Best Life Insurance For Seniors 65 And Older [Rates & Carriers Revealed]

Looking for a quote for life insurance or burial insurance? Click here and send me a message with details of what you’re wanting to accomplish. If you’d prefer to talk live, call 888-626-0439 to speak with me directly.

Today’s Topic Is The Best Life Insurance For Seniors Over 65 Where I Will Be Revealing Both Rates And Options For You

If you are reading this article, most likely I would presume you’re either looking for life insurance coverage for yourself or for your loved one. Maybe you’re looking coverage for your spouse or for your mom and dad. If you’re here to find as much information to do your due diligence to make sure that you find the best options available for you, then you came to the right place.

We’re going to go into explicit detail on all the information you need to know about life insurance for seniors over 65. And my goal is to help you empower you to have all the information necessary to make a good decision on purchasing a life insurance plan for senior over 65 years old.

NOTE: Would you prefer me to present this information to you in video format? Watch the video below for the complete presentation. Enjoy!

Here’s An Overview Of Our Discussion On The Best Term Life Insurance For Seniors 65 And Older:

- Reasons Why Seniors Over 65 Purchase Life Insurance

- Stories From The Field

- How To Pick The Best Life Insurance Option?

- Life Insurance Option Available For Seniors Over 65

- Top 7 Reasons People Buy Whole Life Insurance

- Case Study Examples

- Insurance Riders Definitions and Types Available

- Exam or No Exam?

- How Much Life Insurance Coverage Can A Senior Over 65 Qualify For?

- Burial Insurance Rates, Age 40 to 90*

- What If Health Is Bad?

- How To Qualify?

- Next Steps

Reasons why seniors over 65 purchase life insurance

I would say there are several reasons why life insurance for seniors over 65 years of age is really important to them. What I’m going to do here is go through the list and then describe in detail how each one of these may apply to you.

#1 – Final Expense (Burial or Cremation)

The first reason would be funeral and cremation expenses, otherwise known as final expenses. There’s something that we all have to pay and unfortunately both are a considerable cost. A lot of people buy a life insurance plan specifically to cover funeral and cremation expenses as far as how much they get. It just depends on where they live.

The average burial cost run about $10,000 to $12,000 but it will go and get higher every year. Cremations cost is about $5,000 to $7,000 on the high end, a lot of people buy life insurance perhaps a little more just a cover for additional costs.

#2 – Income Replacement

Also, a good reason to purchase a life insurance plan as a senior for 65 is for income replacement. Let’s say your spouse and you have a combined income which is required to sustain your lifestyle. Now imagine for a moment you die. What would happen to your surviving spouse income? would happen to their lifestyle which she has to change things?

Would it be more difficult? All these things you have to ask yourself because a life insurance plan can replace a loss income at least for a period of time. And make life a little bit easier while the surviving spouse becomes accustomed to being a surviving spouse. Whether selling her home, downsizing, reducing expenses and income replacement. Life insurance plan is great way to replace income is a great reason to own a life insurance plan in the first place.

We here at Buy Life Insurance for Burial give people the best opportunity to get affordable, high quality life insurance thanks to our ability to shop among a number of providers.

If you would like to see what you might qualify for, give us a call at (888) 626-0439. You can also submit a message to the left-hand side of the screen and we will reach out to you within the next 24 business hours.

#3 – As a Gift of Love

Some people buy life insurance as a gift of love. Maybe you just want to leave something to your grandkids or your kids to help them get started on the right foot. A life insurance plan is a great program that will provide extra money when most needed for people that you love.

My grandfather gifted my mother $7,000 life insurance plan when he passed away about five years ago and it was the perfect time gift. Mom needed a new roof cost about $7,000 and she didn’t have to get our own savings to get it done. Mom was very, very grateful and happy she felt the love of my grandfather. Things like that people remembered and they really appreciate it.

#4 – Mortgage Payment

Maybe you own a house and have a mortgage attached to it, and if you die the income situation changes, but you don’t want to lose potentially the house because the mortgage payments defaulting. You can buy a life insurance plan specifically designated in paying the mortgage down as time passes. This is great for your surviving spouse or your family so that they can get the house together to get their lifestyle rearranged and potentially sell the house the top dollar.

Without one of these mortgage payment plans, and if you have to sell the house, you may not get top dollar value. You may lose money because anything that needs to be sold immediately usually sells for a large discount.

#5 – Payment For Existing Loan

One other reason to buy a life insurance plan is for a loan pay down. Perhaps you owe money or business loan somewhere and that money must be paid off. Let’s say life insurance plan is great. protection against that loan as being a protected for the bank. To know that you’ve got some sort of coverage in place so the bank isn’t left high and dry.

Stories from the field

Over the years I have worked with many clients who were being overcharged for their life insurance policies. This story in particular is one I often share to show the importance of making sure you have a policy in place that is going to serve the purpose you need it to serve for the life of the policy.

Back in 2014 I met a nice gentleman for whom I wrote up a small burial plan. Once we were finished working on his policy he said he wanted me to speak with his mother who was in desperate need of better coverage.

He explained that his mother, Mrs. Sanders, was 81 years old. She’d worked almost all of her life at a local dry cleaners and had just been forced into retirement due to heart surgery.

I discovered when I spoke with Mrs. Sanders that she actually had gotten a life insurance policy some 20 years before and had been dutifully paying on the plan ever since.

The problem was that unexpected rate hikes had caused her plan to go from a mere $50 per month to $300 a month. To make matters worse, the plan was set to cancel when she turned 90.

As you can imagine, $300 a month was not even an option for Mrs. Sanders. She was going to have to cancel the plan. I was shocked that she was paying so much, especially at retirement age when her policy should have been locked into a set price and last until her death.

The really unfortunate thing about this whole situation was that because of her recent heart problems, there wasn’t any kind of affordable policy Mrs. Sanders could apply for and get first day coverage for.

She would have to undergo a 2 to 3 year wait period before coverage would take affect or continue with an overly priced plan she couldn’t afford.

It was a tough situation to be in and one that I see many clients face when their life insurance policy doesn’t work the way it should.

This is why I emphasis the importance of working with a broker who can tailor your policy to meet your budget and goals. We also strive to always get our clients first day coverage whenever possible.

We understand the brevity of life. Even if you are young and in good health, you never know when your last day on earth might. That’s why it’s important to not only get first day coverage, but also coverage that you can afford to keep for the long term.

How to pick the best life insurance option?

Let’s talk about how to pick the best life insurance for seniors over 65. The first thing is you’ve got to figure out what you want. That’s what’s extremely important. And what I mean by that is you’ve got to figure out what your goals are. You got to know why you’re buying this life insurance and why it’s important.

I think it’s really important just to do that anyway because a lot of people, they’ll buy a plan and then several years they’ll drop it because they’ve realized their goals weren’t necessarily that clearly defined. They have all this insurance paid for that doesn’t really go for anything.

I think it’s important to really flesh out and better crystallize what it is that you’re looking for as far as your goals is. Here’s how I would suggest a defining your final expense life insurance goal.

Determine your Budget

The first thing you need to know is what your budget? The last thing you want to do is start a life insurance plan as seniors over 65 on a fixed income and then drop it because it was too expensive. That’s certainly a waste of your time.

The key, is to find a budget that is easily affordable. A budget that you can afford and is not going to get dropped at the first sight of a difficulty of finances, it gets something you can easily forward and work from there. You also want the best quality of coverage of courses as kind of a no-brainer.

Nobody wants to get sub-par coverage and when we say sub-par coverage, we want to be comprehensively coverage for natural death, accidental death. Many people want to make sure that their coverage last a particular period of time. There are different plans coverage, you’ve got to define the quality of coverage that best fits your goals best. And you want to know what it’s going to cover and it’s your life insurance plan.

Why did you have it? It really kind of goes back to the why. You got to have a strong why to buy a life insurance plan. Think about it. Life insurance is this interesting product which benefits you only when your dead doesn’t rely for benefit. Your loved ones will benefit from it, but you have to pay a promptly until that time comes, you’ll never see the death benefit payout.

You’ve got to have a strong reason for having it. A lot of that goes back to who you love and who you’re thinking of and why you’re doing this. And you got to make sure that you really believe in it why you’re paying for it.

Life insurance option available for seniors over 65

Let’s talk about some options for life insurance for seniors over 65. Generally speaking, there are a couple of options available for life insurance if you’re a senior 65 year old or older.

Whole Life Insurance

The first one is whole life insurance. And just for a brief description of what whole life insurance. essentially there are two options within whole life insurance. You have what’s called the first a full coverage. And the second is guaranteed acceptance. There’s a big difference between both of these 2 options for whole life insurance.

The first option full coverage whole life insurance the rates never go up, the coverage never goes down and you’re fully protected from the first day. There are underwriting health questions involved in this kind of whole life. Generally speaking, if you get fully underwritten, they’re going to be more rigorous health questions.

But if you get a simplified issue, whole life insurance products that are going to have less rigorous questions so which one you choose depends on your health status. if you’re in great shape, a more fully underwritten or more rigorous question based whole-life insurance program was going to get you a better price and that’s the one I was steering you towards.

If your health isn’t necessarily in great shape, then I would steer you towards a simplified set product because there was a lot of easy with many of those products were. Some health conditions normally declined are totally fine with simplified issue. The drawbacks to this whole life insurance is that the rates tend to be the higher amount of highest per dollar of coverage relative to term insurance.

Permanent Coverage

And the reason for that is that whole life has permanent coverage. Permanent coverage means it never cancels, you’re buying a plan that guarantees that it will pay some sum of cash, no matter when you pass away.

Guaranteed Acceptance

Now the alternative or the other way to buy whole life insurance is through guaranteed acceptance. This is the only option I would use if there are no other options. If your health is really bad that they’re just, nobody else will take you then the only option is guaranteed acceptance.

Guaranteed acceptance means they don’t ask any health questions but the same benefits as simplified issue and fully underwritten whole-life insurance. The rates never go up and the coverage never cancelled due to age or health. But the biggest drawback of guaranteed acceptance, there’s a two year mandatory waiting period until your health or until you’re fully covered for natural causes of death.

You’re covered for accidental death, but not for natural causes. This is again for obvious reasons, something I don’t want to put my clients into unless there is no other options. I don’t want my clients to wait two years, but sometimes we have to use this program because people’s health has progressively worsened.

The best way to figure it out if you fit into that bill or not is to talk with me. I can give you an assessment within 5 to 10 minutes about what most likely you’ll qualify for and then we can determine, if that’s something that’s sensible to you or not.

First-Day Full Coverage

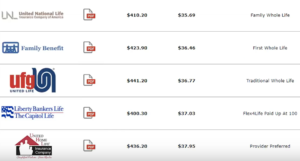

I’m going to just look at a 65 year old rate, everything you’re going to see here on prices and coverage. Just to keep this simple. If you’re over 65 years old, you can go up to 80 in some cases, 90 years old. Just to understand that we’re just a starting point to look for coverage. And what we’re going to do here for whole life insurance, we’re going to just look at $10,000 in coverage.

We can go higher, we can go lower and ultimately understand that this is just a number, it’s not a quote for you. If you were to be quoted, it’s based on your individual health and I can’t do that until we talk. Let’s go on and look at both the life insurance first, a full coverage and then guaranteed acceptance and then we’ll go from there.

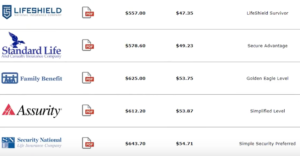

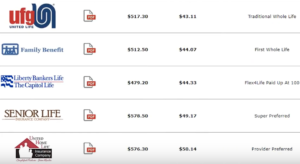

We’re looking at a 65 year old, $10,000 simplified issue whole life insurance program. And basically what we’re looking at here is just a list of different companies and rates. Which one would be you’d be eligible for, depends on your health, but you’re looking at a low of mid $40 to a high of mid $50 a month.

If you can qualify for a $10,000 female nonsmoker, 65 year old, you’re looking a little less expensive than a male. Females generally aren’t as expensive and the rates are upper s $30 to mid $40 a month depending on which company you may qualify.

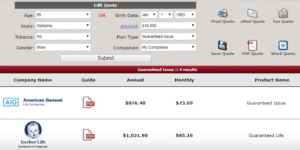

Now we’re looking at guaranteed issue whole life insurance and you’ll notice by the way, this is a 65 year old male, a $10,000 plan. You’ll notice first thing off the bat, he prices are substantially higher.

This is normal whenever we’re dealing with a guaranteed issue situation where they’re probably has health problems, it’s understandable. The prices a little bit higher it will be $73 to $85 for 10,000 in coverage. For $10,000 guaranteed issue plan, it’s going to be mid $50 to low $60 a month.

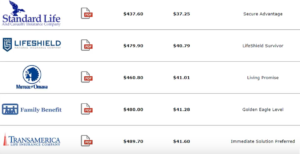

Now we’re looking at what I would call a more fully underwritten whole life insurance product at $10,000. This is the one with more health questions and depending on the company you’re looking at. For male, 65 years old, $10,000 coverage.

You’re looking at more of the low $40 to low $50 a month, slightly less expensive per month for a male compared to the simplified issue product. And the same look at for 65 year old female nonsmoker, $10,000 in coverage, mid $30 to upper $40 a month.

A more fully underwritten Whole Life insurance product at $10,000 for a 65 year old non-smoker female

The last thing I’ll add here after the fully underwritten whole life insurance, which is mostly used and we’re looking at larger amounts than $25,000 coverage because it gives us a tremendous price advantage. And that’s a good perspective on what your potential prices may be if you qualify.

If you would like to see what you might qualify for, give us a call at (888) 626-0439. You’ll speak to an expert in the field who can answer any questions you might have and find a plan that’s right for you.

Top 7 reasons people buy whole life insurance

1.Does not cancel due to age or health

Those who are looking for permanent protection find whole life insurance especially appealing because it is guaranteed to not cancel due to age or health. Unlike some other types of plans, whole life is a permanent solution for permanent financial obligations such as final expense coverage or providing a buy out for a business partnership.

2.Rates never increase

In order to hold on to a policy for a lifetime, it’s important to have a rate that remains consistent. The last thing you want is a rate increase that causes you to have to drop the plan.

3.You can pay up your whole life insurance

A unique aspect of whole life insurance is that after many years of payments you can reach a point where you pay off the plan and no longer have to make payments, though you will still have coverage.

4.Can grow tax-free cash value – Many individuals appreciate the cash value aspect of whole life insurance. What this means is that you can develop cash value over time and borrow from that accumulated amount. This is especially appealing when you consider that the cash loan is tax free.

5.A permanent solution to permanent problems – If you are facing a permanent financial obligation such as burial expenses, estate taxes, or a business partnership buyout, whole life insurance is a great option. You don’t have to worry about whole life insurance canceling or ending – it’s a permanent solution to permanent problems.

6.Exams are optional

If you are interested in whole life insurance but want to avoid a doctor’s visit, you can opt to do what is called a non-medical application. With this type of plan the underwriters rely on your previous medical records so that you don’t have to go through the exam process.

7.Best use of your premium dollar

While there is no doubt that term insurance is cheaper as far as monthly payments go, when you look at the bigger picture, whole life insurance is the long term value winner. When you scale whole life insurance payments over time, you are paying far less for long term coverage then you will pay for short term coverage.

2nd Option – Term Life Insurance

Now let’s talk about term insurance term insurance a lot different than whole life insurance. Let’s talk about some of the benefits of it. For 65 years old, you’re going to have what’s called a 10, 15 or 20 year term insurance. Term Insurance is best described as temporary coverage. That means that the plan will retain the same premium for that length of time.

But once that length of time was over, the plan usually skyrockets and price or just outright cancels. Maybe wondering what’s the pro to a plan like this? The biggest pro is you’re going to get a ton more coverage per dollar of premium that you.

If you can compare to the whole life prices I showed you, you may get instead of 10,000, you may be getting somewhere between $50,000 to a $100,000 in covered with term insurance for the same exact price depending on what length of time that you choose.

There’s a huge coverage advantage with term insurance plan. When you have larger debts that have to be covered, term insurance is a great idea. This would be great if you wanted to cover the entire mortgage. Maybe you had a larger income replacement goal that you want to make sure that more has covered.

The obvious drawback is you may potentially outlive these types of plans. In fact, many term insurance plans don’t pay off, not because there’s some sort of scam involved.

It’s just these people, the underwriters know that they see policy with the hope that you’ll outlive it, and it’s approximately 97, 98 percent never pay because at the end of the day they’re outlived it.

I think term insurance are great for larger obligations. You just need to understand the limitations of these kinds of plans.

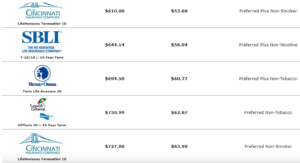

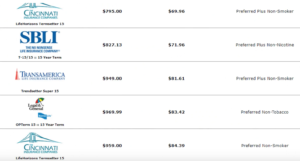

Now let’s take a look at some sample prices in coverage. In this case, we’re going to take a look at 100,000 dollars in term insurance for a male and female at age 65. It will just take a quick look at a 10, 15, and 20 year term for each, just to give you a good idea of the price difference.

As a starting point, I will add as you get older and cross certain age ranges, there will be limitations in the year and even the 15 year term, you may be a senior who’s 75 is very unlikely you’ll get a 20 year term. However, there are coverage options that are temporary in nature, but not necessarily the term insurance.

We can talk if it’s just something you’re looking for, but I just want to make sure that’s clear that the length of time just depends on your age as.

Let’s get started and take a look at what we’ve got. And another disclaimer here, what I’m showing you here are preferred rates. They could be standard rates or lower. It totally depends on your health. These are just an idea of where you could potentially start.

NOTE: Please don’t take these as exact quotes.

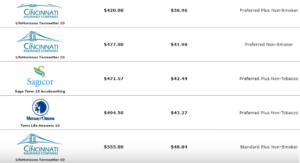

Now we’re looking at a female age 65 years old for a $100,000 and 10 year term. You’re looking at the price per month between mid $30 to low $50. Here’s a 15 year term insurance coverage, mid $50 to mid $60 a month. And for a 20 year term you’re looking at the low $70 to potentially the upper $90 range per month.

Now we’re looking at 65 year old non-smoking males.

Same underwriting standards apply as mentioned earlier for $100,000 term coverage in 10 years term, you’re looking at low $50 to a lower $70 a month. For a 15 years term for a male 65 years old $100,000 in coverage, upper $60 to low $90 a month.

And for a 20 year term you’re looking at low $90 or upper $90. That’s term insurance and obviously you can see there’s a lot more coverage potential per dollar that you pay relative to whole life insurance, and again, the biggest reason why one would purchase this over a whole life insurance plan always comes down to your goal.

If your goal is just to have a burial insurance plan and you don’t care about a large financial amount than a burial insurance, whole life insurance plan is better, in my personal opinion. If you got larger obligations, term insurance has its place.

Case study examples

High Blood Pressure Concern and High Rates

A 66 year old woman named Mrs. Reynolds contacted us recently looking to get a free quote for term insurance. She had life insurance coverage but had received a notice that her rates were about to increase and she could no longer afford the coverage.

Mrs. Reynolds was in overall good health, but she did have high blood pressure. She was taking medication to ensure she didn’t have any additional health problems due to her high blood pressure and she was concerned this would impact her rates.

I’m happy to say we were able to offer Mrs. Reynolds a great policy at a price that was far less than the policy she had been paying for. She was very happy with the result and switched over to the new company.

Though we can’t guarantee the same outcome for every client, we strive to search out the best possible rates and coverage from our many providers.

Smoker Looking for Burial Coverage

A gentleman names Mr. Drury called us looking to get a basic burial policy. He wanted to make sure that his wife and kids would not have to pull from their savings to pay for his funeral and burial.

Mr. Drury was in generally good health, but did smoke. He had heard about smokers getting high rates or even being declined and this was of great concern to him when he got in touch.

We assured Mr. Drury we would do our best to get him quality coverage and I’m pleased to say we were able to offer him first day coverage at a great price.

The outcome of each individual’s application is defendant on a number of factors, so we cannot guarantee approval. However, we do strive to give our clients the best possible chance at getting quality coverage in place by offering them a number of providers to choose from.

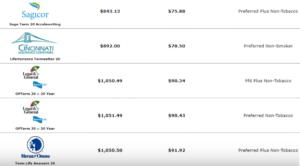

Burial Insurance Rates, Age 40 to 90*

Rates For $5,000 In Burial Insurance

Rates For $10,000 In Burial Insurance

Rates For $15,000 In Burial Insurance

Rates For $20,000 In Burial Insurance

Rates For $25,000 In Burial Insurance

*Burial insurance premiums are subject to underwriting, based on rates as of 8/20/2018, from state-regulated life insurance companies offering final expense burial whole life insurance protection. Understand that in order to potentially qualify, you must submit an application to see if you’re eligible. Rates are subject to change. Give Buy Life Insurance For Burial a call at 888-626-0439 now to see what program you may qualify for.

3rd Option – Guaranteed Universal Life Plan

Now let’s take a look at a product I would call an in between product. It’s called a guaranteed universal life plan. Guaranteed universal life plans kind of something I really liked.

They’re very similar to whole life insurance, something new can qualify. You will get a premium that never goes up as long as you continue to pay the same premium the coverage never cancelled due to age or health and you’re fully covered from the first day.

The underwriting is more in similar with a term insurance plan or a fully underwritten product where there’s a little bit more involvement with it. But what scary about guaranteed universal life plan is you can get a lot of coverage that’s permanent, that won’t cancel at a certain later date..

The minimum on these plans is $25,000 coverage, but you can get 50,000 coverage for really great price. And if your health is good enough, and again, that’s something you and I would have to personally assess this. If your health is good enough, then it is something I would steer you towards versus a whole life insurance product instead because it accomplishes the same goal but gets usually work of coverage.

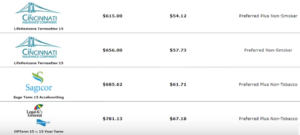

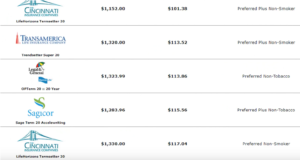

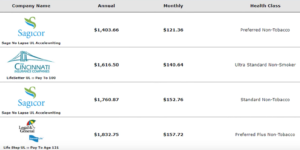

Let’s take a look at a 65 year old female nonsmoker, no lapse universal life or guaranteed universal life plan. And we’re looking at different companies here and we’re looking at from preferred to standard rating somewhere between a $100 to $130 a month.

Different companies offer different rates for a 65 year old female non-smoker for No Lapse Universal Life Plan

This is great because if you look at a simplified issue product for the same price on a female, you may only get about 25,000. Essentially for the same benefits, you get double the coverage, great deal.

For a male, non-smoker, 65 year old you’re looking at $120 a month, depending on which the amount that you may qualify for 50,000 coverage.

Different companies offer different rates for a 65 year old male non-smoker for No Lapse Universal Life Plan

Again, same thing you may potentially be looking at what you normally would get $25,000, $30,000 or $50,000 for essentially the same kind of benefits. Really cool product and I really like helping people with this.

Insurance riders definitions and types available

Now let’s take a look at riders and to find what they are and why you may consider them. Essentially riders on a life insurance plan or just add-on, they’re just additional benefits that you purchased in addition to the life insurance plan at the time of purchase. That riders will gives you some advantages. There are some riders available to ages 16 to 65 and older, but sometimes are not available.

It just depends on the plans that you’re looking at. But here’s just a quick list of the ones that may be available in particular, it’s called critical illness would pay a lump sum payout while you are still alive. If you have been diagnosed of cancer, have a stroke or heart attack or some coronary artery disease issue.

When I say coronary artery disease, I mean an actual occurrence of an open heart surgery, something related to an event, not just coronary artery disease. Also, you may get a valuable tool is called return of premium.

This is where you pay the plan for so many years and then if you reach the end of the term, they’ll pay your money back to you, but it’s not available with all plans. It does cost substantially more and it’s a little bit more difficult to get.

If you’re 65 or older, most plants have what’s called accelerated death benefit and this is designed to pay your death benefit before you die. If you’re terminally diagnosed with a terminal illness from your doctor, some plans have nursing home riders that pay towards a nursing home, on a daily basis on a certain period of time.

And again, this is not a guarantee that these are available. These are sometimes available with certain products at certain ages and understand that they will cost more in most cases.

Exam or no exam?

Let’s talk about getting an exam or not. You may be wondering, if you will get an exam or is it something that’s optional or they will require me to get it? If you’re a 65 year old senior or older and you’re qualifying for life insurance plan, there are times when exams are required but not always.

It just totally depends on the amount of coverage if they will require to get an exam. When we say medical exam, usually require your urine test, blood withdrawal and physical.

But a lot of the companies I’ve worked with, require less hoops to jump through to get qualified. Because insurance companies become more competitive.

A lot of companies just require signature to pull medical records without you actually doing a physical. Some just require a phone interview or they don’t require anything other than that.

The only reason I would advise you take an exam as if you’re getting a large amount of coverage and I believe that your health is significantly in good shape.

That would qualify for better than average rates, or if you’re just forced to do it because of the amount of coverage you’re looking for, I wouldn’t take an exam. If you’re getting a small amount of coverage, that doesn’t really necessarily require it for the amount that you’re looking at.

Again, usually under $100,000 with most plans, term or universal or whole, you don’t need to do an exam most of the time, but not always, because there’s just not a price advantage in many plans. Just don’t even offer it. You just have to do medical record reviews.

How much life insurance coverage can a senior over 65 qualify for?

How much coverage can a senior over 65 can actually get? The first thing you need to do is work with an independent life insurance agent like me. I do have access to different carriers that will be flexible and the minimums and maximums of coverage that you can get for whole life insurance. If you’re looking for just a cremation or burial plans, start around the $5,000 mark.

Starting from there onward, you can get a whole life insurance plan. Term Insurance coverage, depending on the company, and on what you can qualify for. Minimums usually start around $25,000 to $50,000 as a minimum.

And guaranteed universal life that I showed you the is minimum’s $25,000 and the maximums, if you pass on doing an exam, what we call a non -exam company, $250,000 to $400,000 the maximum but it depends on the on the company or your health status. Again, a lot of us couldn’t depend on our age and health, mostly your age maximums for fully underwritten products, multi-million.

If you want to do an exam, they have a large amount of coverage that you want. You can get a lot of coverage in place, even at an advanced age, as long as you wanted to do an exam.

What if health is bad?

Can you qualify for life insurance over 65 if your health is bad?

The short answer is “YES”, of course. There’s always more to it. The long answer depends on how you define bad health though. Let me kind of define this for a little bit.

I think it’s important to understand and get some perspective for me, what is bad health. As somebody who has a cognitive memory disorder like Alzheimer’s, Dementia, somebody who uses oxygen to breathe. Somebody who is just had cancer, heart attack issues, or just had a real serious terminal illness. Maybe they just overcome, even though these are all examples of really bad health, really progressed diabetes where maybe a toes or limbs was remove.

Generally speaking, everything above that we can handle in some kind of quality life insurance hack. We can even handle the issues I just mentioned with a guaranteed acceptance plan. And, if you have bad health, here’s some non-life insurance options. When I say bad health, this is what I would call run of the mill diabetes.

Maybe had a heart attack or cancer several years ago. Perhaps you have COPD or maybe you have some coronary event that happened a couple years ago. Logical problems like Lupus or Parkinson’s can fit into this description. Even if you have this kind of bad health or depression, bipolar, schizophrenia, we can still get your first day a full coverage.

I guess that’s my point. Why make it clear that a lot of these bad health issues may still be insurable, and we also may be in in the worst case scenarios which was first defined, what those would be eligible for, the guaranteed issue return premium coverage.

This is where you would pass away and if you died within the first few years, we will refund your money back to your beneficiary. But if you live past the first few years of the plan, you’re fully covered and again, first a full coverage is full coverage for national accidental coverage from the effective date return premium coverage.

You must wait typically two years for coverage as full effect on natural death. And again, I mentioned this earlier on. The only reason I would consider something like a return premium whole life insurance plan is that nothing else is going to work. We’ve tried you with other companies. We reviewed the health information and nobody’s going to want to take you. This is our last ditch effort.

How to qualify?

How can seniors over 65 years old or older can qualify for life insurance program? It’s a very easy.

First you’ve got to pick an agent you’d like to work with, an independent agent that could shop around. And hopefully that’s me. I help people like you across the country to shop for the best life insurance options available to them.

Once you and I meet over the phone and listen to your needs, I’ll drop a quote and explain why I think this is the best option for you.

The next steps

My goofball son and I thank you for reading, and hope you’ve gained truly valuable information on your search for life or burial insurance. If you’re ready to discover your options for life or burial insurance, call me at 888-626-0439 now for your free life insurance quote!

Assuming you like the quote. The next step would be to apply. Typically this is done over the internet or via email.

Very rarely I ever do a visit with a client. Then after several days or weeks, assuming your coverage is accepted, and approved, it maybe declined or maybe write it up as well.

Just keep that in mind too and we’ll handle that If happens. Assuming it’s accepted and several weeks later you get your policy in the mail and that’s it. You’re very happy because now you’re covered.

If you’re interested in qualifying for life insurance, here’s what you need to do. Go to my website at https://buylifeinsuranceforburial.com request a free quote, or you can call me by hitting the numbers 888- 636-0439 on your phone.

Leave a voicemail and if I don’t pick up because I do speak with people all day long and very busy. And if you liked this article, please leave a comment below. Please make sure you subscribe.

I do a lot of articles like this instructional informative as it relates to life insurance, concerns that people have.

Thanks for stopping by and reading. If you have any lingering questions or would like to see what you might qualify for, get in touch by calling (888) 626-0439 or sending us a message.

We look forward to speaking with you about your options for affordable life insurance coverage.