amount more. It could be that much of course, but this is just a sales ploy, to get you to call the number thinking you’re going to pay a low price.

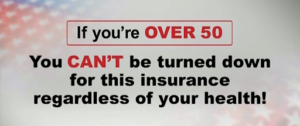

Acceptance Guaranteed

So acceptance is guaranteed. Is that truly the case?

Well, there are final expense life insurance plans out there that ask no health questions as long as your age is represented within the product’s age range. So it’s usually 50 to 80 years old, sometimes 40 to 80. Then no matter how bad your health is, you are approved for coverage.

However, there’s always fine print. When it is that easy to get a policy, usually there’s a catch. And the catch typically with guaranteed acceptance plans is there’s no full natural death coverage for a full two years. This means that you have to have your policy in force, meaning buying it, paying every month, and keeping it for 24 months to pass before you’re fully protected with these guaranteed acceptance products.

So, they’re easy to get, but there are all these catches when it comes to natural death coverage, and that’s how the vast majority of Americans pass away is certain natural causes not accidental.

You’re at risk if you’re forced into one of these plans that are guaranteed acceptance. It’s important to understand you might have health issues, but that doesn’t mean you can’t get first-day full coverage. If you work with a broker, like what we do at buylifeinsuranceforburial.com, where we shop around to see what the best combination of price and coverage is. And if possible, and you’re eligible from a health standpoint get you first-day full coverage after the first payment for natural and accidental death.

Health and Age Restrictions

There is an upper limit in most cases with most products 80 years old. If you’re over 85, you may have access to first-day full coverage, but if your health’s bad enough, you might not be able to qualify for guaranteed acceptance.

The point is if you’re under four 50 and you’ve got really bad health issues, you may not be eligible for what they’re trying to sell you. So, you may want to try us at buylifeinsuranceforburial.com, if that fits you, we might be able to do something where they couldn’t.

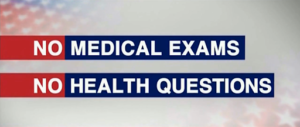

No Medical Exams and No Health Questions

That is a common feature for all final expense burial insurance programs, very few of them force you to take a medical exam. They usually just run your health records with what’s called the Medical Information Bureau and check your prescription history. Then levy a judgment if you’re going to be approved or declined.

Medical exams are not the norm. Most companies don’t do them nowadays and most people don’t want them.

The no-question thing is really the norm if you’re getting guaranteed acceptance. In fact, if you’re looking at the final expense, whether you get from us or not, you want to be asked health questions. Why? Because by asking and getting asked questions, if you can answer certain ones – no, that may allow you to get a better price and better options for coverage.

By taking the no questions asked approach as the first option, you’re getting what would be considered to be the worst option.

Again, it’s the best option if it’s the only option. For a lot of people, even with preexisting conditions like heart issues, cancer, diabetes, et cetera, they can get first-day full coverage. So guaranteed acceptance, no health questions asked type of insurance is not always the first choice. In many cases, it’s the last choice.

Rates Never Go Up and Coverage Doesn’t Go Down

And this is the norm for all final-expense burial insurance. If you buy a final expense plan, it’s likely what we call whole life insurance. If it’s not, call 888-626-0439. You have term insurance that may cancel at some point in the future.

All final expenses, whole life insurance, including burial insurance, and whole life insurance rates never go up and the coverage never goes down.

What you should be concerned with is:

- Can I get first-day full natural death coverage and

- Can I get it at a competitive rate

Those are the things as a consumer you need to be looking for along with making sure the company’s legitimate and you’re working with a good agent, but you want to make sure that you satisfy those things more often than these features that are really just the norm.

Fine Print

Now let’s take a look at the fine print. That’s where you’re going to find the legal stuff that makes the difference and clarifies all these claims made.

So if you look at the bottom it says:

- Your plan could vary depending on your age, health and issue and company, and other factors – there’s no one plan for everybody at the same price with the same conditions.

- Not available in all states – So, you may be in a state where this isn’t available. They’re in most states. These types of plans are, so usually, that’s not an issue.

- Policies may have a graded death benefit for an initial period of time – The graded death benefit is another way to say a modified plan or what we think of as a grade, like stair steps. There is a grade as you go up, so it starts low and goes high.

So graded refers to the coverage starting low for a period of time before stepping upgrade to get to the high level. So in other words, you won’t get level coverage. That’s a terminology used in the final expense world, to signify the client as fully covered for natural and accidental death from the first payment.

The point is you want to make sure they have the option for first-day, full coverage. That is not clear based on how this commercial’s reading because they were saying it’s guaranteed acceptance.

Guaranteed Acceptance and a Guaranteed Rate

Again, the guaranteed rate is normal for final expense whole life insurance.

That is something you definitely want. It’s a good thing with these plans, but it’s not something that’s special or unique. The guaranteed acceptance, again, we’ve made this statement already. It’s good that it’s there, but it’s not always the best option for many folks out there. So understand you don’t want that as a first choice. You want that as a last choice when you can’t get anything better than guaranteed acceptance.

Does Your Coverage Start Immediately?

Your coverage begins as soon as your application is received.

Notice what does it lack saying? It lacks saying that you’re fully covered.

If you are fully covered, this is a huge benefit if you qualify for it, you would say that as part of this presentation, this is an advertising piece, so trying to convince you to call them and buy from them. Wouldn’t it make sense if for everybody you could get somebody fully covered? Of course, it is for natural and accidental death.

The fact that it doesn’t mention it and it just says that coverage starts immediately, but doesn’t qualify to what degree the coverage starts. Is it partial? Is it full? That’s an issue. It’s not saying what we really care about, which is can I get first-day full coverage for natural and accidental death?

Because we don’t know when we’re going to die, right? We don’t know what the next second, the next minute, much less the next day is going to bring. So, you want the most coverage as quickly as possible.

And by reading this, if you don’t read into that, you may think you’re fully covered because it says it starts immediately. Well, doesn’t necessarily cover fully immediately and that’s kind of the catch.

Final Thoughts

So, ladies and gentlemen, that is the end of that commercial.

Keep in mind that this product is not bad, because we don’t know which company’s it with. It’s probably a commercial used by a third-party marketer that just feeds call-ins to agents and then they talk to you and then they offer specific types of insurance, final expense, burial, insurance carriers, and then try to sell directly that way.

At the end of the day, the way this is being presented is that you may be in a situation where you have a two-year full death benefit coverage, and wait for natural causes.

You want to avoid this if at all possible. And by calling this number, I can’t tell you if the gentleman or lady on the call who’s an agent that will help you is going to be able to offer that. Not all insurance agents do what’s called being a broker and shop around to find the best coverage. Notice they didn’t even say that in the commercial.

You want to make sure you’re working with an agent that shops around, looks at different products out there, and offers the best combination of price and coverage. An agent that isn’t married to one company but is married to the process of helping you first and getting you the best options that are out there. And it’s unclear if that’s the case in this particular commercial.

If you choose to work with buylifeinsuranceforburial.com, we can absolutely help you. We shop all the major carriers out there. We work with name-brand companies and our job is simply put, to find the best combination of price and coverage.

And if you would like more information on how that works, the best thing to do is just call us directly. It’s (888) 626-0439. or you can run your own free quote at buylifeinsuranceforburial.com.